Current Report Filing (8-k)

October 30 2020 - 8:45AM

Edgar (US Regulatory)

0001364885

false

0001364885

2020-10-30

2020-10-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event

reported): October 30, 2020

Spirit

AeroSystems Holdings, Inc.

(Exact name of registrant as specified

in its charter)

|

Delaware

|

|

001-33160

|

|

20-2436320

|

(State

or other jurisdiction of

incorporation)

|

|

(Commission

File Number)

|

|

(IRS

Employer Identification No.)

|

3801

South Oliver, Wichita,

Kansas 67210

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including

area code: (316) 526-9000

Not Applicable

(Former name or former address if changed

since last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see

General Instruction A.2. below):

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of each

class

|

|

Trading

Symbol(s)

|

|

Name of each

exchange on which registered

|

|

Class

A Common Stock, par value $0.01 per share

|

|

SPR

|

|

New

York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of

the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item

2.01 Completion of Acquisition or Disposition of Assets.

On

October 30, 2020 (the “Closing Date”), Spirit AeroSystems Holdings, Inc. (the “Company”), through its

wholly-owned subsidiaries, Spirit AeroSystems, Inc. (“Spirit”) and Spirit AeroSystems Global Holdings Limited (“Spirit

UK”), completed its previously announced acquisition of the outstanding equity of Short Brothers plc (“Shorts”)

and Bombardier Aerospace North Africa SAS (“BANA”), and substantially all the assets of the maintenance, repair and

overhaul business in Dallas, Texas (the “Acquisition”) from Bombardier Inc., Bombardier Aerospace UK Limited, Bombardier

Finance Inc. and Bombardier Services Corporation (collectively, the “Bombardier Sellers”) pursuant to the Share Purchase

Agreement between Spirit, Spirit UK and the Bombardier Sellers (as amended, the “Purchase Agreement”). On the Closing

Date, the parties also entered into certain ancillary agreements, as described in the Purchase Agreement.

To

complete the Acquisition, the Company, through Spirit and Spirit UK, paid the Bombardier Sellers $275 million in net

proceeds, and, as of the Closing Date, assumed liabilities including the Shorts Brothers Pension Scheme (the “Shorts

Pension”), which has net pension liabilities of approximately $300 million, and the financial payment obligations under

a repayable investment agreement between Shorts and the United Kingdom’s Department for Business, Energy and Industrial

Strategy (“BEIS”) of approximately $290 million (the “RLI”), in each instance measured as of

September 30, 2020 on a basis consistent with U.S. generally accepted accounting principles.

The

RLI requires the repayment of levies to BEIS upon delivery of each A220 shipset to the customer. The RLI contains usual and customary

affirmative and negative covenants for facilities and transactions of this type and that, among other things, restrict the Company’s,

Spirit’s and Shorts’ ability to incur liens, guarantee obligations of third parties, or dispose of assets. These covenants

are subject to a number of qualifications and limitations. The RLI provides for customary events of default, including, but not

limited to, failure to pay the levies, failure to comply with covenants, agreements or conditions, and certain events of bankruptcy

or insolvency involving the Company, Spirit or Shorts.

As

required by the Purchase Agreement, on the first anniversary of the Closing Date, Spirit will make a special contribution of £100

million (approximately $130 million) to the Shorts Pension. Spirit has also issued an evergreen parent guaranty of up to £112.4

million (approximately $140 million) for the benefit of the Shorts Pension.

The

foregoing description of the Purchase Agreement does not purport to be complete and is qualified in its entirety by reference

to the full text of the Purchase Agreement, which is referenced in Item 9.01 and incorporated by reference or attached (as applicable).

Item

2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The

information set forth in Item 2.01 above is incorporated by reference into this Item 2.03.

Item 7.01 Regulation FD Disclosure.

On October 30,

2020, the Company issued a press release announcing the closing of the Acquisition. A copy of the press release containing the

announcement is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information

in this Item 7.01 of Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities under that

Section, nor shall it be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended,

or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item

9.01 Financial Statements and Exhibits.

(d) Exhibits.

|

Exhibit

No.

|

|

Description

|

|

|

|

|

|

10.1††

|

|

Agreement

for the Sale and Purchase of (1) the Entire Issued Share Capital of Short Brothers plc and Bombardier Aerospace North Africa SAS

and (2) Certain Other Assets, dated October 31, 2019, by and between Bombardier Inc., Bombardier Aerospace UK Limited, Bombardier

Finance Inc., Bombardier Services Corporation, Spirit AeroSystems Global Holdings Limited, and Spirit AeroSystems, Inc. (Incorporated

by reference to the registrant’s Annual Report on Form 10-K (File No. 001-33160), filed February 28, 2020, Exhibit 10.94).

|

|

|

|

|

|

10.2*

|

|

Deed of Amendment, dated as of

October 16, 2020, , by and among Spirit AeroSystems, Inc, and Spirit AeroSystems Global Holdings Limited, and Bombardier Inc.,

Bombardier Aerospace UK Limited, Bombardier Finance Inc. and Bombardier Services Corporation.

|

|

|

|

|

|

10.3

|

|

2nd

Deed of Amendment, dated as of October 26, 2020, by and among Spirit AeroSystems, Inc, and Spirit AeroSystems Global Holdings

Limited, and Bombardier Inc., Bombardier Aerospace UK Limited, Bombardier Finance Inc. and Bombardier Services Corporation (Incorporated

by reference to the registrant’s Current Report on Form 8-K (File No. 001-33160), filed October 26, 2020, Exhibit 10.1).

|

|

|

|

|

|

99.1**

|

|

Press

Release dated October 30, 2020.

|

|

|

|

|

|

104

|

|

Cover Page Interactive Data File (formatted as inline XBRL and contained in Exhibit

101).

|

|

*

|

|

Filed

herewith.

|

|

|

|

|

|

**

|

|

Furnished

herewith.

|

|

††

|

|

Indicates

that confidential portions of the exhibit have been omitted in accordance with the rules of the Securities and Exchange Commission.

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

SPIRIT AEROSYSTEMS HOLDINGS, INC.

|

|

|

|

|

Date: October 30, 2020

|

By:

|

/s/ Stacy

Cozad

|

|

|

|

Name:

|

Stacy Cozad

|

|

|

|

Title:

|

Senior Vice President, General Counsel,

Chief Compliance Officer and Secretary

|

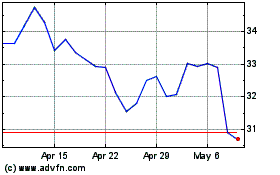

Spirit Aerosystems (NYSE:SPR)

Historical Stock Chart

From Mar 2024 to Apr 2024

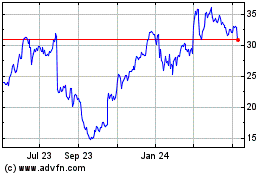

Spirit Aerosystems (NYSE:SPR)

Historical Stock Chart

From Apr 2023 to Apr 2024