UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13A-16 OR 15D-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2019

Commission File Number

333-224459

SEADRILL LIMITED

(Exact name of Registrant as specified in its Charter)

Par-la-Ville Place, 4th Floor

14 Par-la-Ville Road

Hamilton HM 08 Bermuda

(441) 295-6935

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F [X] Form 40-F [ ]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Yes [ ] No [X]

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Yes [ ] No [X]

Seadrill Limited

Report on Form 6-K for the

six months ended June 30, 2019

EXPLANATORY NOTE

This Form 6-K contains the Management’s Discussion and Analysis of Financial Condition and Results of Operations and the unaudited interim condensed Consolidated Financial Statements and related information and data of the Company as of and for the six month period ended June 30, 2019.

This Form 6-K is hereby incorporated by reference into our Registration Statements on (i) Form F-3 (Registration No. 333-224459), and (ii) Form S-8 (Registration No. 333-227101).

INDEX

|

|

|

|

|

|

|

|

|

|

|

|

Interim Financial Statements (unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

We desire to take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, or the PSLRA, and are including this cautionary statement in connection therewith. The PSLRA provides safe harbor protections for forward-looking statements to encourage companies to provide prospective information about their business.

Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other statements, which are other than statements of historical or present facts or conditions.

This report on Form 6-K and any other written or oral statements made by us or on our behalf may include forward-looking statements which reflect our current views with respect to future events and financial performance. The words “believe,” “anticipate,” “intend,” “estimate,” “forecast,” “project,” “plan,” “potential,” “may,” “should,” “expect” and similar expressions identify forward-looking statements.

The forward-looking statements in this document are based upon various assumptions, many of which are based, in turn, upon further assumptions, including, without limitation, management’s examination of historical operating trends, data contained in our records and other data available from third parties. Although we believe that these assumptions were reasonable when made, because these assumptions are inherently subject to significant uncertainties and contingencies that are difficult or impossible to predict and are beyond our control, we cannot assure you that we will achieve or accomplish these expectations, beliefs or projections.

In addition to these important factors and matters discussed elsewhere in this report on Form 6-K, and in the documents incorporated by reference to this report, important factors that, in our view, could cause actual results to differ materially from those discussed in the forward-looking statements include:

|

|

|

|

•

|

our ability to maintain relationships with suppliers, customers, employees and other third parties following our emergence from Chapter 11 proceedings;

|

|

|

|

|

•

|

our ability to maintain and obtain adequate financing to support our business plans following our emergence from Chapter 11;

|

|

|

|

|

•

|

factors related to the offshore drilling market, including changes in oil and gas prices and the state of the global economy on market outlook for our various geographical operating sectors and classes of rigs;

|

|

|

|

|

•

|

supply and demand for drilling units and competitive pressure on utilization rates and dayrates;

|

|

|

|

|

•

|

customer contracts, including contract backlog, contract commencements, contract terminations, contract option exercises, contract revenues, contract awards and rig mobilizations;

|

|

|

|

|

•

|

the repudiation, nullification, modification or renegotiation of drilling contracts;

|

|

|

|

|

•

|

delays in payments by, or disputes with, our customers under our drilling contracts;

|

|

|

|

|

•

|

fluctuations in the market value of our drilling units and the amount of debt we can incur under certain covenants in our debt financing agreements;

|

|

|

|

|

•

|

the liquidity and adequacy of cash flow for our obligations;

|

|

|

|

|

•

|

our ability to successfully employ our drilling units;

|

|

|

|

|

•

|

our ability to procure or have access to financing;

|

|

|

|

|

•

|

our expected debt levels;

|

|

|

|

|

•

|

our ability to satisfy our obligations, including certain covenants, under our debt financing agreements and if needed, to refinance our existing indebtedness;

|

|

|

|

|

•

|

credit risks of our key customers;

|

|

|

|

|

•

|

political and other uncertainties, including political unrest, risks of terrorist acts, war and civil disturbances, public health threats, piracy, corruption, significant governmental influence over many aspects of local economies, or the seizure, nationalization or expropriation of property or equipment;

|

|

|

|

|

•

|

the concentration of our revenues in certain geographical jurisdictions;

|

|

|

|

|

•

|

limitations on insurance coverage, such as war risk coverage, in certain regions;

|

|

|

|

|

•

|

any inability to repatriate income or capital;

|

|

|

|

|

•

|

the operation and maintenance of our drilling units, including complications associated with repairing and replacing equipment in remote locations and maintenance costs incurred while idle;

|

|

|

|

|

•

|

newbuildings, upgrades, shipyard and other capital projects, including the completion, delivery and commencement of operation dates;

|

|

|

|

|

•

|

wage and price controls and the imposition of trade barriers;

|

|

|

|

|

•

|

the recruitment and retention of personnel;

|

|

|

|

|

•

|

regulatory or financial requirements to comply with foreign bureaucratic actions, including potential limitations on drilling activity, changing taxation policies and other forms of government regulation and economic conditions that are beyond our control;

|

|

|

|

|

•

|

the level of expected capital expenditures, our expected financing of such capital expenditures, and the timing and cost of completion of capital projects;

|

|

|

|

|

•

|

fluctuations in interest rates or exchange rates and currency devaluations relating to foreign or US monetary policy;

|

|

|

|

|

•

|

tax matters, changes in tax laws, treaties and regulations, tax assessments and liabilities for tax issues, including those associated with our activities in Bermuda, Brazil, Norway, the United Kingdom and the United States;

|

|

|

|

|

•

|

legal and regulatory matters, including the results and effects of legal proceedings, and the outcome and effects of internal and governmental investigations;

|

|

|

|

|

•

|

hazards inherent in the drilling industry and marine operations causing personal injury or loss of life, severe damage to or destruction of property and equipment, pollution or environmental damage, claims by third parties or customers and the suspension of operations;

|

|

|

|

|

•

|

customs and environmental matters; and

|

|

|

|

|

•

|

other important factors described from time to time in the reports filed or furnished by us with the SEC.

|

We caution readers of this report on Form 6-K not to place undue reliance on these forward-looking statements, which speak to circumstances only as at their dates. We undertake no obligation to update any forward-looking statement or statements to reflect events or circumstances after the date on which such statement is made or to reflect the occurrence of unanticipated events. New factors emerge from time to time, and it is not possible for us to predict all of these factors. Further, we cannot assess the impact of each such factor on our business or the extent to which any factor, or combination of factors, may cause actual results to be materially different from those contained in any forward-looking statement.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

You should read the following discussion of our financial condition and results of operations in conjunction with the interim Financial Statements presented in this report, as well as the historical Consolidated Financial Statements and related notes of Seadrill Limited included in our annual report on Form 20-F filed with the SEC on March 28, 2019 (SEC File No. 333-224459) (the “20-F”). Among other things, those financial statements include more detailed information regarding the basis of presentation for the following information. The unaudited Consolidated Financial Statements of Seadrill Limited included in this report have been prepared in accordance with United States Generally Accepted Accounting Principles (“US GAAP”) and are presented in US Dollars.

