SITE Centers Corp. (NYSE: SITC) today announced operating

results for the quarter ended March 31, 2020.

“SITE Centers had a strong start to the year and is

well-positioned heading into a period of economic uncertainty given

the strength of the Company’s curated portfolio and balance sheet,”

commented David R. Lukes, President and Chief Executive Officer.

“We have substantial liquidity, no material near-term maturities,

and no material capital commitments.”

Results for the Quarter

- First quarter net income attributable to common shareholders

was $29.2 million, or $0.15 per diluted share, as compared to net

income of $27.4 million, or $0.15 per diluted share, in the

year-ago period. The year-over-year increase in net income was

primarily attributable to a gain recognized on the sale of a joint

venture interest offset by a valuation allowance of the Company’s

preferred investments and debt extinguishment costs.

- First quarter operating funds from operations attributable to

common shareholders (“Operating FFO” or “OFFO”) was $61.2 million,

or $0.32 per diluted share, compared to $58.7 million, or $0.32 per

diluted share, in the year-ago period.

Significant First Quarter and Recent Activity

- Completed the sale of SITE Centers’ 15% stake in the DDRTC

Joint Venture to its partner, TIAA-CREF, which resulted in net

proceeds to the Company of approximately $141 million prior to any

working capital adjustments.

- Repaid $200 million aggregate principal amount of 4.625% senior

unsecured notes due 2022. The Company recorded a charge in

connection with the notes repayment of $17.2 million primarily

related to prepayment penalties.

- Sold one shopping center and land for an aggregate sales price

of $33.4 million, totaling $13.4 million at SITE Centers’ share,

including $7.5 million from the repayment of a mezzanine loan.

- Repurchased 0.8 million of its common shares for $7.5 million.

The shares were repurchased at a weighted-average price of

$9.18.

- Implemented a COVID-19 response plan that included

transitioning all company employees to a virtual workplace,

enacting protocols in line with government guidelines at

company-owned shopping centers to keep all centers operational,

working with tenants to access small business resources including

those provided by the Payroll Protection Program (PPP), and by

taking decisive steps to improve liquidity, reduce capital spending

and increase financial flexibility.

- The Company’s Board of Directors has suspended payment of

dividends on its common shares for the second quarter of 2020. The

Board of Directors has not made any decisions with respect to its

dividend policy beyond the second quarter of 2020 and intends to

maintain compliance with REIT taxable income distribution

requirements.

Key Quarterly Operating Results

- Reported 3.7% same store net operating income growth on a pro

rata basis for the first quarter of 2020, excluding redevelopment.

Including redevelopment, same store net operating income growth for

the same period was 3.1%.

- Generated new leasing spreads of 20.1% and renewal leasing

spreads of 3.3%, both on a pro rata basis, for the quarter and new

leasing spreads of 12.2% and renewal leasing spreads of 3.8%, both

on a pro rata basis, for the trailing twelve-month period.

- Reported a leased rate of 92.9% at March 31, 2020 on a pro rata

basis, compared to 93.8% on a pro rata basis at December 31, 2019

and 93.0% at March 31, 2019.

- Annualized base rent per occupied square foot on a pro rata

basis was $18.49 at March 31, 2020, compared to $17.92 at March 31,

2019.

About SITE Centers Corp. SITE Centers is an owner and

manager of open-air shopping centers that provide a

highly-compelling shopping experience and merchandise mix for

retail partners and consumers. The Company is a self-administered

and self-managed REIT operating as a fully integrated real estate

company, and is publicly traded on the New York Stock Exchange

under the ticker symbol SITC. Additional information about the

Company is available at https://www.sitecenters.com. To be included

in the Company’s e-mail distributions for press releases and other

investor news, please click here.

