Amended Tender Offer Statement by Issuer (sc To-i/a)

January 07 2022 - 7:21AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

AMENDMENT NO.

1

to

SCHEDULE

TO

Tender Offer Statement under Section 14(d)(1) or 13(e)(1)

of the Securities Exchange Act of 1934

Summit

Midstream Partners, LP

(Name of Subject Company and Filing Person (Issuer))

9.50% Series A Fixed-to-Floating Rate Cumulative Redeemable

Perpetual Preferred Units

(Title of Class of Securities)

866142AA0

(CUSIP Number

of Class of Securities)

James D. Johnston

910 Louisiana Street, Suite 4200

Houston, Texas 77002

(832) 413-4770

(Name, address and telephone number of person authorized to receive notices and communications on behalf of filing person)

Copies to:

Joshua

Davidson

Clinton W. Rancher

Baker Botts L.L.P.

910

Louisiana Street

Houston, Texas 77002

(713) 229-1234

CALCULATION OF

FILING FEE

|

|

|

|

|

Transaction Valuation*

|

|

Amount of Filing Fee

|

|

$115,562,337.67

|

|

$10,712.63

|

|

|

|

*

|

Estimated solely for the purpose of calculating the registration fee. The transaction valuation upon which the

filing fee was based was calculated as follows: the product of $805.61, the average of the bid and asked price of the Partnership’s 9.50% Series A Fixed-to-Floating

Rate Cumulative Redeemable Perpetual Preferred Units, (the “Series A Preferred Units”) as of December 9, 2021, and 143,447, the total amount of issued and outstanding Series A Preferred Units. The amount of the filing fee assumes that

all of the outstanding Series A Preferred Units will be exchanged and is calculated pursuant to Rule 0-11(b) of the Securities Exchange Act of 1934, as amended. The registration fee was paid on

December 14, 2021 in connection with the filing by the Partnership of the original Schedule TO-I.

|

|

☒

|

Check the box if any part of the fee is offset as provided by Rule

0-11(a)(2) and identify the filing with which the offsetting fee was previously paid. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

Amount Previously Paid: $10,712.63

|

|

Filing Party: Summit Midstream Partners, LP

|

|

Form or Registration No.: Schedule TO-I

|

|

Date Filed: December 14, 2021

|

|

☐

|

Check the box if the filing relates solely to preliminary communications made before the commencement of a

tender offer.

|

Check the appropriate boxes below to designate any transactions to which the statement relates:

|

|

☐

|

third-party tender offer subject to Rule 14d-1.

|

|

|

☒

|

issuer tender offer subject to Rule 13e-4.

|

|

|

☐

|

going-private transaction subject to Rule 13e-3.

|

|

|

☐

|

amendment to Schedule 13D under Rule 13d-2.

|

Check the following box if the filing is a final amendment reporting the results of the tender offer: ☐

If applicable, check the appropriate box(es) below to designate the appropriate rule provision(s) relied upon:

|

|

☐

|

Rule 13e-4(i) (Cross-Border Issuer Tender Offer)

|

|

|

☐

|

Rule 14d-1(d) (Cross-Border Third-Party Tender Offer)

|

INTRODUCTORY STATEMENT

This Amendment No. 1 amends and supplements the Tender Offer Statement on Schedule TO (the “Schedule TO”) originally filed with the

Securities and Exchange Commission on December 14, 2021 by Summit Midstream Partners, LP (the “Partnership”), in connection with its offer to exchange (the “Exchange Offer”), on the terms and subject to the

conditions set forth in the Offer to Exchange, dated December 14, 2021 (as it may be supplemented and amended from time to time, the “Offer to Exchange”), and the related Letter of Transmittal (as it may be supplemented and

amended from time to time, and, together with the Offer to Exchange, the “Offering Documents”), any and all of the Partnership’s 9.50% Series A

Fixed-to-Floating Rate Cumulative Redeemable Perpetual Preferred Units (Liquidation Preference $1,000) (the “Series A Preferred Units”) tendered in the

Exchange Offer for newly issued common units representing limited partner interests in the Partnership.

Except as provided herein, the information

contained in the Offering Documents remains unchanged by this Amendment No. 1. You should read this Amendment No. 1 together with the Offering Documents. Capitalized terms used but not defined herein shall have the meanings given to them

in the Schedule TO.

Item 11. Additional Information.

Item 11 of the Schedule TO is hereby amended and supplemented by adding the following:

|

|

1.

|

On January 7, 2022, the Partnership issued a press release announcing that as of the close of business on

January 6, 2022, based on information provided by American Stock Transfer & Trust Company, LLC, the depositary of the Exchange Offer, and including the Series A Preferred Units covered by the tender and support agreement, 46,203

Series A Preferred Units had been properly tendered (and not validly withdrawn) or committed for exchange by several holders of the Series A Preferred Units, which represents approximately 32.2% of the total Series A Preferred Units outstanding. A

copy of that press release is filed as Exhibit (a)(5)(iii) hereto and is incorporated by reference into Item 11 of this Schedule TO.

|

Item 12. Exhibits.

Item 12 of

the Schedule TO is hereby amended and supplemented by adding the following exhibit:

1

SIGNATURES

After due inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Date: January 7, 2022

|

|

|

|

|

Summit Midstream Partners, LP

|

|

|

|

|

By:

|

|

Summit Midstream GP, LLC (its general partner)

|

|

|

|

/s/ Marc D. Stratton

|

|

Marc D. Stratton, Executive Vice President and Chief Financial Officer

|

2

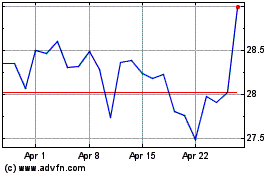

Summit Midstream Partners (NYSE:SMLP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Summit Midstream Partners (NYSE:SMLP)

Historical Stock Chart

From Apr 2023 to Apr 2024