Improves Cash Flow Outlook from Company’s Prior

Guidance

Company Developing Business Transformation

Initiative for Long-Term Earnings Growth

Six Flags Entertainment Corporation (NYSE: SIX), the world’s

largest regional theme park company and the largest operator of

waterparks in North America, today reported, as anticipated, weaker

financial results for the second quarter and first half of 2020 as

compared to the same periods in 2019, primarily due to the COVID-19

pandemic’s negative impact on its operations. Compared to its prior

guidance, the company improved its cash flow performance for the

second quarter and is projecting reduced cash outflows for the

balance of the year. The company has commenced a major

transformation initiative to reinvigorate long-term growth and

shareholder value, including revenue growth, improved cost

efficiencies, and an enhanced end-to-end experience for its

guests.

“I am very proud of our team’s performance in the face of

unprecedented challenges from the pandemic. We have made

transformational changes to park operations by leveraging our

experience and technology to create industry-leading safety

protocols. In close coordination with government leaders and local

communities, these protocols have allowed us to reopen many of our

parks while maintaining the safety of our team members and guests

as our highest priority. Now more than ever, we believe our guests

need opportunities for outdoor entertainment, and I am pleased that

city and state officials have acknowledged our safety standards as

a best-in-class example of how businesses can safely serve guests

during this pandemic,” said Mike Spanos, President and CEO.

“Additionally, I would like to thank our loyal season pass holders

and members for their commitment to our company during this

difficult period.”

“Our team is taking actions that will allow us to emerge a

stronger and more profitable company,” continued Spanos, “and we

have initiated a fundamental review of our business model with the

goal of becoming a more agile, consumer-centric, and

technology-savvy organization.”

Second Quarter 2020

Results

As previously announced, the company suspended operations of its

North American parks beginning on March 13, 2020, due to the spread

of COVID-19 and local government mandates, which had a significant

negative impact on the company’s financial performance. The company

resumed partial operations at many of its parks on a staggered

basis near the end of the second quarter using a cautious and

phased approach, including limiting attendance, in accordance with

local conditions and government guidelines. A schedule of park

reopening dates is set forth in Schedule A of this release.

Revenue for the second quarter of 2020 was $19 million, with

attendance of 433,000 guests, both a decrease of 96 percent

compared to the same period in 2019. The decrease was due to the

pandemic-related suspension of park operations for most of the

quarter. The decrease in revenue was also attributable to a $29

million reduction in sponsorship, international agreements, and

accommodations revenue due to the previously announced terminations

of the company’s contracts in China and Dubai, which generated

revenue in 2019; the suspension of most second-quarter sponsorship

revenue while the parks were not operating; and the

pandemic-related suspension of nearly all accommodations

operations. The company partially offset the decrease in revenue by

implementing cost savings measures immediately after park

operations were suspended.

The company’s net loss during the second quarter of 2020 was

$137 million, a decrease of $216 million compared to the prior year

period, primarily due to reduced attendance and an aggregate

increase in reserves of $8 million associated with several legal

claims. The net loss per share for the second quarter of 2020 was

$1.62, compared to diluted earnings per share of $0.94 in the

second quarter of 2019. Adjusted EBITDA1 for the second quarter of

2020 was a loss of $96 million, a decrease of $276 million compared

to the prior year period. The second quarter 2020 Adjusted EBITDA

calculation reflects an add-back adjustment of approximately $6

million of non-recurring costs related to the transformation

initiative.

Net cash outflow for the second quarter was $76 million,

excluding the one-time financing costs associated with the

company’s debt transactions, or approximately $25 million per

month. This represented an improvement compared to the company’s

previously anticipated average net cash outflow of $30-$35 million

per month. The improvement was driven by disciplined cost

management, higher than expected retention of the Active Pass Base,

which includes all members and season pass holders, and positive

cash flow from reopened parks.

Total guest spending per capita for the second quarter of 2020

was $35.77, a decrease of $6.50, or 15 percent, compared to the

second quarter of 2019. The decrease was primarily due to park mix:

half of the company’s attendance in the second quarter came from

the company’s drive-through Safari at Six Flags Great Adventure,

which reopened in May 2020 after having been converted to a free

park attraction in 2013. The safari experiences lower guest

spending per capita compared to the company’s other parks due to

the lack of in-park spending opportunities.

