UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 21)*

The Charles

Schwab Corporation

(Name of Issuer)

Common Stock, par value $0.01 per share

(Title of Class of Securities)

808513-10-5

(CUSIP Number)

Teresa L.

Johnson, Esq.

Arnold & Porter Kaye Scholer LLP

Three Embarcadero Center, Tenth Floor

San Francisco, CA 94111-4024

(415) 471-3100

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

November 1, 2022

(Date of Event Which Requires Filing of this Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note: Schedules filed in paper format shall

include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

| CUSIP No. 808513-10-5 |

|

13D |

|

Page

2

of 10 Pages |

|

|

|

|

|

|

|

| 1. |

|

Names of Reporting Persons

CHARLES R. SCHWAB |

| 2. |

|

Check the Appropriate Box

if a Member of a Group (See Instructions) (a) ☐ (b) ☐

|

| 3. |

|

SEC Use Only

|

| 4. |

|

Source of Funds (See

Instructions) |

| 5. |

|

Check if Disclosure of

Legal Proceedings Is Required Pursuant to Item 2(d) or 2(e)

☐ |

| 6. |

|

Citizenship or Place of

Organization United States of

America |

|

|

|

|

|

|

|

| Number of

Shares Beneficially

Owned by Each

Reporting Person

With |

|

7. |

|

Sole Voting Power

21,554,556 |

| |

8. |

|

Shared Voting Power

86,338,491 |

| |

9. |

|

Sole Dispositive Power

21,554,556 |

| |

10. |

|

Shared Dispositive Power

86,444,719 |

|

|

|

|

|

|

|

| 11. |

|

Aggregate Amount Beneficially Owned by Each Reporting Person

107,999,275 |

| 12. |

|

Check if the Aggregate

Amount in Row 11 Excludes Certain Shares (See Instructions)

☐ |

| 13. |

|

Percent of Class

Represented by Amount in Row 11 6.1% |

| 14. |

|

Type of Reporting Person

(See Instructions) IN |

| * |

Shares reported on this cover page are as of February 24, 2023. The percentage of the Common Stock

beneficially owned by Mr. Schwab that is reported on this cover page is based on a total of 1,778,029,051 shares of the Issuer’s Common Stock outstanding as of February 23, 2023. |

|

|

|

|

|

| CUSIP No. 808513-10-5 |

|

13D |

|

Page

3

of 10 Pages |

Item 1. Security and Issuer.

This Amendment No. 21 to Schedule 13D (this “Schedule 13D”) relates to the voting common stock, par value $0.01 per share

(“Common Stock”), of The Charles Schwab Corporation (the “Issuer”).

The address of the principal executive office of

the Issuer is:

The Charles Schwab Corporation

3000 Schwab Way

Westlake, Texas

76262

Item 2. Identity and Background.

| |

(a) |

Mr. Charles R. Schwab |

| |

(b) |

The Charles Schwab Corporation |

3000 Schwab Way

Westlake, Texas

76262

| |

(c) |

Co-Chairman and Director |

The Charles Schwab Corporation

3000 Schwab Way

Westlake, Texas

76262

| |

(f) |

United States of America |

Item 3. Source and Amount of Funds or Other Consideration.

Inapplicable

Item 4. Purpose of

Transaction.

The shares of Common Stock are held for personal investment, except as noted in Item 5 below.

Item 5. Interest in Securities of the Issuer.

(a) 107,999,275 shares of Common Stock (including 1,265,582 shares which may be acquired within 60 days upon exercise of options) reported as

of February 24, 2023 represent (for the purposes of this Schedule 13D) approximately 6.1% of the Common Stock outstanding.

