Core Net New Assets Total $120.5 Billion

Total Client Assets Finish at $7.86 Trillion,

up 11% Year-over-Year

The Charles Schwab Corporation announced today that its net

income for the first quarter of 2022 was $1.4 billion compared with

$1.6 billion for the fourth quarter of 2021, and $1.5 billion for

the first quarter of 2021. During the quarter, certain acquisition

and integration-related costs and the amortization of acquired

intangibles totaled $96 million and $154 million, respectively, on

a pre-tax basis.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20220418005169/en/

Three Months Ended March 31,

%

Financial Highlights (1)

2022

2021

Change

Net revenues (in millions)

$

4,672

$

4,715

(1

)%

Net income (in millions)

GAAP

$

1,402

$

1,484

(6

)%

Adjusted (1)

$

1,591

$

1,690

(6

)%

Diluted earnings per common share

GAAP

$

.67

$

.73

(8

)%

Adjusted (1)

$

.77

$

.84

(8

)%

Pre-tax profit margin

GAAP

39.4

%

41.6

%

Adjusted (1)

44.7

%

47.4

%

Return on average common stockholders’

equity (annualized)

12

%

12

%

Return on tangible common equity

(annualized) (1)

26

%

24

%

Note: All per-share results are rounded to the nearest cent, based

on weighted-average diluted common shares outstanding.

(1)

Further details on non-GAAP

financial measures and a reconciliation of such measures to GAAP

reported results are included on pages 10-11 of this release.

CEO Walt Bettinger said, “Our business momentum remained quite

strong throughout the first quarter. We helped clients face a

complex set of crosscurrents, which included an ongoing economic

recovery supported by continued progress against the COVID

pandemic, rising inflation, geopolitical turmoil driven by the

Russian invasion of Ukraine, the Fed initiating its first

tightening cycle since late 2015, and more volatile equity markets

that remained below year-end 2021 levels for the vast majority of

the period. Ongoing client engagement was reflected in trading

activity that averaged more than 6.5 million a day – a level

exceeded only by the ‘re-opening’ surge of last year’s first

quarter. At the same time, Schwab’s contemporary full-service model

and 'no trade-offs' approach to value, service, transparency, and

trust helped attract 1.2 million new brokerage accounts during the

first quarter, along with $121 billion in core net new assets,

which represents a 6% annualized organic growth rate. We ended

March with 33.6 million active brokerage accounts and $7.86

trillion in total client assets, up 5% and 11%, respectively, over

year-earlier levels.”

“Along with supporting clients through a turbulent environment,

we continued to drive progress across our strategic priorities

during the quarter, including two significant steps in the exciting

area of personalized investing,” Mr. Bettinger continued. “We

announced Schwab Personalized Indexing™ (SPI), a proprietary direct

indexing solution designed to bring tax efficient personalized

portfolio management capabilities – along with a highly competitive

account minimum and fee schedule – to a wider spectrum of both

registered investment advisors and retail investors. SPI includes

daily monitoring of client portfolios and tax-loss harvesting

technology that is managed by a team of investment professionals.

Additionally, we introduced our initial thematic stock lists, which

are built using a proprietary algorithm and designed to help

self-directed investors pick stocks aligned with their interests

and values. Clients can view potential investments from a list of

45 different categories and approximately 900 companies

representing a range of themes including data advancement, medical

breakthroughs, and environmental innovation.”

Mr. Bettinger added, “During the first quarter, we took steps to

help our clients navigate the mutual fund selection process more

efficiently as they look across the broad range of choices

available on our open architecture platform. Clients using our

enhanced Fund Finder tool on Schwab.com now have the option of

referencing modules that highlight funds from Schwab and T. Rowe

Price that meet their search criteria, have no transaction fees,

and have Morningstar Overall Ratings of four or five stars. Of

note, independent advisors who custody with Schwab have already

gained access to T. Rowe Price’s lowest cost institutional share

class funds through our platform without transaction fees.”

Mr. Bettinger concluded, “We see SPI and our thematic lists as

initial steps in giving clients more power in personalizing their

investments to reflect their unique circumstances and perspectives.

Similarly, simplifying the research experience for clients when

selecting mutual funds gives them more power to build their

financial futures with investments that make sense for them. We

remain committed to pushing forward with these and other strategic

initiatives even as we keep our TD Ameritrade integration work on

schedule, because we know that both fronts are essential elements

of our 'Through Clients’ Eyes' strategy. Schwab’s strong growth

reflects the enduring appeal of that strategy for millions of

investors as well as the independent advisors who serve them.”

CFO Peter Crawford noted, “Our first quarter 2022 financial

results reflected our ongoing success with clients while contending

with the effects of a challenging environment. Total revenues of

$4.7 billion were just under the record level set in the year-ago

quarter amidst that extraordinary surge in client activity, with

increases in net interest revenue (NIR) and asset management and

administration fees (AMAF) essentially offsetting the effects of

trading activity returning to more moderate levels. First quarter

2022 NIR and AMAF were strengthened by growing balances and

modestly improved – but still low – short-term interest rates. The

lift from these increases, however, was muted somewhat by recent

equity market weakness and volatility, which affected margin loan

balances and securities lending activity as well as client asset

valuations.”

