|

Schedule of Investments PIMCO New York Municipal Income Fund

|

September 30, 2019

(Unaudited)

|

|

(AMOUNTS IN THOUSANDS*, EXCEPT NUMBER OF SHARES, CONTRACTS AND UNITS, IF ANY)

|

|

|

|

|

|

|

|

PRINCIPAL

AMOUNT

(000s)

|

|

MARKET

VALUE

(000s)

|

|

INVESTMENTS IN SECURITIES 184.8% ¤

|

|

|

|

|

|

MUNICIPAL BONDS & NOTES 183.8%

|

|

|

|

|

|

CALIFORNIA 1.8%

|

|

|

|

|

California Health Facilities Financing Authority Revenue Bonds, Series 2016

5.000% due 11/15/2046 (c)

|

$

|

1,500

|

$

|

1,775

|

|

|

|

|

|

1,775

|

|

ILLINOIS 3.5%

|

|

|

|

|

Chicago, Illinois General Obligation Bonds, Series 2007

5.500% due 01/01/2042

|

|

885

|

|

983

|

Chicago, Illinois General Obligation Bonds, Series 2017

6.000% due 01/01/2038

|

|

1,000

|

|

1,195

|

Illinois State General Obligation Notes, Series 2017

5.000% due 11/01/2026

|

|

1,000

|

|

1,135

|

|

|

|

|

|

3,313

|

|

NEW YORK 171.8%

|

|

|

|

|

Build NYC Resource Corp., New York Revenue Bonds, Series 2017

5.000% due 11/01/2047 (c)

|

|

1,000

|

|

1,474

|

Housing Development Corp., New York Revenue Bonds, Series 2017

3.700% due 11/01/2047 (c)

|

|

1,000

|

|

1,048

|

|

Hudson Yards Infrastructure Corp., New York Revenue Bonds, Series 2011

|

|

|

|

|

|

5.250% due 02/15/2047

|

|

3,000

|

|

3,157

|

|

5.750% due 02/15/2047

|

|

4,000

|

|

4,239

|

Metropolitan Transportation Authority, New York Revenue Bonds, Series 2012

5.000% due 11/15/2042

|

|

2,000

|

|

2,209

|

Metropolitan Transportation Authority, New York Revenue Bonds, Series 2013

5.000% due 11/15/2043

|

|

1,000

|

|

1,106

|

Metropolitan Transportation Authority, New York Revenue Bonds, Series 2016

5.000% due 11/15/2031 (c)

|

|

6,500

|

|

7,869

|

|

Metropolitan Transportation Authority, New York Revenue Bonds, Series 2017

|

|

|

|

|

|

4.000% due 11/15/2035

|

|

1,000

|

|

1,134

|

|

4.000% due 11/15/2042 (c)

|

|

1,000

|

|

1,109

|

Monroe County, New York Industrial Development Agency Revenue Bonds, Series 2017

4.000% due 07/01/2036 (c)

|

|

1,000

|

|

1,130

|

Nassau County, New York General Obligation Bonds, (AGM Insured), Series 2018

5.000% due 04/01/2036

|

|

2,000

|

|

2,469

|

|

Nassau County, New York Industrial Development Agency Revenue Bonds, Series 2014

|

|

|

|

|

|

2.000% due 01/01/2049 ^(a)

|

|

433

|

|

70

|

|

6.700% due 01/01/2049

|

|

1,200

|

|

1,200

|

Nassau County, New York Tobacco Settlement Corp. Revenue Bonds, Series 2006

5.125% due 06/01/2046

|

|

1,230

|

|

1,230

|

|

New York City Industrial Development Agency, New York Revenue Bonds, (AGC Insured), Series 2009

|

|

|

|

|

|

6.500% due 01/01/2046

|

|

900

|

|

904

|

|

7.000% due 03/01/2049

|

|

3,200

|

|

3,217

|

New York City Transitional Finance Authority Future Tax Secured, New York Revenue Bonds, Series 2017