Except where the context otherwise requires or where otherwise indicated, the terms “Seadrill,” “the Group,” “we,” “us,” “our,” “the Company” and “our Business” refer to either Seadrill Limited, any one or more of its consolidated subsidiaries, or to all such entities, and, for periods before emergence from Chapter 11 Proceedings on July 2, 2018, to Old Seadrill Limited, any one or more of its consolidated subsidiaries, or to all such entities.

References to the term “Predecessor” refers to the financial position and results of operations of Seadrill prior to, and including, July 1, 2018. This is also applicable to terms “Seadrill,” “the Group,” “we,” “us,” “our,” “the Company” or “our Business” in context of events before emergence from Chapter 11 Proceedings on July 2, 2018.

References to the term “Successor” refers to the financial position and results of operations of Seadrill after July 2, 2018. This is also applicable to terms “Seadrill,” “the Group.” “we,” “us,” “our,” “the Company” or “our Business” in context of events after emergence from Chapter 11 Proceedings on July 2, 2018.

Management’s Discussion and Analysis of Financial Condition and Results of Operations ("MD&A") is designed to provide a reader of our financial statements with a narrative from the perspective of management. Our MD&A is presented in the following sections:

|

|

|

|

•

|

Significant developments

|

|

|

|

|

•

|

Market overview and trends

|

|

|

|

|

•

|

Liquidity and capital resources

|

|

|

|

|

•

|

Contractual obligations

|

|

|

|

|

•

|

Quantitative and qualitative disclosures about market risk

|

|

|

|

|

•

|

Critical accounting estimates

|

Overview

We are an offshore drilling contractor providing worldwide offshore drilling services to the oil and gas industry. Our primary business is the ownership and operation of drillships, semi-submersible rigs and jack-up rigs for operations in shallow to ultra-deepwater areas in both benign and harsh environments. We contract our drilling units to drill wells for our customers on a dayrate basis. Typically, our customers are oil super-majors and major integrated oil and gas companies, state-owned national oil companies and independent oil and gas companies.

Through a number of acquisitions of companies, second-hand units and newbuildings, we have developed into one of the world's largest international offshore drilling contractors. We own and operate

35

drilling rigs and we manage and operate 20 rigs on behalf of Seadrill Partners, SeaMex, Sonangol and Northern Drilling.

Significant Developments

Receipt of overdue receivable

In January 2019, we received $26 million for an overdue receivable which was fully provided in the Predecessor company. This was recognized as other operating income in our first quarter 2019 results.

Sonadrill joint venture

In February 2019, we entered into an agreement to establish a 50:50 joint venture with Sonangol called Sonadrill. The joint venture will operate four drillships, focusing on opportunities in Angolan waters. Each of the joint venture parties will bareboat two drillships into Sonadrill and we will manage and operate all the units. Seadrill is also managing the delivery and mobilization to Angolan waters of the two Sonangol drillships, from the shipyard in Korea, under a separate commissioning and mobilization agreement with Sonangol.

Tender offer of Senior Secured Notes

In March 2019 we launched a consent solicitation process to amend the senior secured notes indenture which included a subsequent tender offer to purchase back

$311 million

of principal amount outstanding.

In April 2019, we repurchased

$311 million

of principal senior secured notes for

$342 million

. The

$31 million

additional cash paid represents the

7%

purchase premium and settlement of accrued payment-in-kind and cash interest on the notes prior to purchase.

Dalian Newbuilds

The Newbuild contracts for the remaining two jack-up rigs from the Dalian shipyard, the

West Dione and West Mimas

, were terminated in February 2019 and April 2019, respectively.

The Seadrill contracting parties have commenced arbitration proceedings in respect of the eight newbuild jack-up rigs previously contracted to be delivered from the Dalian shipyard and are claiming for repayment of yard installments plus interest and damages. Seadrill has also

filed claims for these amounts as part of the Dalian insolvency proceedings in China. Dalian has maintained it has a damages claim in respect of each of the rigs. The newbuild contracts are all with limited liability subsidiaries of Seadrill and there are no parent company guarantees.

Joint venture with Gulf Drilling International

On August 15, 2019, we announced the award of drilling contracts by Qatar Petroleum to Gulf Drilling International ("GDI"). We have entered into a 50:50 joint venture, Gulfdrill, which will initially manage and operate five premium jack-ups in Qatar with Qatar Petroleum commencing throughout 2020. The total contract value is expected to be $656 million, including mobilization fees.

Each contract has five single well options which could add up to an estimated 14 cumulative years of term and an additional contract value of $700 million.

Gulfdrill will initially bareboat charter the

West Telesto

and

West Castor

from Seadrill and has secured bareboat charters for three additional units from a third-party shipyard.

Contract Backlog

We define contract backlog as the maximum contractual operating dayrate multiplied by the number of days remaining in the firm contract period, excluding revenues for mobilization, demobilization and contract preparation or other incentive provisions.

The contract backlog for our fleet was as follows as at the dates specified:

|

|

|

|

|

|

|

|

|

|

|

(In $ millions)

|

|

|

|

|

|

Contract backlog

|

|

June 30, 2019

|

|

|

December 31, 2018

|

|

|

Floaters

|

|

498

|

|

|

630

|

|

|

Jack-ups

|

|

1,411

|

|

|

1,457

|

|

|

Total

|

|

1,909

|

|

|

2,087

|

|

Our contract backlog includes only firm commitments represented by signed drilling contracts. The full contractual operating dayrate may differ to the actual dayrate we ultimately receive. For example, an alternative contractual dayrate, such as a waiting‑on‑weather rate, repair rate, standby rate or force majeure rate, may apply under certain circumstances. The contractual operating dayrate may also differ to the actual dayrate we ultimately receive because of several other factors, including rig downtime or suspension of operations. In certain contracts, the dayrate may be reduced to zero if, for example, repairs extend beyond a stated period.