Mr. Crawford continued, “Our GAAP expenses rose 3%

year-over-year to $2.8 billion, including $96 million in

acquisition and integration-related costs and $154 million in

amortization of acquired intangibles. Exclusive of these items,

adjusted total expenses(1) were up 4% versus the first quarter of

2021, consistent with our expectations as we invest in our people

and our ability to support current and ongoing growth in our client

base. Our diversified revenue model, along with disciplined expense

management that aims to balance near-term profitability and

long-term investment, enabled us to achieve a pre-tax profit margin

of 39.4% – 44.7% on an adjusted basis(1). We believe the relative

resiliency of our first quarter revenues and profitability

represents solid performance in the face of significant

environmental headwinds.”

“Our priority for capital management remains centered on

maintaining flexibility for supporting ongoing growth,” Mr.

Crawford said. “During the first quarter, we migrated an additional

$13 billion in Insured Deposit Account (IDA) balances onto our

balance sheet, and total assets rose by a similar amount versus

year-end 2021. To augment our capital position amidst this growth

in assets, we issued $750 million in preferred stock. We also

issued $3 billion in senior notes primarily for ongoing liquidity

management purposes. The company’s preliminary Tier 1 Leverage

Ratio was 6.1% as of March 31. With a first quarter return on

equity of 12% and ROTCE(1) of 26%, our healthy financial

performance and consistent attention to capital management have

helped us deliver a double-digit return on equity and a ROTCE of at

least 20% every quarter since acquiring TD Ameritrade. As we move

deeper into 2022, we remain confident that Schwab has the financial

strength and flexibility necessary to stay focused on serving our

clients however conditions evolve.”

(1)

Further details on non-GAAP

financial measures and a reconciliation of such measures to GAAP

reported results are included on pages 10-11 of this release.

Commentary from the CFO Periodically, our Chief Financial

Officer provides insight and commentary regarding Schwab’s

financial picture at: https://www.aboutschwab.com/cfo-commentary.

The most recent commentary, which provides perspective on recent

account activity, was posted on May 14, 2021.

Spring Business Update The company has scheduled a Spring

Business Update for institutional investors on Thursday, April 21,

2022. The Update, which will be held via webcast, is scheduled to

run from approximately 8:00 a.m. - 9:00 a.m. PT, 11:00 am - 12:00

pm ET. Registration for this Update is accessible at

https://www.aboutschwab.com/schwabevents.

Forward-Looking Statements This press release contains

forward-looking statements relating to business momentum; strategic

initiatives; TD Ameritrade integration; growth in the client base,

accounts, and assets; investments to attract and retain talent,

improve service and the client experience, expand products,

services and offerings to meet client needs, diversify revenues,

and drive scale and efficiency; expense management; balancing

near-term profitability and long-term investment; capital

management; and financial strength and flexibility. These

forward-looking statements reflect management’s expectations as of

the date hereof. Achievement of these expectations and objectives

is subject to risks and uncertainties that could cause actual

results to differ materially from the expressed expectations.

Important factors that may cause such differences include, but

are not limited to, the company’s ability to attract and retain

clients and independent investment advisors and grow those

relationships and client assets; develop and launch new and

enhanced products, services, and capabilities, as well as enhance

its infrastructure and capacity, in a timely and successful manner;

hire and retain talent; support client activity levels;

successfully implement integration strategies and plans; manage

expenses; and monetize client assets. Other important factors

include general market conditions, including equity valuations,

trading activity, and the level of interest rates; market

volatility; client use of the company’s advisory solutions and

other products and services; client sensitivity to rates; level of

client assets, including cash balances; capital and liquidity needs

and management; the migration of bank deposit account balances; the

scope and duration of the COVID-19 pandemic and actions taken by

governmental authorities to contain the spread of the virus and the

economic impact; and other factors set forth in the company’s most

recent reports on Form 10-K and Form 10-Q.

About Charles Schwab The Charles Schwab Corporation

(NYSE: SCHW) is a leading provider of financial services, with 33.6

million active brokerage accounts, 2.2 million corporate retirement

plan participants, 1.6 million banking accounts, and approximately

$7.86 trillion in client assets. Through its operating

subsidiaries, the company provides a full range of wealth

management, securities brokerage, banking, asset management,

custody, and financial advisory services to individual investors

and independent investment advisors. Its broker-dealer

subsidiaries, Charles Schwab & Co., Inc., TD Ameritrade, Inc.,

and TD Ameritrade Clearing, Inc., (members SIPC,

https://www.sipc.org), and their affiliates offer a complete range

of investment services and products including an extensive

selection of mutual funds; financial planning and investment

advice; retirement plan and equity compensation plan services;

referrals to independent, fee-based investment advisors; and

custodial, operational and trading support for independent,

fee-based investment advisors through Schwab Advisor Services. Its

primary banking subsidiary, Charles Schwab Bank, SSB (member FDIC

and an Equal Housing Lender), provides banking and lending services

and products. More information is available at

https://www.aboutschwab.com.