4.000% due 08/01/2042 (c)

|

|

2,000

|

|

2,235

|

New York City Water & Sewer System, New York Revenue Bonds, Series 2019

5.000% due 06/15/2049 (c)

|

|

9,000

|

|

10,944

|

New York City, New York General Obligation Bonds, Series 2013

5.000% due 08/01/2031

|

|

2,000

|

|

2,268

|

|

New York City, New York General Obligation Bonds, Series 2018

|

|

|

|

|

|

4.000% due 03/01/2042 (c)

|

|

3,200

|

|

3,596

|

|

5.000% due 04/01/2043

|

|

1,500

|

|

1,824

|

|

5.000% due 04/01/2045 (c)

|

|

2,700

|

|

3,275

|

New York City, New York General Obligation Bonds, Series 2019

5.000% due 08/01/2039

|

|

1,000

|

|

1,259

|

New York City, New York Health & Hospital Corp. Revenue Bonds, Series 2010

5.000% due 02/15/2030

|

|

3,500

|

|

3,544

|

New York City, New York Transitional Finance Authority Building Aid Revenue Bonds, Series 2018

5.250% due 07/15/2036

|

|

1,000

|

|

1,268

|

New York City, New York Transitional Finance Authority Future Tax Secured Revenue Bonds, Series 2019

5.000% due 11/01/2043

|

|

1,030

|

|

1,277

|

New York City, New York Water & Sewer System Revenue Bonds, Series 2017

5.000% due 06/15/2048 (c)

|

|

8,000

|

|

9,581

|

New York Counties Tobacco Trust IV Revenue Bonds, Series 2005

0.000% due 06/01/2050 (b)

|

|

20,000

|

|

3,048

|

New York Counties Tobacco Trust V Revenue Bonds, Series 2005

0.000% due 06/01/2055 (b)

|

|

3,000

|

|

233

|

New York Liberty Development Corp. Revenue Bonds, Series 2005

5.250% due 10/01/2035 (c)

|

|

120

|

|

5,165

|

|

Schedule of Investments PIMCO New York Municipal Income Fund (Cont.)

|

September 30, 2019

(Unaudited)

|

|

New York Liberty Development Corp. Revenue Bonds, Series 2010

|

|

|

|

|

|

5.125% due 01/15/2044

|

|

6,150

|

|

6,221

|

|

6.375% due 07/15/2049

|

|

1,500

|

|

1,522

|

|

New York Liberty Development Corp. Revenue Bonds, Series 2011

|

|

|

|

|

|

5.000% due 12/15/2041

|

|

2,000

|

|

2,159

|

|

5.750% due 11/15/2051

|

|

6,000

|

|

6,555

|

New York Liberty Development Corp. Revenue Bonds, Series 2014

5.000% due 11/15/2044

|

|

1,900

|

|

2,102

|

|

New York State Dormitory Authority Revenue Bonds, Series 2010

|

|

|

|

|

|

5.000% due 07/01/2035

|

|

500

|

|

513

|

|

5.500% due 07/01/2040

|

|

1,250

|

|

1,289

|

|

New York State Dormitory Authority Revenue Bonds, Series 2011

|

|

|

|

|

|

5.000% due 07/01/2031

|

|

2,000

|

|

2,123

|

|

5.500% due 07/01/2036

|

|

1,000

|

|

1,076

|

|

6.000% due 07/01/2040

|

|

1,225

|

|

1,268

|

New York State Dormitory Authority Revenue Bonds, Series 2013

5.000% due 02/15/2029

|

|

1,000

|

|

1,116

|

|

New York State Dormitory Authority Revenue Bonds, Series 2017

|

|

|

|

|

|

4.000% due 02/15/2047 (c)

