REPORT OF THE AUDIT COMMITTEE

The Audit Committee is responsible for monitoring the integrity of the Company's consolidated financial statements, the qualifications,

performance and independence of the Company's independent registered public accounting firm, the performance of the Company's internal auditor and the Company's compliance with legal and regulatory

requirements. We have the sole authority to appoint or replace the Company's independent registered public accounting firm as well as approve their compensation. In addition, we have responsibility to

oversee them. The Committee operates under a written charter adopted by the Board which can be found on our website at committeecomposition.simon.com. The Committee currently has

five members and the Board has determined that each is a

financial expert in accordance with the rules adopted by the SEC. The Board has also determined that each of the members of the Audit Committee is independent under the standards of director

independence established under our Governance Principles, NYSE listing standards, and applicable securities laws.

Management

is responsible for the financial reporting process, including the system of internal controls, for the preparation of consolidated financial statements in accordance with accounting

principles generally accepted in the United States and for management's report on internal controls over financial reporting. The Company's independent registered public accounting firm is responsible

for auditing the consolidated financial statements and expressing an opinion on the financial statements and the effectiveness of internal controls over financial reporting. Our responsibility is to

oversee and review the financial reporting process and to review and discuss management's report on internal controls over financial reporting. We are not, however, professionally engaged in the

practice of accounting or auditing and do not provide any expert or other special assurance as to such financial

statements concerning compliance with laws, regulations or accounting principles generally accepted in the United States or as to the independence of the independent registered public accounting firm.

We rely, without independent verification, on the information provided to us and on the representations made by management and the independent registered public accounting firm.

We

held eight meetings during 2019. The meetings were designed, among other things, to facilitate and encourage communication among the Audit Committee, management, the Company's internal auditor, and

its independent registered public accounting firm, EY.

We

discussed with the Company's internal auditor and EY the overall scope and plans for their respective audits. We met with the internal auditor and EY, with and without management present, to

discuss the results of their examinations and their evaluations of the Company's internal controls. We reviewed and discussed the Company's compliance with Section 404 of the Sarbanes-Oxley Act

of 2002, including consideration of the Public Company Accounting Oversight Board's ("PCAOB") Auditing Standard 2201, An Audit of Internal Control Over Financial Reporting That is Integrated With an

Audit of Financial Statements.

We

discussed with management the Company's major financial risk exposures and the steps management has taken to monitor and control such exposures, including the Company's risk assessment and risk

management processes.

We

reviewed and discussed the audited consolidated financial statements for the year ended December 31, 2019 with management, the internal auditor and EY. We reviewed EY's report on our

financial statements, which indicated that the financial statements present fairly, in all material respects, our financial position and results of operations and cash flows in conformity with

accounting principles generally accepted in the United States. We reviewed and discussed with management, the internal auditor and EY, management's report on the effectiveness of internal controls

over financial reporting and EY's report on internal controls over financial reporting. We also discussed with management and the internal auditor the process used to support certifications by the

|

|

|

|

|

44 SIMON

PROPERTY

GROUP 2020

PROXY

STATEMENT

|

Table of Contents

REPORT OF THE AUDIT COMMITTEE

Company's

CEO and Chief Financial Officer that are required by the SEC and the Sarbanes-Oxley Act of 2002 to accompany the Company's periodic filings with the SEC and the processes used to support

management's report on the Company's internal control over financial reporting.

We

also discussed with EY all matters required to be discussed by the applicable requirements of the PCAOB and the SEC. In addition, we discussed with EY and management the PCAOB's Auditing

Standard 3101, The Auditor's Report on an Audit of Financial Statements When the Auditor Expresses an Unqualified Opinion, and EY's process for identifying critical audit matters for the

Company.

We

also received the written disclosures and the letter from EY required by applicable requirements of the PCAOB regarding the independent auditor's communications with us concerning independence and

we discussed with EY the independence of that firm.

When

analyzing EY's independence, we considered if the services EY provided to the Company beyond those rendered in connection with its audit of the Company's consolidated financial statements

including (i) its audit of the effectiveness of internal controls over financial reporting and (ii) its reviews of the Company's quarterly unaudited consolidated financial statements,

and whether such items were compatible with EY maintaining its independence. We concluded that the provision of such services by EY in the past year has not jeopardized EY's independence.

Based

on our review and these meetings, discussions and reports, and subject to the limitations on our role and responsibilities referred to above and in the Audit Committee charter, we recommended to

the Board that the Company's audited consolidated financial statements for the year ended December 31, 2019 be included in the Company's Annual Report.

