As filed with the Securities and Exchange

Commission on February 18, 2021

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM F-3

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

SOS Limited

(Exact name of registrant as specified

in its charter)

|

Cayman Islands

|

|

N/A

|

(State or other jurisdiction of

incorporation or organization)

|

|

(I.R.S. Employer

Identification Number)

|

Room 8888, Jiudingfeng Building, 888

Changbaishan Road,

Qingdao Area, China (Shandong) Pilot

Free Trade Zone

People’s Republic of China

+86 0311-80910921

(Address, including zip code, and telephone

number, including area code, of registrant’s principal executive offices)

Puglisi & Associates

850 Library Avenue

Suite 204

Newark, Delaware 19711

(Name, address, including zip code, and

telephone number, including area code, of agent for service)

Copies to:

Joan Wu Esq.

Hunter Taubman Fischer & Li, LLC

800 Third Avenue, Suite 2800

New York, NY 10022

Tel: (212) 530-2210

Facsimile: (212) 202-6380

Approximate date of commencement of proposed

sale to the public: From time to time after the effective date of the registration statement.

If the only securities being registered

on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered

on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the

following box. ☒

If this Form is filed to register additional

securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities

Act registration statement number of the earlier effective registration statement for the same offering. ☒ 333-252279

If this Form is a post-effective amendment

filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement

pursuant to General Instruction I.C. or a post-effective amendment thereto that shall become effective upon filing with the Commission

pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective amendment

to a registration statement filed pursuant to General Instruction I.C. filed to register additional securities or additional classes

of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933.

Emerging growth company ☒

If an emerging growth company that prepares

its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended

transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 7(a)(2)(B)

of the Securities Act. ☐

†The term “new or revised

financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting

Standards Codification after April 5, 2012.

CALCULATION OF REGISTRATION FEE

|

Title of Each Class of Securities to be Registered(1)

|

|

Amount

to be

Registered(3)

|

|

|

Proposed

Maximum

Aggregate

Offering

Price

|

|

|

Amount of

Registration

Fee(7)

|

|

|

Primary Offering

|

|

|

|

|

|

|

|

|

|

|

Class A ordinary shares, par value US$0.0001 per share, represented by American Depositary Shares(2)

|

|

|

|

|

|

|

|

|

|

|

Preferred shares, par value US$0.0001 per share(4)

|

|

|

|

|

|

|

|

|

|

|

Debt Securities

|

|

|

|

|

|

|

|

|

|

|

Warrants(5)

|

|

|

|

|

|

|

|

|

|

|

Units

|

|

|

|

|

|

|

|

|

|

|

Rights(6)

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

|

|

|

$

|

21,500,000

|

|

|

$

|

2,346

|

|

|

(1)

|

Securities registered hereunder may be sold separately, together or as units with other securities registered hereunder.

|

|

|

|

|

(2)

|

The Class A ordinary shares, par value $0.0001 per share, will be represented by American Depositary Shares, or ADSs, evidenced by American Depositary Receipts, issuable upon deposit of Class A ordinary shares of SOS Limited, or the Registrant which have been registered pursuant to separate registration statements on Form F-6 (File Nos. 333-217079 and 333-252791). Pursuant to Rule 416(a) under the Securities Act, this registration statement shall be deemed to cover any additional number of Class A ordinary shares that may be issued from time to time to prevent dilution as result of a distribution, split, share dividend or similar transaction. Each ADS represents ten (10) Class A ordinary shares.

|

|

|

|

|

(3)

|

There are being registered under this registration statement such indeterminate number of securities as may be offered by the Registrant from time to time at indeterminate prices, which shall have an aggregate offering price not to exceed $21,500,000. In addition, pursuant to Rule 416 under the Securities Act of 1933, as amended, or the Securities Act, the ADSs being registered hereunder include such indeterminate number of ADSs as may be issuable with respect to the Class A ordinary shares being registered hereunder as a result of stock splits, stock dividends or similar transactions.

|

|

|

|

|

(4)

|

The preferred shares registered hereby may be represented by the Registrant’s American Depositary Shares, or preferred ADSs, each of which represent a specified number of preference shares. Preferred ADSs issuable upon deposit of the preference shares registered hereby will be registered under a separate registration statement on Form F-6.

|

|

|

|

|

(5)

|

Warrants may be exercised to purchase any of the other securities registered hereby.

|

|

|

|

|

(6)

|

Consisting of some or all of the securities listed above, in any combination, including ADSs, preferred shares, warrants and units.

|

|

|

|

|

(7)

|

Calculated pursuant to Rule 457(o) under the Securities act of 1933, as amended.

|

The

registrant previously registered (i) an indeterminate number of Class A ordinary shares represented by ADSs, an indeterminate

number of preferred shares, an indeterminate principal amount of debt securities, an indeterminate number of warrants to purchase

equity shares and/or debt securities, an indeterminate number of units and an indeterminate number of rights as may be sold by

the registrant from time to time, which together shall have an aggregate initial offering price not to exceed US$300,000,000 and

(ii) 238,800,000 of Class A ordinary shares represented by ADSs as may be sold by the selling shareholders from time

to time with a maximum aggregate offering price of $51,103,200, pursuant to a prior registration statement (“Prior Registration

Statement”) on Form F-3 (File No. 333-252279) filed on January 21, 2021, as amended, which was declared

effective on February 8, 2021.