Conference Call and Supplemental Information The Company

will hold its quarterly conference call today at 8:00 a.m. Eastern

Time. To participate with access to the slide presentation, please

visit the Investor Relations portion of SITE's website,

ir.sitecenters.com, or for audio only, dial 888-317-6003 (U.S.),

866-284-3684 (Canada) or 412-317-6061 (international) using pass

code 0447058 at least ten minutes prior to the scheduled start of

the call. A replay of the conference call will also be available at

ir.sitecenters.com for one year after the call. A copy of the

Company’s Supplemental package is available on the Company’s

website.

Non-GAAP Measures Funds from Operations (“FFO”) is a

supplemental non-GAAP financial measure used as a standard in the

real estate industry and is a widely accepted measure of real

estate investment trust (“REIT”) performance. Management believes

that both FFO and Operating FFO provide additional indicators of

the financial performance of a REIT. The Company also believes that

FFO and Operating FFO more appropriately measure the core

operations of the Company and provide benchmarks to its peer

group.

FFO is generally defined and calculated by the Company as net

income (loss) (computed in accordance with GAAP), adjusted to

exclude (i) preferred share dividends, (ii) gains and losses from

disposition of real estate property and related investments, which

are presented net of taxes, (iii) impairment charges on real estate

property and related investments, including reserve adjustments of

preferred equity interests, (iv) gains and losses from changes in

control and (v) certain non-cash items. These non-cash items

principally include real property depreciation and amortization of

intangibles, equity income (loss) from joint ventures and equity

income (loss) from non-controlling interests and adding the

Company’s proportionate share of FFO from its unconsolidated joint

ventures and non-controlling interests, determined on a consistent

basis. The Company’s calculation of FFO is consistent with the

definition of FFO provided by NAREIT. The Company calculates

Operating FFO as FFO excluding certain non-operating charges,

income and gains. Operating FFO is useful to investors as the

Company removes non-comparable charges, income and gains to analyze

the results of its operations and assess performance of the core

operating real estate portfolio. Other real estate companies may

calculate FFO and Operating FFO in a different manner.

The Company also uses net operating income (“NOI”), a non-GAAP

financial measure, as a supplemental performance measure. NOI is

calculated as property revenues less property-related expenses. The

Company believes NOI provides useful information to investors

regarding the Company’s financial condition and results of

operations because it reflects only those income and expense items

that are incurred at the property level and, when compared across

periods, reflects the impact on operations from trends in occupancy

rates, rental rates, operating costs and acquisition and

disposition activity on an unleveraged basis.

The Company presents NOI information herein on a same store

basis or “SSNOI.” The Company defines SSNOI as property revenues

less property-related expenses, which exclude straight-line rental

income (including reimbursements) and expenses, lease termination

income, management fee expense, fair market value of leases and

expense recovery adjustments. SSNOI includes assets owned in

comparable periods (15 months for quarter comparisons). In

addition, SSNOI is presented both including and excluding activity

associated with development and major redevelopment. SSNOI excludes

all non-property and corporate level revenue and expenses. Other

real estate companies may calculate NOI and SSNOI in a different

manner. The Company believes SSNOI at its effective ownership

interest provides investors with additional information regarding

the operating performances of comparable assets because it excludes

certain non-cash and non-comparable items as noted above.

FFO, Operating FFO, NOI and SSNOI do not represent cash

generated from operating activities in accordance with GAAP, are

not necessarily indicative of cash available to fund cash needs and

should not be considered as alternatives to net income computed in

accordance with GAAP, as indicators of the Company’s operating

performance or as alternatives to cash flow as a measure of

liquidity. Reconciliations of these non-GAAP measures to their most

directly comparable GAAP measures are included in this release and

the accompanying financial supplement.

