Safehold Announces Upsizing and Pricing of Public Offering and Concurrent Private Placement

November 19 2019 - 7:31PM

Business Wire

Safehold Inc. (NYSE: SAFE) (the "Company") announced today that

it has priced an underwritten public offering of 3,000,000 shares

of its common stock at a price of $34.00 per share for total gross

proceeds of approximately $102.0 million. The public offering was

upsized from the previously announced 2,000,000 shares of common

stock. In connection with the offering, the Company has granted the

underwriters in the offering a 30-day option to purchase up to an

additional 450,000 shares of its common stock. The offering is

expected to close on November 22, 2019, and is subject to customary

closing conditions.

Concurrently with the completion of the public offering, the

Company will sell to iStar Inc. (NYSE: STAR), in a private

placement, 3,823,529 shares of common stock at the public offering

price, which represents 56% of the total shares to be issued in the

public offering and concurrent iStar private placement. The Company

raised total gross proceeds of $232.0 million in the public

offering and concurrent iStar private placement.

The Company intends to use the net proceeds from the offering

and concurrent iStar private placement to make additional ground

lease investments.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy shares of common stock in the

public offering or the concurrent iStar private placement, nor

shall there be any sale of these securities in any jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

jurisdiction.

Goldman Sachs & Co. LLC, BofA Securities, J.P. Morgan,

Barclays and Mizuho Securities will act as joint book-running

managers, SunTrust Robinson Humphrey will act as lead manager, and

Raymond James, Citigroup, Morgan Stanley and UBS Investment Bank

will act as co-managers for the offering. The Company has filed a

registration statement on Form S-3 (including a preliminary

prospectus supplement and accompanying prospectus) with the SEC for

the offering to which this communication relates. Before you

invest, you should read the preliminary prospectus supplement and

accompanying prospectus and other documents the Company has filed

with the SEC for more complete information about the Company and

this offering. You may obtain these documents for free by visiting

EDGAR on the SEC website at www.sec.gov. The Company or any

underwriter or any dealer participating in the offering will

arrange to send you the prospectus supplement (when available) and

accompanying prospectus if you request it by contacting Goldman

Sachs & Co. LLC, 200 West Street, New York, NY 10282, Attn:

Prospectus Department or by email to prospectus-NY@ny.email.gs.com

or BofA Securities, NC1-004-03-43, 200 North College Street, 3rd

Floor, Charlotte, NC 28255-0001, Attn: Prospectus Department or by

email to dg.prospectus_requests@bofa.com or J.P. Morgan Securities

LLC, c/o Broadridge Financial Solutions, 1155 Long Island Avenue,

Edgewood, New York 11717, Telephone: (866) 803-9204.

About Safehold:

Safehold Inc. (NYSE: SAFE) is a publicly traded REIT that

originates and acquires ground leases in order to generate

attractive long-term risk-adjusted returns.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191119006131/en/

Jason Fooks, Senior Vice President of Investor Relations

& Marketing T 212.930.9400 investors@safeholdinc.com

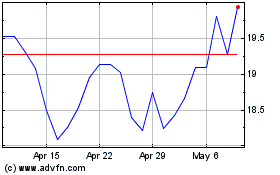

Safehold (NYSE:SAFE)

Historical Stock Chart

From Mar 2024 to Apr 2024

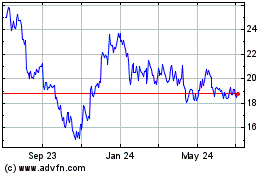

Safehold (NYSE:SAFE)

Historical Stock Chart

From Apr 2023 to Apr 2024