PVH Corp. [NYSE:PVH] announced today that it currently expects

revenue in the fourth quarter and full year 2018 to be at least

$2.40 billion and $9.57 billion, respectively, which is above its

plan.

The Company also revised its projected fourth quarter and full

year 2018 earnings per share outlook. The Company is unable to

project fourth quarter and full year 2018 earnings per share on a

GAAP basis without unreasonable efforts, as further discussed

below. The Company currently expects its earnings per share on a

non-GAAP basis for the fourth quarter 2018 to be at least $1.75,

which is $0.15 per share above the high end of its guidance range

previously announced on November 29, 2018 and includes a $0.05 per

share benefit due to lower than expected income tax expense. The

Company currently expects its full year 2018 earnings per share on

a non-GAAP basis to be at least $9.50. The projected fourth quarter

and full year 2018 earnings per share on a non-GAAP basis excludes,

among other things, the pre-tax costs expected to be incurred in

connection with a restructuring in the Company's Calvin Klein

business, discussed below, and the resulting tax effects.

Emanuel Chirico, Chairman and Chief Executive Officer,

commented, “Our improved 2018 outlook reflects the power of our

diversified global business model. Specifically, we are

experiencing outperformance across all of our businesses relative

to our previous guidance, despite the increasingly volatile

macroeconomic and geopolitical environment.”

Calvin Klein Restructuring:The Company's Calvin Klein

business issued a press release earlier today detailing the

strategic changes for the CALVIN KLEIN brand. The Company expects

to incur pre-tax costs of approximately $120 million over the next

12 months in connection with the Calvin Klein restructuring,

primarily consisting of severance, inventory markdowns and

allowances, asset impairments, and lease and other contract

termination expenses, including as a result of the closure of its

flagship store on Madison Avenue in New York, New York. Cash

outflows related to these pre-tax costs are expected to be

approximately $60 million over the next 12 months.

Earnings Guidance:The Company’s projection of fourth

quarter and full year 2018 earnings per share on a non-GAAP basis

excludes (i) the pre-tax costs incurred and to be incurred related

to the April 2016 acquisition of the 55% interest in the Company’s

former Tommy Hilfiger joint venture in China that it did not

already own (the “TH China acquisition”), consisting of noncash

amortization of short-lived assets, (ii) the pre-tax costs to be

incurred in connection with the Calvin Klein restructuring and

(iii) the pre-tax actuarial gain or loss on the Company’s

retirement plans. The estimated tax effects of the above pre-tax

items are also excluded from the Company’s projections of fourth

quarter and full year 2018 earnings per share on a non-GAAP

basis.

The Company is unable to provide a full reconciliation of its

updated fourth quarter and full year 2018 earnings per share

guidance on a non-GAAP basis to the corresponding measures on a

GAAP basis without unreasonable efforts, as there are significant

uncertainties with respect to (i) the timing of the costs to be

incurred in connection with the Calvin Klein restructuring over the

next 12 months and, more critically, during the Company's fourth

quarter and full year 2018, which end on February 3, 2019, and (ii)

the actuarial gain or loss on the Company’s retirement plans, to be

recorded in the fourth quarter 2018, due to the recent volatility

in the financial markets.

The reconciling information for the fourth quarter and full year

2018 earnings per share guidance on a non-GAAP basis to the

corresponding measures on a GAAP basis that is available without

unreasonable efforts is presented at the end of this release,

consisting of the costs incurred and to be incurred related to the

TH China acquisition and the resulting estimated tax effect.

SAFE HARBOR STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION

REFORM ACT OF 1995: Forward-looking statements in this press

release, including, without limitation, statements relating to the

Company’s future revenue and earnings, plans, strategies,

objectives, expectations and intentions are made pursuant to the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995. Investors are cautioned that such forward-looking