We project our

June 30, 2019

contract backlog to unwind over the following periods:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(In $ millions)

|

|

|

|

Period ended December 31,

|

|

Contract backlog

|

|

Total

|

|

|

2019

|

|

|

2020

|

|

|

2021

|

|

|

2022+

|

|

|

Floaters

|

|

498

|

|

|

298

|

|

|

191

|

|

|

9

|

|

|

—

|

|

|

Jack-ups

|

|

1,411

|

|

|

157

|

|

|

171

|

|

|

169

|

|

|

914

|

|

|

Total

|

|

1,909

|

|

|

455

|

|

|

362

|

|

|

178

|

|

|

914

|

|

The actual amounts of revenues earned and the actual periods during which revenues are earned will differ from the amounts and periods shown in the tables above due to various factors, including shipyard and maintenance projects, unplanned downtime and other factors that result in lower applicable dayrates than the full contractual operating dayrate. Additional factors that could affect the amount and timing of actual revenue to be recognized include customer liquidity issues and contract terminations, which are available to our customers under certain circumstances.

Market Overview and Trends

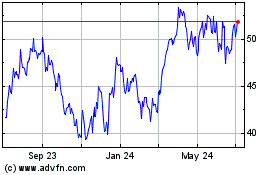

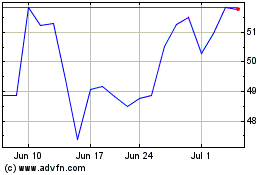

The below table shows the average oil price for the six months ended June 30, 2019 and for each year ended December 31 over the period 2015 to 2018. The Brent oil price at July 31, 2019 was $58.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dec-2015

|

|

|

Dec-2016

|

|

|

Dec-2017

|

|

|

Dec-2018

|

|

|

Jun-2019

|

|

|

|

Average Brent oil price ($/bbl)

|

|

54

|

|

|

45

|

|

|

55

|

|

|

71

|

|

|

60

|

|

|

We have seen a stabilization in the oil and gas market in 2019 with Brent oil prices remaining at $60 per barrel for most of the period. Combined with efficiency improvements across the industry, this stabilization has led to continued improved economics for our customers, which has in turn led to increased tendering activity and a positive trend in dayrates. We expect this trend to continue if the price of oil remains stable and our customers continue to invest in projects.

The below table shows the global number of rigs on contract and marketed utilization at

June 30, 2019

and for each of the four preceding years ending December 31.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dec-2015

|

|

|

Dec-2016

|

|

|

Dec-2017

|

|

|

Dec-2018

|

|

|

Jun-2019

|

|

|

|

Contracted rigs

|

|

|

|

|

|

|

|

|

|

|

|

|

Harsh environment floater

|

|

45

|

|

|

35

|

|

|

30

|

|

|

31

|

|

|

35

|

|

|

|

Benign environment floater

|

|

196

|

|

|

139

|

|

|

120

|

|

|

116

|

|

|

118

|

|

|

|

Jack-up

(1)

|

|

180

|

|

|

152

|

|

|

154

|

|

|

168

|

|

|

194

|

|

|

|

Marketed utilization

|

|

|

|

|

|

|

|

|

|

|

|

|

Harsh environment floater

|

|

93

|

%

|

|

81

|

%

|

|

83

|

%

|

|

85

|

%

|

|

87

|

%

|

|

|

Benign environment floater

|

|

83

|

%

|

|

71

|

%

|

|

71

|

%

|

|

73

|

%

|

|

76

|

%

|

|

|

Jack-up

(1)

|

|

83

|

%

|

|

70

|

%

|

|

70

|

%

|

|

74

|

%

|

|

82

|

%

|

|

(1)

Jack-up rigs capable of operating in water depth greater than 350 feet.

Floater

During 2019 we have seen an increase in the number of opportunities for floaters. This activity, supported by the continued decline in the net floater supply in 2019, has improved utilization levels. Marketed utilization continues to improve, particularly in the harsh environment where there is high demand for high specification units relative to their supply. There is still an excess supply of benign environment units which has slowed the recovery in this market. However, we see future demand for high specification units which will support continued improvement in utilization.

While we expect further newbuild rigs to enter the market in 2020 and beyond, there remains a number of older units with no follow-on work identified which will be prime scrapping candidates, as 35-year classing expenditures can be costly and will only be completed if the economic future profile satisfies this cost. There are also a significant number of cold stacked units with significant reactivation costs that will generally require a sufficient improvement in dayrates to overcome these costs before they are reintroduced into the market, if they are reintroduced at all. This could see total and marketed supply begin to align.

Jack-up

We continue to see an improvement in shallow water market customer demand which has led to an increase in marketed utilization. The increased demand and improved dayrates have seen newbuild rigs begin to enter the market. As newer rigs with high specifications enter the jack-up market, this will lead to the accelerated attrition of older units. The shorter-term contract profile in this market lends itself to higher rig turnover. As these contracts start to lengthen, we expect rig turnover to normalize, which will positively aid the jack-up market recovery.

Results of Operations

The tables included below set out financial information for the three and six months ended

June 30, 2019

(Successor) and

June 30, 2018

(Predecessor). The three and six months ended

June 30, 2019

and

June 30, 2018

are distinct reporting periods because of the application of fresh start accounting upon emergence from Chapter 11 bankruptcy on July 2, 2018. These periods may not be comparable to each other.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Successor

|

|

|

Predecessor

|

|

Successor

|

|

|

Predecessor

|

|

(In $ millions)

|

Three Months Ended June 30, 2019

|

|

|

|

Three Months Ended June 30, 2018

|

|

|

Six months ended June 30, 2019

|

|

|

|

Six months ended June 30, 2018

|

|

|

Operating revenues

|

321

|

|

|

|

348

|

|

|

623

|

|

|

|

712

|

|

|

Operating expenses

|

(397

|

)

|

|

|

(476

|

)

|

|

(796

|

)

|

|

|

(918

|

)

|

|

Other operating items

|

3

|

|

|

|

(411

|

)

|

|

29

|

|

|

|

(407

|

)

|

|

Operating loss

|

(73

|

)

|

|

|

(539

|

)

|

|

(144

|

)

|

|

|

(613

|

)

|

|

Interest expense

|

(122

|

)

|

|

|

(19

|

)

|

|

(254

|

)

|

|

|

(38

|

)

|

|

Reorganization items

|

—

|

|

|

|

(35

|

)

|

|

—

|

|

|

|

(109

|

)

|

|

Other income and expense

|

(41

|

)

|

|

|

165

|

|

|

(116

|

)

|

|

|

161

|

|

|

Loss before income taxes

|

(236

|

)

|

|

|

(428

|

)

