Current Report Filing (8-k)

June 29 2020 - 9:34AM

Edgar (US Regulatory)

false 0000733269 0000733269 2020-06-29 2020-06-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): June 29, 2020

LiveRamp Holdings, Inc.

(Exact Name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

|

Delaware

|

|

001-38669

|

|

83-1269307

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

|

225 Bush Street, Seventeenth Floor

San Francisco, CA

|

|

|

|

94104

|

|

(Address of Principal Executive Offices)

|

|

|

|

(Zip Code)

|

(866) 352-3267

(Registrant’s Telephone Number, Including Area Code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol

|

|

Name of each exchange

on which registered

|

|

Common Stock, $.10 Par Value

|

|

RAMP

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 3.02

|

Unregistered Sales of Equity Securities.

|

On July 2, 2019, LiveRamp Holdings, Inc., a Delaware corporation (the “Company”), acquired Data Plus Math Corporation (“Data Plus Math”) pursuant to that certain Merger Agreement by and among LiveRamp, Inc., a wholly-owned subsidiary of the Company (“LiveRamp”), Addition Merger Sub, Inc., a wholly-owned subsidiary of LiveRamp, Data Plus Math and Shareholder Representative Services, LLC (as stockholder representative), dated as of June 19, 2019. In connection with closing, LiveRamp and the co-founders of Data Plus Math entered into Consideration Holdback Agreements, dated as of July 2, 2019 (the “Holdback Agreements”), pursuant to which approximately $12.2 million of the acquisition consideration otherwise payable to each of the co-founders in the merger (or $24.4 million in the aggregate) was held back and subject to vesting in three equal annual installments on the anniversary of the closing date (or such earlier date as the Board of Directors of the Company may determine), contingent upon the applicable co-founder’s continued employment with LiveRamp through each vesting date. Upon each vesting, such vested portion of the holdback amounts will be settled in a number of shares of common stock of the Company equal to the portion of such holdback amounts then vesting divided by the volume weighted average trading price of the Company’s common stock for the thirty trading days ending on the trading day that is immediately preceding the day that is three business days prior to the vesting date.

On June 29, 2020, the Company issued 181,688 shares of common stock of the Company in the aggregate to the co-founders pursuant to a distribution under the Holdback Agreements (the “Restricted Shares”). The co-founders are “accredited investors” within the meaning of Rule 501 promulgated under the Securities Act of 1933, as amended (the “Securities Act”) and such shares were issued pursuant to an exemption from registration provided by Section 4(a)(2) of the Securities Act.

|

Item 8.01

|

Other Information.

|

Effective July 2, 2019, the Company entered into a registration rights agreement (the “Rights Agreement”) with the co-founders. Under the Rights Agreement, the Company has undertaken to provide certain Securities Act registration rights on behalf of the co-founders. Pursuant to the Rights Agreement, the Company filed a Registration Statement on Form S-3 (File No. 333-239470), including a base prospectus, with the Securities and Exchange Commission that was effective June 26, 2020 (as amended, the “Registration Statement”). The Company is presently filing a prospectus supplement to include a subsequent resale by the co-founders of the Restricted Shares in the Registration Statement. In connection with such registration, the Company attaches Exhibits 5.1 and 23.1 hereto, which shall be incorporated by reference into the Registration Statement.

|

Item 9.01

|

Financial Statements and Exhibits.

|

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

LIVERAMP HOLDINGS, INC.

|

|

|

|

|

|

By:

|

|

/s/ Jerry C. Jones

|

|

|

|

Jerry C. Jones

Chief Ethics and Legal Officer & Executive Vice President

|

Date: June 29, 2020

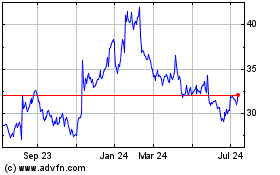

LiveRamp (NYSE:RAMP)

Historical Stock Chart

From Mar 2024 to Apr 2024

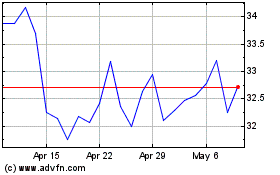

LiveRamp (NYSE:RAMP)

Historical Stock Chart

From Apr 2023 to Apr 2024