TD Ameritrade, Inc. and TD Ameritrade Clearing, Inc. are

separate but affiliated companies and subsidiaries of TD Ameritrade

Holding Corporation. TD Ameritrade Holding Corporation is a wholly

owned subsidiary of The Charles Schwab Corporation. TD Ameritrade

is a trademark jointly owned by TD Ameritrade IP Company, Inc. and

The Toronto-Dominion Bank.

THE CHARLES SCHWAB

CORPORATION

Consolidated Statements of

Income

(In millions, except per share

amounts)

(Unaudited)

Three Months Ended March 31,

2022

2021

Net Revenues

Interest revenue

$

2,319

$

2,015

Interest expense

(136

)

(104

)

Net interest revenue

2,183

1,911

Asset management and administration fees

(1)

1,068

1,016

Trading revenue

963

1,216

Bank deposit account fees

294

351

Other

164

221

Total net revenues

4,672

4,715

Expenses Excluding Interest

Compensation and benefits

1,546

1,430

Professional services

244

226

Occupancy and equipment

269

237

Advertising and market development

102

116

Communications

144

147

Depreciation and amortization

150

129

Amortization of acquired intangible

assets

154

154

Regulatory fees and assessments

68

78

Other

156

238

Total expenses excluding interest

2,833

2,755

Income before taxes on income

1,839

1,960

Taxes on income

437

476

Net Income

1,402

1,484

Preferred stock dividends and other

124

96

Net Income Available to Common

Stockholders

$

1,278

$

1,388

Weighted-Average Common Shares

Outstanding:

Basic

1,894

1,882

Diluted

1,905

1,892

Earnings Per Common Shares

Outstanding (2):

Basic

$

.67

$

.74

Diluted

$

.67

$

.73

(1)

Includes fee waivers of $54

million and $78 million for the three months ended March 31, 2022

and 2021, respectively.

(2)

The Company has voting and

nonvoting common stock outstanding. As the participation rights,

including dividend and liquidation rights, are identical between

the voting and nonvoting stock classes, basic and diluted earnings

per share are the same for each class.

THE CHARLES SCHWAB

CORPORATION

Financial and Operating

Highlights

(Unaudited)

Q1-22 % change

2022

2021

vs.

vs.

First

Fourth

Third

Second

First

(In millions, except per share amounts and

as noted)

Q1-21

Q4-21

Quarter

Quarter

Quarter

Quarter

Quarter

Net Revenues

Net interest revenue

14

%

2

%

$

2,183

$

2,142

$

2,030

$

1,947

$

1,911

Asset management and administration

fees

5

%

(4

)%

1,068

1,110

1,101

1,047

1,016

Trading revenue

(21

)%

(5

)%

963

1,017

964

955

1,216

Bank deposit account fees

(16

)%

(3

)%

294

304

323

337

351

Other

(26

)%

21

%

164

135

152

241

221

Total net revenues

(1

)%

(1

)%

4,672

4,708

4,570

4,527

4,715

Expenses Excluding Interest

Compensation and benefits

8

%

11

%

1,546

1,399

1,303

1,318

1,430

Professional services

8

%

(10

)%

244

271

250

247

226

Occupancy and equipment

14

%

6

%

269

254

246

239

237

Advertising and market development

(12

)%

(16

)%

102

122

119

128

116

Communications

(2

)%

11

%

144

130

144

166

147

Depreciation and amortization

16

%

3

%

150

145

140

135

129

Amortization of acquired intangibles

assets

—

—

154

154

153

154

154

Regulatory fees and assessments

(13

)%

1

%

68

67

64

66

78

Other

(34

)%

9

%

156

143

140

355

238

Total expenses excluding interest

3

%

6

%

2,833

2,685

2,559

2,808

2,755

Income before taxes on income

(6

)%

(9

)%

1,839

2,023

2,011

1,719

1,960

Taxes on income

(8

)%

(1

)%

437

443

485

454

476

Net Income

(6

)%

(11

)%

$

1,402

$

1,580

$

1,526

$

1,265

$

1,484

Preferred stock dividends and other

29

%

(5

)%

124

131

120

148

96

Net Income Available to Common

Stockholders

(8

)%

(12

)%

$

1,278

$

1,449

$

1,406

$

1,117

$

1,388

Earnings per common share (1):

Basic

(9

)%

(13

)%

$

.67

$

.77

$

.74

$

.59

$

.74

Diluted

(8

)%

(12

)%

$

.67

$

.76

$

.74

$

.59

$

.73

Dividends declared per common share

11

%

11

%

$

.20

$

.18

$

.18

$

.18

$

.18

Weighted-average common shares

outstanding:

Basic

1

%

—

1,894

1,892

1,888

1,886

1,882

Diluted

1

%

—

1,905

1,902

1,898

1,896

1,892

Performance Measures

Pre-tax profit margin

39.4

%

43.0

%

44.0

%

38.0

%

41.6

%

Return on average common stockholders’

equity (annualized) (2)

12

%

12

%

12

%

10

%

12

%

Financial Condition (at quarter

end, in billions)

