Public Storage Prices Inaugural Public Offering of Euro-Denominated Senior Notes

January 17 2020 - 4:00PM

Business Wire

Tom Boyle, Senior Vice President and Chief Financial Officer of

Public Storage (NYSE: PSA, the “Company”), announced today that the

Company has priced an inaugural public offering of €500 million

aggregate principal amount of Senior Notes due 2032 (the “Notes”).

The Notes will bear interest at an annual rate of 0.875%, will be

issued at 99.502% of par value and will mature on January 24, 2032.

Interest on the Notes is payable annually on January 24 of each

year, commencing January 24, 2021. The offering is expected to

close on January 24, 2020, subject to customary closing conditions.

The Company expects to use the net proceeds to make investments in

self-storage facilities and in entities that own self-storage

facilities, for the development of self-storage facilities, and for

general corporate purposes.

J.P. Morgan Securities plc, Morgan Stanley & Co.

International plc, Goldman Sachs & Co. LLC and UBS AG London

Branch acted as joint book-running managers of the offering. This

announcement shall not constitute an offer to sell or a

solicitation of an offer to buy these securities nor shall there be

any offer or sale of these securities in any state or jurisdiction

in which such an offer, solicitation or sale would be unlawful. The

offering is being made pursuant to an effective shelf registration

statement filed with the Securities and Exchange Commission (the

“SEC”) and only by means of a prospectus and prospectus supplement.

Investors may obtain these documents for free by visiting EDGAR on

the SEC’s website at www.sec.gov. Alternatively, copies of the

prospectus and prospectus supplement may be obtained by contacting:

J.P. Morgan Securities plc, 25 Bank Street, Canary Wharf, London

E14 5JP, United Kingdom, telephone: +44-207-134-2468; or Morgan

Stanley & Co. International plc, 25 Cabot Square, Canary Wharf,

London E14 4QA, Attention: MS Prospectus Delivery, telephone:

020-7677-7799 or email: prospectus@morganstanley.com.

Company Information

Public Storage, a member of the S&P 500 and FT Global 500,

is a REIT that primarily acquires, develops, owns and operates

self-storage facilities. At September 30, 2019, we had: (i)

interests in 2,468 self-storage facilities located in 38 states

with approximately 167 million net rentable square feet in the

United States, (ii) an approximate 35% common equity interest in

Shurgard Self Storage SA (Euronext Brussels:SHUR) which owned 231

self-storage facilities located in seven Western European nations

with approximately 13 million net rentable square feet operated

under the “Shurgard” brand and (iii) an approximate 42% common

equity interest in PS Business Parks, Inc. (NYSE:PSB) which owned

and operated approximately 29 million rentable square feet of

commercial space at September 30, 2019. Our headquarters are

located in Glendale, California.

Forward-Looking

Statements

When used within this press release, the words “expects,”

“believes,” “anticipates,” “plans,” “would,” “should,” “may,”

“estimates” and similar expressions are intended to identify

“forward-looking statements,” including but not limited to,

statements about the completion, timing and size of the proposed

offering of securities by the Company and the use of net proceeds

of such offering. Such forward-looking statements involve known and

unknown risks, uncertainties and other factors, which may cause our

actual results to be materially different from those expressed or

implied in the forward-looking statements. Such factors include

market conditions and the demand for the Company’s securities and

risks detailed in the Company’s prospectus and prospectus

supplement filed with the SEC in connection with this offering and

in the Company’s SEC reports, including quarterly reports on Form

10-Q, current reports on Form 8-K and annual reports on Form 10-K.

We undertake no obligation to publicly update or revise

forward-looking statements which may be made to reflect events or

circumstances after the date of this release or to reflect the

occurrence of unanticipated events, except as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200117005471/en/

Ryan Burke (818) 244-8080, Ext. 1141

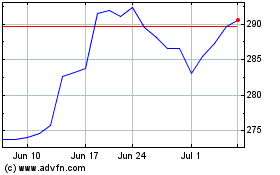

Public Storage (NYSE:PSA)

Historical Stock Chart

From Mar 2024 to Apr 2024

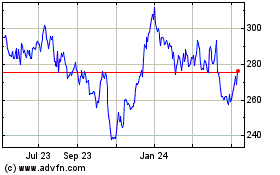

Public Storage (NYSE:PSA)

Historical Stock Chart

From Apr 2023 to Apr 2024