Safe Harbor SITE Centers Corp. considers portions of the

information in this press release to be forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934, both as

amended, with respect to the Company's expectation for future

periods. Although the Company believes that the expectations

reflected in such forward-looking statements are based upon

reasonable assumptions, it can give no assurance that its

expectations will be achieved. For this purpose, any statements

contained herein that are not historical fact may be deemed to be

forward-looking statements. There are a number of important factors

that could cause our results to differ materially from those

indicated by such forward-looking statements, including, among

other factors, the impact of the outbreak of COVID-19 on the

Company’s ability to manage its properties, finance its operations

and perform necessary administrative and reporting functions and on

tenants’ ability to operate their businesses, generate sales and

meet their financial obligations, including the obligation to pay

rent; local conditions such as the supply of, and demand for,

retail real estate space in the area; the impact of e-commerce;

dependence on rental income from real property; the loss of,

significant downsizing of or bankruptcy of a major tenant and the

impact of any such event on rental income from other tenants and

our properties; redevelopment and construction activities may not

achieve a desired return on investment; our ability to buy or sell

assets on commercially reasonable terms; our ability to complete

acquisitions or dispositions of assets under contract; our ability

to secure equity or debt financing on commercially acceptable terms

or at all; impairment charges; our ability to enter into definitive

agreements with regard to our financing and joint venture

arrangements and our ability to satisfy conditions to the

completion of these arrangements; valuation and risks relating to

our joint venture and preferred equity investments; the termination

of any joint venture arrangements or arrangements to manage real

property; property damage, expenses related thereto and other

business and economic consequences (including the potential loss of

rental revenues) resulting from extreme weather conditions or

natural disasters in locations where we own properties, and the

ability to estimate accurately the amounts thereof; sufficiency and

timing of any insurance recovery payments related to damages from

extreme weather conditions or natural disasters; any change in

strategy and our ability to maintain REIT status. For additional

factors that could cause the results of the Company to differ

materially from those indicated in the forward-looking statements,

please refer to the Company's most recent reports on Form 10-K and

Form 10-Q. The impacts of COVID-19 may also exacerbate the risks

described therein, any of which could have a material effect on the

Company. The Company undertakes no obligation to publicly revise

these forward-looking statements to reflect events or circumstances

that arise after the date hereof.

SITE Centers Corp. Income

Statement: Consolidated Interests

in thousands, except per share

1Q20

1Q19

Revenues:

Rental income (1)

$112,529

$112,221

Other property revenues

1,553

1,469

114,082

113,690

Expenses:

Operating and maintenance

18,480

18,841

Real estate taxes

17,657

17,743

36,137

36,584

Net operating income

77,945

77,106

Other income (expense):

Fee income (2)

15,228

17,332

Interest income

3,485

4,521

Interest expense

(20,587)

(21,726)

Depreciation and amortization

(42,993)

(42,608)

General and administrative (3)

(11,376)

(14,112)

Other (expense) income, net (4)

(17,409)

153

Impairment charges

0

(620)

Income before earnings from JVs and

other

4,293

20,046

Equity in net income of JVs

2,171

1,043

Reserve of preferred equity interests

(18,057)

(1,099)

Gain on sale of joint venture interest

45,681

0

Gain on disposition of real estate,

net

773

16,377

Tax expense

(233)

(272)

Net income

34,628

36,095

Non-controlling interests

(295)

(305)

Net income SITE Centers

34,333

35,790

Preferred dividends

(5,133)

(8,383)

Net income Common Shareholders

$29,200

$27,407

Weighted average shares – Basic –

EPS

193,726

180,546

Assumed conversion of diluted

securities

0

545

Weighted average shares – Basic &

Diluted – EPS

193,726

181,091

Earnings per common share –

Basic

$0.15

$0.15

Earnings per common share –

Diluted

$0.15

$0.15

(1)

Rental income:

Minimum rents

$74,641

$74,961

Ground lease minimum rents

5,468

5,018

Percentage and overage rent

601

1,376

Recoveries

27,199

27,461

Lease termination fees

3,025

2,587

Ancillary and other rental income

2,084

1,259

Bad debt

(489)

(441)

(2)

Fee Income:

JV and other fees

7,598

7,876

RVI fees

6,074

6,556

RVI disposition fees

1,556

1,100

RVI refinancing fee

0

1,800

(3)

Mark-to-market adjustment (PRSUs)

2,167

(899)

(4)

Other income (expense), net

Transaction and other expense, net

(223)

163

Debt extinguishment costs, net

(17,186)

(10)

SITE Centers Corp.