The

Audit Committee has also selected EY as the Company's independent registered public accounting firm for the year ended December 31, 2020, based on our belief that it is in the best interest

of the Company and the shareholders, and will present the selection to the shareholders for ratification at the meeting. In connection with this decision, the Audit Committee assessed the independent

auditor's performance. This assessment examined three primary criteria: (1) the independent auditor's qualifications and experience; (2) the communication and interactions with the

independent auditor over the course of the year; and (3) the independent auditor's independence, objectivity, and professional skepticism. These criteria were discussed with management during a

private session, as well as in executive session.

EY

has served as the Company's auditor since 2002. We would also like to note, that commencing with the 2017 audit, a new lead audit partner was appointed. This partner was identified after extensive

discussions among management, the Audit Committee members and EY and we provided a report to the Board.

We

approve all audit and permissible non-audit services to be provided to the Company by EY prior to commencement of services. We have delegated to the Chairman of the Audit Committee the authority to

approve specific services up to specified individual and aggregate fee amounts. Any approval decisions are presented to the full Audit Committee at the next scheduled meeting after such approvals are

made.

The

Company has incurred the fees set forth below for services provided by EY. The Audit Committee has final approval with respect to the amount of these fees. EY has advised us that it has billed or

will bill these indicated amounts for the following categories of services for the years ended December 31, 2019 and 2018, respectively:

|

|

|

|

|

|

|

|

|

|

2019

|

|

2018

|

|

|

|

|

|

|

|

Audit Fees(1)

|

|

$

|

4,230,000

|

|

$

|

3,941,000

|

|

Audit-Related Fees(2)

|

|

$

|

4,835,000

|

|

$

|

5,024,000

|

|

Tax Fees(3)

|

|

$

|

266,000

|

|

$

|

191,000

|

|

All Other Fees

|

|

$

|

0

|

|

$

|

0

|

|

|

|

|

|

|

-

(1)

-

Audit

Fees include fees for the audits of the financial statements and the effectiveness of internal controls over financial reporting for us and the Operating

Partnership and services associated with the related SEC registration statements, periodic reports, and other documents issued in connection with securities offerings.

-

(2)

-

Audit-Related

Fees include audits of individual or portfolios of properties and schedules to comply with lender, joint venture partner or contract requirements and

due diligence services for our managed consolidated and joint venture properties and our consolidated non-managed properties. Our share of these Audit-Related Fees was approximately 59% and 60% in

2019 and 2018, respectively.

-

(3)

-

Tax

Fees include fees for international and other tax consulting services and tax return compliance services associated with the tax returns for certain managed

joint ventures as well as other miscellaneous tax compliance services. Our share of these Tax Fees was approximately 65% and 59% in 2019 and 2018, respectively.

|

|

|

|

|

|

The Audit Committee:

J. Albert Smith, Jr., Chairman

Larry C. Glasscock

Reuben S. Leibowitz

Stefan M. Selig

Marta R. Stewart

|

|

|

|

|

|

SIMON

PROPERTY

GROUP 2020

PROXY

STATEMENT 45

|

Table of Contents

SUSTAINABILITY

We

have a long-standing commitment to our shareholders and communities to conduct our business in an environmentally and socially responsible manner. Our corporate sustainability vision is

to be recognized as a leader in sustainable development and sustainability operations of

retail properties in the United States.

We

incorporate sustainable thinking into various areas of our business, from how we plan, develop, and operate our properties, to how we do business with our customers, engage with our communities,

and create a productive and positive work environment for our employees. Our sustainability framework focuses on four

key areas: Environment; Customers; Communities; and Employees. We have acted on each of these areas by setting specific goals and measuring progress to ensure accountability with respect to our

commitments.

We

leverage sustainability initiatives to achieve cost efficiencies in our operations. By implementing a range of

energy management practices, continuous energy monitoring, and reporting, we have reduced our energy consumption at comparable properties every year since 2003. As a result, excluding new

developments, we have reduced the electricity usage over which we have direct control by 373,777 MWh since 2003. This represents a 38% reduction in electricity usage across a portfolio of comparable

properties.

