Public Storage Reports Lower 2Q Results Amid Pandemic -- Earnings Review

August 05 2020 - 4:40PM

Dow Jones News

By Maria Armental

Public Storage reported on Wednesday that net income and revenue

fell in the second quarter, showing the impact from the coronavirus

pandemic. Here's what you need to know.

PROFIT: Net income fell to $314.9 million, or $1.41 a share,

from $370.1 million, or $1.76 a share, a year earlier. Analysts

surveyed by FactSet expected $1.64 a share.

FFO: Funds from operations, a key measure for REITs, fell to

$2.28 a share from $2.57 a share a year earlier. Core FFO fell to

$2.46 a share. Analysts expected FFO of $2.57 a share and core FFO

of $2.54 a share.

REVENUE: Revenue fell to $709.3 million, from $711 million a

year earlier. Analysts expected $711.9 million.

PANDEMIC: Company officials had said they saw a significant drop

in demand for self-storage space since late March, which led to

lower move-in volumes despite lower move-in rental rates. The

company temporarily curtailed its existing tenant rate increase

program.

Write to Maria Armental at maria.armental@wsj.com

(END) Dow Jones Newswires

August 05, 2020 16:25 ET (20:25 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

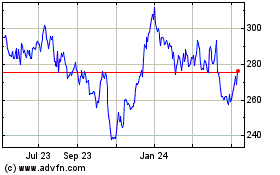

Public Storage (NYSE:PSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

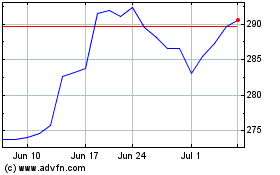

Public Storage (NYSE:PSA)

Historical Stock Chart

From Apr 2023 to Apr 2024