Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

September 16 2020 - 8:38AM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration Nos. 333-240142

September 15, 2020

PRICING TERM SHEET

Dated September 15, 2020

A final base shelf prospectus containing important information relating to the securities described in this document has

been filed with the securities regulatory authorities in each of the provinces and territories of Canada, except Québec, as well as with the U.S. Securities and Exchange Commission on a registration statement on Form F-10. A copy of the final base

shelf prospectus, any amendment to the final base shelf prospectus and any applicable shelf prospectus supplement that has been filed, is required to be delivered with this document.

This document does not provide full disclosure of all material facts relating to the securities offered. Investors should

read the final base shelf prospectus, any amendment and any applicable shelf prospectus supplement for disclosure of those facts, especially risk factors relating to the securities offered, before making an investment decision.

Shopify Inc.

$800,000,000

0.125% Convertible Senior Notes due 2025

|

Issuer:

|

Shopify Inc. (the “Issuer”)

|

|

|

|

|

Title of securities:

|

0.125% Convertible Senior Notes due 2025 (the “Notes”)

|

|

|

|

|

Ticker / Exchanges for Class A Shares:

|

SHOP / The New York Stock Exchange (“NYSE”) and

Toronto Stock Exchange (“TSX”)

|

|

|

|

|

Aggregate principal amount offered:

|

$800,000,000 aggregate principal amount of Notes

|

|

|

|

|

Over-allotment option:

|

Up to an additional $120,000,000 aggregate principal amount of Notes solely to cover over-allotments

|

|

|

|

|

Offering price:

|

The Notes will be issued at a price of 100% of their

principal amount, plus accrued interest, if any, from September 18, 2020, if settlement occurs after that date

|

|

|

|

|

Maturity:

|

November 1, 2025, unless earlier converted,

redeemed or purchased

|

|

|

|

|

Interest rate:

|

0.125% per annum, accruing from the settlement date

|

|

|

|

|

Interest payment dates:

|

Each May 1 and November 1, starting on May 1, 2021

|

|

|

|

|

Record Dates:

|

April 15 and October 15 of each year

|

|

|

|

|

NYSE last reported sale price on September 15, 2020:

|

$929.39 per Class A subordinate voting shares (“Class A Shares”)

|

|

|

|

|

TSX last reported sale price on September 15, 2020:

|

C$1,226.90 per Class A Share

|

|

|

|

|

Public offering price of the Concurrent Equity Offering:

|

$900.00 per Class A Share

|

|

|

|

|

Initial conversion rate:

|

0.6944 of the Issuer’s Class A Shares for each $1,000 principal amount of Notes

|

|

|

|

|

Initial conversion price:

|

Approximately $1,440.09 per Class A Share

|

|

|

|

|

Conversion premium:

|

Approximately 60.0% above the public offering price of the

Concurrent Equity Offering

|

|

|

|

|

Trade date:

|

September 16, 2020

|

|

|

|

|

Expected settlement date:

|

September 18, 2020

|

|

|

|

|

Book-running managers:

|

Goldman Sachs & Co. LLC

Citigroup Global Markets Inc.

Credit Suisse Securities (USA) LLC

|

|

|

|

|

Co-manager:

|

RBC Dominion Securities Inc.

|

|

|

|

|

CUSIP Number / ISIN:

|

82509L AA5 / US82509LAA52

|

|

|

|

|

Use of proceeds:

|

We estimate that the net proceeds from the offering will be approximately $789.5 million (or approximately $908.0 million if the underwriters exercise

their over-allotment option in full), after deducting the underwriters’ discount and estimated offering expenses payable by us.

