ABOUT

THIS PROSPECTUS

This

prospectus is a part of a registration statement that we filed with the Securities and Exchange Commission, or SEC. Under

the registration statement, the selling stockholder may sell, at any time and from time to time, in one or more offerings, up

to 101,844 shares of Class B common stock. You should read this prospectus together with the information

incorporated herein by reference as described under the heading “Where You Can Find Additional Information.”

You

should only rely on the information contained or incorporated by reference in this prospectus or the registration statement of

which it forms a part. No person has been authorized to give any information or make any representations other than

those contained or incorporated by reference in this prospectus in connection with the offering described herein and therein,

and, if given or made, such information or representations must not be relied upon as having been authorized by us or the selling

stockholder.

You

should read the entire prospectus, as well as the documents incorporated by reference into this prospectus before making an investment

decision. Neither the delivery of this prospectus nor any sale made hereunder shall under any circumstances imply that

the information contained or incorporated by reference herein is correct as of any date subsequent to the date hereof. You

should assume that the information appearing in this prospectus or any document incorporated by reference is accurate only as

of the date of the applicable documents, regardless of the time of delivery of this prospectus or any sale of securities. Our

business, financial condition, results of operations and prospects may have changed since that date.

This

prospectus does not constitute an offer to sell or the solicitation of an offer to buy any securities other than the registered

securities to which they relate, nor does this prospectus constitute an offer to sell or the solicitation of an offer to buy securities

in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

As

used in this prospectus, “Rafael Holdings, Inc.,” “Rafael,” “the Company,” “we,”

“our,” “ours,” and “us” refer to Rafael Holdings, Inc. and its consolidated subsidiaries.

SUMMARY

This

summary highlights selected information from this prospectus and the documents incorporated herein by reference and does not contain

all of the information that you need to consider in making your investment decision. You should carefully read the entire prospectus,

including the risks of investing in our securities discussed under “Risk Factors” beginning on page 3 of this

prospectus, the information incorporated herein by reference, including our financial statements, and the exhibits to the registration

statement of which this prospectus is a part. All references in this prospectus to “we,” “us,” “our,”

“Rafael,” “Rafael Holdings, Inc.”, the “Company” and similar designations refer to Rafael

Holdings, Inc. and its consolidated subsidiaries, unless otherwise indicated or as the context otherwise requires.

Our

Business

Rafael

Holdings, Inc. (“Rafael Holdings” or the “Company”), a Delaware corporation, owns interests in pre-clinical

and clinical stage pharmaceutical companies and commercial real estate assets. The assets are operated as two separate lines of

business.

The

pharmaceutical holdings include preferred and common equity interests and a warrant to purchase additional equity interests in

Rafael Pharmaceuticals, Inc., or Rafael Pharmaceuticals, which is a clinical stage, oncology-focused pharmaceutical company committed

to the development and commercialization of therapies that exploit the metabolic differences between normal cells and cancer cells;

and, a majority equity interest in LipoMedix Pharmaceuticals Ltd., or LipoMedix, a clinical stage oncological pharmaceutical company

based in Israel. In addition, in 2019, we established the Barer Institute (“Barer”), a wholly-owned early stage venture

focused on developing a pipeline of therapeutic compounds, including compounds to regulate cancer metabolism. The venture is pursuing

collaborative research agreements with leading scientists from top academic institutions to develop other early stage ventures

such as the launching of a joint venture which has entered into an agreement with Princeton University's Office of Technology

Licensing for technology for an exclusive worldwide license to its SHMT (serine hydroxymethyltransferase) inhibitor program. In

addition, we have recently initiated efforts to develop other early stage pharmaceutical ventures.

The

commercial real estate holdings consist of a building at 520 Broad Street in Newark, New Jersey that serves as headquarters for

the Company and certain other related entities and hosts other tenants and an associated 800-car public garage, and a portion

of a building in Israel. On August 28, 2020 we sold a 3-story, 65,253 square foot office building located at 225 Old New Brunswick

Road in Piscataway, New Jersey for $3,875,000.

Rafael

Pharmaceuticals recently announced two milestones in its clinical trial phase programs including completing target enrollment

of 500 patients of its pivotal phase 3 pancreatic cancer program, ahead of schedule in August 2020, and in October 2020 crossing

enrollment of its hundredth patient in its pivotal phase 3 study for relapsed or refractory Acute Myeloid Leukemia (“AML”).

Additionally, the U.S. Food and Drug Administration (“FDA”) has granted Fast Track designation for Rafael Pharmaceuticals’

lead compound, CPI-613® (devimistat), for the treatment of both metastatic pancreatic cancer and AML.

Risks

and Uncertainties - COVID-19

In

December 2019, a new coronavirus, now known as COVID-19, which has proved to be highly contagious, emerged in Wuhan, China and

has since spread around the globe. The Company actively monitors the outbreak and its potential impact on its operations and those

of the Company’s holdings. Although the Company’s operations are mainly in the United States, the Company has assets

outside of the United States, and some of the Company’s pharmaceutical holdings conduct operations, manufacturing and clinical

trial activities in Europe and Asia.

