Amended Statement of Beneficial Ownership (sc 13d/a)

May 13 2020 - 5:28PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 1)*

Ranger Energy

Services, Inc.

(Name of Issuer)

Class A Common Stock, $0.01 par value per share

(Title of Class of Securities)

75282U104

(CUSIP Number)

David Oestreicher, Esq.

T. Rowe Price Associates, Inc.

100 East Pratt Street - 13th Floor

Baltimore, Maryland 21202

(410) 345-2000

Michael

R. Patrone, Esq.

Goodwin Procter LLP

620 Eighth Avenue

New

York, NY 10011

(212) 756-2000

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

May 11, 2020

(Date of

Event Which Requires Filing of This Statement)

If the filing person has

previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), Rule 13d-1(f) or Rule 13d-1(g), check the following box. ☒

|

*

|

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form

with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

|

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (the “Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

CUSIP No. 75282U104

|

|

SCHEDULE 13D

|

|

Page

2

of 8

|

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF REPORTING PERSON

T. ROWE PRICE ASSOCIATES, INC.

|

|

2

|

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP

(a) ☐ (b) ☐

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

SOURCE OF FUNDS

OO

|

|

5

|

|

CHECK BOX IF DISCLOSURE OF

LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ☐

|

|

6

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Maryland

|

|

|

|

|

|

|

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH:

|

|

7

|

|

SOLE VOTING POWER

316,849 shares of Class A Common Stock

|

|

|

8

|

|

SHARED VOTING POWER

-0-

|

|

|

9

|

|

SOLE DISPOSITIVE POWER

1,363,569 shares of Class A Common Stock

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

-0-

|

|

|

|

|

|

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

1,363,569 shares of Class A Common Stock

|

|

12

|

|

CHECK IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐

|

|

13

|

|

PERCENT OF

CLASS REPRESENTED BY AMOUNT IN ROW (11)

16.0%*

|

|

14

|

|

TYPE OF REPORTING

PERSON

IA

|

|

*

|

Assumes no conversion of the Issuer’s other securities into Class A Common Stock.

|

|

|

|

|

|

|

|

CUSIP No. 75282U104

|

|

SCHEDULE 13D

|

|

Page

3

of 8

|

|

|

|

|

|

|

|

|

|

1

|

|

NAME OF REPORTING PERSON

T. ROWE PRICE SMALL-CAP VALUE FUND, INC.

|

|

2

|

|

CHECK THE APPROPRIATE BOX

IF A MEMBER OF A GROUP

(a) ☐ (b) ☐

|

|

3

|

|

SEC USE ONLY

|

|

4

|

|

SOURCE OF FUNDS

OO

|

|

5

|

|

CHECK BOX IF DISCLOSURE OF

LEGAL PROCEEDING IS REQUIRED PURSUANT TO ITEMS 2(d) or 2(e) ☐

|

|

6

|

|

CITIZENSHIP OR PLACE OF

ORGANIZATION

Maryland

|

|

|

|

|

|

|

|

|

|

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON

WITH:

|

|

7

|

|

SOLE VOTING POWER

1,046,720 shares of Class A Common Stock

|

|

|

8

|

|

SHARED VOTING POWER

-0-

|

|

|

9

|

|

SOLE DISPOSITIVE POWER

-0-

|

|

|

10

|

|

SHARED DISPOSITIVE POWER

-0-

|

|

|

|

|

|

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH PERSON

1,046,720 shares of Class A Common Stock

|

|

12

|

|

CHECK IF THE AGGREGATE

AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES ☐

|

|

13

|

|

PERCENT OF

CLASS REPRESENTED BY AMOUNT IN ROW (11)

12.3%*

|

|

14

|

|

TYPE OF REPORTING

PERSON

IV

|

|

*

|

Assumes no conversion of the Issuer’s other securities into Class A Common Stock.

|

|

|

|

|

|

|

|

CUSIP No. 75282U104

|

|

SCHEDULE 13D

|

|

Page

4

of 8

|

|

Item 1.

|

SECURITY AND ISSUER

|

This Amendment No. 1 (this “Amendment No. 1”) amends and supplements the statement on Schedule 13D

filed with the Securities and Exchange Commission on March 18, 2020. Capitalized terms used but not otherwise defined herein have the meanings set forth in the original Schedule 13D. Except as specifically supplemented and amended by this

