Current Report Filing (8-k)

May 07 2021 - 6:51AM

Edgar (US Regulatory)

false

0001549922

0001549922

2021-05-07

2021-05-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 7, 2021

Summit Midstream Partners, LP

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

001-35666

|

|

45-5200503

|

|

(State or other jurisdiction

|

|

(Commission

|

|

(IRS Employer

|

|

of incorporation)

|

|

File Number)

|

|

Identification No.)

|

910 Louisiana Street, Suite 4200

Houston, TX 77002

(Address of principal executive office) (Zip Code)

(Registrants’ telephone number, including area code): (832) 413-4770

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Securities Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Units

|

SMLP

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

|

Emerging growth company ☐

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 7, 2021, Summit Midstream Partners, LP (the “Partnership,” “we” and “our”) issued a press release announcing its results of operations for the three months ended March 31, 2021. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information furnished in this Item 2.02 shall not be deemed “filed” for purposes of the Securities Exchange Act of 1934, as amended (the “1934 Act”), and shall not be deemed incorporated by reference in any filing with the Securities and Exchange Commission, whether or not filed under the Securities Act of 1933 or the 1934 Act, regardless of any general incorporation language in such document.

Use of Non-GAAP Financial Measures

In addition to reporting financial results in accordance with accounting principles generally accepted in the United States of America ("GAAP"), the Partnership presents certain non-GAAP financial measures. Specifically, the Partnership presents adjusted EBITDA and distributable cash flow. We define adjusted EBITDA as net income or loss, plus interest expense, income tax expense, depreciation and amortization, our proportional adjusted EBITDA for equity method investees, adjustments related to MVC shortfall payments, adjustments related to capital reimbursement activity, unit-based and noncash compensation, impairments, items of income or loss that we characterize as unrepresentative of our ongoing operations and other noncash expenses or losses, less interest income, income tax benefit, income (loss) from equity method investees and other noncash income or gains. We define distributable cash flow as adjusted EBITDA plus cash interest received and cash taxes received, less cash interest paid, senior notes interest adjustment, adjusted Series A Preferred Units cash distribution, cash taxes paid and maintenance capital expenditures.

We exclude these items because they are considered unusual and not indicative of our ongoing operations. Our definitions of these non-GAAP financial measures may differ from the definitions of similar measures used by other companies, thereby diminishing the utility of these measures. Management uses these non-GAAP financial measures in making financial, operating and planning decisions and in evaluating the Partnership’s financial performance. Furthermore, management believes that these non-GAAP financial measures may provide users of the Partnership’s financial statements with additional meaningful comparisons between current results and results of prior periods as they are expected to be reflective of our core ongoing business. These measures have limitations, and investors should not consider them in isolation or as a substitute for analysis of the Partnership’s results as reported under GAAP.

We do not provide the GAAP financial measures of net income or loss or net cash provided by operating activities on a forward-looking basis because we are unable to predict, without unreasonable effort, certain components thereof including, but not limited to, (i) income or loss from equity method investees and (ii) asset impairments. These items are inherently uncertain and depend on various factors, many of which are beyond our control. As such, any associated estimate and its impact on our GAAP performance and cash flow measures could vary materially based on a variety of acceptable management assumptions.

Reconciliations of GAAP to non-GAAP financial measures are included as attachments to the press release which has been posted to the “Investors” section of our website at www.summitmidstream.com.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

1

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

Summit Midstream Partners, LP

|

|

|

|

(Registrant)

|

|

|

|

|

|

|

|

By:

|

Summit Midstream GP, LLC (its general partner)

|

|

|

|

|

|

Dated:

|

May 7, 2021

|

/s/ Marc D. Stratton

|

|

|

|

Marc D. Stratton, Executive Vice President and Chief Financial Officer

|

2

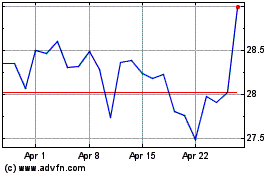

Summit Midstream Partners (NYSE:SMLP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Summit Midstream Partners (NYSE:SMLP)

Historical Stock Chart

From Apr 2023 to Apr 2024