The

impacts on the operations and specifically the ongoing clinical trials of our pharmaceutical holdings have been actively managed

by respective pharmaceutical management teams who have worked closely with the appropriate regulatory agencies to continue clinical

trial activities with as minimal impact as possible including receiving waivers for certain clinical trial activities from the

respective regulatory agencies to continue the studies.

The

Company had one tenant that did not pay rent in August 2020 due to the New Jersey state gym closures; however, the tenant subsequently

resumed rent payments for September and onward. There is a general degree of uncertainty in the national commercial real estate

market based on the COVID-19 pandemic and as a result there is a potential impact to the value of the Company’s real estate

portfolio as well as efforts to monetize those assets.

The

Company has implemented a number of measures to protect the health and safety of our workforce including a mandatory work-from-home

policy for our workforce who can perform their jobs from home as well as restrictions on business travel and workplace and in-person

meetings.

Due

to both known and unknown risks, including quarantines, closures and other restrictions resulting from the outbreak, operations

and those of the Company’s holdings may be adversely impacted. Additionally, as there is an evolving nature to the COVID-19

situation, we cannot reasonably assess or predict at this time the full extent of the negative impact that the COVID-19 pandemic

may have on our business, financial condition, results of operations and cash flows. The impact will depend on future developments

such as the ultimate duration and the severity of the spread of the COVID-19 pandemic in the U.S. and globally, the effectiveness

of federal, state, local and foreign government actions on mitigation and spread of COVID-19, the pandemic’s impact on the

U.S. and global economies, changes in our customers’ behavior emanating from the pandemic and how quickly we can resume

our normal operations, among others. For all these reasons, the Company may incur expenses or delays relating to such events outside

of the Company’s control, which could have a material adverse impact on the Company’s business.

Recent

Financing

On

December 7, 2020, we entered into a Securities Purchase Agreement (the “SPA”) for the sale of 567,437 shares of our

Class B common stock at a price per share of $22.91 (which was the closing price for the Class B common stock on the New York

Stock Exchange on December 4, 2020 the trading day immediately preceding the date of the SPA) for an aggregate purchase price

of $13 million. In connection with the SPA, each purchaser was granted warrants to purchase twenty percent (20%) of the shares

of Class B common stock purchased by such purchaser. The warrants have an exercise price of $22.91 per share and expire on June

6, 2022. We issued warrants to purchase an aggregate of 113,487 shares of Class B common stock.

On

January 22, 2021, Pharma Holdings, LLC (the “Subsidiary”), our 90%-owned subsidiary, used a majority of the proceeds

received pursuant to the SPA to partially exercise a warrant (the “Warrant”) to purchase Series D Convertible Preferred

Stock of Rafael Pharmaceuticals, Inc. (“Rafael Pharmaceuticals”). The Subsidiary purchased 7,298,950 shares of Rafael

Pharmaceuticals’ Series D Convertible Preferred Stock for $9,123,687. The Warrant is exercisable for up to 56.0% of the

equity of Rafael Pharmaceuticals. Commensurate with its interest in the Subsidiary, the Company funded 90% of the aggregate exercise

price. Following the exercise, we and our subsidiaries collectively own securities representing 51.0% of the outstanding capital

stock of Rafael Pharmaceuticals and 41.1% of the capital stock on a fully diluted basis (excluding the remainder of the Warrant).

The exercise allowed us to maintain its ownership of majority of the outstanding capital stock of Rafael Pharmaceuticals (and

to increase our position in Rafael Pharmaceuticals on a fully diluted basis (excluding the remainder of the Warrant)) in light

of issuances of Rafael Pharmaceuticals equity securities to third parties stockholders, including due to warrant exercises by

these stockholders.

We

intend to use additional proceeds received pursuant to the SPA to fund the operations of our drug development programs including

through the Barer Institute, and for general corporate purposes. Under the SPA, two entities, on whose Boards of Directors Howard

Jonas, our Chief Executive Officer and Chairman of the Board serves, each purchased 218,245 shares of Class B common stock for

consideration of $10 million.

The

Offering

The

selling stockholder named in this prospectus may offer and sell up to 101,844 shares of our Class B common stock, par

value $0.01 per share. Our Class B common stock is currently listed on The New York Stock Exchange under the symbol “RFL.”

Shares of our Class B common stock that may be offered under this prospectus will be fully paid and non-assessable. We will not

receive any of the proceeds of sales by the selling stockholder of any of the Class B common stock covered by this prospectus.

Throughout this prospectus, when we refer to the shares of our Class B common stock being registered on behalf of the selling

stockholder for offer and sale, we are referring to the shares that are being registered for resale by the selling

stockholder pursuant to the terms of the Membership Interest Purchase Agreement by and between us and Robert Rodriguez,

dated December 7, 2020, whereby we purchased the economic rights to Mr. Rodriguez’s thirty-three and one-third percent (33.33%)

interest in Altira Capital & Consulting, LLC (the “Purchase Agreement”). Under the Purchase Agreement, we may

pay up to $6,950,000 of the purchase price in shares of Class B common stock and have the obligation to register the resale of

such shares. When we refer to the selling stockholder in this prospectus, we are referring to the holder of registration

rights under the Purchase Agreement. See “Selling Stockholder” beginning on page 7 of

this prospectus.

