Landlords Strike Deal to Acquire Bankrupt J.C. Penney

September 09 2020 - 3:08PM

Dow Jones News

By Suzanne Kapner, Alexander Gladstone and Miriam Gottfried

Mall owners Simon Property Group Inc. and Brookfield Property

Partners LP are poised to acquire J.C. Penney Co. out of bankruptcy

in a deal valued at roughly $800 million that will keep the

beleaguered department-store chain alive amid the coronavirus

pandemic, according to people familiar with the situation.

Simon and Brookfield, J.C. Penney's landlords, have reached an

agreement in principle to buy the chain, which filed for chapter 11

in May after the pandemic shut down nonessential shopping across

the country.

The landlords will own about 490 of the retailer's remaining 650

stores, one of the people said. A group of lenders will own 160

locations plus the company's distribution centers in return for

forgiving some of Penney's $5 billion in debt. The landlords will

pay the lenders rent on those 160 stores and distribution centers,

the person said.

Simon, the biggest U.S. mall owner, and Brookfield are paying

roughly $300 million in cash and assuming $500 million in debt, the

person said.

The Wall Street Journal reported in August that Simon and

Brookfield were the leading contenders to acquire Penney in a

bankruptcy auction.

Write to Suzanne Kapner at Suzanne.Kapner@wsj.com, Alexander

Gladstone at alexander.gladstone@wsj.com and Miriam Gottfried at

Miriam.Gottfried@wsj.com

(END) Dow Jones Newswires

September 09, 2020 14:53 ET (18:53 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

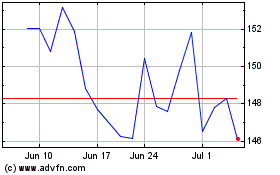

Simon Property (NYSE:SPG)

Historical Stock Chart

From Mar 2024 to Apr 2024

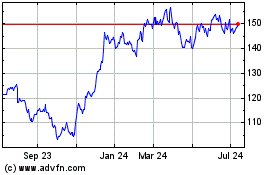

Simon Property (NYSE:SPG)

Historical Stock Chart

From Apr 2023 to Apr 2024