Range Announces Early Results of Cash Tender Offers

September 01 2020 - 4:15PM

RANGE RESOURCES CORPORATION (NYSE: RRC) (“Range”

or the “Company”) announced today the results to date of Range’s

previously announced cash tender offers (the “Tender Offers”) to

purchase up to $500 million aggregate principal amount (the

“Aggregate Maximum Tender Amount”) of its outstanding 5.750% senior

notes due 2021 (the “2021 Senior Notes”), 5.750% senior

subordinated notes due 2021 (the “2021 Subordinated Notes”), 5.875%

senior notes due 2022 (the “5.875% 2022 Senior Notes”), 5.000%

senior notes due 2022 (the “5.000% 2022 Senior Notes”), 5.000%

senior subordinated notes due 2022 (the “2022 Subordinated Notes”)

and 5.000% senior notes due 2023 (the “2023 Senior Notes” and,

together with the 2021 Senior Notes, the 2021 Subordinated Notes,

the 5.875% 2022 Senior Notes, the 5.000% 2022 Senior Notes, and the

2022 Subordinated Notes, collectively, the “Notes”).

Based on information provided by D.F. King and

Co., the tender agent for the Tender Offers, approximately $863.6

million aggregate principal amount of Notes were validly tendered

(and not validly withdrawn) at or prior to 5:00 p.m., New York City

time, on August 31, 2020 (the “Early Tender Date”). The following

table sets forth the approximate aggregate principal amounts of

each series of Notes that were validly tendered (and not validly

withdrawn) as of the Early Tender Date and the principal amounts

that, subject to satisfaction of the conditions to the Tender

Offers described below, are expected to be accepted for purchase

pursuant to the Tender Offers:

|

Title of Notes |

CUSIP Numbers / ISIN |

Acceptance Priority Level |

Principal Amount Outstanding Prior to the Tender

Offers(1) |

Total Consideration(2)(3) |

Principal Amount of Notes Tendered

|

Principal Amount of Notes Expected to Be Accepted for

Purchase |

Proration Factor(4) |

| 5.750%

Senior Notes due 2021 |

75281AAW9/US75281AAW99 |

1 |

$ |

37,570,000 |

$ |

1,010.00 |

$ |

12,074,000 |

$ |

12,074,000 |

100 |

% |

| 5.750% Senior

Subordinated Notes due 2021 |

75281AAM1 |

2 |

$ |

21,105,000 |

$ |

985.00 |

$ |

1,209,000 |

$ |

1,209,000 |

100 |

% |

| 5.875% Senior Notes

due 2022 |

75281AAU3/US75281AAU34 |

3 |

$ |

113,583,000 |

$ |

1,021.25 |

$ |

65,055,000 |

$ |

65,055,000 |

100 |

% |

| 5.000% Senior Notes

due 2022 |

75281AAY5/US75281AAY55 |

4 |

$ |

460,625,000 |

$ |

1,012.50 |

$ |

291,036,000 |

$ |

291,036,000 |

100 |

% |

| 5.000% Senior

Subordinated Notes due 2022 |

75281AAN9 |

5 |

$ |

18,019,000 |

$ |

950.00 |

$ |

8,289,000 |

$ |

8,289,000 |

100 |

% |

| 5.000% Senior Notes

due 2023 |

75281AAZ2

75281ABA6 |

6 |

$ |

654,672,000 |

$ |

1,005.00 |

$ |

485,935,000 |

$ |

122,337,000 |

25.2 |

% |

|

(1) |

As of August 18, 2020. |

|

(2) |

Holders will also receive accrued and unpaid interest from the

applicable last interest payment with respect to the Notes accepted

for purchase to, but not including, the Early Settlement Date (as

defined below). |

|

(3) |

Includes the Early Tender Premium (as defined below). |

|

(4) |

The final proration factor has been rounded to the nearest tenth of

a percentage point for presentation purposes. |

The amount of each series of Notes expected to

be accepted for purchase was determined pursuant to the terms and

conditions of the Tender Offers as set forth in the Offer to

Purchase dated August 18, 2020 (as amended, the “Offer to

Purchase”). Subject to satisfaction of the conditions to the

Tender Offers set forth in the Offer to Purchase, the Company

expects to accept and pay for Notes tendered prior to the Early

Tender Date, subject to proration described herein, on or about

September 2, 2020 (the “Early Settlement Date”). Holders of Notes

that have been accepted for purchase in connection with the Early

Tender Date will receive the applicable Total Consideration set

forth in the table above, which includes an early tender premium of

$50.00 per $1,000 principal amount of the Notes accepted for

purchase (the “Early Tender Premium”). In addition to the Total

Consideration, all holders of Notes accepted for purchase in

connection with the Early Tender Date will receive accrued and

unpaid interest from and including the last interest payment date

applicable to the relevant series of Notes up to, but not

including, the Early Settlement Date. The deadline for holders to

validly withdraw tenders of Notes has passed. Accordingly, tendered

Notes may no longer be withdrawn or revoked, except in certain

limited circumstances where additional withdrawal or revocation

rights are required by law.