Class

B Common Stock

The

selling shareholder may offer to sell shares of our Class B common stock, par value $0.01 per share. Holders of our Class B common

stock are entitled to receive dividends as our board of directors may declare from time to time out of legally available funds,

subject to the preferential rights of the holders of any shares of our preferred stock that are outstanding or that we may issue

in the future. Currently, we do not have any issued and outstanding preferred stock. Each holder of our Class B common stock is

entitled to one tenth of one vote per share. In this prospectus, we provide a general description of, among other things, our

dividend policy and the rights and restrictions that apply to holders of our Class B common stock. Our Class B common stock is

described in greater detail in this prospectus under “Description of Capital Stock — Class B Common Stock.”

RISK

FACTORS

Investment

in our securities involves risks. Prior to making a decision about investing in our securities, you should consider carefully

all of the information included and incorporated by reference or deemed to be incorporated by reference in this prospectus or

the applicable prospectus supplement, including the risk factors incorporated by reference herein from our Form 10-K for the fiscal

year ended July 31, 2020, as updated by annual, quarterly and other reports and documents we file with the Securities and Exchange

Commission (the “SEC”) since July 31, 2020, including after the date of this prospectus and that are incorporated

by reference herein or in the applicable prospectus supplement. Each of these risk factors could have a material adverse effect

on our business, results of operations, financial position or cash flows, which may result in the loss of all or part of your

investment.

FORWARD-LOOKING

STATEMENTS

This

prospectus and the documents incorporated herein by reference contain forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. These statements are based on our management’s current beliefs, expectations and

assumptions about future events, conditions and results and on information currently available to us. Discussions containing these

forward-looking statements may be found, among other places, in the Sections entitled “Business,” “Risk Factors”

and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” incorporated by

reference from our most recent Annual Report on Form 10-K and in our Quarterly Reports on Form 10-Q, as well as any amendments

thereto, filed with the SEC.

All

statements, other than statements of historical fact, included or incorporated herein regarding our strategy, future operations,

financial position, future revenues, projected costs, plans, prospects and objectives are forward-looking statements. Words such

as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,”

“estimate,” “think,” “may,” “could,” “will,” “would,”

“should,” “continue,” “potential,” “likely,” “opportunity” and similar

expressions or variations of such words are intended to identify forward-looking statements, but are not the exclusive means of

identifying forward-looking statements. Additionally, statements concerning future matters such as our expectations of business

and market conditions, development and commercialization of new products, enhancements of existing products or technologies, and

other statements regarding matters that are not historical are forward-looking statements. Such statements are based on currently

available operating, financial and competitive information and are subject to various risks, uncertainties and assumptions that

could cause actual results to differ materially from those anticipated or implied in our forward-looking statements due to a number

of factors including, but not limited to, those set forth above under the section entitled “Risk Factors” in this

prospectus and any accompanying prospectus supplement. Given these risks, uncertainties and other factors, many of which are beyond

our control, you should not place undue reliance on these forward-looking statements.

Except

as required by law, we assume no obligation to update these forward-looking statements publicly, or to revise any forward-looking

statements to reflect events or developments occurring after the date of this prospectus, even if new information becomes available

in the future.

USE

OF PROCEEDS

We

are registering these shares pursuant to registration rights granted to the selling stockholder. We are not selling any securities

under this prospectus and we will not receive any of the proceeds from the sale or other disposition by the selling stockholder

of the shares of Class B common stock covered hereby.

We

have agreed to pay all costs, expenses and fees relating to registering the shares of our Class B common stock referenced in this

prospectus. The selling stockholder will pay any brokerage commissions and/or similar charges incurred in connection with the

sale or other disposition by him of the shares covered hereby.

See

“Selling Stockholder” and “Plan of Distribution” described below.

DESCRIPTION

OF OUR CAPITAL STOCK

Our

authorized capital stock consists of (i) 35 million shares of Class A common stock, (ii) 200 million shares of Class B common

stock, and (iii) 10 million shares of Preferred Stock.

Class

A Common Stock

Holders

of shares of our Class A common stock are entitled to three votes for each share on all matters to be voted on by the stockholders.

Holders of our Class A common stock are entitled to share ratably in dividends, if any, as may be declared from time to time by

the Board of Directors in its discretion from funds legally available therefor. Each share of our Class A common stock may be

converted, at any time and at the option of the holder, and automatically converts upon transfers to unaffiliated parties, into

one fully paid and non-assessable share of our Class B common stock.

As

of February 23, 2021, there were 787,163 of our shares of Class A common stock outstanding.

Class

B Common Stock

Holders

of shares of our Class B common stock are entitled to one tenth of one vote for each share on all matters to be voted on by the

stockholders. Holders of our Class B common stock are entitled to share ratably in dividends, if any, as may be declared from

time to time by the Board of Directors in its discretion from funds legally available therefor.

As

of February 23, 2021, there were 15,884,473 shares of Class B common stock outstanding.