Cash and cash equivalents

87

%

45

%

$

91.1

$

63.0

$

34.3

$

30.3

$

48.6

Cash and investments segregated

35

%

1

%

54.4

53.9

42.3

39.9

40.4

Receivables from brokerage clients —

net

13

%

(7

)%

84.1

90.6

86.6

82.2

74.7

Available for sale securities (3)

(20

)%

(30

)%

272.0

390.1

377.0

359.6

341.6

Held to maturity securities (3)

N/M

N/M

105.3

—

—

—

—

Bank loans — net

46

%

8

%

37.2

34.6

31.6

28.9

25.4

Total assets

21

%

2

%

681.0

667.3

607.5

574.5

563.5

Bank deposits

26

%

5

%

465.8

443.8

395.3

368.6

369.9

Payables to brokerage clients

24

%

—

125.3

125.7

113.1

105.0

101.3

Short-term borrowings

68

%

(14

)%

4.2

4.9

3.0

3.5

2.5

Long-term debt

24

%

16

%

21.9

18.9

19.5

18.7

17.7

Stockholders’ equity

(13

)%

(15

)%

48.1

56.3

57.4

57.5

55.6

Other

Full-time equivalent employees (at quarter

end, in thousands)

7

%

2

%

34.2

33.4

32.4

32.5

32.0

Capital expenditures — purchases of

equipment, office facilities, and property, net (in millions)

—

(52

)%

$

209

$

431

$

176

$

225

$

209

Expenses excluding interest as a

percentage of average client assets

(annualized)

0.15

%

0.13

%

0.13

%

0.15

%

0.16

%

Clients’ Daily Average Trades

(DATs) (in thousands)

(22

)%

8

%

6,578

6,102

5,549

6,042

8,414

Number of Trading Days

2

%

(2

)%

62.0

63.5

64.0

63.0

61.0

Revenue Per Trade (4)

—

(10

)%

$

2.36

$

2.62

$

2.71

$

2.51

$

2.37

(1)

The Company has voting and

nonvoting common stock outstanding. As the participation rights,

including dividend and liquidation rights, are identical between

the voting and nonvoting stock classes, basic and diluted earnings

per share are the same for each class.

(2)

Return on average common

stockholders’ equity is calculated using net income available to

common stockholders divided by average common stockholders’

equity.

(3)

In January 2022, the Company

transferred a portion of its investment securities designated as

available for sale to the held to maturity category, as described

in Part II – Item 8 – Note 6 of our 2021 Annual Report on Form

10-K.

(4)

Revenue per trade is calculated

as trading revenue divided by DATs multiplied by the number of

trading days.

N/M Not meaningful. Percentage changes greater than 200% are

presented as not meaningful.

THE CHARLES SCHWAB

CORPORATION

Net Interest Revenue

Information

(In millions, except ratios or as

noted)

(Unaudited)

Three Months Ended March 31,

2022

2021

Average Balance

Interest Revenue/ Expense

Average Yield/ Rate

Average Balance

Interest Revenue/ Expense

Average Yield/ Rate

Interest-earning assets

Cash and cash equivalents

$

72,465

$

34

0.19

%

$

38,898

$

7

0.08

%

Cash and investments segregated

51,913

15

0.11

%

48,149

10

0.08

%

Receivables from brokerage clients

84,204

626

2.97

%

67,738

563

3.32

%

Available for sale securities (1,2)

284,526

947

1.33

%

338,245

1,091

1.29

%

Held to maturity securities (2)

103,416

378

1.46

%

—

—

—

Bank loans

35,852

187

2.10

%

24,476

139

2.27

%

Total interest-earning assets

632,376

2,187

1.38

%

517,506

1,810

1.40

%

Securities lending revenue

129

204

Other interest revenue

3

1

Total interest-earning assets

$

632,376

$

2,319

1.47

%

$

517,506

$

2,015

1.56

%

Funding sources

Bank deposits

$

452,692

$

16

0.01

%

$

363,099

$

13

0.01

%

Payables to brokerage clients

105,929

2

0.01

%

87,339

2

0.01

%

Short-term borrowings (3)

4,717

4

0.33

%

1,093

—

0.22

%

Long-term debt

19,864

108

2.18

%

14,245

85

2.37

%

Total interest-bearing liabilities

583,202

130

0.09

%

465,776

100

0.09

%

Non-interest-bearing funding sources

49,174

51,730

Securities lending expense

7

5

Other interest expense

(1

)

(1

)

Total funding sources

$

632,376

$

136

0.09

%

$

517,506

$

104

0.08

%

Net interest revenue

$

2,183

1.38

%

$

1,911

1.48

%

(1)

Amounts have been calculated

based on amortized cost.

(2)

In January 2022, the Company

transferred a portion of its investment securities designated as

available for sale to the held to maturity category, as described

in Part II – Item 8 – Note 6 of our 2021 Annual Report on Form

10-K.

(3)

Interest revenue or expense was

less than $500 thousand in the period or periods presented.