|

|

1,000

|

|

1,113

|

|

5.000% due 12/01/2031

|

|

500

|

|

596

|

|

New York State Dormitory Authority Revenue Bonds, Series 2018

|

|

|

|

|

|

4.000% due 03/15/2043

|

|

1,000

|

|

1,131

|

|

5.000% due 03/15/2037

|

|

3,000

|

|

3,703

|

New York State Dormitory Authority Revenue Bonds, Series 2019

5.000% due 03/15/2041

|

|

2,000

|

|

2,489

|

|

New York State Thruway Authority Revenue Bonds, Series 2012

|

|

|

|

|

|

5.000% due 01/01/2037

|

|

1,000

|

|

1,079

|

|

5.000% due 01/01/2042

|

|

3,645

|

|

3,924

|

|

New York State Urban Development Corp., Revenue Notes, Series 2019

|

|

|

|

|

|

4.000% due 03/15/2048 (c)

|

|

7,000

|

|

7,725

|

|

5.000% due 03/15/2040 (c)

|

|

6,000

|

|

7,444

|

Onondaga County, New York Revenue Bonds, Series 2011

5.000% due 12/01/2036

|

|

600

|

|

648

|

Port Authority of New York & New Jersey Revenue Bonds, Series 2010

6.000% due 12/01/2036

|

|

1,000

|

|

1,055

|

Port Authority of New York & New Jersey Revenue Bonds, Series 2016

5.250% due 11/15/2056 (c)

|

|

2,000

|

|

4,223

|

Port Authority of New York & New Jersey Revenue Bonds, Series 2018

5.000% due 07/15/2036

|

|

1,000

|

|

1,255

|

|

Triborough Bridge & Tunnel Authority, New York Revenue Bonds, Series 2018

|

|

|

|

|

|

4.000% due 11/15/2048

|

|

1,000

|

|

1,117

|

|

5.000% due 11/15/2045 (c)

|

|

3,000

|

|

3,691

|

|

Triborough Bridge & Tunnel Authority, New York Revenue Bonds, Series 2019

|

|

|

|

|

|

5.000% due 11/15/2041

|

|

840

|

|

1,056

|

|

5.000% due 11/15/2042

|

|

500

|

|

628

|

Troy Industrial Development Authority, New York Revenue Bonds, Series 2002

4.625% due 09/01/2026

|

|

5,860

|

|

6,187

|

TSASC, Inc., New York Revenue Bonds, Series 2016

5.000% due 06/01/2048

|

|

1,750

|

|

1,741

|

TSASC, Inc., New York Revenue Bonds, Series 2017

5.000% due 06/01/2041

|

|

2,000

|

|

2,236

|

Ulster County, New York Capital Resource Corp. Revenue Bonds, Series 2017

5.250% due 09/15/2047

|

|

500

|

|

514

|

Utility Debt Securitization Authority Revenue Bonds, Series 2015

5.000% due 12/15/2037 (c)

|

|

1,000

|

|

1,196

|

Westchester County Healthcare Corp., New York Revenue Bonds, Series 2010

6.125% due 11/01/2037

|

|

910

|

|

958

|

Yonkers Economic Development Corp., New York Revenue Bonds, Series 2010

6.000% due 10/15/2030

|

|

170

|

|

175

|

|

|

|

|

|

164,910

|

|

OHIO 3.1%

|

|

|

|

|

Buckeye Tobacco Settlement Financing Authority, Ohio Revenue Bonds, Series 2007

6.500% due 06/01/2047

|

|

2,875

|

|

2,952

|

|

PUERTO RICO 3.6%

|

|

|

|

|

|

Puerto Rico Sales Tax Financing Corp. Sales Tax Revenue Bonds, Series 2018

|

|

|

|

|

|

0.000% due 07/01/2046 (b)

|

|

1,845

|

|

491

|

|

4.750% due 07/01/2053

|

|

820

|

|

853

|

|

5.000% due 07/01/2058

|

|

1,940

|

|

2,050

|

|

Schedule of Investments PIMCO New York Municipal Income Fund (Cont.)