Preferred

Stock

The

Board of Directors has the authority to fix the price, rights, preferences, privileges and restrictions, including voting rights,

of those shares without any further vote or action by the stockholders.

As

of February 23, 2021, there were no shares of our preferred stock outstanding.

Anti-Takeover

Effects of Our Charter and By-Laws

Some

provisions of Delaware law and our Certificate of Incorporation and By-Laws could make the following more difficult:

|

|

●

|

acquisition of us by means of a tender offer;

|

|

|

●

|

acquisition of us by means of a proxy contest

or otherwise; or

|

|

|

●

|

removal of our incumbent officers and directors.

|

These

provisions, summarized below, are expected to discourage coercive takeover practices and inadequate takeover bids. These provisions

also are designed to encourage persons seeking to acquire control of us to first negotiate with our Board of Directors. We believe

that the benefits of increased protection give us the potential ability to negotiate with the proponent of an unfriendly or unsolicited

proposal to acquire or restructure us and outweigh the disadvantages of discouraging those proposals because negotiation of them

could result in an improvement of their terms.

Certificate

of Incorporation; By-Laws

Our

Certificate of Incorporation and By-Laws contain provisions that could make more difficult the acquisition of us by means of a

tender offer, a proxy contest or otherwise. These provisions are summarized below.

Undesignated

Preferred Stock. The authorization of our undesignated preferred stock makes it possible for our Board of Directors to

issue our preferred stock with voting or other rights or preferences that could impede the success of any attempt to change control

of us. These and other provisions may have the effect of deferring hostile takeovers or delaying changes of control of our management.

Size

of Board and Vacancies. Our Certificate of Incorporation provides that the number of directors on our Board of Directors

will be between two and seventeen. Newly created directorships resulting from any increase in our authorized number of directors

or any vacancies in our Board of Directors resulting from death, resignation, retirement, disqualification, removal from office

or other cause will be filled solely by the vote of our remaining directors in office.

Disparate

Voting Rights. Holders of shares of our Class A common stock are entitled to three votes for each share and holders of shares

of Class B common stock are entitled to one tenth of one vote for each share on all matters to be voted on by the stockholders.

NYSE

Listing

Our

Class B common stock is listed on the NYSE and trades under the symbol “RFL.”

Transfer

Agent and Registrar

The

transfer agent and registrar for our capital stock is American Stock Transfer & Trust, LLC.

SELLING

STOCKHOLDER

Pursuant

to the Purchase Agreement, we agreed to file the registration statement of which this prospectus forms a part to cover the resale

of 101,844 shares of our Class B common stock issued to the selling stockholder in accordance with the Purchase Agreement, and

to keep such registration statement effective until all the shares issued pursuant to the Purchase Agreement have been sold pursuant

to such registration statement or may sold without restriction under Rule 144(b)(i) of the Securities Act.

Registration

of Shares under the Purchase Agreement

We

are registering the shares in accordance with the terms of the Purchase Agreement to permit the selling stockholder, to sell,

resell or otherwise dispose of the shares in a manner contemplated under “Plan of Distribution” in this prospectus.

Throughout this prospectus, when we refer to the selling stockholder in this prospectus we are referring to the holder of registration

rights under the Purchase Agreement.

The

selling stockholder may sell some, all or none of the shares he owns that are covered by the registration statement. We do not

know how long the selling stockholder will hold the shares before selling them, and we currently have no agreements, arrangements

or understandings with the selling stockholder regarding the sale or other disposition of any of the shares. The shares covered

hereby may be offered from time to time by the selling stockholder.

The

following table sets forth the name of the selling stockholder, the number and percentage of our Class B common stock beneficially

owned by the selling stockholder as of February 23, 2021, the number of shares that may be offered under this prospectus, and

the number and percentage of our Class B common stock beneficially owned by the selling stockholder assuming all of the shares

covered hereby are sold. Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment

power with respect to our Class B common stock.

All

information contained in the table below is based upon information provided to us by the selling stockholder. The percentage of

our shares owned after the offering is based on 15,884,473 shares of Class B common stock outstanding as of February 23, 2021.

Unless otherwise indicated in the footnotes to this table, we believe that the selling stockholder named in this table has sole

voting power with respect to the shares of Class B common stock indicated as beneficially owned.

The

address of the stockholder listed on the table is c/o Rafael Holdings, Inc., 520 Broad Street, Newark, New Jersey 07102.

|

|

|

Number of Shares Beneficially Owned Prior to this Offering

|

|

|

Number of Shares Being Sold

|

|

|

Number of Shares Beneficially Owned After this Offering

|

|

|

Selling Stockholder

|

|

Number

|

|

|

Percent

|

|

|

Offered

|

|

|

Number

|

|

|

Percent

|

|

|

Robert Rodriguez

|

|

|

101,844

|

|

|

|

*

|

|

|

|

101,844

|

|

|

|

0

|

|

|

|

*

|

|

PLAN

OF DISTRIBUTION

We

are registering the shares of Class B common stock issued to the selling stockholder to permit the sale and resale of

these shares of Class B common stock by the selling stockholder from time to time from after the date of this prospectus.