During

the same time period, Simon reduced greenhouse gas emissions by 45%, eliminating over 260,532 metric tons of carbon dioxide equivalents, including emission streams that have been consistently

tracked since 2003 including scope 1, scope 2, and for scope 3 only employee commuting and business travel. Additional emission streams, such as emissions generated from solid waste management, use of

refrigerants, and tenant plug-load consumptions, have been included in Simon's sustainability disclosure since 2013

and are reported in Simon's annual sustainability report published in accordance with the guidelines of the Global

Reporting Initiatives (GRI), the most widely used international standard for sustainability reporting.

Simon's

sustainability performance has been recognized by international organizations. Simon was awarded a Green Star ranking—the designation

awarded for leadership in sustainability performance by the Global Real Estate Sustainability Benchmark (GRESB). In 2019, Simon participated in

CDP's annual climate change questionnaire and received a B score that represents results that are higher than the North America regional average of C, and

higher than our sector average of C.

FOR ADDITIONAL INFORMATION ABOUT THE COMPANY'S SUSTAINABILITY EFFORTS, PLEASE VIEW OUR 2019 SUSTAINABILITY REPORT ON THE COMPANY'S WEBSITE, BY VISITING

SUSTAINABILITY.SIMON.COM.

|

|

|

|

|

46 SIMON

PROPERTY

GROUP 2020

PROXY

STATEMENT

|

Table of Contents

ADDITIONAL INFORMATION

ANNUAL REPORT

Our Annual Report, including financial statements audited by EY, our independent registered public accounting firm, and EY's report thereon, is

available to our shareholders on the Internet as described in the Notice. In addition, a copy of our Annual Report will be sent to any shareholder without charge (except for exhibits, if requested,

for which a reasonable fee will be charged), upon written request to: Investor Relations, Simon Property Group, Inc., 225 West Washington Street, Indianapolis, Indiana 46204. Our Annual Report

is also available and may be accessed free of charge at annualreports.simon.com.

SHAREHOLDER PROPOSALS AT OUR 2021 ANNUAL MEETING

RULE 14a-8 SHAREHOLDER PROPOSALS

To be considered for inclusion in the proxy materials for the 2021 annual meeting of shareholders pursuant to Rule 14a-8 of the Exchange

Act, a shareholder proposal made pursuant to such rule must be received by the General Counsel and Secretary of the Company, Steven E. Fivel, at 225 West Washington Street, Indianapolis,

Indiana 46204, by the close of business on December 3, 2020. For any such proposal to be considered for inclusion, it should be delivered by U.S. Postal Service-Priority Mail Express with proof

of delivery or an internationally recognized overnight carrier (providing proof of delivery). If the date of such meeting is changed by more than 30 days from May 12, 2021, the proposal

must be received by the Company at a reasonable time before the Company begins to print and send its proxy materials. In addition, shareholder proposals must otherwise comply with the requirements of

Rule 14a-8 promulgated under the Exchange Act and any other applicable laws and regulations.

SHAREHOLDER PROPOSALS OR OTHER BUSINESS OUTSIDE OF THE RULE 14a-8 PROCESS

The Company's By-Laws also establish an advance notice procedure for shareholders who wish to present a proposal of business or nominate a

director before an annual meeting of shareholders but do not intend for the proposal to be included in the Company's Proxy Statement pursuant to Rule 14a-8. Pursuant to the Company's By-Laws,

such a proposal of business or nomination of a director may be brought before the meeting by a shareholder who is entitled to vote at such meeting and who gives timely notice of such proposal or

nomination and otherwise satisfies the applicable requirements. To be timely for the 2021 annual meeting of shareholders, such notice should be delivered by U.S. Postal Service-Priority Mail Express

with proof of delivery or an internationally recognized overnight carrier (providing proof of delivery), and must be received by the General Counsel and Secretary of the Company, Steven E.

Fivel, at 225 West Washington Street, Indianapolis, Indiana 46204 by the close of business on January 12, 2021. If the date of the 2021 annual meeting of

shareholders is changed by more than 30 days from May 12, 2021, the proposal must be received by the Company not later than the close of business

on the later of 120 calendar days in advance of the 2021 annual meeting of shareholders or 10 calendar days following the date upon which public announcement of the date of the meeting is first made.