Admissions revenue per capita in the second quarter of 2020

increased $1.29, or 5 percent, to $25.32 compared to the second

quarter of 2019. This increase was driven by a higher mix of

single-day paid admissions, offset by the deferral of approximately

$24 million of monthly membership revenue. After a member’s initial

12-month commitment period ends, the company ordinarily recognizes

revenue from those membership payments on a monthly basis; however,

in response to the pandemic-related park closures, the company

added one additional month of membership privileges for every month

a member paid but could not visit their home park. The membership

payments received while parks were closed due to the pandemic were

deferred and will be recognized as revenue when these additional

months are used.

In-park spending per capita in the second quarter of 2020

decreased $7.79, or 43 percent compared to the second quarter of

2019, to $10.45, primarily due to the lack of in-park spending

opportunity at the company’s drive-through Safari at Six Flags

Great Adventure. The decrease was also attributable to the deferral

of approximately $6 million of monthly membership revenue related

to all-season membership products such as the all-season dining

pass. Similar to the membership admission payments described above,

this revenue will be deferred until the additional months received

for these products are utilized.

First Half 2020 Results

For the first six months of 2020, revenue was $122 million, an

80 percent decrease compared to the prior year period. The decrease

was due to an 84 percent decrease in attendance resulting from the

temporary pandemic-related suspension of park operations, and a $40

million decrease in sponsorship, international agreements, and

accommodations revenue. The company had a net loss of $221 million

and a net loss per share of $2.62 for the first six months of 2020,

compared to net income of $10 million and diluted earnings per

share of $0.12 for the same period in 2019. Adjusted EBITDA was a

loss of $138 million for the first six months of 2020, compared to

Adjusted EBITDA of $148 million for the first six months of

2019.

Attendance for the first six months of 2020 was 2.0 million

guests, an 84 percent decrease compared to 12.7 million guests in

the first six months of 2019. Guest spending per capita increased

$8.80 to $52.13 for the first six months of 2020, with admissions

per capita increasing 40 percent and in-park spending per capita

decreasing 6 percent to $35.10 and $17.03, respectively.

The improvement in admissions spending per capita for the first

six months of 2020 was primarily due to recurring monthly

membership revenue in the first quarter of 2020 from members who

retained their memberships on a monthly basis after their initial

12-month commitment period ended. Prior to the suspension of park

operations, when the company began deferring this revenue while

park operations were suspended, these payments were recognized as

received. Higher guest spending per capita by single-day guests

prior to the suspension of operations also contributed to the

improvement. The decrease in in-park spending per capita was driven

by attendance at the company’s drive-through Safari, which lacks

in-park spending opportunities.

Active Pass Base

The company is working with its members and season pass holders

to extend their usage privileges to compensate for any lost days

due to its temporary park closures, and is offering higher-tiered

benefits to members in return for maintaining their current payment

schedule. The company has also offered members the option to pause

payments on their current membership. However, as anticipated, the

company sold fewer season passes and memberships while its parks

were not operating compared to the same period in 2019. As a

result, the Active Pass Base decreased 38 percent as of the end of

the second quarter of 2020 compared to the same prior year period.

Included in the Active Pass Base were 2.1 million members, compared

to 2.6 million members at the end of 2019 and 2.4 million members

at the end of the first quarter of 2020.

Deferred revenue was $182 million as of June 30, 2020, a

decrease of $53 million, or 22 percent, from June 30, 2019. The

decrease in deferred revenue was primarily due to lower season pass

and membership sales. This was partially offset by the deferral of

revenue from members and season pass holders.

For those members whose initial 12-month commitment period

ended, but who continued paying for membership on a monthly basis

after the parks temporarily closed for the pandemic, revenue will

be deferred until the end of their membership. In contrast,

payments from members whose initial 12-month commitment period had

ended in 2019 were recognized as they were received and had limited

contribution to deferred revenue in the prior year period.

