Shopify's Business Sells Itself, for Now -- Heard on the Street

July 29 2020 - 1:11PM

Dow Jones News

By Laura Forman

Overall U.S. retail sales were down in the second quarter,

according to Census Bureau data. You would never know it from

Shopify's results.

With the pandemic forcing store closures world-wide, e-commerce

business is booming. Companies rushed to Shopify's online retail

platform in the early months of the pandemic, driving eye-popping

quarterly results for a company that was already growing at an

impressive clip.

Second-quarter revenue was up 97% from a year earlier to $714

million -- roughly 40% higher than Wall Street's expectations.

Meanwhile, gross merchandise volume topped $30 billion, well above

analysts' forecast of $19.9 billion and up 119% versus a year ago.

That growth looks all the more impressive when compared with the

26% growth in gross merchandise volume eBay reported Tuesday

evening. Shopify shares were up around 10% on Wednesday.

The company says its e-commerce platform is built to enable

businesses of all sizes "to sell to anyone, anywhere." As the

pandemic rages on, that value proposition has apparently been

selling itself. Shopify managed to turn a slight operating profit,

despite analysts' expectation for a loss, driven not only by

top-line outperformance but also by lower sales and marketing costs

versus Street expectations.

There were more incentives for business to come online this year

than just the pandemic. Shopify said it recently extended its trial

period for new standard plans from 14 to 90 days. That offer, which

ended May 31, was very popular. The company said new stores created

on its platform, or those who have provided billing information but

for which the company doesn't yet collect a subscription fee, grew

71% in the second quarter versus the same period last year.

But is that kind of growth sustainable? Shopify is now a $127

billion market-cap company whose share price has risen roughly 70%

over the past three months alone. And while the pandemic appears to

be far from over, it could be that the initial rush online is

moderating.

In its earnings release, Shopify said data from June 15 to July

19 shows new stores created during its extended free trial were

converting to paid subscriptions "at a slightly lower rate" than

merchants who joined the platform before the pandemic. It also

suggested more recent customers may be less established and

therefore less valuable to its top line.

The company declined to provide a formal third-quarter outlook,

citing both the unknown future impact of the pandemic and the

greater likelihood of an extended global recession.

Shopify says it now has nearly 6% of U.S. e-commerce sales --

more than eBay, Walmart, and Apple, but significantly lower than

Amazon.com's 37%. That highlights the upside opportunity for the

platform to continue to grow and take share, especially given its

wide range of subscription packages, priced anywhere from $29 to

over $2,000 a month. Still, with shares trading at all-time highs,

some correction seems likely, particularly if growth eases in the

third quarter.

"The world is changing fast," Shopify's chief executive said in

the company's earnings release. The question is whether Shopify's

market value can continue to rise as quickly.

Write to Laura Forman at laura.forman@wsj.com

(END) Dow Jones Newswires

July 29, 2020 12:56 ET (16:56 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

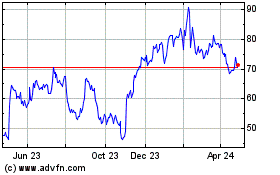

Shopify (NYSE:SHOP)

Historical Stock Chart

From Mar 2024 to Apr 2024

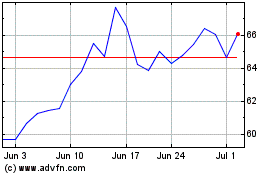

Shopify (NYSE:SHOP)

Historical Stock Chart

From Apr 2023 to Apr 2024