Reconciliation: Net Income to FFO and Operating FFO and Other

Financial Information

in thousands, except per share

1Q20

1Q19

Net income attributable to Common

Shareholders

$29,200

$27,407

Depreciation and amortization of real

estate

41,619

40,957

Equity in net income of JVs

(2,171)

(1,043)

JVs' FFO

7,143

7,975

Non-controlling interests

28

28

Impairment of real estate

0

620

Reserve of preferred equity interests

18,057

1,099

Gain on sale of joint venture interest

(45,681)

0

Gain on disposition of real estate,

net

(773)

(16,377)

FFO attributable to Common

Shareholders

$47,422

$60,666

RVI disposition and refinancing fees

(1,556)

(2,900)

Mark-to-market adjustment (PRSUs)

(2,167)

899

Debt extinguishment, transaction, net

17,409

22

Joint ventures - debt extinguishment,

other

42

14

Total non-operating items, net

13,728

(1,965)

Operating FFO attributable to Common

Shareholders

$61,150

$58,701

Weighted average shares & units –

Basic: FFO & OFFO

193,867

180,690

Assumed conversion of dilutive

securities

0

545

Weighted average shares & units –

Diluted: FFO & OFFO

193,867

181,235

FFO per share – Basic

$0.24

$0.34

FFO per share – Diluted

$0.24

$0.33

Operating FFO per share – Basic

$0.32

$0.32

Operating FFO per share –

Diluted

$0.32

$0.32

Common stock dividends declared, per

share

$0.20

$0.20

Capital expenditures (SITE Centers

share):

Development and redevelopment costs

8,734

6,849

Maintenance capital expenditures

2,255

1,398

Tenant allowances and landlord work

10,383

8,311

Leasing commissions

968

843

Construction administrative costs

(capitalized)

840

626

Certain non-cash items (SITE Centers

share):

Straight-line rent

(1,342)

316

Straight-line fixed CAM

149

201

Amortization of (above)/below-market rent,

net

1,402

1,196

Straight-line rent expense

(70)

(420)

Debt fair value and loan cost

amortization

(1,110)

(1,122)

Capitalized interest expense

286

271

Stock compensation expense

176

(1,855)

Non-real estate depreciation expense

(1,316)

(1,558)

SITE Centers Corp. Balance

Sheet: Consolidated Interests

$ in thousands

At Period End

1Q20

4Q19

Assets:

Land

$881,360

$881,397

Buildings

3,289,988

3,277,440

Fixtures and tenant improvements

493,371

491,312

4,664,719

4,650,149

Depreciation

(1,323,390)

(1,289,148)

3,341,329

3,361,001

Construction in progress and land

62,250

59,663

Real estate, net

3,403,579

3,420,664

Investments in and advances to JVs

85,074

181,906

Investment in and advances to affiliate

(1)

190,105

190,105

Receivable – preferred equity interests,

net

93,909

112,589

Cash

514,258

16,080

Restricted cash

106

3,053

Notes receivable

0

7,541

Receivables and straight-line (2)

56,436

60,594

Intangible assets, net (3)

76,038

79,813

Other assets, net

25,576

21,277

Total Assets

4,445,081

4,093,622

Liabilities and Equity:

Revolving credit facilities

645,000

5,000

Unsecured debt

1,447,997

1,647,963

Unsecured term loan

99,504

99,460

Secured debt

54,210

94,874

2,246,711

1,847,297

Dividends payable

44,047

44,036

Other liabilities (4)