The

selling stockholder may, from time to time, sell any or all of his shares of Class B common stock covered hereby on the New York

Stock Exchange or any other stock exchange, market or trading facility on which the shares are traded or in private transactions. These

sales may be at fixed prices, at prevailing market prices at the time of the sale, at varying prices determined at the time of

sale, or privately negotiated prices. The selling stockholder may use any one or more of the following methods when

selling shares:

|

|

●

|

ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

|

|

|

|

●

|

block

trades in which the broker-dealer will attempt to sell the shares as agent but may position and resell a portion of the block

as principal to facilitate the transaction;

|

|

|

|

|

|

|

●

|

purchases

by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

|

|

|

|

●

|

an

exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

|

|

|

|

●

|

privately

negotiated transactions;

|

|

|

|

|

|

|

●

|

settlement

of short sales, to the extent permitted by law;

|

|

|

|

|

|

|

●

|

in

transactions through broker-dealers that agree with the selling stockholder to sell a specified number of such shares at a stipulated

price per share;

|

|

|

|

|

|

|

●

|

through

the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

|

|

|

|

|

|

|

●

|

a

combination of any such methods of sale; or

|

|

|

|

|

|

|

●

|

any

other method permitted pursuant to applicable law.

|

The

selling stockholder may also sell the shares of Class B common stock under Rule 144 under the Securities Act, if available, rather than

under this prospectus.

Broker-dealers

engaged by the selling stockholder may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions

or discounts from the selling stockholder (or, if any broker-dealer acts as agent for the purchaser of shares, from the purchaser)

in amounts to be negotiated, but, except as set forth in a supplement to this prospectus, in the case of an agency transaction

not in excess of a customary brokerage commission in compliance with FINRA Rule 2121; and in the case of a principal transaction

a markup or markdown in compliance with FINRA Rule 2121.

The

aggregate proceeds to the selling stockholder from the sale of the Class B common stock offered by him will be the purchase

price of the common stock less discounts or commissions, if any. The selling stockholder reserves the right to accept and,

together with their agents from time to time, to reject, in whole or in part, any proposed purchase of Class B common stock

to be made directly or through agents. We will not receive any of the proceeds from the sale by the selling stockholder of

the shares of Class B common stock.

In

connection with the sale of the shares of Class B common stock or interests therein, the selling stockholder may enter into hedging

transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the shares of Class

B common stock in the course of hedging the positions they assume. The selling stockholder may also sell the shares of Class B

common stock short and deliver these securities to close out their short positions or to return borrowed shares in connection

with such short sales, or loan or pledge the shares of Class B common stock to broker-dealers that in turn may sell these securities.

The selling stockholder may also enter into option or other transactions with broker-dealers or other financial institutions or

create one or more derivative securities which require the delivery to such broker-dealer or other financial institution of shares

of Class B common stock offered by this prospectus, which shares such broker-dealer or other financial institution may resell

pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The

selling stockholder and any broker-dealers or agents that are involved in selling the shares of Class B common stock may be deemed

to be “underwriters” within the meaning of the Securities Act in connection with such sales. In such event, any commissions

received by the selling stockholder, broker-dealers or agents and any profit on the resale of the shares purchased by them may

be deemed to be underwriting commissions or discounts under the Securities Act.

In

the event, the selling stockholder is an “underwriter” within the meaning of Section 2(11) of the Securities Act will

be subject to the prospectus delivery requirements of the Securities Act and may be subject to certain statutory liabilities of,

including but not limited to, Sections 11, 12 and 17 of the Securities Act and Rule 10b-5 under the Exchange Act. The selling

stockholder has informed us that it is not a registered broker-dealer or an affiliate of a registered broker-dealer. In no event

shall any broker-dealer receive fees, commissions and markups which, in the aggregate, would exceed eight percent (8%).

We

are required to pay certain fees and expenses incurred by us incident to the registration of the shares. We have agreed to indemnify

the selling stockholder against certain losses, claims, damages and liabilities, including liabilities under the Securities Act,

and the selling stockholder may be entitled to contribution. We may be indemnified by the selling stockholder against certain

losses, claims, damages and liabilities, including liabilities under the Securities Act that may arise from any written information

furnished to us by the selling stockholder specifically for use in this prospectus, or we may be entitled to contribution.

We

agreed to cause the registration statement of which this prospectus is a part to remain effective for the period set

forth in the Purchase Agreement. Shares of Class B common stock will be sold only through registered or licensed brokers

or dealers if required under applicable state securities laws. In addition, in certain states, the shares of Class B common stock

covered hereby may not be sold unless they have been registered or qualified for sale in the applicable state or an exemption

from the registration or qualification requirement is available and complied with.

Under

applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the shares of Class B common

stock may not simultaneously engage in market making activities with respect to the shares of Class B common stock for the applicable

restricted period, as defined in Regulation M, prior to the commencement of the distribution. In addition, the selling stockholder

will be subject to applicable provisions of the Exchange Act and the rules and regulations thereunder, including Regulation M,

which may limit the timing of purchases and sales of shares of Class B common stock by the selling stockholder or any other person.

We will make copies of this prospectus available to the selling stockholder and have informed him of the need to deliver a copy

of this prospectus at or prior to the time of the sale (including by compliance with Rule 172 under the Securities Act).

