Current Report Filing (8-k)

September 23 2022 - 7:01AM

Edgar (US Regulatory)

false000140797300014079732022-09-222022-09-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): September 22, 2022 |

Sonendo, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-40988 |

20-5041718 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

26061 Merit Circle, Suite 102 |

|

Laguna Hills, CA 92653, California |

|

92653 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 949 7663636 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.001 per share |

|

SONX |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On September 22, 2022, Sonendo, Inc. (the “Company”) entered into Securities Purchase Agreements (the “Purchase Agreements”) with certain institutional investors and accredited investors (the “Purchasers”), for the purchase of an aggregate of 23,045,536 shares of its common stock (“Common Stock”) at a purchase price per share of $0.95, and pre-funded warrants (“Pre-Funded Warrants”) to purchase an aggregate of 43,315,846 shares of Common Stock at a purchase price of $0.949 per Pre-Funded Warrant, through a private investment in public equity financing (the “Private Placement”). The Pre-Funded Warrants will have an exercise price of $0.001 per share of Common Stock, be immediately exercisable and remain exercisable until exercised in full.

The Purchase Agreements contain customary representations, warranties, and covenants of the Company and the Purchasers, and customary indemnification rights and other obligations of the parties.

The Private Placement is expected to close on or about September 27, 2022, subject to the satisfaction of certain customary closing conditions. The Company will receive aggregate gross proceeds from the Private Placement of approximately $63 million, before deducting placement agent fees and offering estimated expenses. BofA Securities, Inc. and Stifel, Nicolaus & Company, Incorporated are acting as co-lead placement agents for the private placement made to institutional investors. Sonendo intends to use the net proceeds from the Private Placement to accelerate ongoing commercialization efforts and further expand its current product portfolio and for working capital as well as other general corporate purposes.

Pursuant to the terms of the Purchase Agreements, the Company agreed to provide the Purchasers with certain registration rights, which require the Company to prepare and file a registration statement with the Securities and Exchange Commission (the “SEC”) covering the resale by the Purchasers of the shares of Common Stock sold in the Private Placement and the shares of Common Stock issuable upon exercise of the Pre-Funded Warrants within 45 days of the closing of the Private Placement.

The foregoing description of the Purchase Agreements and the Pre-Funded Warrant does not purport to be complete and is qualified in its entirety by reference to the full text of the Purchase Agreements and the form of Pre-Funded Warrant, which are filed as Exhibits 10.1, 10.2 and 10.3, respectively, to this Current Report on Form 8-K and are incorporated herein by reference.

The representations, warranties and covenants contained in the Purchase Agreements were made solely for the benefit of the parties to thereto and may be subject to limitations agreed upon by the contracting parties. Accordingly, the Purchase Agreements are incorporated herein by reference only to provide investors with information regarding the terms thereof and not to provide investors with any other factual information regarding the Company or its business.

Item 3.02 Unregistered Sales of Equity Securities.

The information related to the offer and sale of the Common Stock and the Pre-Funded Warrants presented in Item 1.01 above is incorporated by reference into this Item 3.02.

Neither the Common Stock, the Pre-Funded Warrants nor the shares of Common Stock issuable upon exercise of the Pre-Funded Warrants to be issued and sold in the Private Placement have been registered under the Securities Act of 1933, as amended (the “Securities Act”), or applicable state securities laws, and are being issued and sold pursuant to Section 4(a)(2) of the Securities Act. Each of the Purchasers has represented that it is a “qualified institutional buyer” within the meaning of Rule 144A of the Securities Act, or an “institutional accredited investor” or “accredited investor” within the meaning of Rule 501 of Regulation D under the Securities Act, and is acquiring the Common Stock and/or Pre-Funded Warrants for investment purposes only and not with a view to any public distribution or with any intention of selling, distributing or otherwise

disposing of the Common Stock or Pre-Funded Warrants in a manner that would violate the registration requirements of the Securities Act. The Common Stock and Pre-Funded Warrants were offered without any general solicitation by the Company or its representatives.

Item 7.01 Regulation FD Disclosure.

On September 23, 2022, the Company issued a press release announcing the Private Placement. The full text of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

The information contained in this Item 7.01 and Exhibit 99.1 hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any other filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 8.01 Other Events.

On August 26, 2022, the Company was notified via email by the New York Stock Exchange (“NYSE”) about its non-compliance with the continued listing criteria of the NYSE under Rule 802.01B of the NYSE Listed Company Manual (the “NYSE Rule”). A company will be considered to be below compliance if its average global market capitalization over a consecutive 30 trading-day period is less than $50,000,000 while, at the same time its stockholders’ equity is less than $50,000,000. The Company continues to discuss with the NYSE its plans to remedy this non-compliance, and believes that the proceeds from this Private Placement will be helpful with its plan to restore compliance with the NYSE Rule.

Notwithstanding the successful completion of the Private Placement, the Company may continue to be in non-compliance with the NYSE Rule as its global average market capitalization will depend not only on the amount of proceeds raised in the Private Placement but also the market price of its Common Stock, as well as the timing of exercise of the Pre-Funded Warrants, and its total stockholders’ equity will depend on its operating results.

As a result, notwithstanding the successful completion of the Private Placement, the NYSE may send the Company a written notice of non-compliance and the Company will then have 45 days from receipt of such notice to submit a plan that would bring it into compliance with the requirements of Rule 802.02B within 18 months. After such time, the NYSE could initiate suspension and delisting procedures with respect to the Company’s Common Stock. Thus, the Company may continue to be in non-compliance with Rule 802.01B of the continued listing criteria of the NYSE and potential delisting procedures as a result of a failure to regain compliance may have a material adverse effect on the Company’s business, and the price and liquidity of its common stock.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Sonendo, Inc. |

|

|

|

|

Date: |

September 23, 2022 |

By: |

/Bjarne Bergheim/ |

|

|

|

Bjarne Bergheim

President and Chief Executive Officer |

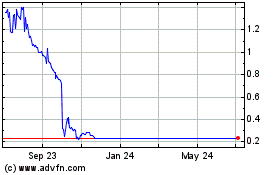

Sonendo (NYSE:SONX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sonendo (NYSE:SONX)

Historical Stock Chart

From Apr 2023 to Apr 2024