Balance Sheet and

Liquidity

As of June 30, 2020, the company had cash on hand of $296

million and $460 million available under its revolving credit

facility, net of $21 million of letters of credit, or total

liquidity of $756 million. Based on the parks that are currently

open, the company estimates that its net cash outflow2 through the

end of 2020 will be, on average, $25-$30 million per month. The

company has no debt maturities until 2024.

In the first half of 2020, the company invested $73 million in

new capital projects, net of property insurance recoveries, paid

$21 million in dividends, and prepaid $51 million of its 4.875

percent notes due 2024. Net debt as of June 30, 2020, calculated as

total reported debt of $2,620 million less cash and cash

equivalents of $296 million, was $2,324 million.

In April, the company amended its credit facility to, among

other things, suspend testing of its senior secured leverage ratio

financial maintenance covenant through December 31, 2020. The

company’s lenders also approved modified testing of the senior

secured leverage ratio financial maintenance covenant through

December 31, 2021. Through the duration of the amendment period

ending December 31, 2021, the company agreed to suspend paying

dividends and repurchasing its common stock, and to maintain

minimum liquidity of $150 million.

In response to curtailed operations, and to preserve the

company’s liquidity position and prepare for multiple

contingencies, the company continues to take actions to reduce

operating expenses and defer or eliminate certain discretionary

capital projects planned for 2020 and 2021. The company is able to

take additional measures or further modify park operations and park

schedules based on changing conditions.

At this time, the company anticipates it has sufficient

liquidity to meet its cash obligations through the end of 2021 even

if the currently open parks are forced to close; however, if its

operations continue to be significantly reduced in 2021, the

company would likely require additional covenant relief during 2021

from its credit facility lenders. The company will continue to

explore options to further reduce cash outflows and be prepared to

respond to a more protracted reduction of operations.

Transformation

Initiative

The company launched a holistic transformation program to

reinvigorate revenue growth, reduce operating expenses by

optimizing the company’s operating model, and improve its guests’

end-to-end experience through technological advancements. Through

this transformation initiative, the company is targeting

significant improvement to its financial performance and to the

guest experience. The company will not make a final determination

of the costs or associated savings until it completes the work. The

company anticipates that a portion of the work will be completed by

the fourth quarter of 2020, and the remaining portion will be

completed when the parks are again operating at a more normal

capacity.

Conference Call

At 8:00 a.m. Central Time today, July 29, 2020, the company will

host a conference call to discuss its second quarter 2020 financial

performance. The call is accessible through either the Six Flags

Investor Relations website at investors.sixflags.com or by dialing

1-855-889-1976 in the United States or +1-937-641-0558 outside the

United States and requesting the Six Flags earnings call. A replay

of the call will be available through August 7, 2020, by dialing

1-855-859-2056 or +1-404-537-3406 and requesting conference ID

6867339.

About Six Flags Entertainment

Corporation

Six Flags Entertainment Corporation is the world’s largest

regional theme park company and the largest operator of waterparks

in North America, with 26 parks across the United States, Mexico

and Canada. For 58 years, Six Flags has entertained millions of

families with world-class coasters, themed rides, thrilling

waterparks and unique attractions. For more information, visit

www.sixflags.com.

Forward Looking

Statements

This release contains forward-looking statements within the

meaning of Section 27A of the Securities Act and Section 21E of the

Securities Exchange Act of 1934, as amended, including statements

regarding (i) our ability to continue to safely and profitably

operate our parks, or reopen our parks that are temporarily closed,

in accordance with CDC and local health guidelines, (ii) estimates

of our net cash outflow during the time our operations are limited

or fully suspended and for the balance of the year, (iii) the

adequacy of our preparations for or the sufficiency of our

liquidity, (iv) expectations regarding future actions and

initiatives to increase profitability and resilience, and (v) our

ability to significantly improve our financial performance and the

guest experience. Forward-looking statements include all statements

that are not historical facts and often use words such as

"anticipates," "intends," "plans," "seeks," "believes,"

