Simon Property Group, Kraft Heinz, United Parcel Service: Stocks That Defined the Week

May 01 2020 - 6:58PM

Dow Jones News

By Francesca Fontana

Simon Property Group Inc.

U.S. malls are throwing open their doors in certain parts of the

country as some states loosen stay-at-home restrictions. Simon

Property Group, the largest U.S. mall landlord, planned to reopen

49 malls and outlet centers in the first days of May, The Wall

Street Journal reported Tuesday. Macy's Inc. will reopen 68 stores

on May 4, some of them located in Simon's properties, while Best

Buy Co. will open about 200 in May. Simon shares gained 11%

Tuesday.

3M Co.

3M's N95 face masks are still in high demand as health-care

workers treat coronavirus patients. The rest of its products? Not

so much. The company said Tuesday that demand has fallen for other

goods in its vast product line, such as industrial glues, as

factory closures ripple through the industrial economy. The maker

of Post-it Notes also said that sales of office supplies decreased

as many people began working from home. The company is cutting its

capital investments this year and is temporarily shutting down some

nonmask production lines due to weakened demand. About 25% of the

company's factories and warehouses were closed as of April. 3M

shares added 2.6% Tuesday.

United Parcel Service Inc.

UPS is doing more but making less. The delivery giant is logging

higher revenue as millions of homebound Americans shop online for

everything from toothpaste to trampolines during the coronavirus

pandemic. However, the more profitable business of delivering big

shipments to offices and stores has dried up since nonessential

businesses shut their doors. The company said its drivers are

traveling 10% farther and making 15% more stops on their daily

routes to keep up with rising demand for home deliveries. Those

packages are also 33% lighter, generating less revenue than the

bulkier shipments that would go to businesses. UPS shares fell 6%

Tuesday.

Boeing Co.

The world's biggest aerospace company plans to cut thousands of

jobs and raise fresh funds to survive after the near-collapse of

global passenger air travel. Already wounded financially by the

yearlong grounding of its 737 MAX aircraft, Boeing on Wednesday

reported its second consecutive quarterly loss alongside plans to

cut jetliner production and shed 10% of its workforce. Chief

Executive David Calhoun outlined a modest near-term plan: catering

to airliner retirements instead of fleet growth and holding off on

designing new aircraft. Boeing also plans to take on more debt and

is evaluating federal loans to support a supply chain of about

17,000 companies. Boeing shares gained 5.9% Wednesday.

Microsoft Corp.

The pickup in remote work and entertainment during the pandemic

is boosting demand for Microsoft services. On Wednesday, the

company reported strong growth in quarterly sales and profit, with

gains in areas from cloud computing to videogame consoles. The

health crisis has spurred use of Microsoft's workplace

collaboration software suite, called Teams, that includes

videoconferencing and messaging functions. It now has 75 million

daily active users, Microsoft CEO Satya Nadella said, more than

double the number in early March. Microsoft shares added 1%

Thursday.

Kraft Heinz Co.

More people reached for the comfort of Kraft macaroni and cheese

during the spread of the new coronavirus earlier this year. Kraft

Heinz, which makes Kraft cheeses, Oscar Mayer cold cuts, Planters

nuts and other food products, said Thursday that boxes of mac and

cheese helped sales in the U.S. increase 6.4% to about $4.5

billion. It also reported strong growth in condiments and sauces,

ready-to-drink beverages, and nuts. The pandemic has stoked demand

for all kinds of grocery items, forcing packaged-food companies to

run their factories near their capacities to keep products flowing

to store shelves. Kraft Heinz shares fell 0.7% Thursday.

Amazon.com Inc.

The high demand for Amazon's home deliveries is coming at a

cost. Quarterly sales soared 26% after a coronavirus-fueled surge

in orders -- the highest on record for a typically slow period for

the company -- but profit fell 29% from a year earlier. The company

hired 175,000 more staffers as the flood of orders taxed its

operations, and world-wide shipping costs rose 49% from the

year-earlier period. Amazon expects to spend around $4 billion on

coronavirus-related costs such as employee testing and increased

wages after spending more than $600 million on such costs in the

first quarter. Amazon shares fell 7.6% Friday.

Write to Francesca Fontana at francesca.fontana@wsj.com

(END) Dow Jones Newswires

May 01, 2020 18:43 ET (22:43 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

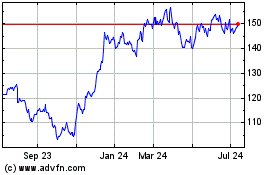

Simon Property (NYSE:SPG)

Historical Stock Chart

From Mar 2024 to Apr 2024

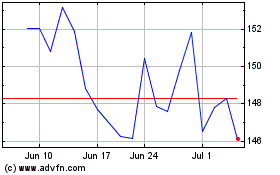

Simon Property (NYSE:SPG)

Historical Stock Chart

From Apr 2023 to Apr 2024