PROXY ACCESS NOMINATIONS

The Company's By-Laws also establish a proxy access provision for shareholders who wish to include director nominees in the Company's proxy

statement. Such nomination of a director may be submitted by a shareholder if the shareholder nominee, nominating shareholder and nomination process meet certain requirements outlined in our By-Laws,

including that timely notice of such director nomination is provided. To be timely for the 2021 annual meeting of shareholders, such notice should be delivered by U.S. Postal Service-Priority Mail

Express with proof of delivery or an internationally recognized overnight carrier (providing proof of delivery), and must be received by the General Counsel and Secretary of the Company,

Steven E. Fivel, at 225 West Washington Street, Indianapolis, Indiana 46204 not later than December 3, 2020 nor earlier than November 3, 2020. If the date of the 2021 annual

meeting of shareholders is changed more than 30 days from May 12, 2021, the notice must be received no later than the close of business on the 10th day following the day on which

public announcement of the date of the annual meeting is first made. For more information on our proxy access provision, see the section of this Proxy Statement titled "Corporate Governance of the

Company—Policies on Corporate Governance."

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the informational requirements of the Exchange Act and thus file periodic reports and other information with the SEC. These

reports and the other information we file with the SEC can be read and copied at the public reference room facilities maintained by the SEC in Washington, DC at 100 F Street, N.E., Washington,

DC 20549. The SEC's telephone number to obtain information on the operation of the public reference room is (800) SEC-0330. These reports and other information are also filed by us

electronically with the SEC and are available at its website, www.sec.gov.

INCORPORATION BY REFERENCE

To the extent this Proxy Statement has been or will be specifically incorporated by reference into any filing under the Securities Act of 1933,

as amended, or the Exchange Act, the sections of this Proxy Statement, titled, "Compensation Committee Report" and "Report of the Audit Committee" should not be deemed to be so incorporated unless

specifically otherwise provided in any such filing.

|

|

|

|

|

SIMON

PROPERTY

GROUP 2020

PROXY

STATEMENT 47

|

Table of Contents

FREQUENTLY ASKED QUESTIONS AND ANSWERS

WHAT IS A PROXY?

A proxy is your legal designation of another person to vote on your behalf. By completing and returning the enclosed proxy card, you are giving

the persons named in the proxy card, Mr. David Simon and Mr. Larry C. Glasscock, the authority to vote your shares in the manner you indicate on your proxy card.

WHO IS ELIGIBLE TO VOTE?

You are eligible to vote on all matters presented to the shareholders at the meeting if you own shares of our common stock, par value $.0001

per share at the close of business on the Record Date.

All

of the Class B common stock is subject to voting trusts as to which Mr. David Simon and Mr. Herbert Simon are the voting trustees. The Board is not soliciting proxies in

respect of the Class B common stock.

HOW MANY SHARES MAY VOTE AT THE MEETING?

On the Record Date, there were outstanding 305,614,225 shares of common stock and 8,000 shares of Class B common stock. As a result, a

total of 305,622,225 shares are entitled to vote (which we refer to in this Proxy Statement as the "voting shares") on all matters presented to shareholders at the meeting.

HOW MANY SHARES MUST BE PRESENT TO HOLD THE MEETING?

The presence at the meeting in person or by proxy of holders of shares representing a majority of all the votes entitled to be cast at the

meeting, or 152,811,113 voting shares, will constitute a quorum for the transaction of business.

WHAT IS THE DIFFERENCE BETWEEN A "SHAREHOLDER OF RECORD" AND A "STREET NAME" HOLDER?

These terms describe how your shares are held. If your shares are registered directly in your name with Computershare Shareowner Services, our

transfer agent, you are a "shareholder of record." If your shares are held in the name of a brokerage, bank, trust or other nominee as a custodian, you are a "street name" holder.

HOW DO I VOTE MY SHARES?

If you are a "shareholder of record," you have several choices. You can vote your shares by

proxy:

-

•

-

Via the Internet by visiting www.proxyvote.com;

-

•

-

By telephone by dialing toll-free 1-800-690-6903;

-

•

-

By mailing your proxy card. Please refer to the specific instructions set forth on the Notice or printed proxy materials. For security reasons,

our electronic voting system has been designed to authenticate your identity as a shareholder; or

-

•

-

By voting in person at Simon Property Group Headquarters, 225 W. Washington Street, Indianapolis, Indiana 46204 on May 12, 2020 at

8:30 a.m. EDT.

If

you are a "street name" holder, you can vote your shares by following the instructions on the voting instructions or your broker/bank/trustee/nominee will provide you with materials and

instructions for voting your shares.

CAN I VOTE MY SHARES IN PERSON AT THE MEETING?