|

September 30, 2019

(Unaudited)

|

Puerto Rico Sales Tax Financing Corp. Sales Tax Revenue Bonds, Series 2019

0.000% due 08/01/2042 (b)

|

|

600

|

|

30

|

|

|

|

|

|

3,424

|

|

Total Municipal Bonds & Notes (Cost $165,264)

|

|

|

|

176,374

|

|

SHORT-TERM INSTRUMENTS 1.0%

|

|

|

|

|

|

REPURCHASE AGREEMENTS (d) 1.0%

|

|

|

|

979

|

|

Total Short-Term Instruments (Cost $979)

|

|

|

|

979

|

|

Total Investments in Securities (Cost $166,243)

|

|

|

|

177,353

|

|

Total Investments 184.8% (Cost $166,243)

|

|

|

$

|

177,353

|

|

Auction Rate Preferred Shares (42.8)%

|

|

|

|

(41,025)

|

|

Other Assets and Liabilities, net (42.0)%

|

|

|

|

(40,367)

|

|

Net Assets Applicable to Common Shareholders 100.0%

|

|

|

$

|

95,961

|

|

|

|

|

|

|

|

|

Schedule of Investments PIMCO New York Municipal Income Fund (Cont.)

|

September 30, 2019

(Unaudited)

|

NOTES TO SCHEDULE OF INVESTMENTS:

* A zero balance may reflect actual amounts rounding to less

than one thousand.

|

¤

|

The geographical classification of foreign (non-U.S.) securities in this report, if any, are classified by the country of incorporation of a holding. In certain instances, a security's country of incorporation may be different from its country of economic exposure.

|

|

^

|

Security is in default.

|

|

(a)

|

Security is not accruing income as of the date of this report.

|

|

(b)

|

Zero coupon security.

|

|

(c)

|

Represents an underlying municipal bond transferred to a tender option bond trust established in a tender option bond transaction in which the Fund sold, or caused the sale of, the underlying municipal bond and purchased the residual interest certificate. The security serves as collateral in a financing transaction.

|

|

BORROWINGS AND OTHER FINANCING TRANSACTIONS

|

|

(d)

|

REPURCHASE AGREEMENTS:

|

|

Counterparty

|

Lending

Rate

|

Settlement

Date

|

Maturity

Date

|

|

Principal

Amount

|

Collateralized By

|

|

Collateral

(Received)

|

|

Repurchase

Agreements,

at Value

|

|

Repurchase

Agreement

Proceeds

to be

Received(1)

|

|

|

FICC

|

1.500%

|

09/30/2019

|

10/01/2019

|

$

|

979

|

U.S. Treasury Notes 2.250% due 03/31/2021

|

$

|

(1,002)

|

$

|

979

|

$

|

979

|

|

|

Total Repurchase Agreements

|

|

$

|

(1,002)

|

$

|

979

|

$

|

979

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Includes

accrued interest.

|

|

FAIR VALUE MEASUREMENTS

|

|

The following is a summary of the fair valuations according to the inputs used as of September 30, 2019 in valuing the Fund's assets and liabilities:

|

|

|

|

|

|

|

Category and Subcategory

|

Level 1

|

Level 2

|

Level 3

|

Fair Value

at 09/30/2019

|

|

|

Investments in Securities, at Value

|

|

|

Municipal Bonds & Notes

|

|

|

|

California

|

$

|

0

|

$

|

1,775

|

$

|

0

|

$

|

1,775

|

|

|

|

Illinois

|

|

0

|

|

3,313

|

|

0

|

|

3,313

|

|

|

|

New York

|

|

0

|

|

164,910

|

|

0

|

|

164,910

|

|

|

|

Ohio

|

|

0

|

|

2,952

|

|

0

|

|

2,952

|

|

|

|

Puerto Rico

|

|

0

|

|

3,424

|

|

0

|

|

3,424

|

|

|

Short-Term Instruments

|

|

|

|

Repurchase Agreements

|

|

0

|

|

979

|

|

0

|

|

979

|

|

|

|

|

|

Total Investments

|

$

|

0

|

$

|

177,353

|

$

|

0

|

$

|

177,353

|

|

|

|

|

|

There were no significant transfers into or out of Level 3 during the period ended September 30, 2019.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Notes to Financial Statements

1.