THE CHARLES SCHWAB

CORPORATION

Asset Management and

Administration Fees Information

(In millions, except ratios or as

noted)

(Unaudited)

Three Months Ended March 31,

2022

2021

Average Client Assets

Revenue

Average Fee

Average Client Assets

Revenue

Average Fee

Schwab money market funds before fee

waivers

$

144,732

$

102

0.29

%

$

169,683

$

122

0.29

%

Fee waivers

(54

)

(78

)

Schwab money market funds

144,732

48

0.13

%

169,683

44

0.11

%

Schwab equity and bond funds, ETFs, and

collective trust funds (CTFs)

456,326

97

0.09

%

377,282

86

0.09

%

Mutual Fund OneSource® and other

non-transaction fee funds

212,641

165

0.31

%

222,455

172

0.31

%

Other third-party mutual funds and

ETFs

872,212

179

0.08

%

849,409

168

0.08

%

Total mutual funds, ETFs, and CTFs (1)

$

1,685,911

489

0.12

%

$

1,618,829

470

0.12

%

Advice solutions (1)

Fee-based

$

469,325

496

0.43

%

$

424,629

468

0.45

%

Non-fee-based

90,335

—

—

84,767

—

—

Total advice solutions

$

559,660

496

0.36

%

$

509,396

468

0.37

%

Other balance-based fees (2)

616,679

67

0.04

%

576,562

64

0.05

%

Other (3)

16

14

Total asset management and

administration fees

$

1,068

$

1,016

(1)

Advice solutions include managed

portfolios, specialized strategies, and customized investment

advice such as Schwab Private Client™, Schwab Managed Portfolios™,

Managed Account Select®, Schwab Advisor Network®, Windhaven®

Strategies, ThomasPartners® Strategies, Schwab Index Advantage®

advised retirement plan balances, Schwab Intelligent Portfolios®,

Institutional Intelligent Portfolios®, Schwab Intelligent

Portfolios Premium®, TD Ameritrade AdvisorDirect®, Essential

Portfolios, Selective Portfolios, and Personalized Portfolios; as

well as legacy non-fee advice solutions including Schwab Advisor

Source and certain retirement plan balances. Average client assets

for advice solutions may also include the asset balances contained

in the mutual fund and/or ETF categories listed above. For the

total end of period view, please see the Monthly Activity

Report.

(2)

Includes various asset-related

fees, such as trust fees, 401(k) recordkeeping fees, and mutual

fund clearing fees and other service fees.

(3)

Includes miscellaneous service

and transaction fees relating to mutual funds and ETFs that are not

balance-based.

THE CHARLES SCHWAB

CORPORATION

Growth in Client Assets and

Accounts

(Unaudited)

Q1-22 % Change

2022

2021

vs.

vs.

First

Fourth

Third

Second

First

(In billions, at quarter end, except as

noted)

Q1-21

Q4-21

Quarter

Quarter

Quarter

Quarter

Quarter

Assets in client accounts

Schwab One®, certain cash equivalents and

bank deposits

25

%

3

%

$

584.3

$

566.1

$

503.9

$

469.5

$

467.3

Bank deposit account balances

(6

)%

(2

)%

154.8

158.5

153.3

161.9

164.2

Proprietary mutual funds (Schwab Funds®

and Laudus Funds®) and CTFs

Money market funds (1)

(13

)%

(2

)%

143.1

146.5

147.7

151.9

163.6

Equity and bond funds and CTFs (2)

15

%

(4

)%

175.8

183.1

167.4

165.9

152.9

Total proprietary mutual funds and

CTFs

1

%

(3

)%

318.9

329.6

315.1

317.8

316.5

Mutual Fund Marketplace® (3)

Mutual Fund OneSource® and other

non-transaction fee funds

4

%

—

235.5

234.9

234.7

240.2

227.3

Mutual fund clearing services

(5

)%

(7

)%

235.4

254.2

271.9

271.3

248.7

Other third-party mutual funds (4)

1

%

(8

)%

1,383.3

1,497.7

1,450.1

1,441.5

1,375.8

Total Mutual Fund Marketplace

—

(7

)%

1,854.2

1,986.8

1,956.7

1,953.0

1,851.8

Total mutual fund assets

—

(6

)%

2,173.1

2,316.4

2,271.8

2,270.8

2,168.3

Exchange-traded funds (ETFs)

Proprietary ETFs (2)

22

%

(1

)%

268.5

271.8

251.6

245.2

220.9

Other third-party ETFs

23

%

(2

)%

1,270.6

1,296.4

1,183.7

1,158.8

1,035.1

Total ETF assets

23

%

(2

)%

1,539.1

1,568.2

1,435.3

1,404.0

1,256.0

Equity and other securities

15

%

(4

)%

3,131.1

3,259.8

2,976.7

2,988.8

2,721.0

Fixed income securities

(1

)%

1

%

360.7

356.4

356.8

359.6

364.5

Margin loans outstanding

12

%

(7

)%

(81.0

)

(87.4

)

(83.8

)

(79.8

)

(72.2

)

Total client assets

11

%

(3

)%

$

7,862.1

$

8,138.0

$

7,614.0

$

7,574.8

$

7,069.1

Client assets by business

Investor Services

10

%

(4

)%

$

4,235.5

$

4,400.7

$

4,137.7

$

4,146.2

$

3,865.9

Advisor Services

13

%

(3

)%

3,626.6

3,737.3

3,476.3

3,428.6

3,203.2

Total client assets

11

%

(3

)%

$

7,862.1

$

8,138.0

$

7,614.0

$

7,574.8

$

7,069.1

Net growth in assets in client

accounts (for the quarter ended)