|

|

(514

|

)

|

|

|

(599

|

)

|

|

Income tax benefit/(expense)

|

30

|

|

|

|

(4

|

)

|

|

12

|

|

|

|

(36

|

)

|

|

Net loss

|

(206

|

)

|

|

|

(432

|

)

|

|

(502

|

)

|

|

|

(635

|

)

|

1) Operating revenues

Operating revenues consist of contract revenues, reimbursable revenues and other revenues. We have analyzed operating revenues between these categories in the table below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Successor

|

|

|

Predecessor

|

|

Successor

|

|

|

Predecessor

|

|

(In $ millions)

|

Three Months Ended June 30, 2019

|

|

|

|

Three Months Ended June 30, 2018

|

|

|

Six months ended June 30, 2019

|

|

|

|

Six months ended June 30, 2018

|

|

|

Contract revenues

|

253

|

|

|

|

311

|

|

|

508

|

|

|

|

619

|

|

|

Reimbursable revenues

|

44

|

|

|

|

9

|

|

|

70

|

|

|

|

21

|

|

|

Other revenues

|

24

|

|

|

|

28

|

|

|

45

|

|

|

|

72

|

|

|

Total operating revenues

|

321

|

|

|

|

348

|

|

|

623

|

|

|

|

712

|

|

a) Contract revenues

Contract revenues represent the revenues that we earn from contracting our drilling units to customers, primarily on a dayrate basis. We have analyzed contract revenues by segment in the table below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Successor

|

|

|

Predecessor

|

|

Successor

|

|

|

Predecessor

|

|

(In $ millions)

|

Three Months Ended June 30, 2019

|

|

|

|

Three Months Ended June 30, 2018

|

|

|

Six months ended June 30, 2019

|

|

|

|

Six months ended June 30, 2018

|

|

|

Floaters

|

164

|

|

|

|

226

|

|

|

338

|

|

|

|

436

|

|

|

Jack-ups

|

89

|

|

|

|

85

|

|

|

170

|

|

|

|

183

|

|

|

Contract revenues

|

253

|

|

|

|

311

|

|

|

508

|

|

|

|

619

|

|

Contract revenues are primarily driven by the average number of rigs under contract during a period, the average dayrates earned and economic utilization achieved by those rigs under contract. We have set out movements in these key indicators of performance in the sections below.

|

|

|

|

i.

|

Average number of rigs on contract

|

We calculate the average number of rigs on contract by dividing the aggregate days our rigs were on contract during the reporting period by the number of days in that reporting period. The average number of rigs on contract for the periods covered is set out in the below table:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Successor

|

|

|

Predecessor

|

|

Successor

|

|

|

Predecessor

|

|

(Number)

|

Three Months Ended June 30, 2019

|

|

|

|

Three Months Ended June 30, 2018

|

|

|

Six months ended June 30, 2019

|

|

|

|

Six months ended June 30, 2018

|

|

|

Floaters

|

7

|

|

|

|

9

|

|

|

8

|

|

|

|

9

|

|

|

Jack-ups

|

8

|

|

|

|

8

|

|

|

8

|

|

|

|

8

|

|

|

Average number of rigs on contract

|

15

|

|

|

|

17

|

|

|

16

|

|

|

|

17

|

|

The average number of floaters on contract decreased by

two

between the three months ended

June 30, 2019

and the three months ended

June 30, 2018

primarily due to the

West Eclipse

and

Sevan Brasil

completing contracts in June 2018 and July 2018, respectively.

The average number of jack-ups on contract was the same for the three months ended

June 30, 2019

and the three months ended

June 30, 2018

. The

West Tucana

started a new contract in October 2018, this was offset by idle time on the

West Telesto

during April and May 2019.

The average number of floaters on contract decreased by

one

between the six months ended

June 30, 2019

and the six months ended

June 30, 2018

primarily due to the

West Eclipse

and

Sevan Brasil

completing contracts in June 2018 and July 2018. This was partly offset by idle time on the

West Hercules

from January to April 2018.

The average number of jack-ups on contract was the same for the six months ended

June 30, 2019

and the six months ended

June 30, 2018

. The

West Tucana

started a new contract in October 2018. This was offset by the

West Ariel

operating from January to March 2018 and by idle time on the

West Telesto

in April and May 2019.

|

|

|

|

ii.

|

Average contractual dayrates

|

We calculate the average contractual dayrate by dividing the aggregate contractual dayrates during a reporting period by the aggregate number of rig operating days for the reporting period. We have set out the average contractual dayrates for the periods presented in the below table:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Successor

|

|

|

Predecessor

|

|

Successor

|

|

|

Predecessor

|

|

(In $ thousands)

|

Three Months Ended June 30, 2019

|

|

|

|

Three Months Ended June 30, 2018

|

|

|

Six months ended June 30, 2019

|

|

|

|

Six months ended June 30, 2018

|

|

|

Floaters

|

253

|

|

|

|

274

|

|

|

237

|

|

|

|

285

|

|

|

Jack-ups

|

113

|

|

|

|

113

|

|

|

110

|

|

|

|

124

|

|

The average contractual dayrate for floaters decreased by

$21k

and

$48k

per day between the three and six months ended

June 30, 2019

and

June 30, 2018

due to the

West Carina

,

Sevan Brasil

and

West Eclipse

completing legacy

contracts for Petrobras and ExxonMobil in July 2018, respectively. The

West Carina

secured a new contract with Petronas in December 2018 at a lower dayrate.

The average contractual dayrate for jack-ups was the same between the three months ended

June 30, 2019

and

June 30, 2018

. The

West Elara

moved to a higher dayrate on its contract with ConocoPhillips in December 2018 and the

West Telesto

started a new contract with GDI at a higher dayrate that it previously earned for its work in India. This was offset by the

West Callisto

moving to a lower dayrate in January 2019.

The average contractual dayrate for jack-ups decreased by

$14k

per day between the six months ended

June 30, 2019

and

June 30, 2018

due to the

West Linus

moving to a lower dayrate as part of securing a long-term contract with ConocoPhillips, the

West Ariel

and

West Castor

completing legacy contracts and the

West Callisto

moving to a lower dayrate. This was partly offset by the

West Elara

and

West Telesto

moving to higher dayrates.

|

|

|

|

iii.

|

Economic utilization for rigs on contract

|

We define economic utilization as dayrate revenue earned during the period, excluding bonuses, divided by the contractual operating dayrate multiplied by the number of days on contract in the period. If a drilling unit earns its full operating dayrate throughout a reporting period, its economic utilization would be 100%. However, there are many situations that give rise to a dayrate being earned that is less than the contractual operating rate. In such situations economic utilization reduces below 100%.

