By Chris Matthews and William Watts, MarketWatch

Expectations for central bank easing help underpin equities,

analysts say

Stocks traded mostly higher midday Tuesday, with Wall Street

building on the previous session's modest gains, as investors

digested a batch of good earnings reports, signs of progress on

trade talks with China, and a proposed deal to lift the U.S. debt

ceiling and avoid a government shutdown.

How are the major benchmarks faring?

The Dow Jones Industrial Average was up 51 points at 27,223,

while the S&P 500 index advanced 8 points to 2,9992. The Nasdaq

Composite Index was up 2 points to 8,205.

Equity benchmarks edged higher Monday. The Dow eked out a 17.7

point gain, a rise of less than 0.1%, to end at 27,171.90, while

the S&P 500 rose 8.42 points, or 0.3%, to close at 2,985.03.

The Nasdaq Composite rallied 57.65 points, or 0.7%, to

8,204.14.

Including Tuesday, the DJIA has not had a 1% move in either

direction for 24 consecutive trading days, the longest such streak

since August-October 2018 when it went 30 days without a 1% move.

Similarly, the S&P 500 has not had a 1% move in either

direction for 31 trading days, the longest such streak since

June-October 2018 when it went 74 days without a 1% move.

What's driving the market?

Dow-members Coca-Cola Co.(KO) saw its shares climb to a record

after reporting better-than-expected earnings and raising its

revenue forecast.

United Technologies Corp.(UTX), also a Dow component, beat

earnings forecasts also and raised its full year outlook for

earnings and revenue.

Visa , Chipotle (CMG), and Snap (SNAP) are due to report

earnings after the market close Tuesday.

Earnings reporting season rolls on with companies including

Amazon.com , Alphabet (GOOGL), Caterpillar (CAT), McDonald's (MCD)

and (BA) still to report this week.

More than 18% of S&P 500 companies have posted quarterly

numbers this earnings season. Of those companies more than 78% have

reported better-than-expected profits, according to FactSet data.

Those companies have also seen their earnings grow by an aggregate

of 3.6%.

Expectations the Federal Reserve will deliver at least a

quarter-point interest rate cut when policy makers meet at the end

of the month have underpinned stocks, analysts said.

"Stocks are rallying this morning as the feel-good factor in

relation to central bank expectations continues to circulate," said

David Madden, market analyst at CMC Markets UK, in a note.

Signs of progress on trade talks with China were also

supportive. The White House said that President Trump agreed to a

request from US technology companies for the Commerce Department to

make timely licensing decisions on the sale of products to

blacklisted Huawei Technologies, Reuters reported

(https://www.reuters.com/article/us-huawei-tech-usa/trump-agrees-to-prompt-responses-to-license-requests-for-huawei-sales-idUSKCN1UH1Y4).

Any easing of restrictions on Huawei is expected to be met with a

resumption of Chinese purchases of US farm products.

Late Monday, President Donald Trump and congressional leaders

announced a budget deal

(http://www.marketwatch.com/story/trump-says-compromise-deal-on-budget-debt-ceiling-reached-2019-07-22)

that would avoid the possibility of a government shutdown or

federal default.

But on the economic data front, existing home sales

(http://www.marketwatch.com/story/existing-home-sales-dip-17-housing-market-struggles-despite-cheaper-mortgages-2019-07-23)

fell 1.7% despite lower mortgages rates.

Read:Brace yourselves for Britain's new prime minister -- here's

how markets may react

(http://www.marketwatch.com/story/brace-yourselves-for-britains-new-prime-minister---heres-how-markets-will-react-2019-07-22)

Which stocks are in focus?

Dow-members Coca-Cola Co.(KO) saw its shares climb to a record

after reporting better-than-expected earnings and raising its

revenue forecast.

United Technologies Corp.(UTX), also a Dow component, beat

earnings forecasts also and raised its full year outlook for

earnings and revenue.

Apple Inc. (AAPL) shares rose, following a report in the Wall

Street Journal that it is in "advanced talks' to buy Intel Corp.'s

smartphone-modem chip business, valued at $1 billion. Apple stock

rose 2.3% Monday, the best performing stock in the Dow

(http://www.marketwatch.com/story/stock-futures-point-to-higher-start-ahead-of-earnings-deluge-2019-07-22).

Intel shares advanced 0.9%.

Shares of Biogen Inc.(BIIB) were also on the rise after the

company topped earnings forecasts and raised its outlook

(http://www.marketwatch.com/story/biogens-stock-jumps-after-big-earnings-beat-raised-outlook-2019-07-23).

Lockhead Martin Corp. (LMT) stock fell, even after the aerospace

and defense manufacturer surpassed analyst expectations for

second-quarter profits and sales

(http://www.marketwatch.com/story/lockheed-martin-shares-climb-premarket-after-earnings-beat-2019-07-23).

Shares of Snap Inc. (SNAP) were up, after Stifel analyst John

Egbert upgraded the stock

(http://www.marketwatch.com/story/snap-stock-gains-after-stifel-upgrades-ahead-of-earnings-2019-07-23)

from buy to hold, ahead of the social media company's

second-quarter earnings results, due after the close of trade

Tuesday.

How are other markets trading?

The 10-year U.S. Treasury note was little changed around

2.05%.

West Texas Intermediate crude for September delivery fell 19

cents, or 0.3%, on the New York Mercantile Exchange to $56.03 a

barrel. September Brent , the global benchmark, was off 28 cents,

or 0.4%, to $62.98 a barrel on ICE Futures Europe. News of Iran's

seizing of tankers in the Gulf was outweighed by a weak outlook for

demand.

In Asia, stocks closed mostly higher, with China's CSI 300 index

rising 0.2%, Japan's Nikkei 225 adding 1% and Hong Kong's Hang Seng

index climbing 0.3%. European stocks rallied 1.1%, according to the

Stoxx Europe .

(END) Dow Jones Newswires

July 23, 2019 12:28 ET (16:28 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

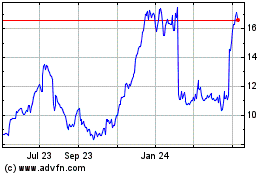

Snap (NYSE:SNAP)

Historical Stock Chart

From Mar 2024 to Apr 2024

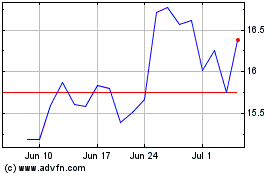

Snap (NYSE:SNAP)

Historical Stock Chart

From Apr 2023 to Apr 2024