Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

September 16 2021 - 5:16PM

Edgar (US Regulatory)

|

Royal Bank of Canada

Market Linked Securities

|

|

Filed Pursuant to Rule 433

Registration No. 333-259205

|

|

Market Linked Securities – Leveraged Upside Participation to a Cap and Fixed Percentage Buffered Downside Principal at Risk

Securities Linked to the ARK Innovation ETF

Final Term Sheet to Pricing Supplement No. WFC167 dated September 14, 2021

|

|

|

Issuer

|

|

Royal Bank of Canada

|

|

|

Term

|

|

Approximately 1.25 years

|

|

|

Fund

|

|

ARK Innovation ETF

|

|

|

Pricing Date

|

|

September 14, 2021

|

|

|

Original Issue Date

|

|

September 17, 2021

|

|

|

Principal Amount

|

|

$1,000 per security (each security will be offered at an initial public offering price of $1,000)

|

|

|

Payment at Maturity

|

|

See “How the maturity payment amount is calculated” on page 3

|

|

|

Maturity Date

|

|

December 19, 2022

|

|

|

Initial Fund Price

|

|

$116.86, which was the fund closing price of the Fund on the pricing date

|

|

|

Final Fund Price

|

|

The fund closing price of the Fund on the valuation date

|

|

|

Maximum Maturity

Payment Amount

|

|

$1,170.00 per security

|

|

|

Buffer Price

|

|

$102.2525, which is 87.50% of the Initial Fund Price

|

|

|

Participation Rate

|

|

150%

|

|

|

Valuation Date

|

|

December 12, 2022

|

|

|

Calculation Agent

|

|

RBC Capital Markets, LLC, a wholly-owned subsidiary of the issuer

|

|

|

Denominations

|

|

$1,000 and any integral multiple of $1,000

|

|

|

Underwriting

Discount and

Commission

|

|

2.15%, of which dealers, including those using the trade name Wells Fargo Advisors (“WFA”), will receive a selling concession of 1.25% and WFA will receive a distribution expense fee of 0.075%.

In respect of certain securities sold in this offering, our affiliate, RBC Capital Markets, LLC, may pay a fee of up to $1.00 per security to selected securities dealers in consideration for marketing and other

services in connection with the distribution of the securities to other securities dealers.

|

|

|

CUSIP

|

|

78016EN52

|

|

•

|

Linked to the ARK Innovation ETF

|

|

o

|

The Fund is actively managed and is subject to additional risks. Unlike a passively managed fund, an actively managed fund does not attempt to track an index or other benchmark, and the investment decisions for

an actively managed fund are instead made by its investment adviser.

|

|

•

|

Unlike ordinary debt securities, the securities do not pay interest or repay a fixed amount of principal at maturity. Instead, the securities provide for a payment at maturity that may be greater than, equal to

or less than the initial public offering price of the securities, depending on the performance of the Fund from its Initial Fund Price to its Final Fund Price.

|

The payment at maturity will reflect the following terms:

o If the price of the Fund increases:

You will receive the initial public offering price plus 150% participation in the upside performance of the Fund, subject to a maximum total return at maturity of 17.00% of the initial

public offering price

o If the price of the Fund does not change or decreases but the decrease is not more than 12.50%:

You will be repaid the initial public offering price

o If the price of the Fund decreases by more than 12.50%:

You will receive less than the initial public offering price and will have 1-to-1 downside exposure to the decrease in the price of the Fund below the Buffer

Price

|

•

|

Investors may lose up to 87.50% of the initial public offering price

|

|

•

|

All payments on the securities are subject to the credit risk of Royal Bank of Canada, and you will have no ability to pursue the Fund or any securities held by the Fund for payment; if Royal Bank of Canada

defaults on its obligations, you could lose some or all of your investment

|

|

•

|

No periodic interest payments or dividends

|

No exchange listing; designed to be held to maturity

The issuer’s initial estimated value of the securities as of the pricing date was $967.13 per $1,000 in principal amount, which is less than the public offering

price. The market value of the securities at any time will reflect many factors, cannot be predicted with accuracy, and may be less than this amount. See “Risk Factors” and “Supplemental Plan of Distribution – Structuring the Securities”

in the accompanying pricing supplement for further information.

|

The securities are not subject to conversion into our common shares under subsection 39.2(2.3) of the Canada Deposit Insurance Corporation Act. The securities have complex

features and investing in the securities involves risks not associated with an investment in conventional debt securities. See “Selected Risk Considerations” in this term sheet and “Risk Factors” in the accompanying pricing supplement and

prospectus supplement.