"estimates," "expects," "may," "should," "could" and variations of

such words or similar expressions. These statements may involve

risks and uncertainties that could cause actual results to differ

materially from those described in such statements. These risks and

uncertainties include, among others, factors impacting attendance,

such as local conditions, natural disasters, contagious diseases,

including the novel coronavirus (COVID-19), or the perceived threat

of contagious diseases, events, disturbances and terrorist

activities; regulations and guidance of federal, state and local

governments and health officials regarding the response to

COVID-19, including with respect to business operations, safety

protocols and public gatherings; recall of food, toys and other

retail products sold at our parks; accidents or contagious disease

outbreaks occurring at our parks or other parks in the industry and

adverse publicity concerning our parks or other parks in the

industry; availability of commercially reasonable insurance

policies at reasonable rates; inability to achieve desired

improvements and our financial performance targets set forth in our

aspirational goals; adverse weather conditions such as excess heat

or cold, rain and storms; general financial and credit market

conditions, including our ability to access credit or raise

capital; economic conditions (including customer spending

patterns); changes in public and consumer tastes; construction

delays in capital improvements or ride downtime; competition with

other theme parks, waterparks and entertainment alternatives;

dependence on a seasonal workforce; unionization activities and

labor disputes; laws and regulations affecting labor and employee

benefit costs, including increases in state and federally mandated

minimum wages, and healthcare reform; environmental laws and

regulations; laws and regulations affecting corporate taxation;

pending, threatened or future legal proceedings and the significant

expenses associated with litigation; cybersecurity risks and other

factors could cause actual results to differ materially from the

company’s expectations, including the risk factors or uncertainties

listed from time to time in the Company’s filings with the

Securities and Exchange Commission (the “SEC”). Although we believe

that the expectations reflected in such forward-looking statements

are reasonable, we make no assurance that such expectations will be

realized and actual results could vary materially. Reference is

made to a more complete discussion of forward-looking statements

and applicable risks contained under the captions "Cautionary Note

Regarding Forward-Looking Statements" and "Risk Factors" in our

Annual and Quarterly Reports on Forms 10-K and 10-Q, and our other

filings and submissions with the SEC, each of which are available

free of charge on the company’s investor relations website at

investors.sixflags.com and on the SEC’s website at www.sec.gov.

Footnotes

(1)

See the following financial statements and

Note 3 to those financial statements for a discussion of Adjusted

EBITDA (a non-GAAP financial measure) and its reconciliation to net

income (loss).

(2)

Projected net monthly cash outflow

reflects the company’s current estimate of reduced revenues,

ongoing park and operating costs, capital expenditures, contractual

obligations of the company’s parks that are less than wholly-owned

(Six Flags Over Texas, Six Flags Over Georgia and Six Flags White

Water Atlanta), federal and state income tax obligations, debt

amortization and interest, including the most recent financing

transactions, and the costs associated with the company’s

transformation initiative, assuming limited operations at the parks

currently open. The company’s ability to predict the impact of the

COVID-19 global pandemic on its brands and future prospects is

limited. In addition, the magnitude, duration and speed of the

pandemic is uncertain. As a consequence, the company cannot

estimate the impact on its business, financial condition or near-

or longer-term financial or operational results with certainty.

Schedule A

Name of Park

City

Opening Date

Six Flags Great Adventure – Safari

only

Jackson, NJ

May 29

Frontier City

Oklahoma City, OK

June 5

Six Flags Over Georgia

Austell, GA

June 15

Six Flags Hurricane Harbor Arlington

Arlington, TX

June 18

Six Flags Over Texas

Arlington, TX

June 19

Six Flags Fiesta Texas

San Antonio, TX

June 19

Six Flags Hurricane Harbor Oklahoma

City

Oklahoma City, OK

June 20

Six Flags St. Louis

Eureka, MO

June 22

Six Flags Darien Lake – campground

only

Darien, NY

June 25

The Great Escape The Lodge – hotel

only

Queensbury, NY

June 26

Six Flags White Water Atlanta

Marietta, GA

June 29

Six Flags America

Largo, MD

July 1

Six Flags Discovery Kingdom – animals

only

Vallejo, CA

July 2

Six Flags Great Adventure

Jackson, NJ

July 3

Six Flags Great America – water park

only

Gurnee, IL

July 20

Hurricane Harbor Rockford

Rockford, IL

July 20

Hurricane Harbor New Jersey

Jackson, NJ

July 23

La Ronde

Montreal, Quebec, Canada

July 25

Statement of Operations Data

(1)