As set out in the below table, economic utilization has remained in the range of 90% to 98% for each of the periods presented.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Successor

|

|

|

Predecessor

|

|

Successor

|

|

|

Predecessor

|

|

(Percentage)

|

Three Months Ended June 30, 2019

|

|

|

|

Three Months Ended June 30, 2018

|

|

|

Six months ended June 30, 2019

|

|

|

|

Six months ended June 30, 2018

|

|

|

Floaters

|

95

|

%

|

|

|

90

|

%

|

|

93

|

%

|

|

|

90

|

%

|

|

Jack-ups

|

98

|

%

|

|

|

90

|

%

|

|

98

|

%

|

|

|

94

|

%

|

The economic utilization for floaters has increased for the three and six months ended

June 30, 2019

to

95%

and

93%

, respectively. This was primarily due to operational downtime on

the

West Carina

and

West Tellus

during the three months ended

June 30, 2018

.

The economic utilization for jack-ups has increased for the three and six months ended

June 30, 2019

to

98%

. This was primarily due to operational downtime on the

West Linus

during the three months ended

June 30, 2018

.

b) Reimbursable revenues

We generally receive reimbursements from our customers for the purchase of supplies, equipment, personnel and other services provided at their request in accordance with a drilling contract. We classify such revenues as reimbursable revenues.

Reimbursable revenues for the three months ended

June 30, 2019

included revenue of $21 million (six months ended

June 30, 2019

: $38 million) for a contract to perform the first mobilization of the

West Mira

for Northern Drilling and $12 million (six months ended

June 30, 2019

: $12 million) for a contract to perform the first mobilization of the

Libongos

and

Quenguela

for Sonangol.

c) Other revenues

Other revenues include the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Successor

|

|

|

Predecessor

|

|

Successor

|

|

|

Predecessor

|

|

(In $ millions)

|

Three Months Ended June 30, 2019

|

|

|

|

Three Months Ended June 30, 2018

|

|

|

Six months ended June 30, 2019

|

|

|

|

Six months ended June 30, 2018

|

|

|

Related party revenues

(i)

|

22

|

|

|

|

21

|

|

|

43

|

|

|

|

43

|

|

|

Amortization of unfavorable contracts

(ii)

|

—

|

|

|

|

9

|

|

|

—

|

|

|

|

21

|

|

|

Other

(iii)

|

2

|

|

|

|

(2

|

)

|

|

2

|

|

|

|

8

|

|

|

Total other revenues

|

24

|

|

|

|

28

|

|

|

45

|

|

|

|

72

|

|

|

|

|

|

i.

|

Related party revenues

|

Related party revenues represent income from management and technical support services provided to Seadrill Partners, SeaMex and Northern Drilling.

|

|

|

|

ii.

|

Amortization of unfavorable contracts

|

We recognize an intangible asset or liability if we acquire a drilling contract in a business combination and the contract had a dayrate that was above or below market rates at the time of the business combination. For the periods before emergence from Chapter 11 we classified the amortization of these intangible assets or liabilities within other revenues. Post-emergence and after the application of fresh start accounting, we have applied a new accounting policy which classifies amortization of these intangible assets and liabilities within operating expenses.

Other revenues for the three and six months ended

June 30, 2019

consisted of management fees for the contract to perform the first mobilization of the Sonangol rigs

Libongos

and

Quenguela

.

Other revenues for the three months ended

June 30, 2018

included the reversal of third party management fee revenue that was deemed no longer recoverable. Other revenues for the six months ended

June 30, 2018

included early termination fee revenue for the

West Pegasus

offset by the reversal of third party management fee revenue referred above.

2) Operating expenses

Total operating expenses include vessel and rig operating expenses, amortization of favorable and unfavorable contracts, reimbursable expenses, depreciation of drilling units and equipment, and general and administrative expenses. We have analyzed operating expenses between these categories in the table below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Successor

|

|

|

Predecessor

|

|

Successor

|

|

|

Predecessor

|

|

(In $ millions)

|

Three Months Ended June 30, 2019

|

|

|

|

Three Months Ended June 30, 2018

|

|

|

Six months ended June 30, 2019

|

|

|

|

Six months ended June 30, 2018

|

|

|

Vessel and rig operating expenses

|

(182

|

)

|

|

|

(224

|

)

|

|

(381

|

)

|

|

|

(407

|

)

|

|

Reimbursable expense

|

(43

|

)

|

|

|

(8

|

)

|

|

(69

|

)

|

|

|

(20

|

)

|

|

Depreciation

|

(104

|

)

|

|

|

(195

|

)

|

|

(212

|

)

|

|

|

(391

|

)

|

|

Amortization of intangibles

|

(38

|

)

|

|

|

—

|

|

|

(73

|

)

|

|

|

—

|

|

|

General and administrative expenses

|

(30

|

)

|

|

|

(49

|

)

|

|

(61

|

)

|

|

|

(100

|

)

|

|

Total operating expenses

|

(397

|

)

|

|

|

(476

|

)

|

|

(796

|

)

|

|

|

(918

|

)

|

|

|

|

|

i.

|

Vessel and rig operating expenses

|

Vessel and rig operating expenses represent the costs we incur to operate a drilling unit that is either in operation or stacked. This includes the remuneration of offshore crews, rig supplies, expenses for repair and maintenance and onshore support costs.

For periods prior to emergence from Chapter 11 we classified certain operational support and information technology related costs incurred by our support functions within general and administrative expenses. As part of fresh start accounting and for periods after emergence we classified these costs within vessel and rig operating expenses. Vessel and rig operating expenses for the 2018 Predecessor and 2019 Successor periods are therefore not comparable.

We have analyzed vessel and rig operating expenses by segment in the table below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Successor

|

|

|

Predecessor

|

|

Successor

|

|

|

Predecessor

|

|

(In $ millions)

|

Three Months Ended June 30, 2019

|

|

|

|

Three Months Ended June 30, 2018

|

|

|

Six months ended June 30, 2019

|

|

|

|

Six months ended June 30, 2018

|

|

|

Floaters

|

(118

|

)

|

|

|

(115

|

)

|

|

(250

|

)

|

|

|

(239

|

)

|

|

Jack-ups

|

(50

|

)

|

|

|

(105

|

)

|

|

(106

|

)

|

|

|

(158

|

)

|

|

Other

|

(14

|

)

|

|

|

(4

|

)

|

|

(25

|

)

|

|

|

(10

|

)

|

|

Vessel and rig operating expenses

|

(182

|

)

|

|

|

(224

|

)

|

|

(381

|

)

|

|

|

(407

|

)

|

Vessel and rig expenses for the for jack-ups for the three and six months ended June 30, 2018 included a bad debt expense of $48 million relating to an overdue receivable, subsequently received after emergence within "Other operating income".