If you are a "shareholder of record," you may vote your shares in person at the meeting. If you

hold your shares in "street name," you must obtain a proxy from your broker, bank, trustee or nominee, giving you the right to vote the shares at the

meeting.

HOW DO I SIGNUP FOR ELECTRONIC DELIVERY OF PROXY MATERIALS?

On the Internet visit www.proxyvote.com with your proxy card

in hand with your control number, and follow the instructions to indicate that you agree to receive or access proxy materials electronically in future years. The Company will make a $1.00 charitable

contribution to the Simon Youth Foundation

(www.syf.org) on behalf of each shareholder who signs up for electronic delivery.

ADMISSION REQUIREMENTS—WHAT DO I NEED TO DO TO ATTEND THE MEETING IN PERSON?

Proof of stock ownership and some form of government-issued photo identification (such as a valid driver's license or passport) will be

required for admission to the meeting. Only shareholders who owned Company common stock as of the close of business on the Record Date are entitled to attend the meeting.

If

your shares are registered in your name and you owned Company common stock as of the close of business on the Record Date, you only need to provide some form of government issued photo

identification for admission. If your shares are held in a bank or brokerage account, contact your bank or broker to obtain a written legal proxy in order to vote your shares at the meeting. If you do

not obtain a legal proxy from your bank or broker, you will not be entitled to vote your shares, but you can still attend the meeting if you bring a recent bank or brokerage statement showing that you

owned shares of common stock on the Record Date, and provide some form of government-issued photo identification.

We

intend to hold the meeting in person as described herein; however, as part of our precautions regarding COVID-19, we are planning for the possibility that the meeting may be held solely by means of

remote communication. If we take this step, we will announce the decision to do so in advance by filing Definitive Additional Materials with the SEC along with notice of the changes to the meeting.

Details on how to participate will be available at investors.simon.com.

|

|

|

|

|

48 SIMON

PROPERTY

GROUP 2020

PROXY

STATEMENT

|

Table of Contents

FREQUENTLY ASKED QUESTIONS AND ANSWERS

WHAT ARE THE BOARD'S RECOMMENDATIONS ON HOW I SHOULD VOTE MY SHARES?

The Board recommends that you vote your shares as follows:

-

•

-

Proposal 1: FOR the election of all ten (10) independent director nominees named in this

Proxy Statement.

-

•

-

Proposal 2: FOR the advisory vote to approve the compensation of our Named Executive Officers.

-

•

-

Proposal 3: FOR the ratification of the appointment of Ernst & Young LLP as our

independent registered public accounting firm for 2020.

HOW WOULD MY SHARES BE VOTED IF I DO NOT SPECIFY HOW THEY SHOULD BE VOTED?

If you sign and return a proxy card without indicating how you want your shares to be voted, the persons named as proxies will vote your shares

as follows:

-

•

-

Proposal 1: FOR the election of all ten (10) independent director nominees named in this

Proxy Statement.

-

•

-

Proposal 2: FOR the advisory vote to approve the compensation of our Named Executive Officers.

-

•

-

Proposal 3: FOR the ratification of the appointment of Ernst & Young LLP as our

independent registered public accounting firm for 2020.

HOW WILL ABSTENTIONS BE TREATED?

For the 2020 Annual Meeting, abstentions will have no effect on the outcome of Proposal 1: Election of Directors, Proposal 2:

Advisory

Vote to Approve the Compensation of our NEOs, and Proposal 3: Ratification of Independent Registered Public Accounting Firm.

However,

abstentions will be considered present and entitled to vote at the 2020 Annual Meeting and will be counted towards determining whether or not a quorum is present.

WHAT ARE BROKER NON-VOTES AND HOW WILL BROKER NON-VOTES BE TREATED?

A broker non-vote occurs when a nominee, such as a broker, holding shares for a beneficial owner does not vote on a particular proposal because

the nominee does not have discretionary authority to vote for that particular proposal and has not received instructions from the beneficial owner as to how to vote its shares. Proposals 1 and

2 fall into this category. If you do not provide your broker with voting instructions, any of your shares held by the broker will not be counted as having been voted on any of these proposals. We do

not expect there to be any broker non-votes with respect to Proposal 3, as brokers are entitled to vote on the ratification of independent registered accounting firms. "Broker non-votes" will

be considered present at the 2020 Annual Meeting and will be counted towards determining whether or not a quorum is present.

WHAT VOTE IS REQUIRED TO APPROVE EACH PROPOSAL?