We currently expect to use the net proceeds from the offering and the Concurrent Equity Offering to further strengthen our balance sheet, providing us flexibility to fund our growth strategies that may include: product innovation, future

acquisitions and strategic partnerships. Pending their use, we intend to invest the net proceeds from the offering and the Concurrent Equity Offering in short-term, investment grade, interest bearing instruments or hold them as cash.

|

|

|

|

|

Redemption:

|

We may not redeem the Notes prior to September 15,

2023, except if less than $80 million aggregate principal amount of Notes remains outstanding as described under “Description of Notes—Cleanup Redemption” in the preliminary prospectus supplement or in the event of certain changes in Canadian

tax law as described under “Description of Notes—Redemption for Changes in Canadian Tax Law” in the preliminary prospectus supplement. We may redeem for cash all or any portion of the Notes, at our option, on or after September 15, 2023 if the

last reported sale price on the NYSE of the Class A Shares has been at least 130% of the conversion price then in effect for at least 20 trading days (whether or not consecutive) during any 30 consecutive trading day period (including the last

trading day of such period) ending on, and including, the trading day immediately preceding the date on which we provide notice of redemption at a redemption price equal to 100% of the principal amount of the notes to be redeemed, plus accrued

and unpaid interest to, but excluding, the redemption date.

|

|

Adjustment to conversion rate upon conversion in connection with a make-whole fundamental change or during a

redemption period:

|

Following certain corporate events which are a “fundamental change” (as defined under “Description of Notes—Conversion Rights—Increase in Conversion Rate upon Conversion upon a Make-whole Fundamental Change or during a Redemption Period” in the preliminary prospectus supplement) that occur prior to the maturity date or if we issue a notice of redemption, we will increase the conversion rate by reference to the table below,

for a holder who elects to convert its Notes in connection with such fundamental change or who elects to convert its Notes called for redemption during the related redemption period in certain circumstances as described under “Description of Notes—Conversion Rights—Increase in Conversion Rate upon Conversion upon a Make-whole Fundamental Change or during a Redemption

Period” in the preliminary prospectus supplement.

The following table sets forth the number of additional shares by which the conversion rate will be increased per $1,000 principal amount of Notes:

|

|

|

|

|

Effective Date/Redemption Notice Date

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 18, 2020

|

0.4167

|

0.3465

|

0.2467

|

0.1708

|

0.1362

|

0.0951

|

0.0810

|

0.0602

|

0.0453

|

0.0266

|

0.0160

|

0.0097

|

|

|

November 1, 2021

|

0.4167

|

0.3432

|

0.2384

|

0.1601

|

0.1250

|

0.0843

|

0.0707

|

0.0508

|

0.0370

|

0.0203

|

0.0114

|

0.0064

|

|

|

November 1, 2022

|

0.4167

|

0.3361

|

0.2257

|

0.1450

|

0.1099

|

0.0702

|

0.0574

|

0.0392

|

0.0272

|

0.0134

|

0.0066

|

0.0032

|

|

|

November 1, 2023

|

0.4167

|

0.3247

|

0.2070

|

0.1237

|

0.0890

|

0.0519

|

0.0406

|

0.0254

|

0.0161

|

0.0065

|

0.0025

|

0.0008

|

|

|

November 1, 2024

|

0.4167

|

0.3097

|

0.1789

|

0.0913

|

0.0582

|

0.0273

|

0.0192

|

0.0098

|

0.0050

|

0.0012

|

0.0001

|

0.0000

|

|

|

November 1, 2025

|

0.4167

|

0.3056

|

0.1389

|

0.0000

|

0.0000

|

0.0000

|

0.0000

|

0.0000

|

0.0000

|

0.0000

|

0.0000

|

0.0000

|

|

The exact share prices and effective dates or redemption notice dates may not be set forth in the table above, in which case:

|

•

|

If the share price is between two share prices in the table or the effective date or redemption notice date, as the case may be, is between two

effective dates or redemption notice dates, as applicable, in the table, the number of additional shares by which the conversion rate will be increased will be determined by a straight-line interpolation between the number of additional

shares set forth for the higher and lower share prices and the earlier and later effective dates or redemption notice dates, as applicable, based on a 365-day year.

|

|

•

|

If the share price is greater than $4,000.00 per share (subject to adjustment in the same manner as the share prices set forth in the column headings

of the table above), no additional shares will be added to the conversion rate.

|

|

•

|

If the share price is less than $900.00 per share (subject to adjustment in the same manner as the share prices set forth in the column headings of

the table above), no additional shares will be added to the conversion rate.

|

Notwithstanding the foregoing, in no event will the conversion rate per $1,000 principal amount of Notes exceed 1.1111 Class A Shares,

subject to adjustment in the same manner as the conversion rate as set forth under “Description of Notes—Conversion Rate Adjustments” in the preliminary prospectus supplement.