Excluding the effect of this one-time item, vessel and rig operating expenses are mainly driven by rig activity. On average, we incur higher vessel and rig operating expenses when a rig is operating compared to when it is stacked. For stacked rigs we incur higher vessel and rig expenses for warm stacked rigs compared to cold stacked rigs. We incur one-time costs for activities such as preservation and severance when we cold stack a rig. We also incur significant costs when re-activating a rig from cold stack, a proportion of which is expensed as incurred.

Vessel and rig operating expenses allocated to the "Other" segment represent rig related onshore costs incurred in connection with our contracts to provide technical support services to Seadrill Partners, Seamex, Sonangol and Northern Drilling.

We have analyzed the average number of rigs by status and segment over the reporting period in the table below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Successor

|

|

|

Predecessor

|

|

Successor

|

|

|

Predecessor

|

|

(Number of rigs)

|

Three Months Ended June 30, 2019

|

|

|

|

Three Months Ended June 30, 2018

|

|

|

Six months ended June 30, 2019

|

|

|

|

Six months ended June 30, 2018

|

|

|

Floaters

|

|

|

|

|

|

|

|

|

|

|

Operating

|

7

|

|

|

|

9

|

|

|

8

|

|

|

|

9

|

|

|

Warm stacked

|

3

|

|

|

|

1

|

|

|

2

|

|

|

|

1

|

|

|

Cold stacked

|

9

|

|

|

|

9

|

|

|

9

|

|

|

|

9

|

|

|

Average number of Floaters

|

19

|

|

|

|

19

|

|

|

19

|

|

|

|

19

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Jack-ups

|

|

|

|

|

|

|

|

|

|

|

Operating

|

8

|

|

|

|

8

|

|

|

8

|

|

|

|

8

|

|

|

Warm stacked

|

2

|

|

|

|

3

|

|

|

2

|

|

|

|

3

|

|

|

Cold stacked

|

6

|

|

|

|

5

|

|

|

6

|

|

|

|

5

|

|

|

Average number of Jack-ups

|

16

|

|

|

|

16

|

|

|

16

|

|

|

|

16

|

|

For the three and six months ended

June 30, 2019

and

June 30, 2018

, the number of cold stacked floaters was the same and the number of warm stacked floaters increased by two and one respectively. Between these dates the

Sevan Louisiana

was reactivated from cold stack but was subsequently warm stacked in March 2019 for BOP repairs, the

West Eclipse

was warm stacked and the

Sevan Brasil

was cold stacked.

For the three and six months ended

June 30, 2019

and

June 30, 2018

, the number of cold stacked jack-ups increased by one and the warm stacked jack-ups decreased by one. Between these dates the

West Freedom

and

West Ariel

were taken from warm stacked to cold stacked offset by the

West Castor

which was warm stacked and the

West Tucana

which was reactivated from cold stack for a new contract.

|

|

|

|

ii.

|

Depreciation of drilling units and equipment

|

We record depreciation expense to reduce the carrying value of drilling unit and equipment balances to their residual value over their expected remaining useful economic lives. We reduced the carrying value of drilling unit and equipment balances to their fair values when we applied fresh start accounting on emergence from Chapter 11. The depreciation expense for the three and six months ended

June 30, 2019

is therefore based on lower carrying values of drilling units and equipment and is not comparable to the level of depreciation expense for the three and six months ended

June 30, 2018

.

|

|

|

|

iii.

|

Amortization of intangibles

|

For periods before emergence from Chapter 11 we recognized intangible assets or liabilities only where we acquired a drilling contract in a business combination. The accounting policy we applied in the Predecessor was to classify amortization for such contracts within other revenues. On emergence from Chapter 11 and application of fresh start accounting, we recognized intangible assets and liabilities for favorable and unfavorable drilling contracts at fair value. We amortize these assets and liabilities over the remaining contract period and classify the amortization under operating expenses.

|

|

|

|

iv.

|

General and administrative expenses

|

General and administrative expenses include the cost of our corporate and regional offices, certain legal and professional fees as well as the remuneration and other compensation of our officers, directors and employees engaged in central management and administration activities. Legal and professional fees incurred for our Chapter 11 reorganization post-petition were classified under reorganization items. As discussed above, we changed the classification of certain support function costs for periods after emergence from general and administrative expenses to vessel and rig operating expenses. General and administrative expenses are therefore not comparable to between the Successor and Predecessor periods.

General and administrative expenses for the three months ended

June 30, 2019

and

June 30, 2018

were

$30 million

and

$49 million

, respectively. For the three months ended

June 30, 2019

this includes $8 million (June 30, 2018: $14 million) related to rigs we manage for our partners, which is charged out on a cost plus basis.

General and administrative expenses for the six months ended

June 30, 2019

and

June 30, 2018

were

$61 million

and

$100 million

, respectively. For the six months ended

June 30, 2019

this includes $16 million (June 30, 2018: $27 million) related to rigs we manage for our partners, which is charged out on a cost plus basis.

3) Other operating items

Other operating items for the three and months ended

June 30, 2019

represents the settlement with Jurong Shipyard regarding a long outstanding builders credit issue. The six months ended

June 30, 2019

further includes cash received for the recovery of a receivable balance previously written down to nil on fresh start.

Other operating items for the three and six months ended

June 30, 2018

represents an impairment charge of $414 million against the W

est Alpha, West Navigator

and

West Epsilon,

following an assessment of recoverability, as we

determined that the continuing downturn in the offshore drilling market was an indicator of impairment on certain assets.

This was slightly offset by

amounts recognized for contingent consideration from the sales of the

West Vela

and

West Polaris

to Seadrill Partners in 2014 and 2015. On emergence from Chapter 11 we recognized receivables equal to the fair value of expected future cash flows under these arrangements and have therefore not recognized further income in the Successor periods.