All voting shares are entitled to one vote per share. To approve each of the proposals, the following votes are required from the holders of

voting shares.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROPOSAL

NUMBER

|

|

SUBJECT

|

|

VOTE REQUIRED

|

|

IMPACT OF ABSTENTIONS AND BROKER NON-VOTES, IF ANY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1

|

|

Elect the ten (10) independent director nominees named in this Proxy Statement

|

|

More votes FOR than AGAINST. Under our By-Laws, for purposes of this proposal, a "majority of votes cast" means more votes cast FOR than AGAINST.

|

|

Abstentions and broker non-votes will not impact the outcome of this proposal, as they are not considered votes cast under the majority of votes cast standard.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2

|

|

Advisory vote to approve the compensation of our Named Executive Officers

|

|

Majority of votes cast.

|

|

Abstentions and broker non-votes will not impact the outcome of this proposal, as they are not considered votes cast under the majority of votes cast standard.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

3

|

|

Ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for 2020

|

|

Majority of votes cast.

|

|

Abstentions will not impact the outcome of this proposal, as they are not considered votes cast under the majority of votes cast standard. We do not expect there to be any broker non-votes with respect to this proposal, as brokers are entitled to

vote on the ratification of independent registered accounting firms.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The

voting trustees who vote the Class B common stock have advised us that they intend to vote all shares of the Class B common stock FOR the election of all nominees and FOR

Proposals 2 and 3.

WHY DID I RECEIVE MORE THAN ONE NOTICE OR PROXY CARD?

You will receive multiple Notices or cards if you hold your shares in different ways (e.g., joint tenancy, trusts, custodial

accounts)

or in multiple accounts. If your shares are held by a broker (i.e., in "street name"), you will receive your proxy card or other voting information from your broker, and you will

return your proxy card(s) to your broker. You should vote on and sign each proxy card you receive.

|

|

|

|

|

SIMON

PROPERTY

GROUP 2020

PROXY

STATEMENT 49

|

Table of Contents

FREQUENTLY ASKED QUESTIONS AND ANSWERS

CAN I CHANGE MY VOTE AFTER I HAVE MAILED IN MY PROXY CARD?

You may revoke your proxy by doing one of the following:

-

•

-

By sending a written notice of revocation to our Secretary at 225 West Washington Street, Indianapolis, Indiana 46204 that is received prior to

the 2020 Annual Meeting, stating that you revoke your proxy;

-

•

-

By signing a later-dated proxy card and submitting it so that it is received prior to the 2020 Annual Meeting in accordance with the

instructions included in the proxy card(s); or

-

•

-

By attending the 2020 Annual Meeting and voting your shares in person.

WHAT HAPPENS IF ADDITIONAL MATTERS ARE PRESENTED AT THE ANNUAL MEETING?

We know of no other matters other than the items of business described in this Proxy Statement that can be considered at the 2020 Annual

Meeting. If other matters requiring a vote do arise, the persons named as proxies will have the discretion to vote on those matters for you.

WHO WILL COUNT THE VOTES?

Broadridge Financial Solutions, Inc. will count the votes and will facilitate the engagement of an independent inspector of election.

The inspector will be present at the 2020 Annual Meeting.

WILL THE MEETING BE ACCESSIBLE TO DISABLED PERSONS?

Our corporate headquarters is accessible to disabled persons. Please call us at least five days in advance at 800-461-3439 if you require any

special accommodations.

HOW CAN I REVIEW THE LIST OF SHAREHOLDERS ENTITLED TO VOTE AT THE ANNUAL MEETING?

A list of shareholders entitled to vote at the meeting will be available at the 2020 Annual Meeting and for ten days prior to the 2020 Annual

Meeting, between the hours of 9:00 a.m. and 5:00 p.m. (EDT), at our offices at 225 West Washington Street, Indianapolis, Indiana 46204. If you were a shareholder on the Record Date, and

would like to view the shareholder list, please contact our Secretary to schedule an appointment.

WHO PAYS THE COST OF THIS PROXY SOLICITATION?

The Company will pay the cost of soliciting proxies in connection with this Proxy Statement, including the cost of preparing, assembling and

mailing the proxy materials. We will also request banks, brokers and other holders of record to send

the proxy materials to, and obtain proxies from, beneficial owners and will reimburse them for their reasonable expenses in doing so. In addition, we have hired Georgeson LLC to assist in the

solicitation of proxies. We will pay Georgeson LLC a base fee of $20,000 for its proxy solicitation services.