Net new assets by business

Investor Services (5)

(16

)%

63

%

$

54.6

$

33.4

$

57.9

$

44.5

$

65.1

Advisor Services

(4

)%

(35

)%

65.9

101.2

81.1

64.3

68.7

Total net new assets

(10

)%

(10

)%

$

120.5

$

134.6

$

139.0

$

108.8

$

133.8

Net market gains (losses)

N/M

N/M

(396.4

)

389.4

(99.8

)

396.9

243.6

Net growth (decline)

N/M

N/M

$

(275.9

)

$

524.0

$

39.2

$

505.7

$

377.4

New brokerage accounts (in

thousands, for the quarter ended)

(62

)%

(9

)%

1,202

1,318

1,178

1,657

3,153

Client accounts (in thousands)

Active brokerage accounts

5

%

1

%

33,577

33,165

32,675

32,265

31,902

Banking accounts

2

%

2

%

1,641

1,614

1,580

1,574

1,608

Corporate retirement plan participants

7

%

2

%

2,246

2,200

2,207

2,149

2,105

(1)

Total client assets in purchased

money market funds are located at:

https://www.aboutschwab.com/investor-relations.

(2)

Includes balances held on and off

the Schwab platform. As of March 31, 2022, off-platform equity and

bond funds, CTFs, and ETFs were $23.9 billion, $5.7 billion, and

$94.9 billion, respectively.

(3)

Excludes all proprietary mutual

funds and ETFs.

(4)

As of March 31, 2022, third-party

money funds were $12.3 billion.

(5)

Fourth quarter of 2021 includes

outflows of $27.6 billion from mutual fund clearing services

clients. First quarter of 2021 includes an outflow of $14.4 billion

from a mutual fund clearing services client.

N/M Not meaningful. Percentage changes greater than 200% are

presented as not meaningful.

The Charles Schwab Corporation

Monthly Activity Report For March 2022

2021

2022

Change

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

Mar

Mo.

Yr.

Market Indices (at month end)

Dow Jones Industrial Average®

32,982

33,875

34,529

34,503

34,935

35,361

33,844

35,820

34,484

36,338

35,132

33,893

34,678

2

%

5

%

Nasdaq Composite®

13,247

13,963

13,749

14,504

14,673

15,259

14,449

15,498

15,538

15,645

14,240

13,751

14,221

3

%

7

%

Standard & Poor’s® 500

3,973

4,181

4,204

4,298

4,395

4,523

4,308

4,605

4,567

4,766

4,516

4,374

4,530

4

%

14

%

Client Assets (in billions of

dollars)

Beginning Client Assets

6,900.5

7,069.1

7,336.1

7,395.7

7,574.8

7,642.7

7,838.2

7,614.0

7,982.3

7,918.3

8,138.0

7,803.8

7,686.6

Net New Assets (1)

62.6

37.2

28.1

43.5

44.3

51.8

42.9

22.9

31.4

80.3

33.6

40.6

46.3

14

%

(26

)%

Net Market (Losses) Gains

106.0

229.8

31.5

135.6

23.6

143.7

(267.1

)

345.4

(95.4

)

139.4

(367.8

)

(157.8

)

129.2

Total Client Assets (at month end)

7,069.1

7,336.1

7,395.7

7,574.8

7,642.7

7,838.2

7,614.0

7,982.3

7,918.3

8,138.0

7,803.8

7,686.6

7,862.1

2

%

11

%

Core Net New Assets (2)

62.6

37.2

28.1

43.5

44.3

51.8

42.9

36.8

45.1

80.3

33.6

40.6

46.3

14

%

(26

)%

Receiving Ongoing Advisory Services (at

month end)

Investor Services

495.2

511.1

517.8

525.1

531.9

542.5

530.1

548.3

543.1

559.2

541.9

533.7

538.9

1

%

9

%

Advisor Services (3)

2,997.9

3,112.5

3,150.4

3,209.3

3,256.5

3,333.4

3,253.2

3,399.8

3,374.3

3,505.2

3,382.4

3,342.5

3,404.6

2

%

14

%

Client Accounts (at month end, in

thousands)

Active Brokerage Accounts

31,902

31,877

32,110

32,265

32,386

32,513

32,675

32,796

32,942

33,165

33,308

33,421

33,577

—

5

%

Banking Accounts

1,608

1,562

1,584

1,574

1,578

1,594

1,580

1,593

1,608

1,614

1,628

1,641

1,641

—

2

%

Corporate Retirement Plan Participants

2,105

2,116

2,130

2,149

2,159

2,188

2,207

2,213

2,198

2,200

2,216

2,235

2,246

—

7

%

Client Activity

New Brokerage Accounts (in thousands)

847

609

549

499

402

402

374

397

448

473

426

356

420

18

%

(50

)%

Client Cash as a Percentage of Client

Assets (4)