4) Interest expense

We have analyzed interest expense into the following components:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Successor

|

|

|

Predecessor

|

|

Successor

|

|

|

Predecessor

|

|

(In $ millions)

|

Three Months Ended June 30, 2019

|

|

|

|

Three Months Ended June 30, 2018

|

|

|

Six months ended June 30, 2019

|

|

|

|

Six months ended June 30, 2018

|

|

|

Cash and payment-in-kind interest on debt facilities

|

(110

|

)

|

|

|

(18

|

)

|

|

(230

|

)

|

|

|

(36

|

)

|

|

Unwind of discount on debt

|

(12

|

)

|

|

|

—

|

|

|

(24

|

)

|

|

|

—

|

|

|

Loan fee amortization

|

—

|

|

|

|

(1

|

)

|

|

—

|

|

|

|

(2

|

)

|

|

Interest expense

|

(122

|

)

|

|

|

(19

|

)

|

|

(254

|

)

|

|

|

(38

|

)

|

|

|

|

|

i.

|

Cash and payment-in-kind interest on debt facilities

|

We incur cash and payment-in-kind interest on our debt facilities. This is summarized in the table below.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Successor

|

|

|

Predecessor

|

|

Successor

|

|

|

Predecessor

|

|

(In $ millions)

|

Three Months Ended June 30, 2019

|

|

|

|

Three Months Ended June 30, 2018

|

|

|

Six months ended June 30, 2019

|

|

|

|

Six months ended June 30, 2018

|

|

|

Senior credit facilities

|

(82

|

)

|

|

|

(63

|

)

|

|

(167

|

)

|

|

|

(118

|

)

|

|

Less: adequate protection payments

|

—

|

|

|

|

57

|

|

|

—

|

|

|

|

106

|

|

|

Senior secured notes

|

(16

|

)

|

|

|

—

|

|

|

(39

|

)

|

|

|

—

|

|

|

Debt of consolidated variable interest entities

|

(12

|

)

|

|

|

(12

|

)

|

|

(24

|

)

|

|

|

(24

|

)

|

|

Cash and payment-in-kind interest

|

(110

|

)

|

|

|

(18

|

)

|

|

(230

|

)

|

|

|

(36

|

)

|

We are charged interest on our senior credit facilities at LIBOR plus a margin. This margin increased by one percentage point when we emerged from Chapter 11. There has also been an increase in LIBOR rates. Both factors increased the effective interest rate on our senior credit facilities.

During Chapter 11, we recorded contractual interest payments against debt held as subject to compromise ("adequate protection payments") as a reduction to debt in the Consolidated Balance Sheet and not as an expense to the Consolidated Statement of Operations. We then expensed the adequate protection payments on emergence from Chapter 11 on July 2, 2018.

At

June 30, 2019

, we had $458 million of principal outstanding of the $880 million senior secured notes that we issued on emergence from Chapter 11. We incurred 4% cash interest and 8% payment-in-kind interest on these notes.

Our Consolidated Balance Sheet includes approximately $1 billion of debt facilities held by subsidiaries of Ship Finance that we consolidate as variable interest entities. Our interest expense includes the interest incurred by these entities.

|

|

|

|

ii.

|

Unwind of discount on debt

|

On emergence from Chapter 11 and application of fresh start accounting, we recorded a discount against our debt to reduce its carrying value to equal its fair value. The debt discount is unwound over the remaining terms of the debt facilities.

|

|

|

|

iii.

|

Loan fee amortization

|

We amortize loan issuance costs over the expected term of the associated debt facility.

5) Reorganization items

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Successor

|

|

|

Predecessor

|

|

Successor

|

|

|

Predecessor

|

|

(In $ millions)

|

Three Months Ended June 30, 2019

|

|

|

|

Three Months Ended June 30, 2018

|

|

|

Six months ended June 30, 2019

|

|

|

|

Six months ended June 30, 2018

|

|

|

Advisory and professional fees

|

—

|

|

|

|

(40

|

)

|

|

—

|

|

|

|

(115

|

)

|

|

Interest income on surplus cash invested

|

—

|

|

|

|

5

|

|

|

—

|

|

|

|

6

|

|

|

Total reorganization items

|

—

|

|

|

|

(35

|

)

|

|

—

|

|

|

|

(109

|

)

|

For the three months ended

June 30, 2018

, reorganization items included professional and advisory fees for post-petition Chapter 11 expenses and interest income generated from cash held by filed entities.

6) Other income and expense

We have analyzed other income and expense into the following components:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Successor

|

|

|

Predecessor

|

|

Successor

|

|

|

Predecessor

|

|

(In $ millions)

|

Three Months Ended June 30, 2019

|

|

|

|

Three Months Ended June 30, 2018

|

|

|

Six months ended June 30, 2019

|

|

|

|

Six months ended June 30, 2018

|

|

|

Interest income

|

19

|

|

|

|

9

|

|

|

39

|

|

|

|

19

|

|

|

Share in results from associated companies

|

(23

|

)

|

|

|

141

|

|

|

(65

|

)

|

|

|

149

|

|

|

Loss on derivative financial instruments

|

(6

|

)

|

|

|

(1

|

)

|

|

(33

|

)

|

|

|

(4

|

)

|

|

Foreign exchange (loss)/gain

|

4

|

|

|

|

(8

|

)

|

|

2

|

|

|

|

—

|

|

|

(Loss)/gain on marketable securities

|

(14

|

)

|

|

|

25

|

|

|

(35

|

)

|

|

|

(3

|

)

|

|

Other financial items

|

1

|

|

|

|

(1

|

)

|

|

(2

|

)

|

|

|

—

|

|

|

Net loss on debt extinguishment

|

(22

|

)

|

|

|

—

|

|

|

(22

|

)

|

|

|

—

|

|

|

Other income and expense

|

(41

|

)

|

|

|

165

|

|

|

(116

|

)

|

|

|

161

|

|

Interest income relates to interest earned on cash deposits and other financial assets. During the period we were in Chapter 11 (September 12, 2017 to July 1, 2018), we classified interest income on cash held by filed entities within reorganization items. This totaled

$5 million

and

$6 million

for the three and six months ended

June 30, 2018

, respectively.

|

|

|

|

ii.

|

Share in results from associated companies

|

Share in results from associated companies represents our share of earnings or losses in our investments accounted under the equity method. We reduced the carrying value of our equity method investments when we applied fresh start accounting on emergence from Chapter 11. This led to differences between (i) the book value of rig and contract asset balances recorded in the balance sheets of our equity method investees and (ii) the implied value of these assets in our consolidated balance sheet. We refer to these differences as "basis differences." We amortize basis differences over the expected lives of the associated assets or liabilities. We classify this amortization within the "share in results of associated companies" line item in our statement of operations. Therefore, the share in results from associated companies for the three and months ended

June 30, 2019

is not comparable to the share in results from associated companies for the three and six months ended

June 30, 2018

.

iii.

