Amended Current Report Filing (8-k/a)

March 16 2020 - 4:21PM

Edgar (US Regulatory)

false0001127703

0001127703

2020-03-16

2020-03-16

|

|

|

|

|

|

UNITED STATES

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

Washington, D.C. 20549

|

|

|

|

|

FORM

|

8-K/A

|

|

CURRENT REPORT

|

|

(Amendment No. 1)

|

|

|

|

|

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

|

|

|

|

Date of Report (Date of earliest event reported): March 16, 2020

|

|

|

|

ProAssurance Corporation

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

Delaware

|

001-16533

|

63-1261433

|

|

(State of Incorporation)

|

(Commission File No.)

|

(IRS Employer I.D. No.)

|

|

|

|

|

|

|

|

|

100 Brookwood Place,

|

Birmingham,

|

Alabama

|

35209

|

|

(Address of Principal Executive Office )

|

(Zip code)

|

|

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

(205)

|

877-4400

|

|

|

|

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Securities Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-(c) under the Exchange Act

(17CFR 240.13e-(c))

|

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

PRA

|

New York Stock Exchange

|

|

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

Emerging growth company

|

☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

|

|

|

|

|

|

|

|

EXPLANATORY NOTE

|

|

We are filing this Amendment No. 1 to Form 8-K to amend our Current Report on Form 8-K filed with the Securities and Exchange Commission on February 20, 2020 (the Original Form 8-K). This amendment is intended to clarify commentary that was included in the press release we issued on February 20, 2020 and attached to the Original 8-K as Exhibit 99.1. This news release reported our results of operations for the year and quarter ended December 31, 2019.

|

|

Item 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

|

|

On February 20, 2020, we issued a news release reporting the results of our operations for the quarter and year ended December 31, 2019. Subsequent to the filing of the release, we determined that certain commentary included in the section titled "Key Takeaways - Full Year 2019" required clarification and amendment. The commentary relates to the impact that two factors had on certain of our key ratios.

Our ORIGINAL disclosure in this section read as follows, with relocated and amended commentary underlined:

|

|

l

|

For the full year ended December 31, 2019, the effects of the large national healthcare account are as follows:

|

|

|

l

|

Adverse development of $51.5 million in prior accident year reserves.

|

|

|

l

|

Increases of 5.0 and 6.7 percentage points in the consolidated and Specialty P&C current accident year net loss ratios, respectively, including the impact of the $9.2 million PDR recorded in relation to this account.

|

|

l

|

The following figures are shown excluding the effects of adjustments to our reserve estimates and the PDR in the full year 2019 relating to the large national healthcare account:

|

|

|

l

|

Consolidated prior accident year reserves developed favorably by $63.3 million in 2019.

|

|

|

l

|

Our consolidated current accident year net loss ratio for 2019 was 85.3%, as compared to 83.7% in 2018. This increase was driven primarily by deteriorating loss experience in our broader HCPL excess and surplus lines of business. In addition, the higher current accident year net loss ratio reflects changes in our reserves for our Death, Disability, and Retirement (“DDR”) coverage endorsements. Furthermore, the increase reflects the $10 million reserve established by a segregated portfolio cell (“SPC”) for an errors & omissions (“E&O”) policy in the second quarter of 2019. ProAssurance has no participation nor ownership interest in this particular cell, and the recording of this reserve was offset by a decrease to the SPC dividend expense, resulting in no effect to our operating income (loss). However, the recording of this reserve increased our net loss ratio for the year, as the offsetting effect of the SPC dividend expense is not included in this ratio calculation.

|

|

|

l

|

The full-year 2019 consolidated net loss ratio increased 6.2 percentage points to 77.8%, driven by increases to the net loss ratios for our Specialty P&C and Segregated Portfolio Cell Reinsurance segments, partially offset by a decrease in the Lloyd’s Syndicates segment. The net loss ratio for the Worker’s Compensation Insurance segment was essentially flat year-over-year.