(b) The

107,999,275 shares of Common Stock referred to in Item 5(a) above consist of: (i) 21,554,556 shares of Common Stock as to which Mr. Schwab may be deemed to have sole voting and dispositive power (including 1,265,582 shares which may be acquired

within 60 days upon exercise of options; 226,880 shares held by The Charles R. Schwab Foundation for Financial Freedom, a nonprofit public benefit corporation as to which Mr. Schwab is a director but disclaims beneficial ownership; 6,000 shares

held in the Lilly Marie Huys O’Neill Trust for which Mr. Schwab acts as trustee but disclaims beneficial ownership; and 20,056,094 shares held by certain trusts for which Mr. Schwab acts as trustee); (ii) 106,228 shares of Common

Stock as to which Mr. Schwab may be deemed to have shared dispositive power but no voting power (held by The CRS 2016 Sibling Grantor Retained Annuity Trust for which Mr. Schwab has a nondurable power of attorney); and (iii) 86,338,491

shares of Common Stock as to which Mr. Schwab may be deemed to have shared voting and dispositive power (including 39,264,089 shares held by Mr. and Mrs. Schwab as trustees of The Charles & Helen Schwab Living Trust

(“The Schwab Living Trust”); 9,216,012 shares held

|

|

|

|

|

| CUSIP No. 808513-10-5 |

|

13D |

|

Page

4

of 10 Pages |

by Mrs. Schwab as trustee of The Charles & Helen Schwab Living Trust; 15,272,277 shares held by HOS CSP Investments LP, a limited partnership organized and existing under the laws

of the State of Texas as to which Mr. and Mrs. Schwab are two of three members with shared voting and dispositive power; 15,458,979 shares held by HOS MBS Investments LP, a limited partnership organized and existing under the laws of the

State of Texas as to which Mr. and Mrs. Schwab are two of three members with shared voting and dispositive power; 6,636,186 shares held by the Charles & Helen Schwab Foundation, a nonprofit public benefit corporation as to which

Mr. and Mrs. Schwab are directors with shared voting and dispositive power but disclaim beneficial ownership; 385,000 shares held in the Helen O. Schwab Generation Skipping Trust; 61,923 shares held in trusts for the benefit of

Mr. Schwab’s grandchildren; and 44,025 shares held by 188 Corp., a corporation incorporated under the laws of the State of California as to which Mr. and Mrs. Schwab are directors with shared voting and dispositive power).

(c) The following transactions in Common Stock were effected in the sixty days prior to the filing of this Schedule 13D:

|

|

|

|

|

|

|

|

|

| Date of

Transaction |

|

Amount of

Securities

Involved |

|

Nature of Transaction |

|

Price Per Share |

|

Where and How

Effected |

| 12/27/2022 |

|

6,500,261 |

|

Disposition |

|

N/A |

|

Gifts by certain trusts for which Mr. Schwab acts as trustee |

|

|

|

|

|

| 12/27/2022 |

|

5,719,560 |

|

Disposition/Acquisition |

|

N/A |

|

Gifts by certain trusts for which Mr. Schwab acts as trustee to The Schwab Living Trust |

|

|

|

|

|

| 1/30/2023 |

|

4,123,642 |

|

Disposition/Acquisition |

|

N/A |

|

Gift by a certain trust for which Mr. Schwab acts as trustee to The Schwab Living Trust |

|

|

|

|

|

| 1/30/2023 |

|

4,123,642 |

|

Disposition/Acquisition |

|

N/A |

|

Gift by a certain trust for which Mrs. Schwab acts as trustee to The Schwab Living Trust |

