China Banks Get First S&P Ratings -- WSJ

July 12 2019 - 3:02AM

Dow Jones News

By Shen Hong

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 12, 2019).

SHANGHAI -- S&P Global Inc. became the first foreign

credit-rating company to offer an independent assessment of risk in

China's vast domestic debt market, giving a top grade to a unit of

the country's largest bank.

The move is a milestone for the $13.3 trillion onshore bond

market, where foreign investment is increasing and the world's

three major rating companies -- S&P, Moody's Investors Service

and Fitch Ratings -- have long coveted a bigger presence.

Beijing is also eager to foster a more rational market in which

investors are more discriminating about credit risk, and recognize

they won't be shielded from defaults.

S&P gave a triple-A rating to ICBC Financial Leasing Co., a

unit of Industrial & Commercial Bank of China Ltd., with a

stable outlook, it said Thursday. The grade is the highest on the

dedicated scale S&P has developed for China, which doesn't

correspond to the same grade on its global system.

Beijing first pledged to allow wholly owned foreign companies to

rate onshore bonds in discussions with the Trump administration in

May 2017, and S&P won the first such approval, from the central

bank, this January.

Global rating houses had previously been required to pair with

local partners in conducting credit ratings in China. S&P,

however, didn't have a joint venture in China, and so didn't rate

yuan bonds issued inside the country.

Fitch set up a wholly owned subsidiary, Fitch (China) Bohua

Credit Ratings Ltd., last year, and has applied for a license to

rate bonds in China's interbank market. A Fitch Bohua

representative said the company was communicating closely with

regulators.

Moody's has also set up its wholly owned unit in China and is

applying for a license as well. In a statement, Moody's said it is

exploring ways to better serve its customers but didn't address its

pending application.

Investors hope that allowing the global raters to operate could

help improve the quality of the local ratings industry, which has

long been criticized for being overly lenient with debtors. Earlier

this year, a government-owned enterprise took control of Dagong

Global Credit Rating Co., one of China's biggest debt-risk

assessors. Regulators had earlier suspended Dagong's rating

business for a year, criticizing it for "chaotic internal

management" and for offering consulting services to debt

issuers.

However, some bondholders worry that applying a custom rating

system to China could make the three global companies bow to

demands from debt issuers and regulators and be less critical in

their assessment.

Among the 4,706 bond issuers in China's domestic market, 18%

enjoy a triple-A rating, while 81% are at or above double-A,

according to data provider Wind.

ICBC Financial Leasing, which specializes in aviation, shipping

and equipment leases, also has a triple-A credit rating from China

Lianhe Credit Rating Co., a local company in which Fitch had owned

a 49% stake until last year.

S&P said it views the leasing company as a core subsidiary

of ICBC, the world's largest bank by assets.

Write to Shen Hong at hong.shen@wsj.com

(END) Dow Jones Newswires

July 12, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

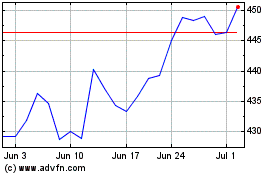

S&P Global (NYSE:SPGI)

Historical Stock Chart

From Mar 2024 to Apr 2024

S&P Global (NYSE:SPGI)

Historical Stock Chart

From Apr 2023 to Apr 2024