|

|

|

l

|

Our consolidated combined ratio for 2019 was 107.7%, as compared to 101.5% in 2018, driven by the increased 2019 consolidated net loss ratio.

|

|

The AMENDED disclosure is presented below, with relocated and amended commentary underlined:

|

|

l

|

For the full year ended December 31, 2019, our results were affected by the following factors:

|

|

|

l

|

Adverse development of $51.5 million in prior accident year reserves related to the large national healthcare account.

|

|

|

l

|

A $10 million reserve established by a segregated portfolio cell ("SPC") for an errors & omissions (“E&O”) policy in the second quarter of 2019. ProAssurance has no participation nor ownership interest in this particular cell, and the recording of this reserve was offset by a decrease to the SPC dividend expense, resulting in no effect to our operating income (loss). However, the recording of this reserve increased our net loss ratio for the year, as the offsetting effect of the SPC dividend expense is not included in this ratio calculation.

|

|

|

l

|

Increases of 5.0 and 6.7 percentage points in the consolidated and Specialty P&C current accident year net loss ratios, respectively, which reflect the effect of the large national healthcare account, including the impact of the $9.2 million PDR recorded in relation to this account, and the aforementioned $10 million E&O policy reserve.

|

|

|

|

|

|

|

|

|

l

|

The following figures are shown excluding the effects of adjustments to our reserve estimates and the PDR in the full year 2019 relating to the large national healthcare account, and the $10 million reserve related to the E&O policy:

|

|

|

l

|

Consolidated prior accident year reserves developed favorably by $63.3 million in 2019.

|

|

|

l

|

Our consolidated current accident year net loss ratio for 2019 was 85.3%, as compared to 83.7% in 2018. This increase was driven primarily by deteriorating loss experience in our broader HCPL excess and surplus lines of business. In addition, the higher current accident year net loss ratio reflects changes in our reserves for our Death, Disability, and Retirement (“DDR”) coverage endorsements.

|

|

|

l

|

The full-year 2019 consolidated net loss ratio increased 5.4 percentage points to 77.8%, driven by increases to the net loss ratios for our Specialty P&C and Segregated Portfolio Cell Reinsurance segments, partially offset by a decrease in the Lloyd’s Syndicates segment. The net loss ratio for the Worker’s Compensation Insurance segment was essentially flat year-over-year.

|

|

|

l

|

Our consolidated combined ratio for 2019 was 107.7%, as compared to 101.5% in 2018, driven by the increased 2019 consolidated net loss ratio.

|

|

In addition to the filing of the Amendment to our Original 8-K filing, we are amending the press release issued on February 20, 2020 and have provided a copy of the amended release as Exhibit 99.1 to this Current Report on Form 8-K.

|

|

The information we are furnishing under Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, is not to be deemed “filed” for the purposes of Section 18 of the Securities and Exchange Act of 1934 (the “Exchange Act”) as amended, or otherwise subject to the liability of that section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1993, as amended, or the Exchange Act, regardless of the general incorporation language of such filing, except as shall be expressly set forth by specific reference in such filing.

|

|

Item 9.01 FINANCIAL STATEMENTS AND EXHIBITS

|

|

|

|

|

|

|

|

SIGNATURE

|

|

Pursuant to the requirements of the Securities Exchange act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

Date: March 16, 2020

|

|

|

|

|

PROASSURANCE CORPORATION

|

|

by: /s/ Jeffrey P. Lisenby

|

|

-----------------------------------------------------

|

|

Jeffrey P. Lisenby

General Counsel

|

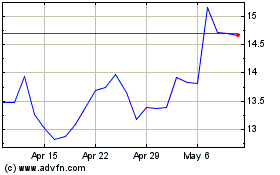

ProAssurance (NYSE:PRA)

Historical Stock Chart

From Mar 2024 to Apr 2024

ProAssurance (NYSE:PRA)

Historical Stock Chart

From Apr 2023 to Apr 2024