statements are inherently subject to risks and uncertainties, many

of which cannot be predicted with accuracy and some of which might

not be anticipated, including, without limitation, (i) the

Company’s plans, strategies, objectives, expectations and

intentions are subject to change at any time at the discretion of

the Company; (ii) the Company may be considered to be highly

leveraged and uses a significant portion of its cash flows to

service its indebtedness, as a result of which the Company might

not have sufficient funds to operate its businesses in the manner

it intends or has operated in the past; (iii) the levels of

sales of the Company’s apparel, footwear and related products, both

to its wholesale customers and in its retail stores, the levels of

sales of the Company’s licensees at wholesale and retail, and the

extent of discounts and promotional pricing in which the Company

and its licensees and other business partners are required to

engage, all of which can be affected by weather conditions, changes

in the economy, fuel prices, reductions in travel, fashion trends,

consolidations, repositionings and bankruptcies in the retail

industries, repositionings of brands by the Company’s licensors,

and other factors; (iv) the Company’s ability to manage its

growth and inventory, including the Company’s ability to realize

benefits from acquisitions; (v) quota restrictions, the

imposition of safeguard controls and the imposition of duties or

tariffs on goods from the countries where the Company or its

licensees produce goods under its trademarks, any of which, among

other things, could limit the ability to produce products in

cost-effective countries, or in countries that have the labor and

technical expertise needed; (vi) the availability and cost of raw

materials; (vii) the Company’s ability to adjust timely to changes

in trade regulations and the migration and development of

manufacturers (which can affect where the Company’s products can

best be produced); (viii) changes in available factory and shipping

capacity, wage and shipping cost escalation, civil conflict, war or

terrorist acts, the threat of any of the foregoing, or political or

labor instability in any of the countries where the Company’s or

its licensees’ or other business partners’ products are sold,

produced or are planned to be sold or produced; (ix) disease

epidemics and health related concerns, which could result in closed

factories, reduced workforces, scarcity of raw materials and

scrutiny or embargoing of goods produced in infected areas, as well

as reduced consumer traffic and purchasing, as consumers become ill

or limit or cease shopping in order to avoid exposure;

(x) acquisitions and divestitures and issues arising with

acquisitions, divestitures and proposed transactions, including,

without limitation, the ability to integrate an acquired entity or

business into the Company with no substantial adverse effect on the

acquired entity’s, the acquired business’s or the Company’s

existing operations, employee relationships, vendor relationships,

customer relationships or financial performance, and the ability to

operate effectively and profitably the Company’s continuing

businesses after the sale or other disposal of a subsidiary,

business or the assets thereof; (xi) the failure of the

Company’s licensees to market successfully licensed products or to

preserve the value of the Company’s brands, or their misuse of the

Company’s brands; (xii) significant fluctuations of the U.S. dollar

against foreign currencies in which the Company transacts

significant levels of business; (xiii) the Company’s retirement

plan expenses recorded throughout the year are calculated using

actuarial valuations that incorporate assumptions and estimates

about financial market, economic and demographic conditions, and

differences between estimated and actual results give rise to gains

and losses, which can be significant, that are recorded immediately

in earnings, generally in the fourth quarter of the year; (xiv) the

impact of new and revised tax legislation and regulations,

particularly the U.S. Tax Cuts and Jobs Act of 2017 and the still

to-be-issued regulations with respect thereto that might

disproportionately affect the Company as compared to some of its

peers due to the specific tax structure of the Company and its

greater percentage of revenues and income generated outside of the

U.S.; and (xv) other risks and uncertainties indicated from

time to time in the Company’s filings with the Securities and

Exchange Commission (“SEC”).

The earnings per share guidance provided in this press release

is on a non-GAAP basis, as defined under SEC rules. A full

reconciliation of the earnings per share guidance on a non-GAAP

basis cannot be provided without unreasonable efforts. The

reconciling information that is available without unreasonable

efforts is included in the financial information later in this

release, as well as in the Company’s Current Report on Form 8-K

furnished to the SEC in connection with this release, which is

available on the Company’s website at www.PVH.com and on the SEC’s

website at www.sec.gov.

Revenue and earnings per share guidance in this release speaks

as of January 10, 2019, the date on which it was made. The Company

does not undertake any obligation to update publicly any

forward-looking statement, including, without limitation, any

estimate regarding revenue or earnings, whether as a result of the

receipt of new information, future events or otherwise.

PVH CORP.Full Year and Quarterly Reconciliations of

GAAP to Non-GAAP Amounts

The Company is presenting its 2018 estimated results excluding

(i) the pre-tax costs incurred and to be incurred related to the

April 2016 acquisition of the 55% interest in the Company’s former

Tommy Hilfiger joint venture in China that it did not already own

(the “TH China acquisition”), consisting of noncash amortization of

short-lived assets, (ii) the pre-tax costs to be incurred in

connection with the Calvin Klein restructuring, primarily

consisting of severance, inventory markdowns and allowances, asset

impairments, and lease and other contract termination expenses,

including as a result of the closure of its flagship store on

Madison Avenue in New York, New York, (iii) the pre-tax actuarial

gain or loss on the Company’s retirement plans and (iv) the

estimated tax effects associated with the foregoing pre-tax

items.

A full reconciliation of the Company’s current 2018 estimated

results on a non-GAAP basis to the corresponding GAAP measures

cannot be provided without unreasonable efforts due to the

significant uncertainties with respect to (i) the timing of the

costs to be incurred in connection with the Calvin Klein

restructuring and (ii) the actuarial gain or loss on the Company’s

retirement plans to be recorded in the fourth quarter. However, the

reconciling information that is available without unreasonable

efforts, consisting of the pre-tax costs incurred and to be

incurred related to the TH China acquisition and the resulting

estimated tax effect, is set forth in the reconciliation below. The

previous 2018 net income per common share guidance as provided in

the Company’s 2018 third quarter earnings press release issued on

November 29, 2018 and set forth below, presented on both a GAAP and

non-GAAP basis, is no longer valid and presented only for

informational purposes.