11.5

%

10.9

%

10.8

%

10.5

%

10.4

%

10.3

%

10.8

%

10.4

%

10.5

%

10.9

%

11.3

%

11.5

%

11.4

%

(10) bp

(10) bp

Derivative Trades as a Percentage of Total

Trades

18.5

%

20.4

%

20.9

%

20.6

%

22.2

%

23.1

%

23.1

%

22.5

%

23.4

%

23.0

%

22.4

%

24.0

%

22.4

%

(160) bp

390 bp

Selected Average Balances (in millions

of dollars)

Average Interest-Earning Assets (5)

520,074

527,194

528,642

536,146

546,579

552,372

565,379

574,181

584,362

605,709

622,997

629,042

644,768

2

%

24

%

Average Margin Balances

71,266

72,863

75,921

78,410

79,910

81,021

81,705

83,835

87,311

88,328

86,737

84,354

81,526

(3

)%

14

%

Average Bank Deposits Account Balances

(6)

164,866

162,392

160,459

161,377

151,275

150,896

152,330

154,040

153,877

154,918

157,706

153,824

155,657

1

%

(6

)%

Mutual Fund and Exchange-Traded

Fund

Net Buys (Sells) (7,8) (in millions of

dollars)

Equities

16,301

13,422

9,854

10,873

7,418

8,808

7,596

8,840

13,099

11,519

7,384

9,371

14,177

Hybrid

1,133

877

1

390

666

569

335

81

308

(1,207

)

(367

)

(478

)

(497

)

Bonds

8,237

8,940

5,906

10,101

6,917

8,044

6,232

4,425

4,097

5,600

1,804

(1,973

)

(7,851

)

Net Buy (Sell) Activity (in millions of

dollars)

Mutual Funds (7)

6,190

5,754

2,022

5,872

2,644

3,876

(308

)

302

189

(2,859

)

(4,961

)

(6,318

)

(11,888

)

Exchange-Traded Funds (8)

19,481

17,485

13,739

15,492

12,357

13,545

14,471

13,044

17,315

18,771

13,782

13,238

17,717

Money Market Funds

(4,528

)

(5,153

)

(3,988

)

(3,806

)

(2,501

)

(1,372

)

(1,512

)

(451

)

(1,725

)

(144

)

(1,984

)

(1,086

)

(1,344

)

Note: Certain supplemental details related to the information above

can be found at: https://www.aboutschwab.com/financial-reports.

(1)

November 2021 includes an outflow

of $13.7 billion from a mutual fund clearing services client.

October 2021 includes an outflow of $13.9 billion from a mutual

fund clearing services client.

(2)

Net new assets before significant

one-time inflows or outflows, such as acquisitions/divestitures or

extraordinary flows (generally greater than $10 billion) relating

to a specific client. These flows may span multiple reporting

periods.

(3)

Excludes Retirement Business

Services.

(4)

Schwab One®, certain cash

equivalents, bank deposits, third-party bank deposit accounts, and

money market fund balances as a percentage of total client

assets.

(5)

Represents average total

interest-earning assets on the company’s balance sheet.

(6)

Represents average TD Ameritrade

clients’ uninvested cash sweep account balances held in deposit

accounts at third-party financial institutions.

(7)

Represents the principal value of

client mutual fund transactions handled by Schwab, including

transactions in proprietary funds. Includes institutional funds

available only to Investment Managers. Excludes money market fund

transactions.

(8)

Represents the principal value of

client ETF transactions handled by Schwab, including transactions

in proprietary ETFs.

THE CHARLES SCHWAB CORPORATION Non-GAAP

Financial Measures (In millions, except ratios and per share

amounts) (Unaudited)

In addition to disclosing financial results in accordance with

generally accepted accounting principles in the U.S. (GAAP),

Schwab’s first quarter earnings release contains references to the

non-GAAP financial measures described below. We believe these

non-GAAP financial measures provide useful supplemental information

about the financial performance of the Company, and facilitate

meaningful comparison of Schwab’s results in the current period to

both historic and future results. These non-GAAP measures should

not be considered a substitute for, or superior to, financial

measures calculated in accordance with GAAP, and may not be

comparable to non-GAAP financial measures presented by other

companies.

Schwab’s use of non-GAAP measures is reflective of certain

adjustments made to GAAP financial measures as described below.

Non-GAAP Adjustment or

Measure

Definition

Usefulness to Investors and

Uses by Management

Acquisition and integration-related costs

and amortization of acquired intangible assets

Schwab adjusts certain GAAP financial

measures to exclude the impact of acquisition and

integration-related costs incurred as a result of the Company’s

acquisitions, amortization of acquired intangible assets, and,

where applicable, the income tax effect of these expenses.

Adjustments made to exclude amortization

of acquired intangible assets are reflective of all acquired

intangible assets, which were recorded as part of purchase

accounting. These acquired intangible assets contribute to the

Company’s revenue generation. Amortization of acquired intangible

assets will continue in future periods over their remaining useful

lives.

We exclude acquisition and

integration-related costs and amortization of acquired intangible

assets for the purpose of calculating certain non-GAAP measures

because we believe doing so provides additional transparency of

Schwab’s ongoing operations, and is useful in both evaluating the

operating performance of the business and facilitating comparison

of results with prior and future periods.

