SelectQuote Raises Going Concern Warning and Begins Talks With Lenders

May 05 2022 - 5:59PM

Dow Jones News

SelectQuote Inc. said there could be major doubts about its

long-term survival if negotiations with senior secured lenders

aren't successful.

In a Securities and Exchange Commission filing Thursday, the

Overland Park, Kan.-based insurance distributor said that, under a

credit facility, it must maintain a certain financial ratio.

As of March 31, the business was in compliance but said

forecasts show a risk it could fall out of compliance within a

year. That would permit lenders to declare a default and demand all

amounts due, liquidity that SelectQuote would lack.

SelectQuote spokesman Matt Gunter said the company has "a

relatively small group of lenders" and is "in active and

constructive dialogue" about a debt covenant waiver or

modification.

It currently owes more than $700 million under the facility.

Write to Becky Yerak at becky.yerak@wsj.com

(END) Dow Jones Newswires

May 05, 2022 17:44 ET (21:44 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

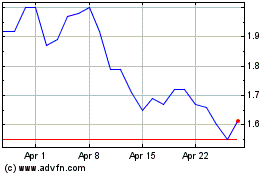

SelectQuote (NYSE:SLQT)

Historical Stock Chart

From Mar 2024 to Apr 2024

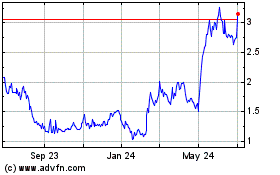

SelectQuote (NYSE:SLQT)

Historical Stock Chart

From Apr 2023 to Apr 2024