|

|

|

|

|

| 1/30/2023 |

|

6,500 |

|

Disposition |

|

N/A |

|

Gift by Charles & Helen Schwab Foundation |

|

|

|

|

|

| 2/1/2023 |

|

121,066 |

|

Acquisition |

|

$16.40 |

|

Share issuance to The Schwab Living Trust in connection with option exercise |

|

|

|

|

|

| 2/1/2023 |

|

121,066 |

|

Disposition |

|

$77.8431(1) |

|

Open Market Sale by The Schwab Living Trust |

|

|

|

|

|

| 2/3/2023 |

|

63,780 |

|

Disposition |

|

N/A |

|

Gift by The Charles R. Schwab Foundation for Financial Freedom |

|

|

|

|

|

| 2/3/2023 |

|

64,515 |

|

Disposition |

|

$79.7624(2) |

|

Open Market Sale by HOS MBS Investments LP |

|

|

|

|

|

| CUSIP No. 808513-10-5 |

|

13D |

|

Page

5

of 10 Pages |

|

|

|

|

|

|

|

|

|

| Date of

Transaction |

|

Amount of

Securities

Involved |

|

Nature of Transaction |

|

Price Per Share |

|

Where and

How Effected |

| 2/3/2023 |

|

64,515 |

|

Disposition |

|

$79.7624(2) |

|

Open Market Sale by HOS CSP Investments LP |

|

|

|

|

|

| 2/6/2023 |

|

62,890 |

|

Disposition |

|

$80.0971(3) |

|

Open Market Sale by HOS MBS Investments LP |

|

|

|

|

|

| 2/6/2023 |

|

62,890 |

|

Disposition |

|

$80.0971(3) |

|

Open Market Sale by HOS CSP Investments LP |

|

|

|

|

|

| 2/6/2023 |

|

62,890 |

|

Disposition |

|

$80.0216(4) |

|

Open Market Sale by The Schwab Living Trust |

|

|

|

|

|

| 2/7/2023 |

|

62,890 |

|

Disposition |

|

$81.0702(5) |

|

Open Market Sale by HOS CSP Investments LP |

|

|

|

|

|

| 2/7/2023 |

|

62,895 |

|

Disposition |

|

N/A |

|

Gift by a certain trust for which Mr. Schwab acts as trustee |

|

|

|

|

|

| 2/8/2023 |

|

62,500 |

|

Disposition |

|

$81.5373(6) |

|

Open Market Sale by HOS CSP Investments LP |

|

|

|

|

|

| 2/13/2023 |

|

41,980 |

|

Disposition |

|

$81.0335(7) |

|

Open Market Sale by a certain trust for which Mr. Schwab acts as trustee |

|

|

|

|

|

| 2/13/2023 |

|

41,980 |

|

Disposition |

|

$81.033(8) |

|

Open Market Sale by a certain trust for which Mr. Schwab acts as trustee |

|

|

|

|

|

| 2/13/2023 |

|

11,070 |

|

Disposition |

|

$81.052(9) |

|

Open Market Sale by a certain trust for which Mr. Schwab acts as trustee |

|

|

|

|

|

| 2/13/2023 |

|

62,500 |

|

Disposition |

|

N/A |

|

Gift by The Schwab Living Trust |

|

|

|

|

|

| 2/14/2023 |

|

13,880 |

|

Disposition |

|

$80.6433(10) |

|

Open Market Sale by a certain trust for which Mr. Schwab acts as trustee |

|

|

|

|

|

| 2/14/2023 |

|

13,710 |

|

Disposition |

|

$80.6584(11) |

|

Open Market Sale by a certain trust for which Mr. Schwab acts as trustee |

|

|

|

|

|

| 2/14/2023 |

|

1,185 |

|

Disposition |

|

$80.6739(12) |

|

Open Market Sale by a certain trust for which Mr. Schwab acts as trustee |

|

|

|

|

|

| 2/24/2023 |

|

37,975 |

|

Disposition |

|

N/A |

|

Gift by a certain trust for which Mr. Schwab acts as trustee |

|

|

|

|

|

| CUSIP No. 808513-10-5 |

|

13D |

|

Page

6

of 10 Pages |

| (1) |

This transaction was executed in multiple trades at prices ranging from $77.50 to $78.155. The price reported

reflects the weighted average sale price. Mr. Schwab hereby undertakes to provide upon request to the SEC staff full information regarding the number of shares and prices at which the transaction was effected. |

| (2) |

This transaction was executed in multiple trades at prices ranging from $79.33 to $80.19. The price reported

reflects the weighted average sale price. Mr. Schwab hereby undertakes to provide upon request to the SEC staff full information regarding the number of shares and prices at which the transaction was effected. |

| (3) |

This transaction was executed in multiple trades at prices ranging from $79.81 to $80.48. The price reported

reflects the weighted average sale price. Mr. Schwab hereby undertakes to provide upon request to the SEC staff full information regarding the number of shares and prices at which the transaction was effected. |