IS THIS PROXY STATEMENT THE ONLY WAY THAT PROXIES ARE BEING SOLICITED?

Certain employees or other representatives of the Company may also solicit proxies by telephone, facsimile, e-mail or personal contact. They

will not be specifically compensated for doing so.

HAS THE COMPANY ADOPTED A MAJORITY VOTING STANDARD?

Yes. Under our By-Laws, in an uncontested election a nominee will be elected only if the number of votes cast FOR a director's election exceeds

the number of votes cast AGAINST that director's election. A nominee who receives more AGAINST votes than FOR votes will be required to tender his or her resignation, subject to acceptance by the

Board. For more information, see the section of this Proxy Statement titled "Corporate Governance Matters—Majority Vote Standard for Election of Directors."

WHERE DO I FIND RECONCILIATION OF NON-GAAP TERMS TO GAAP TERMS?

FFO is a non-GAAP financial measure that we believe provides useful information to investors. Please refer to Management's Discussion and

Analysis of Financial Condition and Results of Operations on pages 69-72 of our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, for a definition and

reconciliation of FFO to consolidated net income and FFO per share to net income per share. When comparing 2017 FFO per share to 2019 FFO per share to calculate the CAGR, the Compensation Committee

utilized comparable FFO per share rather than reported FFO per share. The 2017 reported FFO per share was adjusted for the effect of a $0.36 per share loss on extinguishment of debt during 2017 as

well as to reflect a $0.12 per share amount related to the new Leases standard (ASC 842) which was adopted by the Company effective January 1, 2019. As a result of the adoption of the

new Leases standard, the Company is no longer permitted to capitalize certain indirect leasing costs. The adjustment for 2017 reflects the amounts capitalized in the previously reported periods, which

were not required to be restated to adopt this change in accounting. The 2019 comparable FFO excludes a $0.33 per share loss on extinguishment of debt, which is consistent with the $0.36 per share

loss on extinguishment of debt adjustment made in 2017.

NOI

is a non-GAAP financial measure that we believe provides useful information to investors. Please refer to Management's Discussion and Analysis of Financial Condition and Results of Operations on

pages 69-72 of our Annual Report on Form 10-K for the fiscal year ended December 31, 2019, for a definition and reconciliation of NOI to consolidated net income and set forth the

computations of portfolio NOI and comparable property NOI.

|

|

|

|

|

50 SIMON

PROPERTY

GROUP 2020

PROXY

STATEMENT

|

Table of Contents

FREQUENTLY ASKED QUESTIONS AND ANSWERS

ATTEND OUR ANNUAL MEETING

|

|

|

|

|

Date and Time:

|

|

May 12, 2020 at 8:30 a.m. EDT

|

Location:

|

|

Simon Property Group Headquarters

225 W. Washington Street

Indianapolis, Indiana 46204

|

Record Date:

|

|

March 16, 2020

|

We

intend to hold the meeting in person as described above; however, as part of our precautions regarding COVID-19, we are planning for the possibility that the meeting may be held solely by means of

remote communication. If we take this step, we will announce the decision to do so in advance by filing Definitive Additional Materials with the SEC along with notice of the changes to the meeting.

Details on how to participate will be available at investors.simon.com.