This term sheet should be read together with the accompanying pricing supplement, prospectus supplement and prospectus.

NOT A BANK DEPOSIT AND NOT INSURED OR GUARANTEED BY THE FDIC OR ANY OTHER GOVERNMENTAL AGENCY

Hypothetical payout profile

The profile to the right is based on the maximum maturity payment amount of 17.00% or $1,700.00 per $1,000 security, the Participation Rate of 150% and a Buffer Price equal to 87.50%

of the Initial Fund Price.

This graph has been prepared for purposes of illustration only. Your actual return will depend on the actual Final Fund Price and whether you hold your securities to

maturity.

Hypothetical returns

Hypothetical

Final Fund Price

|

|

|

Hypothetical Percentage

Change from the

Hypothetical Initial Fund

Price to the Hypothetical

Final Fund Price

|

|

Hypothetical Maturity

Payment Amount per

Security(1)

|

|

Hypothetical Pre-

Tax Total Rate of

Return on the

Securities

|

|

$0.00

|

|

|

-100.00%

|

|

$125.00

|

|

-87.50%

|

|

$10.00

|

|

|

-90.00%

|

|

$225.00

|

|

-77.50%

|

|

$20.00

|

|

|

-80.00%

|

|

$325.00

|

|

-67.50%

|

|

$30.00

|

|

|

-70.00%

|

|

$425.00

|

|

-57.50%

|

|

$40.00

|

|

|

-60.00%

|

|

$525.00

|

|

-47.50%

|

|

$50.00

|

|

|

-50.00%

|

|

$625.00

|

|

-37.50%

|

|

$60.00

|

|

|

-40.00%

|

|

$725.00

|

|

-27.50%

|

|

$70.00

|

|

|

-30.00%

|

|

$825.00

|

|

-17.50%

|

|

$80.00

|

|

|

-20.00%

|

|

$925.00

|

|

-7.50%

|

|

$87.50

|

(2)

|

|

-12.50%

|

|

$1,000.00

|

|

0.00%

|

|

$90.00

|

|

|

-10.00%

|

|

$1,000.00

|

|

0.00%

|

|

$95.00

|

|

|

-5.00%

|

|

$1,000.00

|

|

0.00%

|

|

$100.00

|

(3)

|

|

0.00%

|

|

$1,000.00

|

|

0.00%

|

|

$105.00

|

|

|

5.00%

|

|

$1,075.00

|

|

7.50%

|

|

$110.00

|

|

|

10.00%

|

|

$1,150.00

|

|

15.00%

|

|

$111.333

|

|

|

11.333%

|

|

$1,170.00

|

|

17.00%

|

|

$115.00

|

|

|

15.00%

|

|

$1,170.00

|

|

17.00%

|

|

$120.00

|

|

|

20.00%

|

|

$1,170.00

|

|

17.00%

|

|

$130.00

|

|

|

30.00%

|

|

$1,170.00

|

|

17.00%

|

|

$140.00

|

|

|

40.00%

|

|

$1,170.00

|

|

17.00%

|

|

$150.00

|

|

|

50.00%

|

|

$1,170.00

|

|

17.00%

|

|

(1)

|

Based on the maximum maturity payment amount of $1,170.00.

|

|

(2)

|

This is the hypothetical Buffer Price.

|

|

(3)

|

This is the hypothetical Initial Fund Price.

|

How the maturity payment amount is calculated

The maturity payment amount will be determined as follows:

|

•

|

If the Final Fund Price is greater than the Initial Fund Price, the maturity payment amount per security will equal the lesser of:

|

|

(i)

|

|

|

(ii)

|

the maximum maturity payment amount

|

|

•

|

If the Final Fund Price is equal to or less than the Initial Fund Price but greater than or equal to the Buffer Price, the maturity payment amount per security will equal the issue price of $1,000.00

|

|

•

|

If the Final Fund Price is less than the Buffer Price, the maturity payment amount per security will equal:

|

In such a case, you will lose up to 87.50% of your principal.

Historical Fund Prices*

*The graph above sets forth the historical daily closing prices of the Fund for the period from January 1, 2016 to September 14, 2021. The closing price on September 14,

2021 was $116.86. The historical performance of the Fund is not an indication of its future performance during the term of the securities.