___________________

|

Concurrent Equity Offering:

|

Concurrently with this offering, we are offering 1,100,000

Class A Shares (or 1,265,000 Class A Shares if the underwriters of such offering exercise in full their option to purchase additional Class A

Shares) at a price of $900.00 per Class A Share.

The completion of this offering is not conditional upon the

completion of the Concurrent Equity Offering and the completion of the Concurrent Equity Offering is not conditional upon the completion of this offering. The Concurrent Equity Offering is expected to close on or about September 18, 2020, the same date as this offering is expected to close.

|

___________________

The Issuer has filed a registration statement on Form F-10 (including a prospectus) with the United States Securities and Exchange Commission

(“SEC”) for the offering to which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the Company has filed with the SEC for more complete information about the Company and

the offering to which this communication relates. The offering to which this communication relates is being made only by means of a prospectus supplement and accompanying base shelf prospectus. A copy of the prospectus supplement and accompanying base

shelf prospectus related to the offering may be obtained from Citigroup, Attention: Citigroup, c/o Broadridge Financial Solutions, 1155 Long Island Avenue, Edgewood, NY 11717 (Tel: 800-831-9146); or Goldman Sachs & Co. LLC, Attention: Prospectus

Department, 200 West Street, New York, NY 10282 (Tel: 1-866-471-2526). Copies of the prospectus supplement and accompanying base shelf prospectus may also be obtained for free from www.sec.gov and www.sedar.com.

The Notes described herein will not be listed on any securities exchange. There is currently no market through which such securities may be

sold and purchasers may not be able to resell any such securities purchased under the applicable prospectus supplement relating to such securities (the “Prospectus Supplement”). This may affect the pricing of such securities in the secondary market,

the transparency and availability of trading prices, the liquidity of such securities and the extent of issuer regulation. See the ‘‘Risk Factors’’ section of the applicable Prospectus Supplement.

Purchasers of securities should be aware that the acquisition of securities may have tax consequences both in the United States and in

Canada. This document does not discuss U.S. or Canadian tax consequences and any such tax consequences may not be described fully in any applicable Prospectus Supplement with respect to a particular offering of securities. Prospective investors should

consult their own tax advisors prior to deciding to purchase any of the securities.

An investment in the securities described herein involves significant risks that should be carefully considered by prospective investors

before purchasing securities described herein. The risks outlined in the applicable Prospectus Supplement, the short form base shelf prospectus of the Issuer dated August 6, 2020 and in the documents incorporated by reference therein should be

carefully reviewed and considered by prospective investors in connection with any investment in the securities described herein.

___________________

ANY DISCLAIMERS OR OTHER NOTICES THAT MAY APPEAR BELOW ARE NOT APPLICABLE TO THIS COMMUNICATION AND SHOULD BE DISREGARDED. SUCH DISCLAIMERS OR OTHER NOTICES

WERE AUTOMATICALLY GENERATED AS A RESULT OF THIS COMMUNICATION BEING SENT VIA BLOOMBERG OR ANOTHER EMAIL SYSTEM.

4

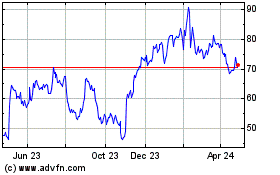

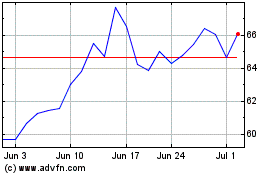

Shopify (NYSE:SHOP)

Historical Stock Chart

From Mar 2024 to Apr 2024

Shopify (NYSE:SHOP)

Historical Stock Chart

From Apr 2023 to Apr 2024