| (4) |

This transaction was executed in multiple trades at prices ranging from $79.815 to $80.225. The price reported

reflects the weighted average sale price. Mr. Schwab hereby undertakes to provide upon request to the SEC staff full information regarding the number of shares and prices at which the transaction was effected. |

| (5) |

This transaction was executed in multiple trades at prices ranging from $80.895 to $81.32. The price reported

reflects the weighted average sale price. Mr. Schwab hereby undertakes to provide upon request to the SEC staff full information regarding the number of shares and prices at which the transaction was effected. |

| (6) |

This transaction was executed in multiple trades at prices ranging from $81.27 to $81.89. The price reported

reflects the weighted average sale price. Mr. Schwab hereby undertakes to provide upon request to the SEC staff full information regarding the number of shares and prices at which the transaction was effected. |

| (7) |

This transaction was executed in multiple trades at prices ranging from $80.82 to $81.17. The price reported

reflects the weighted average sale price. Mr. Schwab hereby undertakes to provide upon request to the SEC staff full information regarding the number of shares and prices at which the transaction was effected. |

| (8) |

This transaction was executed in multiple trades at prices ranging from $80.82 to $81.17. The price reported

reflects the weighted average sale price. Mr. Schwab hereby undertakes to provide upon request to the SEC staff full information regarding the number of shares and prices at which the transaction was effected. |

| (9) |

This transaction was executed in multiple trades at prices ranging from $80.83 to $81.16. The price reported

reflects the weighted average sale price. Mr. Schwab hereby undertakes to provide upon request to the SEC staff full information regarding the number of shares and prices at which the transaction was effected. |

| (10) |

This transaction was executed in multiple trades at prices ranging from $80.59 to $80.75. The price reported

reflects the weighted average sale price. Mr. Schwab hereby undertakes to provide upon request to the SEC staff full information regarding the number of shares and prices at which the transaction was effected. |

| (11) |

This transaction was executed in multiple trades at prices ranging from $80.59 to $80.775. The price reported

reflects the weighted average sale price. Mr. Schwab hereby undertakes to provide upon request to the SEC staff full information regarding the number of shares and prices at which the transaction was effected. |

| (12) |

This transaction was executed in multiple trades at prices ranging from $80.64 to $80.70. The price reported

reflects the weighted average sale price. Mr. Schwab hereby undertakes to provide upon request to the SEC staff full information regarding the number of shares and prices at which the transaction was effected. |

| (d) |

No other person has the right to receive or the power to direct the receipt of dividends from, or the proceeds

from the sale of, the shares of Common Stock beneficially owned by Mr. Schwab, except for The CRS 2016 Sibling Grantor Retained Annuity Trust, the Charles & Helen Schwab Foundation, HOS MBS Investments LP and HOS CSP Investments LP, as

noted in Item 5(b) above. |

|

|

|

|

|

| CUSIP No. 808513-10-5 |

|

13D |

|

Page

7

of 10 Pages |

(e) Inapplicable

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

|

|

|

| 1. |

|

Non-Qualified Stock Option Agreement dated as of August 1, 2013 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2004 Stock Incentive Plan. |

|

|

| 2. |

|

Non-Qualified Stock Option Agreement dated as of November 1, 2013 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2004 Stock Incentive Plan. |

|

|

| 3. |

|

Non-Qualified Stock Option Agreement dated as of March 3, 2014 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2013 Stock Incentive Plan. |

|

|

| 4. |

|

Non-Qualified Stock Option Agreement dated as of August 1, 2014 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2013 Stock Incentive Plan. |

|

|

| 5. |

|

Non-Qualified Stock Option Agreement dated as of November 3, 2014 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2013 Stock Incentive Plan. |

|

|

| 6. |

|

Non-Qualified Stock Option Agreement dated as of March 2, 2015 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2013 Stock Incentive Plan. |

|

|

| 7. |

|

Non-Qualified Stock Option Agreement dated as of March 1, 2016 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2013 Stock Incentive Plan. |

