SL Green Announces Sale of 220 East 42nd Street

October 01 2019 - 4:05PM

Business Wire

Sale of Second Avenue Tower is One of NYC’s

Largest Transactions This Year

SL Green Realty Corp. (NYSE:SLG), New York City’s largest office

landlord, today announced that it has entered into a contract to

sell 220 East 42nd Street in Midtown Manhattan for total

consideration of $815.0 million, or approximately $715 per square

foot. The transaction is expected to close in the first quarter of

2020, subject to customary closing conditions.

Located on the corner of 42nd Street and Second Avenue, 220 East

42nd Street, also known as The News Building, is a 37-story

art-deco skyscraper that was originally the headquarters for The

New York Daily News. SL Green purchased the property in February

2003 for $265.0 million, following its initial $53.5 million

preferred equity investment in September 2001. The company then

commenced a multi-year repositioning and retenanting of the

property. Currently boasting occupancy of 97 percent and the

highest net operating income since SL Green’s acquisition, the

building’s tenant roster includes the Visiting Nurse Service of New

York, Omnicom Group, local television station WPIX and the United

Nations.

SL Green's Co-Chief Investment Officer, Isaac Zion,

commented, “The sale of the historic News Building demonstrates the

continued demand, both international and domestic, for large,

fully-stabilized assets in East Midtown, Manhattan’s preeminent

business district. This sale also furthers our strategy of selling

assets into a healthy investment market and using the proceeds from

these sales to repurchase deeply discounted shares of our stock

while maintaining a low leverage profile.”

Adam Spies and Doug Harmon of Cushman & Wakefield along with

Robert Verrone of Iron Hound Management facilitated the

transaction.

About SL Green Realty Corp.

SL Green Realty Corp., an S&P 500 company and New York

City's largest office landlord, is a fully integrated real estate

investment trust, or REIT, that is focused primarily on acquiring,

managing and maximizing value of Manhattan commercial properties.

As of June 30, 2019, SL Green held interests in 96 Manhattan

buildings totaling 46.0 million square feet. This included

ownership interests in 27.2 million square feet of Manhattan

buildings and 18.8 million square feet securing debt and preferred

equity investments. In addition, SL Green held ownership interests

in 7 suburban properties comprised of 15 buildings totaling 2.3

million square feet in Brooklyn, Westchester County, and

Connecticut.

Forward-looking Statement

This press release includes certain statements that may be

deemed to be "forward-looking statements" within the meaning of the

Private Securities Litigation Reform Act of 1995 and are intended

to be covered by the safe harbor provisions thereof. All

statements, other than statements of historical facts, included in

this press release that address activities, events or developments

that we expect, believe or anticipate will or may occur in the

future, are forward-looking statements. Forward-looking statements

are not guarantees of future performance and we caution you not to

place undue reliance on such statements. Forward-looking statements

are generally identifiable by the use of the words "may," "will,"

"should," "expect," "anticipate," "estimate," "believe," "intend,"

"project," "continue," or the negative of these words, or other

similar words or terms.

Forward-looking statements contained in this press release are

subject to a number of risks and uncertainties, many of which are

beyond our control, that may cause our actual results, performance

or achievements to be materially different from future results,

performance or achievements expressed or implied by forward-looking

statements made by us. Factors and risks to our business that could

cause actual results to differ from those contained in the

forward-looking statements are described in our filings with the

Securities and Exchange Commission. We undertake no obligation to

publicly update or revise any forward-looking statements, whether

as a result of future events, new information or otherwise.

SLG- A&D

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191001006136/en/

Investors: Matt DiLiberto Chief Financial Officer SL Green

Realty Corp. (212) 594-2700 Press: BerlinRosen

slgreen@berlinrosen.com (646) 452-5637

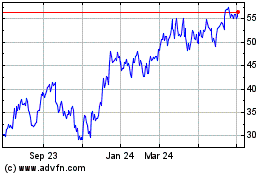

SL Green Realty (NYSE:SLG)

Historical Stock Chart

From Mar 2024 to Apr 2024

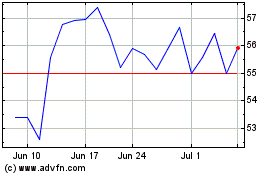

SL Green Realty (NYSE:SLG)

Historical Stock Chart

From Apr 2023 to Apr 2024