As

of the date of this registration statement, the maximum aggregate offering price of securities that remain to be issued in the

primary offering pursuant to the Prior Registration Statement is US$107,500,000. The maximum aggregate offering price of the additional

securities being registered hereby pursuant to Rule 462(b) under the Securities Act is US$21,500,000, which represents no more

than 20% of the maximum aggregate offering price of securities remaining to be issued in the primary offering pursuant to the Prior

Registration Statement.

The

registration statement shall become effective upon filing with the Securities and Exchange Commission in accordance with Rule 462(b)

under the Securities Act of 1933, as amended.

EXPLANATORY

NOTE AND INCORPORATION BY REFERENCE

This

registration statement is being filed pursuant to Rule 462(b) and General Instruction IV to Form F-3, both promulgated

under the Securities Act of 1933, as amended. The contents of the registration statement (“Prior Registration Statement”)

on Form F-3 (File No. 333-252279) initially filed by the registrant with the Securities and Exchange Commission

(the “Commission”) on January 21, 2021, which was declared effective by the Commission on February 8, 2021, including

all amendments, supplements and exhibits thereto and each of the documents filed by the registrant with the Commission and incorporated

or deemed to be incorporated therein, are incorporated herein by reference. This registration statement is being filed solely

to increase the amount of securities to be offered pursuant to the Prior Registration Statement.

The

required opinions and consents are listed on an Exhibit Index attached hereto.

SOS Limited

Exhibit Index

|

**

|

To be filed by amendment or as an exhibit to a filing with the SEC under Section 13 or 15(d) of the Securities Exchange Act of 1934 and incorporated by reference in connection with the offering of securities to the extent required for any such offering.

|

SIGNATURES

Pursuant to the requirements

of the Securities Act of 1933, as amended, the registrant certifies that it has reasonable grounds to believe that it meets all

of the requirements for filing on Form F-3 and has duly caused this registration statement to be signed on its behalf by the undersigned,

thereunto duly authorized, in the City of Qingdao, China, on February 18, 2021.

|

|

SOS LIMITED

|

|

|

|

|

|

By:

|

/s/ Yandai Wang

|

|

|

|

Name:

|

Yandai Wang

|

|

|

|

Title:

|

Chief Executive Officer

|

POWER OF ATTORNEY

Each person whose signature

appears below hereby constitutes and appoints Yandai Wang and Li Sing Leung, and each of them, individually, his or her true and

lawful attorneys-in-fact and agents, with full power of substitution and resubstitution, in his or her name, place and stead, in

any and all capacities (including his capacity as a director and/or officer of the registrant), to sign any and all amendments

and post-effective amendments and supplements to this registration statement, and including any registration statement for the

same offering that is to be effective upon filing pursuant to Rule 462(b) under the U.S. Securities Act of 1933, as amended, and

to file the same, with all exhibits thereto and other documents in connection therewith, with the SEC, granting unto said attorneys-in-fact

and agents, and each of them, full power and authority to do and perform each and every act and thing requisite and necessary to

be done in and about the premises, as fully to all intents and purposes as he might or could do in person, hereby ratifying and

confirming all that said attorneys-in-fact and agents or any of them, or his substitute, may lawfully do or cause to be done by

virtue hereof.

Pursuant to the requirements

of the U.S. Securities Act of 1933, as amended, this Form F-3 registration statement has been signed by the following persons in

the capacities and on the date indicated.

|

Name

|

|

Position

|

|

Date

|

|

|

|

|

|

|

|

/s/ Yandai Wang

|

|

Chief Executive Officer and Executive Chairman

|

|

February 18, 2021

|

|

Yandai Wang

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Li Sing Leung

|

|

Chief Financial Officer and Director

|

|

February 18, 2021

|

|

Li Sing Leung

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Russell Krauss

|

|

Director

|

|

February 18, 2021

|

|

Russell Krauss

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Douglas L. Brown

|

|

Director

|

|

February 18, 2021

|

|

Douglas L. Brown

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Ronggang (Jonathan) Zhang

|

|

Director

|

|

February 18, 2021

|

|

Ronggang (Jonathan) Zhang

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Wenbin Wu

|

|

Director

|

|

February 18, 2021

|

|

Wenbin Wu

|

|

|

|

|

SIGNATURE OF AUTHORIZED REPRESENTATIVE

IN THE UNITED STATES

Pursuant to the Securities

Act of 1933 as amended, the undersigned, the duly authorized representative in the United States of America, has signed this registration

statement thereto in Newark, DE on February 18, 2021.

|

|

By:

|

/s/ Donald J. Puglisi

|

|

|

Name:

|

Donald J. Puglisi

|

|

|

Title:

|

Managing Director

Puglisi & Associates

|

3

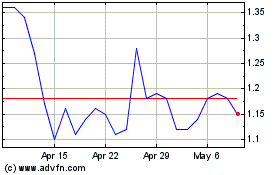

SOS (NYSE:SOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

SOS (NYSE:SOS)

Historical Stock Chart

From Apr 2023 to Apr 2024