|

|

| 8. |

|

Non-Qualified Stock Option Agreement dated as of March 1, 2017 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2013 Stock Incentive Plan. |

|

|

| 9. |

|

Non-Qualified Stock Option Agreement dated as of March 1, 2018 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2013 Stock Incentive Plan. |

|

|

| 10. |

|

Restricted Stock Unit Agreement dated as of March 1, 2019 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2013 Stock Incentive Plan. |

|

|

| 11. |

|

Non-Qualified Stock Option Agreement dated as of March 1, 2019 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2013 Stock Incentive Plan. |

|

|

| 12. |

|

Form of Power of Attorney of Beneficiary of The CRS 2016 Sibling Grantor Retained Annuity Trust. |

|

|

| 13. |

|

Registration Rights Agreement dated as of November 24, 2019 by and among The Charles Schwab Corporation, Mr. Schwab, The Toronto-Dominion Bank and, if they elect to be parties thereto, certain other stockholders described

therein. The information in Item 4 of Amendment No. 19 to Mr. Schwab’s Schedule 13D dated November 29, 2019 is incorporated herein by reference. |

|

|

| 14. |

|

Restricted Stock Unit Agreement dated as of March 2, 2020 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2013 Stock Incentive Plan. |

|

|

| 15. |

|

Non-Qualified Stock Option Agreement dated as of March 2, 2020 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2013 Stock Incentive Plan. |

|

|

| 16. |

|

Non-Qualified Stock Option Agreement dated as of March 1, 2021 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2013 Stock Incentive

Plan. |

|

|

|

|

|

| CUSIP No. 808513-10-5 |

|

13D |

|

Page

8

of 10 Pages |

|

|

|

| 17. |

|

Restricted Stock Unit Agreement dated as of March 1, 2021 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2013 Stock Incentive Plan. |

|

|

| 18. |

|

Non-Qualified Stock Option Agreement dated as of March 1, 2022 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2013 Stock Incentive Plan. |

|

|

| 19. |

|

Restricted Stock Unit Agreement dated as of March 1, 2022 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2013 Stock Incentive Plan. |

Also, the responses to Item 5 of this Schedule 13D are incorporated herein by reference.

Item 7. Material to Be Filed as Exhibits.

|

|

|

| 1. |

|

Non-Qualified Stock Option Agreement dated as of August 1, 2013 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2004 Stock Incentive Plan (incorporated by

reference to Exhibit 20 to Amendment No. 16 to Mr. Schwab’s Schedule 13D dated October 15, 2014). |

|

|

| 2. |

|

Non-Qualified Stock Option Agreement dated as of November 1, 2013 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2004 Stock Incentive Plan (incorporated by

reference to Exhibit 21 to Amendment No. 16 to Mr. Schwab’s Schedule 13D dated October 15, 2014). |

|

|

| 3. |

|

Non-Qualified Stock Option Agreement dated as of March 3, 2014 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2013 Stock Incentive Plan (incorporated by

reference to Exhibit 22 to Amendment No. 16 to Mr. Schwab’s Schedule 13D dated October 15, 2014). |

|

|

| 4. |

|

Non-Qualified Stock Option Agreement dated as of August 1, 2014 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2013 Stock Incentive Plan (incorporated by

reference to Exhibit 24 to Amendment No. 16 to Mr. Schwab’s Schedule 13D dated October 15, 2014). |

|

|

| 5. |

|

Non-Qualified Stock Option Agreement dated as of November 3, 2014 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2013 Stock Incentive Plan (incorporated by

reference to Exhibit 25 to Amendment No. 17 to Mr. Schwab’s Schedule 13D dated August 13, 2015). |

|

|

| 6. |

|

Non-Qualified Stock Option Agreement dated as of March 2, 2015 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2013 Stock Incentive Plan (incorporated by

reference to Exhibit 27 to Amendment No. 17 to Mr. Schwab’s Schedule 13D dated August 13, 2015). |

|

|

| 7. |

|

Non-Qualified Stock Option Agreement dated as of March 1, 2016 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2013 Stock Incentive Plan (incorporated by

