TD Bank Open to U.S. Deals -- WSJ

December 06 2019 - 3:02AM

Dow Jones News

By Vipal Monga

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (December 6, 2019).

Toronto-Dominion Bank Group said it remains poised to take

advantage of acquisition opportunities in the U.S. despite a profit

slump prompted by declining interest rates and worsening credit

quality.

TD reported net income of $2.86 billion Canadian dollars ($2.17

billion), or C$1.54 a share, for the three months ended Oct. 31.

Earnings fell from C$2.94 billion, or C$1.58 a share, in the like

period a year earlier. Adjusted earnings of C$1.59 a share were

down from a year earlier. They missed analysts' projection of

C$1.74 a share, according to FactSet.

Earnings at TD's U.S. subsidiary, which ranks as the

10th-largest U.S. bank by assets, rose 7% from a year earlier to

$900 million. The figure included $219 million in reported earnings

from the bank's 43% stake in broker TD Ameritrade. TD agreed to

back an acquisition of the broker by Charles Schwab Corp. last

month.

Excluding the Ameritrade income, TD's U.S. retail-bank earnings

totaled $681 million, unchanged from last year. Net interest margin

-- the difference between how much the bank pays out for deposits

and how much it charges for loans -- fell 0.09 of a percentage

point to 3.18% in the U.S. The margin will continue to fall on the

back of recent rate cuts by the Federal Reserve, said TD Chief

Financial Officer Riaz Ahmed.

TD will continue to hold a 13.4% stake in a merged

Schwab-Ameritrade entity, and the reported contribution from a

larger firm will likely add more to TD's earnings after a deal is

completed, said Mr. Ahmed. "We think those earnings will grow

substantially," he said.

TD, like its Canadian peers, noted an increase in the capital it

held to meet regulatory requirements. Its capital ratio of 12.1% is

up from 12% a year earlier. The capital buffer, above the minimum

10% required by Canadian regulators, gives TD a cushion it could

deploy for other uses, including acquisitions, said Chief Executive

Bharat Masrani.

"We'll always make sure we have capital flexibility should some

opportunities present themselves," Mr. Masrani said in a call with

analysts. "I'm sure with the type of environment we are seeing and

what we are calling for -- which is challenging -- that certainly

may give us opportunities more so than it might have

previously."

TD increased its provision for credit losses by about one-third

to C$891 million. TD executives called the increase in the

provision "normalization" after several years of historically low

levels. The trend toward weaker credit quality could continue, said

Ajai Bambawale, the bank's chief risk officer.

"Looking to the year ahead, the period of cyclically low loss

rates are likely behind us," he said.

--Allison Prang contributed to this article.

Write to Vipal Monga at vipal.monga@wsj.com

(END) Dow Jones Newswires

December 06, 2019 02:47 ET (07:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

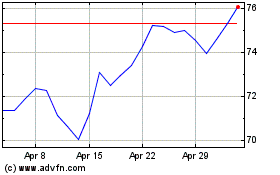

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Mar 2024 to Apr 2024

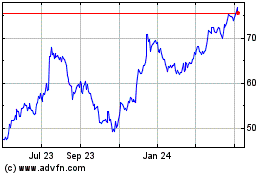

Charles Schwab (NYSE:SCHW)

Historical Stock Chart

From Apr 2023 to Apr 2024