Three Months Ended

Six Months Ended

Twelve Months Ended

(Amounts in thousands, except per share

data)

June 30, 2020

June 30, 2019

June 30, 2020

June 30, 2019

June 30, 2020

June 30, 2019

Park admissions

$

10,962

$

252,508

$

70,768

$

318,588

$

567,962

$

821,860

Park food, merchandise and other

4,523

191,655

34,329

230,633

378,136

565,859

Sponsorship, international agreements and

accommodations

3,658

33,047

16,549

56,182

57,728

107,007

Total revenues

19,143

477,210

121,646

605,403

1,003,826

1,494,726

Operating expenses (excluding depreciation

and amortization shown separately below)

62,681

178,348

168,545

292,870

483,466

601,130

Selling, general and administrative

expenses (excluding depreciation, amortization, and stock-based

compensation shown separately below)

30,800

56,170

62,710

92,389

156,241

182,106

Costs of products sold

2,214

43,513

9,974

53,788

86,490

125,608

Other net periodic pension benefit

(994)

(1,055)

(1,990)

(2,110)

(4,066)

(4,725)

Depreciation

29,032

28,674

59,095

57,144

117,776

115,063

Amortization

402

601

1,003

1,204

2,204

2,428

Stock-based compensation

6,020

3,553

10,300

7,444

16,130

(59,829)

Loss (gain) on disposal of assets

513

(690)

393

446

2,109

160

Interest expense, net

51,047

29,572

78,204

57,920

133,586

111,798

Loss on debt extinguishment

5,087

6,231

6,106

6,231

6,359

6,231

Other expense (income), net

4,252

(1,278)

5,812

(1,705)

10,059

(486)

(Loss) income before income taxes

(171,911)

133,571

(278,506)

39,782

(6,528)

415,242

Income tax (benefit) expense

(55,661)

33,675

(77,710)

9,018

5,214

100,635

Net (loss) income

(116,250)

99,896

(200,796)

30,764

(11,742)

314,607

Less: Net income attributable to

noncontrolling interests

(20,644)

(20,377)

(20,644)

(20,377)

(41,020)

(40,381)

Net (loss) income attributable to Six

Flags Entertainment Corporation

$

(136,894)

$

79,519

$

(221,440)

$

10,387

$

(52,762)

$

274,226

Weighted-average common shares

outstanding:

Basic:

84,704

84,288

84,680

84,207

84,582

84,174

Diluted:

84,704

84,868

84,680

84,882

84,582

85,094

Net (loss) income per average common share

outstanding:

Basic:

$

(1.62)

$

0.94

$

(2.62)

$

0.12

$

(0.62)

$

3.26

Diluted:

$

(1.62)

$

0.94

$

(2.62)

$

0.12

$

(0.62)

$

3.22

Balance Sheet Data

As of

(Amounts in thousands)

June 30, 2020

December 31, 2019

June 30, 2019

Cash and cash equivalents

$

295,956

$

174,179

$

113,798

Total assets

2,968,934

2,882,540

2,938,066

Deferred revenue

182,386

144,040

235,109

Current portion of long-term debt

—

8,000

8,000

Long-term debt

2,619,929

2,266,884

2,269,761

Redeemable noncontrolling interests

544,020

529,258

545,386

Total stockholders' deficit

(970,782)

(716,118)

(749,807)

Shares outstanding

84,757

84,634

84,335

Definition and Reconciliation of Non-GAAP Financial

Measures

We prepare our financial statements in accordance with United

States generally accepted accounting principles ("GAAP"). In our

press release, we make reference to non-GAAP financial measures

including Modified EBITDA, Adjusted EBITDA and Adjusted Free Cash

Flow. The definition for each of these non-GAAP financial measures

is set forth below in the notes to the reconciliation tables. We

believe that these non-GAAP financial measures provide important

and useful information for investors to facilitate a comparison of

our operating performance on a consistent basis from period to

period and make it easier to compare our results with those of

other companies in our industry. We use these measures for internal

planning and forecasting purposes, to evaluate ongoing operations

and our performance generally, and in our annual and long-term

incentive plans. By providing these measures, we provide our

investors with the ability to review our performance in the same

manner as our management.