The Company believes presenting its results on a non-GAAP basis

provides useful additional information to investors. The Company

excludes amounts from its non-GAAP results that it deems to be

non-recurring or non-operational and believes that excluding them

(i) facilitates comparing current results against past and future

results by eliminating amounts that it believes are not comparable

between periods, thereby permitting management to evaluate

performance and investors to make decisions based on the ongoing

operations of the Company, and (ii) assists investors in evaluating

the effectiveness of the Company’s operations and underlying

business trends in a manner that is consistent with management’s

evaluation of business performance. The Company uses its results on

a non-GAAP basis to evaluate its operating performance and to

discuss its business with investment institutions, the Company’s

Board of Directors and others. The Company’s results on a non-GAAP

basis are also the basis for certain incentive compensation

calculations. The non-GAAP measures should be viewed in addition

to, and not in lieu of or as superior to, the Company’s operating

performance measures calculated in accordance with GAAP. The

information presented on a non-GAAP basis may not be comparable to

similarly titled measures reported by other companies.

The estimated tax effects associated with the above pre-tax

items are based on the Company’s assessment of deductibility. In

making this assessment, the Company evaluates each item that it has

identified above as a non-GAAP exclusion to determine if such item

is taxable or tax deductible, and if so, in what jurisdiction the

tax expense or tax deduction would occur. The estimated tax effect

associated with the pre-tax costs incurred and to be incurred

related to the TH China acquisition is identified as tax

deductible, with the tax effect taken at the statutory income tax

rate of the local jurisdiction.

2018 Net Income

Per Common Share Reconciliations

Current Guidance

Previous Guidance(superseded)

Full Year2018(Estimated)

Fourth Quarter2018(Estimated)

Full Year2018(Estimated)

Fourth Quarter2018(Estimated)

GAAP net income per common share attributable to PVH Corp.

$9.10 - $9.12 $1.54 - $1.56 Estimated per common share impact of TH

China acquisition $(0.23) $(0.04) $(0.23) $(0.04) Estimated per

common share impact of Calvin Klein restructuring (a) (a) Estimated

per common share impact of actuarial gain or loss on retirement

plans (b) (b) Net income per common share attributable to PVH Corp.

on a non-GAAP basis at least $9.50 at least $1.75 $9.33 - $9.35

$1.58 - $1.60 (a) The Company is unable to provide without

unreasonable efforts the projected net income per common share

impact of the costs to be incurred in connection with the Calvin

Klein restructuring announced today due to the significant

uncertainties with respect to the timing of such costs, including

which portion, if any, will be incurred during the current quarter,

which ends on February 3, 2019. (b) The Company is unable to

provide without unreasonable efforts the projected net income per

common share impact of the gain or loss on the Company’s retirement

plans, to be recorded in the current quarter, due to the recent

volatility in the financial markets.

The previous GAAP net income per common share attributable to

PVH Corp. amounts presented in the above table, as well as the

amounts excluded in providing non-GAAP earnings guidance, would be

expected to change as a result of (i) acquisition, restructuring,

divestment or similar transactions or activities, (ii) the timing

and strategy of restructuring and integration initiatives or other

one-time events, if any, that the Company engages in or suffers

during the period, including the Calvin Klein restructuring, (iii)

any market or other changes affecting the Company’s expected

actuarial gain or loss on retirement plans, (iv) the imposition of

significant tariffs on apparel, footwear and accessories imported

from China or any of the Company’s other significant sourcing

countries, (v) adjustments to the Company’s income tax provision

related to the U.S. Tax Cuts and Jobs Act of 2017 (the "Tax

Legislation"), including as a result of changes in the provisional

amounts recorded in 2017 during the permitted measurement period,

as regulatory guidance may be issued related to the Tax Legislation

and as the Company completes its final analysis of the impacts of

the Tax Legislation, or (vi) any discrete tax events including

changes in tax rates or tax law and events arising from audits or

the resolution of uncertain tax positions. The Company has no

current understanding or agreement regarding any such transaction

or definitive plans regarding any such activity that has not been

announced or completed.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190110005670/en/

Dana PerlmanTreasurer, Senior Vice President, Business

Development and Investor Relations(212)

381-3502investorrelations@pvh.com

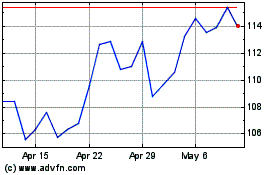

PVH (NYSE:PVH)

Historical Stock Chart

From Mar 2024 to Apr 2024

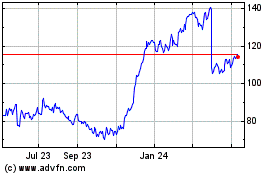

PVH (NYSE:PVH)

Historical Stock Chart

From Apr 2023 to Apr 2024