Acquisition and integration-related costs

fluctuate based on the timing of acquisitions and integration

activities, thereby limiting comparability of results among

periods, and are not representative of the costs of running the

Company’s ongoing business. Amortization of acquired intangible

assets is excluded because management does not believe it is

indicative of the Company’s underlying operating performance.

Return on tangible common equity

Return on tangible common equity

represents annualized adjusted net income available to common

stockholders as a percentage of average tangible common equity.

Tangible common equity represents common equity less goodwill,

acquired intangible assets — net, and related deferred tax

liabilities.

Acquisitions typically result in the

recognition of significant amounts of goodwill and acquired

intangible assets. We believe return on tangible common equity may

be useful to investors as a supplemental measure to facilitate

assessing capital efficiency and returns relative to the

composition of Schwab’s balance sheet.

The Company also uses adjusted diluted EPS and return on

tangible common equity as components of performance criteria for

employee bonus and certain executive management incentive

compensation arrangements. The Compensation Committee of CSC’s

Board of Directors maintains discretion in evaluating performance

against these criteria.

THE CHARLES SCHWAB CORPORATION Non-GAAP

Financial Measures (In millions, except ratios and per share

amounts) (Unaudited)

The tables below present reconciliations of GAAP measures to

non-GAAP measures:

Three Months Ended March 31,

2022

2021

Total Expenses Excluding

Interest

Net Income

Total Expenses Excluding

Interest

Net Income

Total expenses excluding interest

(GAAP),

Net income (GAAP)

$

2,833

$

1,402

$

2,755

$

1,484

Acquisition and integration-related costs

(1)

(96

)

96

(119

)

119

Amortization of acquired intangible

assets

(154

)

154

(154

)

154

Income tax effects (2)

N/A

(61

)

N/A

(67

)

Adjusted total expenses

(non-GAAP),

Adjusted net income (non-GAAP)

$

2,583

$

1,591

$

2,482

$

1,690

(1)

Acquisition and

integration-related costs for the three months ended March 31, 2022

primarily consist of $56 million of compensation and benefits, $31

million of professional services, and $4 million of occupancy and

equipment. Acquisition and integration-related costs for the three

months ended March 31, 2021 primarily consist of $72 million of

compensation and benefits, $27 million of professional services,

and $16 million of occupancy and equipment.

(2)

The income tax effects of the

non-GAAP adjustments are determined using an effective tax rate

reflecting the exclusion of non-deductible acquisition costs and

are used to present the acquisition and integration-related costs

and amortization of acquired intangible assets on an after-tax

basis.

N/A Not applicable.

Three Months Ended March 31,

2022

2021

Amount

% of Total Net Revenues

Amount

% of Total Net Revenues

Income before taxes on income (GAAP),

Pre-tax profit margin (GAAP)

$

1,839

39.4

%

$

1,960

41.6

%

Acquisition and integration-related

costs

96

2.1

%

119

2.5

%

Amortization of acquired intangible

assets

154

3.2

%

154

3.3

%

Adjusted income before taxes on income

(non-GAAP), Adjusted pre-tax profit margin (non-GAAP)

$

2,089

44.7

%

$

2,233

47.4

%

Three Months Ended March 31,

2022

2021

Amount

Diluted EPS

Amount

Diluted EPS

Net income available to common

stockholders (GAAP), Earnings per common share — diluted

(GAAP)

$

1,278

$

.67

$

1,388

$

.73

Acquisition and integration-related

costs

96

.05

119

.06

Amortization of acquired intangible

assets

154

.08

154

.08

Income tax effects

(61

)

(.03

)

(67

)

(.03

)

Adjusted net income available to common

stockholders (non-GAAP), Adjusted diluted EPS (non-GAAP)

$

1,467

$

.77

$

1,594

$

.84

Three Months Ended March 31,

2022

2021

Return on average common stockholders’

equity (GAAP)

12

%

12

%

Average common stockholders’ equity

$

41,856

$

46,691

Less: Average goodwill

(11,952

)

(11,952

)

Less: Average acquired intangible assets —

net

(9,303

)

(9,915

)

Plus: Average deferred tax liabilities

related to goodwill and acquired intangible assets — net

1,886

1,935

Average tangible common equity

$

22,487

$

26,759

Adjusted net income available to common

stockholders (1)

$

1,467

$

1,594

Return on tangible common equity

(non-GAAP)

26

%

24

%

(1)

See table above for the

reconciliation of net income available to common stockholders to

adjusted net income available to common stockholders

(non-GAAP).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220418005169/en/

MEDIA: Mayura Hooper Charles Schwab Phone: 415-667-1525

INVESTORS/ANALYSTS: Jeff Edwards Charles Schwab Phone:

415-667-1524

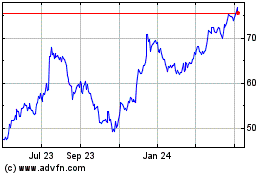

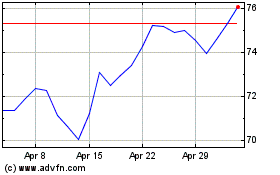

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Mar 2024 to Apr 2024

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Apr 2023 to Apr 2024