Current Report Filing (8-k)

November 08 2019 - 10:31AM

Edgar (US Regulatory)

false0001127703

0001127703

2019-11-08

2019-11-08

|

|

|

|

|

|

UNITED STATES

|

|

SECURITIES AND EXCHANGE COMMISSION

|

|

Washington, D.C. 20549

|

|

|

|

|

FORM

|

8-K

|

|

CURRENT REPORT

|

|

|

|

|

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

|

|

|

|

Date of Report (Date of earliest event reported): November 8, 2019

|

|

|

|

ProAssurance Corporation

|

|

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

Delaware

|

001-16533

|

63-1261433

|

|

(State of Incorporation)

|

(Commission File No.)

|

(IRS Employer I.D. No.)

|

|

|

|

|

|

|

|

|

100 Brookwood Place,

|

Birmingham,

|

AL

|

35209

|

|

(Address of Principal Executive Office )

|

(Zip code)

|

|

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

(205)

|

877-4400

|

|

|

|

|

|

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Securities Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act

(17CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-(c) under the Exchange Act

(17CFR 240.13e-(c))

|

|

|

|

|

|

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

PRA

|

New York Stock Exchange

|

|

|

|

|

|

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

Emerging growth company

|

☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

|

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

We are describing an amendment of our Revolving Credit Agreement under “Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.” That description is hereby incorporated by reference into this Item 1.01.

ITEM 2.03 CREATION OF A DIRECT FINANCIAL OBLIGATION OR AN OBLIGATION UNDER AN OFF-BALANCE SHEET ARRANGEMENT OF A REGISTRANT

On November 7, 2019, ProAssurance Corporation and participating lenders entered into an amended and restated revolving line of credit facility, increasing the available line of credit by $50 million to $250 million and extending the facility termination date to November 7, 2024. The facility continues to include an option to increase the line of credit by $50 million (“the accordion”), which, if exercised, would expand the available line to a total of $300 million.

The amended and restated facility extends and modifies the terms of an existing facility that originated on April 15, 2011. It will continue to allow us to borrow up to the aggregate amount of the unused lender commitment at any time prior to its termination. The interest rate we will pay depends on our credit ratings at the time we borrow the money, and on whether the borrowing is secured or unsecured. Participating lenders are U.S. Bank, Wells Fargo, Regions Bank, KeyBank, BB&T Bank, First Horizon Bank, and Cadence Bank.

Significant financial covenants require us to maintain a defined minimum consolidated net worth and a maximum leverage ratio, each determined as of the end of each of our fiscal quarters. The facility also includes customary representations, covenants and events in the event of default.

We anticipate that any funds we borrow under terms of the amended and restated facility will be used for general corporate purposes, including, but not limited to, use as short-term working capital, funding for share repurchases as authorized by our Board, and for support of other activities we enter into in the normal course of business including mergers and acquisitions.

We maintain various relationships, including the provision of financial services such as cash management and investment custodial arrangements and investment banking with some of the lenders participating in this Agreement.

SIGNATURE

Pursuant to the requirements of the Securities Exchange act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: November 8, 2019

|

|

|

|

|

PROASSURANCE CORPORATION

|

|

by: /s/ Jeffrey P. Lisenby

|

|

-----------------------------------------------------

|

|

Jeffrey P. Lisenby

General Counsel

|

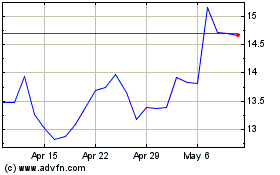

ProAssurance (NYSE:PRA)

Historical Stock Chart

From Mar 2024 to Apr 2024

ProAssurance (NYSE:PRA)

Historical Stock Chart

From Apr 2023 to Apr 2024