Amendment No. 1, items in the Schedule 13D remain unchanged.

|

|

|

|

|

|

|

CUSIP No. 75282U104

|

|

SCHEDULE 13D

|

|

Page

5

of 8

|

|

Item 4.

|

PURPOSE OF TRANSACTION

|

Item 4 of the Schedule 13D is hereby amended and supplemented by deleting the third and fourth paragraphs thereof and replacing it with the

following:

On the evening of March 12, 2020, CSL and Bayou Holding Company (together, the “Offering Parties”)

informed T. Rowe Price Associates that the Offering Parties had delivered a non-binding Offer (the “Offer Letter”) to the Issuer to acquire all of the issued and outstanding publicly held

shares of Class A Common Stock of the Issuer that are not directly owned by the Offering Parties and certain other holders (including certain Funds and Accounts) in exchange for $6.00 in cash for each such share of Class A Common Stock.

The Issuer subsequently formed a special committee (the “Special Committee”) of the board of directors of the Issuer for the purpose of, among other things, considering the proposals set forth in the Offer Letter.

On May 11, 2020, the Offering Parties delivered a letter to the Special Committee stating that they were withdrawing the non-binding proposal set forth in the Offer Letter with immediate effect. Upon the Offering Parties’ delivery of the letter withdrawing the non-binding proposal, the

Reporting Parties withdrew their letter of support to the Offering Parties also with immediate effect. The Reporting Parties intend to continue engaging in amicable discussions with the Offering Parties and the Issuer.

|

|

|

|

|

|

|

CUSIP No. 75282U104

|

|

SCHEDULE 13D

|

|

Page

6

of 8

|

|

Item 5.

|

INTEREST IN SECURITIES OF THE ISSUER

|

Item 5 of the Schedule 13D is hereby amended and supplemented by deleting the first paragraph thereof and replacing it with the following:

|

|

(a)

|

The aggregate number of shares of Class A Common Stock to which this Schedule 13D relates is 1,363,569

shares of Class A Common Stock held as of the close of business on April 29, 2020, constituting approximately 16% of the outstanding Class A Common Stock. The percentages used in this Schedule 13D are calculated based upon 8,477,425

shares of Class A Common Stock reported to be outstanding as of April 29, 2020, as reported on the Issuer’s quarterly report on Form 10-Q for the quarterly period ended March 31, 2020,

filed by the Issuer with the Securities and Exchange Commission on May 1, 2020.

|

|

|

|

|

|

|

|

CUSIP No. 75282U104

|

|

SCHEDULE 13D

|

|

Page

7

of 8

|

|

Item 6.

|

CONTRACTS, ARRANGEMENTS, UNDERSTANDINGS OR RELATIONSHIPS WITH RESPECT TO SECURITIES OF THE ISSUER

|

The information provided or incorporated by reference in Item 4 is hereby incorporated herein by reference.

|

|

|

|

|

|

|

CUSIP No. 75282U104

|

|

SCHEDULE 13D

|

|

Page

8

of 8

|

SIGNATURES

After reasonable inquiry and to the best of his knowledge and belief, the undersigned certifies that the information set forth in this statement is true,

complete and correct.

|

|

|

Date: May 13, 2020

|

|

|

|

T. ROWE PRICE ASSOCIATES, INC.

|

|

|

|

/s/ David Oestreicher

|

|

Name: David Oestreicher

|

|

Title: Vice President

|

|

|

|

T. ROWE PRICE SMALL-CAP VALUE FUND, INC.

|

|

|

|

/s/ David Oestreicher

|

|

Name: David Oestreicher

|

|

Title: Executive Vice President

|

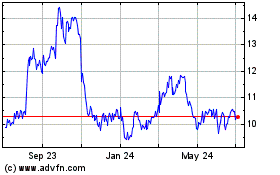

Ranger Energy Services (NYSE:RNGR)

Historical Stock Chart

From Mar 2024 to Apr 2024

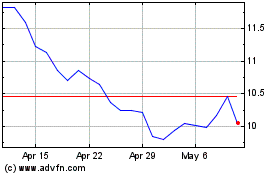

Ranger Energy Services (NYSE:RNGR)

Historical Stock Chart

From Apr 2023 to Apr 2024