However, because these non-GAAP financial measures are not

determined in accordance with GAAP, they are susceptible to varying

calculations, and not all companies calculate these measures in the

same manner. As a result, these non-GAAP financial measures as

presented may not be directly comparable to a similarly titled

non-GAAP financial measure presented by another company. These

non-GAAP financial measures are presented as supplemental

information and not as alternatives to any GAAP financial measures.

When reviewing a non-GAAP financial measure, we encourage our

investors to fully review and consider the related reconciliation

as detailed below.

The following table sets forth a reconciliation of net (loss)

income to Adjusted EBITDA for the three, six and twelve months

ended June 30, 2020 and June 30, 2019:

Three Months Ended

Six Months Ended

Twelve Months Ended

(Amounts in thousands, except per share

data)

June 30, 2020

June 30, 2019

June 30, 2020

June 30, 2019

June 30, 2020

June 30, 2019

Net (loss) income

$

(116,250)

$

99,896

$

(200,796)

$

30,764

$

(11,742)

$

314,607

Income tax (benefit) expense

(55,661)

33,675

(77,710)

9,018

5,214

100,635

Other expense (income), net (2)

4,252

(1,278)

5,812

(1,705)

10,059

(486)

Loss on debt extinguishment

5,087

6,231

6,106

6,231

6,359

6,231

Interest expense, net

51,047

29,572

78,204

57,920

133,586

111,798

Loss (gain) on disposal of assets

513

(690)

393

446

2,109

160

Amortization

402

601

1,003

1,204

2,204

2,428

Depreciation

29,032

28,674

59,095

57,144

117,776

115,063

Stock-based compensation

6,020

3,553

10,300

7,444

16,130

(59,829)

Impact of Fresh Start valuation

adjustments (3)

—

—

—

—

—

11

Modified EBITDA (4)

(75,558)

200,234

(117,593)

168,466

281,695

590,618

Third party interest in EBITDA of certain

operations (5)

(20,644)

(20,377)

(20,644)

(20,377)

(41,020)

(40,381)

Adjusted EBITDA (4)

$

(96,202)

$

179,857

$

(138,237)

$

148,089

$

240,675

$

550,237

Weighted-average common shares

outstanding

84,704

84,288

84,680

84,207

84,582

84,174

The following table sets forth a reconciliation of net cash

(used in) provided by operating activities to Adjusted Free Cash

Flow for the three, six and twelve months ended June 30, 2020 and

June 30, 2019:

Three Months Ended

Six Months Ended

Twelve Months Ended

(Amounts in thousands, except per share

data)

June 30, 2020

June 30, 2019

June 30, 2020

June 30, 2019

June 30, 2020

June 30, 2019

Net cash (used in) provided by operating

activities

$

(50,316)

$

167,020

$

(110,703)

$

126,197

$

173,673

$

404,638

Changes in working capital

(81,719)

(2,918)

(88,441)

(20,069)

(39,633)

55,645

Interest expense, net

51,047

29,572

78,204

57,920

133,586

111,798

Income tax (benefit) expense

(55,661)

33,675

(77,710)

9,018

5,214

100,635

Amortization of debt issuance costs

(1,611)

(865)

(2,467)

(1,872)

(4,158)

(3,885)

Other expense (income), net (2)

5,284

(40)

5,178

(384)

12,019

5,648

Interest accretion on notes payable

(285)

(326)

(605)

(664)

(1,251)

(1,338)

Changes in deferred income taxes

57,703

(25,884)

78,951

(1,680)

2,245

(82,534)

Impact of Fresh Start valuation

adjustments (3)

—

—

—

—

—

11

Third party interest in EBITDA of certain

operations (5)

(20,644)

(20,377)

(20,644)

(20,377)

(41,020)

(40,381)

Capital expenditures, net of property

insurance recovery

(21,693)

(47,666)

(73,109)

(95,125)

(118,160)

(137,716)

Cash paid for interest, net

(20,274)

(28,307)

(51,932)

(59,733)

(105,196)

(106,590)

Cash taxes (6)

(367)

(12,097)

(2,326)

(17,407)

(13,128)

(32,584)

Adjusted Free Cash Flow (7)

$

(138,536)

$

91,787

$

(265,604)

$

(24,176)

$

4,191

$

273,347

Weighted-average common shares outstanding

- basic:

84,704

84,288

84,680

84,207

84,582

84,174

(1)

Revenues and expenses of international

operations are converted into U.S. dollars on an average basis as

provided by GAAP.