To

the extent required, the shares of our Class B common stock to be sold, the name of the selling stockholder, the respective

purchase prices and public offering prices, the names of any agents, dealer or underwriter, any applicable commissions or

discounts with respect to a particular offer will be set forth in an accompanying prospectus supplement or, if appropriate,

a post-effective amendment to the registration statement that includes this prospectus.

There

can be no assurance that the selling stockholder will sell any or all of the shares of Class B common stock we registered on behalf

of the selling stockholder pursuant to the registration statement of which this prospectus forms a part.

Once

sold under the registration statement of which this prospectus forms a part, the shares of Class B common stock will be freely

tradable in the hands of persons other than our affiliates.

LEGAL

MATTERS

Schwell

Wimpfheimer & Associates, LLP, New York, New York, will pass for us upon the validity of the securities being offered by this

prospectus and applicable prospectus supplement, and counsel named in the applicable prospectus supplement will pass upon legal

matters for any underwriters, dealers or agents. Certain partners of the Firm are the beneficial owner of an aggregate of 9,249

shares of Class B Common Stock, consisting of (a) 2,499 unvested restricted shares Class B Common Stock, and (b) 6,750 shares

of Class B Common Stock.

EXPERTS

The

consolidated financial statements of Rafael Holdings, Inc. appearing in Rafael Holdings, Inc.’s Annual Report on Form 10-K

for the year ended July 31, 2020, have been audited by CohnReznick LLP, independent registered public accounting firm, as set

forth in their report thereon, included therein, and incorporated herein by reference. Such consolidated financial statements

are incorporated herein by reference in reliance upon such report given on the authority of such firm as experts in accounting

and auditing.

WHERE

YOU CAN FIND ADDITIONAL INFORMATION

We

are a reporting company and file annual, quarterly and current reports, proxy statements and other information with the SEC. We

have filed with the SEC a registration statement on Form S-3 under the Securities Act with respect to the securities we are offering

under this prospectus. This prospectus does not contain all of the information set forth in the registration statement and the

exhibits to the registration statement. For further information with respect to us and the securities we are offering under this

prospectus, we refer you to the registration statement and the exhibits and schedules filed as a part of the registration statement.

The SEC maintains an internet site that contains reports, proxy and information statements, and other information regarding issuers

that file electronically with the SEC, where our SEC filings are also available. The address of the SEC’s web site is http://www.sec.gov.

We maintain a website at http://www.rafaelholdings.com. Information contained in or accessible through our website does not constitute

a part of this prospectus.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC allows us to “incorporate by reference” information that we file with it into this prospectus, which means that

we can disclose important information to you by referring you to those documents. The information incorporated by reference is

an important part of this prospectus. Information in this prospectus supersedes information incorporated by reference that we

filed with the SEC prior to the date of this prospectus, while information that we file later with the SEC will automatically

update and supersede the information in this prospectus. We incorporate by reference into this registration statement and prospectus

the following documents, and any future filings we will make with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange

Act after the date of the initial registration statement but prior to effectiveness of the registration statement and after the

date of this prospectus but prior to the termination of the offering of the securities covered by this prospectus (other than

current reports or portions thereof furnished under Item 2.02 or Item 7.01 of Form 8-K):

|

|

●

|

Our

Annual Report on Form 10-K for the year ended July 31, 2020, filed with the SEC on October 29, 2020;

|

|

|

●

|

Our Quarterly Report on Form 10-Q for the year quarter

ended October 31, 2020, filed with the SEC on December 15, 2020;

|

|

|

●

|

Our

Current Reports on Form 8-K filed with the SEC on September 1, 2020, October 29, 2020, December 11, 2020, December 15, 2020,

January 19, 2021 and January 28, 2021;

|

|

|

●

|

Our definitive proxy

statement on Schedule 14A filed with the SEC on November 23, 2020; and

|

|

|

●

|

Description

of our Class B common stock set forth under Item 11 in Post-Effective Amendment No. 3 to the Registrant’s

Registration Statement on Form 10, filed with the SEC on March 26, 2018, and contained in Exhibit 4.2 to our

Annual Report on 10-K filed with SEC on October 29, 2020, including any amendment or report filed for the purpose

of updating such information.

|

We

will provide each person, including any beneficial owner, to whom a prospectus is delivered, a copy of any or all of the information

that has been incorporated by reference into this prospectus but not delivered with this prospectus upon written or oral request

at no cost to the requester. Requests should be directed to: Rafael Holdings, Inc., 520 Broad Street, Newark, New Jersey 07102,

Attn: Investor Relations, or you may call us at (212) 658-1450.

RAFAEL

HOLDINGS, INC.

101,844

Shares

of Class B Common Stock

PROSPECTUS

February

24, 2021

PART II

INFORMATION

NOT REQUIRED IN PROSPECTUS

14.