Although the Tender Offers are scheduled to

expire at Midnight, New York City time, at the end of September 15,

2020, the Company does not expect to accept for purchase any

tenders of Notes after the Early Tender Date. Because holders of

Notes subject to the Tender Offers validly tendered and did not

validly withdraw Notes on or before the Early Tender Date in an

amount that exceeds the Aggregate Maximum Tender Amount, the 2023

Senior Notes validly tendered (and not validly withdrawn) at or

prior to the Early Tender Date are expected to be accepted on a pro

rata basis, subject to a proration factor of approximately

25.2%.

The Tender Offers are subject to the

satisfaction of the conditions described in the Offer to Purchase.

Such conditions may be waived by the Company in its sole

discretion, subject to applicable law. Any waiver of a condition by

the Company will not constitute a waiver of any other

condition.

The dealer manager for the Tender Offers is

Citigroup Global Markets Inc.. Any questions regarding the terms of

the Tender Offers should be directed to the Dealer Manager,

Citigroup Global Markets Inc. at (toll-free) (800) 558-3745 or

(collect) (212) 723-6106. The information agent and tender

agent is D.F. King & Co., Inc. Any questions regarding

procedures for tendering Notes or requests for copies of the Offer

to Purchase or other documents relating to the Tender Offers should

be directed to the information agent for the Tender Offers, D.F.

King & Co., Inc., at (800) 628-8538 (toll-free), (212) 269-5550

(all others) or rrc@dfking.com.

This press release shall not constitute an offer

to sell, a solicitation to buy or an offer to purchase or sell any

securities. No offer, solicitation, purchase or sale will be made

in any jurisdiction in which such offer, solicitation, or sale

would be unlawful. The offer is being made solely pursuant to the

terms and conditions set forth in the Offer to Purchase. Nothing

contained herein shall constitute an offer of Range’s separately

announced 9.25% senior notes due 2026 (the “Debt Financing”).

RANGE RESOURCES CORPORATION (NYSE:

RRC) is a leading U.S. independent natural gas and

NGL producer with operations focused in stacked-pay projects

in the Appalachian Basin. The Company pursues an organic

development strategy targeting high return, low-cost projects

within its large inventory of low risk development drilling

opportunities. The Company is headquartered in Fort

Worth, Texas.

This press release contains forward-looking

statements within the meaning of Section 27A of the Securities Act

and Section 21E of the Securities Exchange Act of 1934, including

those related to the completion of the Debt Financing and Tender

Offers. These statements are based on expectations and assumptions

that Range’s management believes are reasonable based on currently

available information; however, there is no assurance that these

expectations and assumptions can or will be met. Any number of

factors could cause actual results to differ materially from those

in this press release, including, but not limited to, the

satisfaction of the Debt Financing and all conditions set forth in

the Offer to Purchase, not all of which are within Range’s control.

Range undertakes no obligation to publicly update or revise any

forward-looking statements. Further information on risks and

uncertainties is available in Range’s filings with the Securities

and Exchange Commission, including its most recent Annual Report on

Form 10-K and its subsequent Quarterly Reports on Form 10-Q, which

are incorporated herein by reference.

Range Investor Contact:

Laith Sando, Vice President – Investor Relations 817-869-4267

lsando@rangeresources.com

Range Media Contact:

Mark Windle, Manager of Corporate

Communications 724-873-3223 mwindle@rangeresources.com

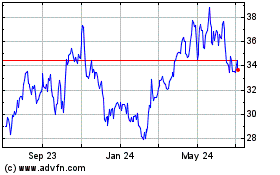

Range Resources (NYSE:RRC)

Historical Stock Chart

From Mar 2024 to Apr 2024

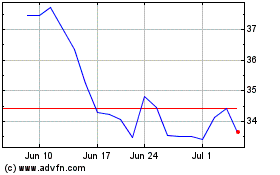

Range Resources (NYSE:RRC)

Historical Stock Chart

From Apr 2023 to Apr 2024