(2)

Amounts recorded as “Other expense

(income), net” include amounts related to our transformation

initiative. These amounts are excluded from Modified EBITDA as they

are non-routine, non-recurring and unrelated to our ongoing

operations and costs necessary to operate our business.

(3)

Amounts recorded as valuation adjustments

and included in reorganization items for the month of April 2010

that would have been included in Modified EBITDA and Adjusted

EBITDA, had fresh start accounting not been applied. Balances

consisted primarily of discounted insurance reserves that were

accreted through the statement of operations each quarter through

2018.

(4)

"Adjusted EBITDA", a non-GAAP measure, is

defined as Modified EBITDA minus the interests of third parties in

the Adjusted EBITDA of properties that are less than wholly owned

(consisting of Six Flags Over Georgia, Six Flags White Water

Atlanta and Six Flags Over Texas). Adjusted EBITDA is approximately

equal to “Parent Consolidated Adjusted EBITDA” as defined in our

secured credit agreement, except that Parent Consolidated Adjusted

EBITDA excludes Adjusted EBITDA from equity investees that is not

distributed to us in cash on a net basis and has limitations on the

amounts of certain expenses that are excluded from the calculation.

Adjusted EBITDA as defined herein may differ from similarly titled

measures presented by other companies. Our board of directors and

management use Adjusted EBITDA to measure our performance and our

current management incentive compensation plans are based largely

on Adjusted EBITDA. We believe that Adjusted EBITDA is frequently

used by all our sell-side analysts and most investors as their

primary measure of our performance in the evaluation of companies

in our industry. In addition, the instruments governing our

indebtedness use Adjusted EBITDA to measure our compliance with

certain covenants and, in certain circumstances, our ability to

make certain borrowings. Adjusted EBITDA, as computed by us, may

not be comparable to similar metrics used by other companies in our

industry.

(5)

Represents interests of third parties in

the Adjusted EBITDA of Six Flags Over Georgia, Six Flags Over Texas

and Six Flags White Water Atlanta.

(6)

Cash taxes represents statutory taxes

paid, primarily driven by Mexico and state level obligations. Based

on our current federal net operating loss carryforwards and reduced

operations due to the COVID-19 pandemic, we anticipate paying

minimal federal income taxes in 2020 and do not anticipate becoming

a full cash taxpayer until 2024. During the years 2021 through

2024, we have significant federal operating loss carryforwards

which will offset the majority of our taxable income.

(7)

Management uses Adjusted Free Cash Flow, a

non-GAAP measure, in its financial and operational decision making

processes, for internal reporting, and as part of its forecasting

and budgeting processes as it provides additional transparency of

our operations. Management believes that Adjusted Free Cash Flow is

useful information to investors regarding the amount of cash that

we estimate that we will generate from operations over a certain

period. Management believes the presentation of this measure will

enhance the investors' ability to analyze trends in the business

and evaluate the Company's underlying performance relative to other

companies in the industry. A reconciliation from net cash provided

by (used in) operating activities to Adjusted Free Cash Flow is

presented in the table above. Adjusted Free Cash Flow as presented

herein may differ from similarly titled measures presented by other

companies.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200729005096/en/

Stephen Purtell Senior Vice President Investor Relations and

Treasurer +1-972-595-5180 investors@sftp.com

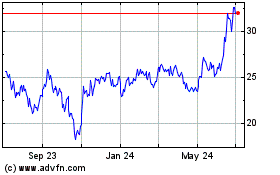

Six Flags Entertainment (NYSE:SIX)

Historical Stock Chart

From Mar 2024 to Apr 2024

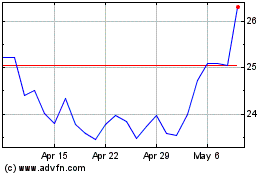

Six Flags Entertainment (NYSE:SIX)

Historical Stock Chart

From Apr 2023 to Apr 2024