|

|

|

|

|

SIMON

PROPERTY

GROUP 2020

PROXY

STATEMENT 51

|

VOTE BY INTERNET - www.proxyvote.com Use the Internet to transmit your voting instructions and for electronic delivery of information. Vote by 11:59 p.m. Eastern Time on May 11, 2020. Have your proxy card in hand when you access the web site and follow the instructions to obtain your records and to create an electronic voting instruction form. ELECTRONIC DELIVERY OF FUTURE PROXY MATERIALS If you would like to reduce the costs incurred by our company in mailing proxy materials, you can consent to receiving all future proxy statements, proxy cards and annual reports electronically via e-mail or the Internet. To sign up for electronic delivery, please follow the instructions above to vote using the Internet and, when prompted, indicate that you agree to receive or access proxy materials electronically in future years. VOTE BY PHONE - 1-800-690-6903 Use any touch-tone telephone to transmit your voting instructions. Vote by 11:59 p.m. Eastern Time on May 11, 2020. Have your proxy card in hand when you call and then follow the instructions. VOTE BY MAIL Mark, sign and date your proxy card and return it in the postage-paid envelope we have provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, NY 11717. SIMON PROPERTY GROUP, INC. 225 WEST WASHINGTON STREET INDIANAPOLIS, IN 46204 TO VOTE, MARK BLOCKS BELOW IN BLUE OR BLACK INK AS FOLLOWS: D08861-P34870-Z76476 KEEP THIS PORTION FOR YOUR RECORDS DETACH AND RETURN THIS PORTION ONLY THIS PROXY CARD IS VALID ONLY WHEN SIGNED AND DATED. SIMON PROPERTY GROUP, INC. The Board of Directors recommends you vote FOR the following proposals: 1. Election of Directors Nominees: For Against Abstain ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! ! 1a. Glyn F. Aeppel For Against Abstain ! ! ! ! ! ! 1b. Larry C. Glasscock 2. An advisory vote to approve the compensation of our Named Executive Officers. Ratification of Ernst & Young LLP as our independent registered public accounting firm for 2020. 1c. Karen N. Horn, Ph.D. 3. 1d. Allan Hubbard NOTE: Such other business as may properly come before the meeting or any adjournment thereof. 1e. Reuben S. Leibowitz 1f. Gary M. Rodkin 1g. Stefan M. Selig 1h. Daniel C. Smith, Ph.D. 1i. J. Albert Smith, Jr. 1j. Marta R. Stewart Please sign exactly as your name(s) appear(s) hereon. When signing as attorney, executor, administrator, or other fiduciary, please give full title as such. Joint owners should each sign personally. All holders must sign. If a corporation or partnership, please sign in full corporate or partnership name by authorized officer. Signature [PLEASE SIGN WITHIN BOX] Date Signature (Joint Owners) Date Sign up for E-Delivery and we will make a $1 donation to Simon Youth Foundation on your behalf.

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting: The Notice and Proxy Statement and Annual Report on Form 10-K for the fiscal year ended December 31, 2019 are available at www.proxyvote.com. D08862-P34870-Z76476 SIMON PROPERTY GROUP, INC. THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS FOR THE ANNUAL MEETING OF SHAREHOLDERS TO BE HELD ON MAY 12, 2020 The shareholder hereby appoints David Simon and Larry C. Glasscock, or either of them, as proxies, each with the power of substitution, and hereby authorizes them to represent and to vote, as designated on the reverse side of this ballot, all of the shares of Common Stock of Simon Property Group, Inc. that the shareholder is entitled to vote at the Annual Meeting of Shareholders to be held at 8:30 a.m., Eastern Daylight Time, on May 12, 2020 and any adjournment or postponement thereof. The meeting will be held either at 225 WEST WASHINGTON STREET, INDIANAPOLIS, INDIANA 46204 or virtually through hosting on the Internet. If we decide that the meeting will be a virtual one, we will announce the decision in advance by filing Definitive Additional Materials with the Securities and Exchange Commission along with notice of the changes to the Annual Meeting. Details on how to participate will be available at investors.simon.com. THIS PROXY, WHEN PROPERLY EXECUTED, WILL BE VOTED AS DIRECTED BY THE SHAREHOLDER. IF NO SUCH DIRECTIONS ARE MADE, THIS PROXY WILL BE VOTED "FOR" ALL TEN NOMINEES LISTED ON THE REVERSE SIDE FOR ELECTION TO THE BOARD OF DIRECTORS, "FOR" PROPOSAL 2 AND "FOR" PROPOSAL 3. IF ANY OTHER MATTER IS PROPERLY BROUGHT BEFORE THE ANNUAL MEETING AND ANY ADJOURNMENTS OR POSTPONEMENTS THEREOF, THE PERSONS NAMED IN THIS PROXY WILL VOTE IN THEIR DISCRETION. PLEASE MARK, SIGN, DATE AND RETURN THIS PROXY CARD PROMPTLY USING THE ENCLOSED REPLY ENVELOPE. Continued and to be signed on reverse side

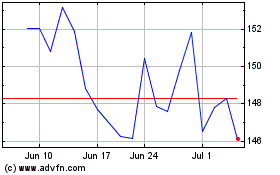

Simon Property (NYSE:SPG)

Historical Stock Chart

From Mar 2024 to Apr 2024

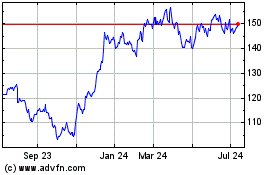

Simon Property (NYSE:SPG)

Historical Stock Chart

From Apr 2023 to Apr 2024

See More Message Board Posts