reference to Exhibit 29 to Amendment No. 18 to Mr. Schwab’s Schedule 13D dated January 10, 2018). |

|

|

| 8. |

|

Non-Qualified Stock Option Agreement dated as of March 1, 2017 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2013 Stock Incentive Plan (incorporated by

reference to Exhibit 31 to Amendment No. 18 to Mr. Schwab’s Schedule 13D dated January 10, 2018). |

|

|

| 9. |

|

Non-Qualified Stock Option Agreement dated as of March 1, 2018 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2013 Stock Incentive Plan (incorporated by

reference to Exhibit 33 to Amendment No. 19 to Mr. Schwab’s Schedule 13D dated November 29, 2019). |

|

|

| 10. |

|

Restricted Stock Unit Agreement dated as of March 1, 2019 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2013 Stock Incentive Plan (incorporated by reference to Exhibit 34 to Amendment No. 19 to

Mr. Schwab’s Schedule 13D dated November 29, 2019). |

|

|

|

|

|

| CUSIP No. 808513-10-5 |

|

13D |

|

Page

9

of 10 Pages |

|

|

|

| 11. |

|

Non-Qualified Stock Option Agreement dated as of March 1, 2019 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2013 Stock Incentive Plan (incorporated by

reference to Exhibit 35 to Amendment No. 19 to Mr. Schwab’s Schedule 13D dated November 29, 2019). |

|

|

| 12. |

|

Form of Power of Attorney of Beneficiary of The CRS 2016 Sibling Grantor Retained Annuity Trust (incorporated by reference to Exhibit 36 to Amendment No. 19 to Mr. Schwab’s Schedule 13D dated November 29,

2019). |

|

|

| 13. |

|

Registration Rights Agreement dated as of November 24, 2019 by and among The Charles Schwab Corporation, Mr. Schwab, The Toronto-Dominion Bank and, if they elect to be parties thereto, certain other stockholders described

therein (incorporated by reference to Exhibit 10.5 of the Issuer’s Current Report on Form 8-K filed with the Commission on November 29, 2019 (File

No. 1-9700)). |

|

|

| 14. |

|

Restricted Stock Unit Agreement dated as of March 2, 2020 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2013 Stock Incentive Plan (incorporated by reference to Exhibit 39 to Amendment No. 20 to

Mr. Schwab’s Schedule 13D dated November 13, 2020). |

|

|

| 15. |

|

Non-Qualified Stock Option Agreement dated as of March 2, 2020 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2013 Stock Incentive Plan (incorporated by

reference to Exhibit 40 to Amendment No. 20 to Mr. Schwab’s Schedule 13D dated November 13, 2020). |

|

|

| 16. |

|

Non-Qualified Stock Option Agreement dated as of March 1, 2021 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2013 Stock Incentive Plan.* |

|

|

| 17. |

|

Restricted Stock Unit Agreement dated as of March 1, 2021 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2013 Stock Incentive Plan.* |

|

|

| 18. |

|

Non-Qualified Stock Option Agreement dated as of March 1, 2022 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2013 Stock Incentive Plan.* |

|

|

| 19. |

|

Restricted Stock Unit Agreement dated as of March 1, 2022 between The Charles Schwab Corporation and Mr. Schwab pursuant to the 2013 Stock Incentive Plan.* |

|

|

|

|

|

| CUSIP No. 808513-10-5 |

|

13D |

|

Page

10

of 10 Pages |

Signature

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

Dated: February 24, 2023

|

| /s/ Charles R. Schwab |

| Charles R. Schwab |

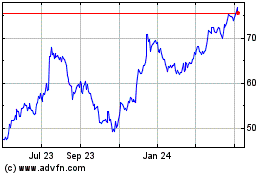

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

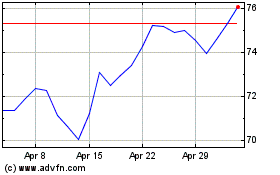

From Mar 2024 to Apr 2024

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Apr 2023 to Apr 2024