Net loss on debt extinguishment

On April 10, 2019 we purchased back $311 million of the senior secured notes issued on emergence at a 7% premium. The premium paid was recognized as a loss on debt extinguishment.

We have analyzed our share of results in associated companies by equity method investment below:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Successor

|

|

|

Predecessor

|

|

Successor

|

|

|

Predecessor

|

|

(In $ millions)

|

Three Months Ended June 30, 2019

|

|

|

|

Three Months Ended June 30, 2018

|

|

|

Six months ended June 30, 2019

|

|

|

|

Six months ended June 30, 2018

|

|

|

Seadrill Partners

|

(36

|

)

|

|

|

114

|

|

|

(78

|

)

|

|

|

99

|

|

|

Seamex

|

(5

|

)

|

|

|

1

|

|

|

(13

|

)

|

|

|

4

|

|

|

Seabras Sapura

|

18

|

|

|

|

26

|

|

|

26

|

|

|

|

46

|

|

|

Share of results from associated companies

|

(23

|

)

|

|

|

141

|

|

|

(65

|

)

|

|

|

149

|

|

The share in after tax loss of associated companies for the three and six months ended

June 30, 2019

reflected our share of the after-tax losses of our investments in Seadrill Partners and Seamex offset by our share of profits in the Seabras Sapura joint venture. This included a net expense for the amortization of basis differences for the three months ended

June 30, 2019

of

$21 million

(six months ended

June 30, 2019

: $49 million).

The share in after-tax profit for the three and six months ended

June 30, 2018

reflected our share of the after-tax profit of our investments in Seadrill Partners, Seamex and Seabras Sapura Joint venture.

|

|

|

|

iii.

|

Loss on derivative financial instruments

|

On May 11, 2018, we bought an interest rate cap from Citigroup for $68 million. The interest rate cap mitigates our exposure to future increases in LIBOR over 2.87%. We currently have exposure to LIBOR from our floating rate debt. We also have a conversion option on a bond issued to us by Archer Ltd. We record both of these assets at fair value.

The loss on derivatives for the three and six months ended

June 30, 2019

of $

6 million

and

$33 million

respectively comprised a fair value loss on our interest rate cap. The fair value loss on the interest rate cap was caused by a decrease in forward interest rates. There was an immaterial movement in the Archer share price which resulted in the value of the conversion option on the Archer convertible bond remaining stable.

The loss on derivatives for the three months ended

June 30, 2018

of $

1 million

comprised of a fair value gain on the conversation option on the Archer convertible bond offset by a fair value loss on our interest rate cap. The loss on derivatives for the six months ended

June 30, 2018

of

$4 million

comprised of a fair value loss on our interest rate cap. There was an immaterial movement in the Archer share price.

|

|

|

|

iv.

|

Foreign exchange (loss)/gain

|

Foreign exchange gains and losses relate to exchange differences on the settlement or revaluation of monetary balances denominated in currencies other than the US Dollar.

|

|

|

|

v.

|

(Loss)/gain on marketable securities

|

The (loss)/gain on marketable securities for the three and six months ended

June 30, 2019

and

June 30, 2018

reflect the changes in mark to market movements in our investments in Seadrill Partners common units and our Archer shares.

|

|

|

|

vi.

|

Other financial items

|

Other financial items for the six months ended

June 30, 2019

primarily comprised an indenture fee incurred for a tender offer of our senior secured notes. We did not incur significant other financial items for the three and six months ended

June 30, 2018

.

7) Income taxes

Income tax expense consists of taxes currently payable and changes in deferred tax assets and liabilities related to our ownership and operation of drilling units and may vary significantly depending on jurisdictions and contractual arrangements. In most cases the calculation of taxes is based on net income or deemed income, the latter generally being a function of gross revenue.

Liquidity and Capital Resources

1) Introduction

We operate in a capital-intensive industry. We have historically funded acquisitions of drilling units and investments in associated companies through a combination of debt and equity issuances and from cash generated from operations. Although we restructured our debt through the Chapter 11 Reorganization we remain a highly leveraged company with outstanding borrowings on our external debt facilities totaling

$6.8 billion

as of

June 30, 2019

.

Our liquidity requirements relate to servicing our debt, making capital investments, funding working capital requirements and maintaining adequate cash reserves to mitigate the effects of fluctuations in operating cash flows. Most of our contract and other revenues are received between 30 and 60 days in arrears, and most of our operating costs are paid monthly. We believe our current resources, available cash and cash from operations will be sufficient to meet our working capital requirements and other obligations as they fall due for at least the next twelve months from the date of this report.

Our funding and treasury activities are conducted in accordance with our corporate policies, which aim to maximize returns while maintaining appropriate liquidity for our operating requirements. Cash and cash equivalents are held mainly in U.S. dollars, with lesser amounts held in Norwegian Kroner, Brazilian Reais and Great British Pounds.

This section discusses the most important factors affecting our liquidity and capital resources.

2) Liquidity

Our level of liquidity fluctuates depending on a number of factors. These include, among others, our contract backlog, economic utilization achieved, average contract day rates, timing of accounts receivable collection, timing of payments for operating costs and other obligations. Our liquidity comprises cash and cash equivalents. The below table shows cash and restricted cash balances for each period presented.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Successor

|

|

|

Successor

|

|

(In $ millions)

|

|

As at June 30, 2019

|

|

|

|

As at December 31, 2018

|

|

|

Cash and cash equivalents

|

|

1,251

|

|

|

|

1,542

|

|

|

Restricted cash

|

|

218

|

|

|

|

461

|

|

|

Cash and cash equivalents, including restricted cash

|

|

1,469

|

|

|

|

2,003

|

|

We have shown our sources and uses of cash by category of cash flow in the below table.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Successor

|

|

|

Predecessor

|

|

(In $ millions)

|

|

Six months ended June 30, 2019

|

|

|

|

Six months ended June 30, 2018

|

|

|

Cash flows from operating activities

|

|

(184

|

)

|

|

|

(132

|

)

|

|

Cash flows from investing activities

|

|

(11

|

)

|

|

|

149

|

|

|

Cash flows from financing activities

|

|

(343

|

)

|

|

|

(153

|

)

|

|

Effect of exchange rate changes in cash and cash equivalents

|

|

4

|

|

|

|

(5

|

)

|

|

Change in period

|

|

(534

|

)

|

|

|

(141

|

)

|

This reconciles to the total cash and cash equivalents, including restricted, which is as follows:

|