Current Report Filing (8-k)

June 11 2020 - 8:56AM

Edgar (US Regulatory)

0001063761

false

0001063761

2020-06-11

2020-06-11

0001063761

SPG:SimonPropertyGroupLPMember

2020-06-11

2020-06-11

0001063761

SPG:CommonStock0.0001ParValueMember

2020-06-11

2020-06-11

0001063761

SPG:Sec88540SeriesJCumulativeRedeemablePreferredStock0.0001ParValueMember

2020-06-11

2020-06-11

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event

reported): June 11, 2020

SIMON PROPERTY GROUP, INC.

SIMON PROPERTY GROUP, L.P.

(Exact name of registrant as specified

in its charter)

Delaware

(Simon Property Group, Inc.)

|

001-14469

(Simon Property Group, Inc.)

|

04-6268599

(Simon Property Group, Inc.)

|

Delaware

(Simon Property Group, L.P.)

(State of incorporation

or organization)

|

001-36110

(Simon Property Group, L.P.)

(Commission File No.)

|

34-1755769

(Simon Property Group, L.P.)

(I.R.S. Employer

Identification No.)

|

225 West Washington Street

Indianapolis, Indiana 46204

(Address of principal executive offices)

|

(317) 636-1600

(Registrant’s telephone number, including area code)

|

|

CIK

|

0001022344

|

|

Document Type

|

8-K

|

|

Amendment Flag

|

False

|

|

Address

|

225 West Washington Street

|

|

City

|

Indianapolis

|

|

State

|

Indiana

|

|

Zip

|

46204

|

|

Area code

|

(317)

|

|

Phone number

|

636-1600

|

|

Written Communications

|

☐

|

|

Soliciting

|

☐

|

|

Tender Offer

|

☐

|

|

Issuer tender offer

|

☐

|

|

Date of Report

|

June 11, 2020

|

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of

the Act:

|

Title of each class

|

|

Trading Symbols

|

|

Name of each exchange on which registered

|

|

|

|

|

|

|

|

Common stock, $0.0001 par value

|

|

SPG

|

|

New York Stock Exchange

|

|

8⅜% Series J Cumulative Redeemable Preferred Stock, $0.0001 par value

|

|

SPGJ

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

|

Simon Property Group, Inc.:

|

Emerging growth company ☐

|

|

Simon Property Group, L.P.:

|

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act.

Simon Property Group, Inc.: ☐

Simon Property Group, L.P.: ☐

Item 1.02. Entry into a Material Definitive Agreement.

Merger Agreement

As previously announced on February 10, 2020,

Simon Property Group, Inc., a Delaware corporation (“Simon”), Simon Property Group, L.P., a Delaware limited partnership,

Silver Merger Sub 1, LLC, a Delaware limited liability company and wholly owned subsidiary of the Simon Operating Partnership,

Silver Merger Sub 2, LLC, a Delaware limited liability company and wholly owned subsidiary of Merger Sub, Taubman Centers, Inc.,

a Michigan corporation (“TCO”), and The Taubman Realty Group Limited Partnership, a Delaware limited partnership, entered

into an Agreement and Plan of Merger dated as of February 9, 2020 (the “Merger Agreement”). The Merger Agreement contemplated

that the Company would acquire all TCO common stock and an effective 80% interest in TRG in a transaction valued at approximately

$3.6 billion.

The closing

of the transactions contemplated by the Merger Agreement was subject to closing conditions relating to the accuracy

of representations and warranties by TCO, compliance by TCO with covenants relating to the operations of its business and that

no material adverse effect had occurred in respect of TCO. As a result of the Taubman Parties’ incurable breaches

of multiple provisions of the Merger Agreement and the occurrence of a material adverse effect in respect of TCO, these closing

conditions cannot be satisfied. Accordingly, the Board of Directors of Simon elected to exercise Simon’s right to terminate

the Merger Agreement and Simon notified TCO on June 10, 2020 of Simon’s termination of the Merger Agreement.

Item 8.01. Other Events.

On June 10, 2020, Simon issued a press release

announcing, among other things, the termination of the Merger Agreement. A copy of this press release is attached to this Current

Report on Form 8-K as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrants have duly caused this report to be signed on their behalf by the undersigned hereunto duly authorized.

Date: June 11, 2020

|

|

|

|

|

|

|

Simon Property Group, Inc.

|

|

|

|

|

|

|

|

|

By:

|

/s/ Steven E. Fivel

|

|

|

|

|

General Counsel and Secretary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Simon Property Group, L.P.

|

|

|

|

|

|

|

|

|

By:

|

Simon Property Group, Inc.

|

|

|

|

|

Its general partner

|

|

|

|

|

|

|

|

|

By:

|

/s/ Steven E. Fivel

|

|

|

|

|

General Counsel and Secretary

|

|

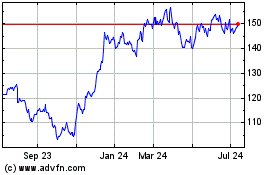

Simon Property (NYSE:SPG)

Historical Stock Chart

From Mar 2024 to Apr 2024

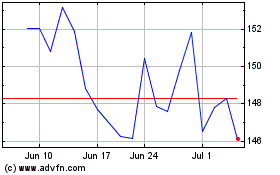

Simon Property (NYSE:SPG)

Historical Stock Chart

From Apr 2023 to Apr 2024