Other Expenses of Issuance and Distribution

The

following statement sets forth the estimated expenses in connection with the offering described in the registration statement

(all of which will be borne by Rafael Holdings, Inc.).

|

Securities and Exchange Commission

Fee

|

|

$

|

495.84

|

|

|

Accountants’ Fees and Expenses

|

|

$

|

7,500

|

|

|

Legal Fees and Expenses

|

|

$

|

4,000

|

|

|

Printing Fees

|

|

$

|

484

|

|

|

Miscellaneous

|

|

$

|

-

|

|

|

TOTAL

|

|

$

|

12,479.84

|

|

15.

Indemnification of Officers and Directors

Delaware

law authorizes corporations to eliminate the personal liability of directors to corporations and their stockholders for monetary

damages for breach or alleged breach of the directors' "duty of care". While the relevant statute does not change directors'

duty of care, it enables corporations to limit available relief to equitable remedies such as injunction or rescission. The statute

has no effect on directors' duty of loyalty, acts or omissions not in good faith or involving intentional misconduct or knowing

violations of law, illegal payment of dividends and approval of any transaction from which a director derives an improper personal

benefit.

The

Company has adopted provisions in its Amended and Restated Certificate of Incorporation, as amended, which eliminate the personal

liability of its directors to the Company and its stockholders for monetary damages for breach or alleged breach of their duty

of care. The bylaws of the Company provide for indemnification of its directors, officers, employees and agents to the fullest

extent permitted by the General Corporation Law of the State of Delaware, the Company's state of incorporation, including those

circumstances in which indemnification would otherwise be discretionary under Delaware Law. Section 145 of the General Corporation

Law of the State of Delaware permits a corporation to indemnify any director or officer of the corporation against expenses (including

attorneys’ fees), judgments, fines, and amounts paid in settlement actually and reasonably incurred in connection with any

action, suit, or proceeding brought by reason of the fact that such person is or was a director or officer of the corporation,

if such person acted in good faith and in a manner that he or she reasonably believed to be in, or not opposed to, the best interests

of the corporation, and, with respect to any criminal action or proceeding, if he or she had no reason to believe his or her conduct

was unlawful. In a derivative action, or an action brought by or on behalf of the corporation, indemnification may be provided

only for expenses actually and reasonably incurred by any director or officer in connection with the defense or settlement of

such an action or suit if such person acted in good faith and in a manner that he or she reasonably believed to be in, or not

opposed to, the best interests of the corporation, except that no indemnification shall be provided if such person shall have

been adjudged to be liable to the corporation, unless and only to the extent that the court in which the action or suit was brought

shall determine that the defendant is fairly and reasonably entitled to indemnity for such expenses despite such adjudication

of liability.

The

Company may enter into indemnification agreements with certain of its executive officers and directors, indemnifying them against

certain potential liabilities that may arise as a result of their service to the Company, and providing certain other protections.

The Company also maintains insurance policies which insure the officers and directors against certain liabilities.

16.

Exhibits

EXHIBIT

LIST

|

|

(1)

|

Incorporated

by reference to Form 10-12G/A, filed March 26, 2018.

|

|

|

(2)

|

Incorporated

by reference to Form 8-K, filed September 26, 2019.

|

17.

Undertakings

The

undersigned registrant hereby undertakes:

1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) to include any prospectus required by Section 10(a)(3) of the Securities Act; (ii) to reflect in the prospectus

any facts or events arising after the effective date of the registration statement (or the most recent post-effective amendment

thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration

statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value

of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated

maximum offering range may be reflected in the form of prospectus filed with the Securities and Exchange Commission (the “Commission”),

pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change

in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective

registration statement; and (iii) to include any material information with respect to the plan of distribution not previously

disclosed in the registration statement or any material change to such information in the registration statement;

Provided,

however, that paragraphs (a)(1)(i), (a)(1)(ii) and (a)(1)(iii) do not apply if the registration statement is on

Form S-3 or Form F-3 and the information required to be included in a post-effective amendment by those paragraphs is contained

in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of

the Securities Exchange Act of 1934 (the “Exchange Act”), that are incorporated by reference in the registration statement,

or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

2)

That, for the purpose of determining any liability under the Securities Act, each such post-effective amendment shall be deemed

to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time

shall be deemed to be the initial bona fide offering thereof.

3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold

at the termination of the offering.

4)

That, for the purpose of determining liability under the Securities Act to any purchaser:

i.

Each prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement

as of the date the filed prospectus was deemed part of and included in the registration statement; and

ii.

Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5) or (b)(7) as part of a registration statement

in reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii) or (x) for the

purpose of providing the information required by Section 10(a) of the Securities Act shall be deemed to be part of and

included in the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness

or the date of the first contract of sale of securities in the offering described in prospectus. As provided in Rule 430B,

for liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new

effective date of the registration statement relating to the securities in the registration statement to which the prospectus

relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided,

however , that no statement made in a registration statement or prospectus that is part of the registration statement

or made in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part

of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date, supersede

or modify any statement that was made in the registration statement or prospectus that was part of the registration statement

or made in any such document immediately prior to such effective date; or

iii.

If the registrant is subject to Rule 430C, each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating

to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A,

shall be deemed to be part of and included in the registration statement as of the date it is first used after effectiveness. Provided,

however, that no statement made in a registration statement or prospectus that is part of the registration statement or made

in a document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the

registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any

statement that was made in the registration statement or prospectus that was part of the registration statement or made in any

such document immediately prior to such date of first use.