186,845

220,811

Total Liabilities

2,477,603

2,112,144

Preferred shares

325,000

325,000

Common shares

19,399

19,382

Paid-in capital

5,703,521

5,700,400

Distributions in excess of net income

(4,075,813)

(4,066,099)

Deferred compensation

5,994

7,929

Other comprehensive income

(104)

(491)

Common shares in treasury at cost

(13,600)

(7,707)

Non-controlling interests

3,081

3,064

Total Equity

1,967,478

1,981,478

Total Liabilities and Equity

$4,445,081

$4,093,622

(1)

Preferred investment in RVI

$190,000

$190,000

Receivable from RVI

105

105

(2)

SL rents (including fixed CAM), net

30,646

31,909

(3)

Operating lease right of use assets

22,013

$21,792

(4)

Operating lease liabilities

41,008

40,725

Below-market leases, net

45,700

46,961

SITE Centers Corp.

Reconciliation of Net Income Attributable to SITE to Same Store

NOI

$ in thousands

1Q20

1Q19

1Q20

1Q19

SITE Centers at 100%

At SITE Centers Share

(Non-GAAP)

GAAP

Reconciliation:

Net income attributable to SITE

Centers

$34,333

$35,790

$34,333

$35,790

Fee income

(15,228)

(17,332)

(15,228)

(17,332)

Interest income

(3,485)

(4,521)

(3,485)

(4,521)

Interest expense

20,587

21,726

20,587

21,726

Depreciation and amortization

42,993

42,608

42,993

42,608

General and administrative

11,376

14,112

11,376

14,112

Other expense (income), net

17,409

(153)

17,409

(153)

Impairment charges

0

620

0

620

Equity in net income of joint ventures

(2,171)

(1,043)

(2,171)

(1,043)

Reserve of preferred equity interests

18,057

1,099

18,057

1,099

Tax expense

233

272

233

272

Gain on sale of joint venture interest

(45,681)

0

(45,681)

0

Gain on disposition of real estate,

net

(773)

(16,377)

(773)

(16,377)

Income from non-controlling interests

295

305

295

305

Consolidated NOI

77,945

77,106

77,945

77,106

SITE Centers' consolidated JV

0

0

(476)

(444)

Consolidated NOI, net of

non-controlling interests

77,945

77,106

77,469

76,662

Net (loss) income from unconsolidated

joint ventures

(18,654)

6,666

1,981

774

Interest expense

17,755

25,656

3,329

4,429

Depreciation and amortization

30,104

39,504

5,196

6,167

Impairment charges

31,720

12,267

1,586

2,453

Preferred share expense

4,530

5,459

227

273

Other expense, net

4,657

5,456

936

996

Gain on disposition of real estate,

net

(8,906)

(15,966)

(1,739)

(1,555)

Unconsolidated NOI

$61,206

$79,042

11,516

13,537

Total Consolidated + Unconsolidated

NOI

88,985

90,199

Less: Non-Same Store NOI adjustments

(4,505)

(8,220)

Total SSNOI including

redevelopment

84,480

81,979

Less: Redevelopment Same Store NOI

adjustments

(5,240)

(5,566)

Total SSNOI excluding

redevelopment

$79,240

$76,413

SSNOI % Change including

redevelopment

3.1%

SSNOI % Change excluding

redevelopment

3.7%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200430005017/en/

Conor Fennerty, 216-755-5500 EVP and Chief Financial Officer

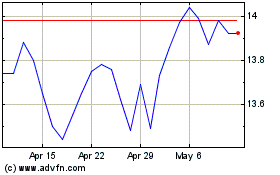

SITE Centers (NYSE:SITC)

Historical Stock Chart

From Mar 2024 to Apr 2024

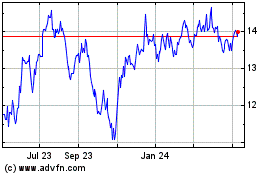

SITE Centers (NYSE:SITC)

Historical Stock Chart

From Apr 2023 to Apr 2024