Selected risk considerations

The risks set forth below are discussed in detail in the “Risk Factors” section in the accompanying pricing supplement. Please review those risk disclosures carefully.

Risks Relating to the Terms and Structure of the Securities

|

•

|

Your investment may result in a loss of up to 87.50% of your principal

|

|

•

|

You will not receive interest payments on the securities

|

|

•

|

Your yield may be lower than the yield on a standard debt security of comparable maturity

|

|

•

|

Your return is limited and will not reflect the return of owning the Fund or the common stocks held by the Fund

|

|

•

|

Owning the securities is not the same as owning the shares of the Fund or the common stocks held by the Fund

|

|

•

|

The securities will be debt obligations of Royal Bank of Canada. No other company or entity will be responsible for payments under the securities

|

|

•

|

The tax treatment of the securities is uncertain and gain on the securities may be treated as ordinary income under the constructive ownership rules

|

Risks Relating to the Secondary Market for the Securities

|

•

|

There may not be an active trading market for the securities

|

|

•

|

The amount to be paid at maturity is not linked to the price of the Fund at any time other than the valuation date

|

|

•

|

Many factors affect the market value of the securities

|

Risks Relating to the Fund

|

•

|

An investment in the securities is subject to risks associated with actively managed funds

|

|

•

|

An investment in the securities is subject to risks associated with disruptive innovation companies

|

|

•

|

An investment in the securities is subject to risks associated with mid-size, small and micro-capitalization stocks

|

|

•

|

The securities are subject to risks associated with foreign securities markets, and emerging markets in particular

|

|

•

|

The securities are subject to currency exchange rate risk

|

|

•

|

Recent executive orders may adversely affect the performance of the Fund

|

|

•

|

The performance of the Fund may not correlate with the net asset value per share of the Fund, especially during periods of market volatility

|

|

•

|

Historical prices of the Fund should not be taken as an indication of the future prices of the Fund during the term of the securities

|

Risks Relating to the Initial Estimated Value of the Securities

|

•

|

Our initial estimated value of the securities is less than the initial public offering price

|

|

•

|

The price, if any, at which you may be able to sell your securities prior to maturity may be less than the initial public offering price and our initial estimated value

|

|

•

|

The initial estimated value of the securities is an estimate only, calculated as of the time the terms of the securities were set

|

Risks Relating to Conflicts of Interest

|

•

|

Hedging transactions may affect the return on the securities

|

|

•

|

Potential conflicts of interest could arise

|

|

•

|

Anti-dilution adjustments relating to the shares of the Fund do not address every event that could affect such shares

|

|

•

|

The calculation agent may postpone the valuation date and, therefore, determination of the Final Fund Price and the maturity date if a market disruption event occurs on the valuation date

|

|

•

|

There are potential conflicts of interest between you and the calculation agent

|

Not suitable for all investors

Investment suitability must be determined individually for each investor. The securities described herein are not a suitable investment for all investors. In particular, no

investor should purchase the securities unless they understand and are able to bear the associated market, liquidity and yield risks. Unless market conditions and other relevant factors change significantly in your favor, a sale of the

securities prior to maturity is likely to result in sale proceeds that are substantially less than the initial public offering price per security. Royal Bank of Canada, Wells Fargo Securities, LLC and their respective affiliates are not

obligated to purchase the securities from you at any time prior to maturity.

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to which this communication relates. Before you invest, you should

read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get these documents for free by visiting EDGAR on the SEC website

at www.sec.gov. Alternatively, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling your financial advisor or by calling Royal Bank of Canada toll-free at

1-877-688-2301.

Wells Fargo Advisors is a trade name used by Wells Fargo Clearing Services, LLC and Wells Fargo Advisors Financial Network, LLC, members SIPC, separate registered broker-dealers and

non-bank affiliates of Wells Fargo & Company.

Consult your tax advisor

Investors should review carefully the accompanying pricing supplement, prospectus supplement and prospectus and consult their tax advisors regarding the application of the U.S. federal

income tax laws to their particular circumstances, as well as any tax consequences arising under the laws of any state, local or foreign jurisdiction.

5

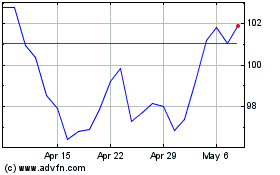

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

From Mar 2024 to Apr 2024

Royal Bank of Canada (NYSE:RY)

Historical Stock Chart

From Apr 2023 to Apr 2024