5)

That, for the purpose of determining liability of the registrant under the Securities Act to any purchaser in the initial distribution

of the securities, the undersigned registrant undertakes that in a primary offering of securities of the undersigned registrant

pursuant to this registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if

the securities are offered or sold to such purchaser by means of any of the following communications, the undersigned registrant

will be a seller to the purchaser and will be considered to offer or sell such securities to such purchaser:

i.

Any preliminary prospectus or prospectus of the undersigned registrant relating to the offering required to be filed pursuant

to Rule 424;

ii.

Any free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred

to by the undersigned registrant;

iii.

The portion of any other free writing prospectus relating to the offering containing material information about the undersigned

registrant or its securities provided by or on behalf of an undersigned registrant; and

iv.

Any other communication that is an offer in the offering made by the undersigned registrant to the purchaser.

6)

That, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report

pursuant to section 13(a) or section 15(d) of the Exchange Act (and, where applicable, each filing of an employee benefit plan’s

annual report pursuant to section 15(d) of the Exchange Act) that is incorporated by reference in the registration statement shall

be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at

that time shall be deemed to be the initial bona fide offering thereof.

7)

To file an application for the purpose of determining the eligibility of the trustee to act under subsection (a) of Section 310

of the Trust Indenture Act in accordance with the rules and regulations prescribed by the Commission under Section 305(b)(2) of

the Trust Indenture Act.

Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons

of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the

Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable.

In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred

or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding)

is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant

will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate

jurisdiction the question whether such indemnification by it is against public policy as expressed in the Act and will be governed

by the final adjudication of such issue.

SIGNATURES

Pursuant

to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it

meets all of the requirements for filing on Form S-3 and has duly caused this registration statement to be signed on its behalf

by the undersigned thereunto duly authorized in the City of Newark, State of New Jersey, on February 24, 2021.

|

|

RAFAEL

HOLDINGS, INC.

|

|

|

|

|

|

|

By:

|

/s/ Howard Jonas

|

|

|

|

Howard Jonas

|

|

|

|

Chairman

of the Board of Directors and

Chief Executive Officer

|

POWER

OF ATTORNEY

KNOW

ALL PERSONS BY THESE PRESENTS, that each person whose signature appears below constitutes and appoints Joyce Mason as his true

and lawful attorneys-in-fact and agents, with full powers of substitution and resubstitution, for him and in his name, place and

stead, in any and all capacities, to sign any and all amendments to this registration statement (including post-effective amendments

and any related registration statements filed pursuant to Rule 462 and otherwise), and to file the same with all exhibits thereto,

and other documents in connection therewith, with the Securities and Exchange Commission, granting unto said attorneys-in-fact

and agents and full power and authority to do and perform each and every act and thing requisite and necessary to be done in connection

therewith, as fully for all intents and purposes as he might or could do in person, hereby ratifying and confirming that said

attorney-in-fact and agent, or any substitute or resubstitute, may lawfully do or cause to be done by virtue hereof.

Pursuant

to the requirements of the Securities Act of 1933, as amended, this registration statement has been signed by the following persons

in the capacities indicated and as of February 24, 2021.

|

Signature

|

|

Titles

|

|

|

|

|

|

|

|

/s/ Howard S. Jonas

|

|

Chairman of the Board and Chief Executive Officer

|

|

|

Howard S. Jonas

|

|

(Principal Executive Officer)

|

|

|

|

|

|

|

|

/s/ David Polinsky

|

|

Chief Financial Officer

|

|

|

David Polinsky

|

|

(Principal

Financial Officer and Principal Accounting Officer)

|

|

|

|

|

|

|

|

/s/ Stephen Greenberg

|

|

Director

|

|

|

Stephen Greenberg

|

|

|

|

|

|

|

|

|

|

/s/ Rachel Jonas

|

|

Director

|

|

|

Rachel Jonas

|

|

|

|

|

|

|

|

|

|

/s/ Boris C. Pasche

|

|

Director

|

|

|

Dr. Boris C. Pasche

|

|

|

|

|

|

|

|

|

|

/s/ Michael J. Weiss

|

|

Director

|

|

|

Dr. Michael J. Weiss

|

|

|

|

EXHIBIT

INDEX

|

|

(1)

|

Incorporated

by reference to Form 10-12G/A, filed March 26, 2018.

|

|

|

(2)

|

Incorporated

by reference to Form 8-K, filed September 26, 2019.

|

II-5

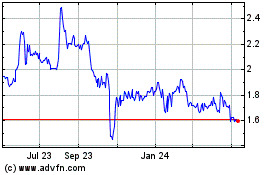

Rafael (NYSE:RFL)

Historical Stock Chart

From Mar 2024 to Apr 2024

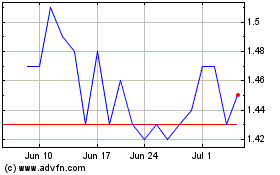

Rafael (NYSE:RFL)

Historical Stock Chart

From Apr 2023 to Apr 2024