INVESTMENT VALUATION AND FAIR VALUE MEASUREMENTS

(a) Investment Valuation Policies

The net asset value (“NAV”) of the Fund's shares, is determined by dividing the total value of portfolio investments

and other assets attributable to the Fund, less any liabilities, by the total number of shares outstanding of the Fund.

On each day that the New York Stock

Exchange (“NYSE”) is open, Fund shares are ordinarily valued as of the close of regular trading (normally 4:00 p.m.,

Eastern time) (“NYSE Close”). Information that becomes known to the Fund or its agents after the time as of which

NAV has been calculated on a particular day will not generally be used to retroactively adjust the price of a security or the

NAV determined earlier that day. The Fund reserves the right to change the time as of which its NAV is calculated if the Fund

closes earlier, or as permitted by the U.S. Securities and Exchange Commission (“SEC”).

For purposes of calculating a NAV,

portfolio securities and other assets for which market quotes are readily available are valued at market value. Market value is

generally determined on the basis of official closing prices or the last reported sales prices, or if no sales are reported, based

on quotes obtained from established market makers or prices (including evaluated prices) supplied by the Fund's approved pricing

services, quotation reporting systems and other third-party sources (together, “Pricing Services”). The Fund will

normally use pricing data for domestic equity securities received shortly after the NYSE Close and does not normally take into

account trading, clearances or settlements that take place after the NYSE Close. If market value pricing is used, a foreign (non-U.S.)

equity security traded on a foreign exchange or on more than one exchange is typically valued using pricing information from the

exchange considered by Pacific Investment Management Company LLC (“PIMCO” or the “Manager”) to be the

primary exchange. A foreign (non-U.S.) equity security will be valued as of the close of trading on the foreign exchange, or the

NYSE Close, if the NYSE Close occurs before the end of trading on the foreign exchange. Domestic and foreign (non-U.S.) fixed

income securities, non-exchange traded derivatives, and equity options are normally valued on the basis of quotes obtained from

brokers and dealers or Pricing Services using data reflecting the earlier closing of the principal markets for those securities.

Prices obtained from Pricing Services may be based on, among other things, information provided by market makers or estimates

of market values obtained from yield data relating to investments or securities with similar characteristics. Certain fixed income

securities purchased on a delayed-delivery basis are marked to market daily until settlement at the forward settlement date. Exchange-traded

options, except equity options, futures and options on futures are valued at the settlement price determined by the relevant exchange.

Swap agreements are valued on the basis of bid quotes obtained from brokers and dealers or market-based prices supplied by Pricing

Services. The Fund's investments in open-end management investment companies, other than exchange-traded funds ("ETFs"),

are valued at the NAVs of such investments.

Investments for which market quotes

or market based valuations are not readily available are valued at fair value as determined in good faith by the Board or persons

acting at their direction. The Board has adopted methods for valuing securities and other assets in circumstances where market

quotes are not readily available, and has delegated to PIMCO the responsibility for applying the fair valuation methods. In the

event that market quotes or market based valuations are not readily available, and the security or asset cannot be valued pursuant

to a Board approved valuation method, the value of the security or asset will be determined in good faith by the Board. Market

quotes are considered not readily available in circumstances where there is an absence of current or reliable market-based data

(e.g., trade information, bid/ask information, indicative market quotations (“Broker Quotes”), Pricing Services’

prices), including where events occur after the close of the relevant market, but prior to the NYSE Close, that materially affect

the values of the Fund's securities or assets. In addition, market quotes are considered not readily available when, due to extraordinary

circumstances, the exchanges or markets on which the securities trade do not open for trading for the entire day and no other

market prices are available. The Board has delegated, to the Manager, the responsibility for monitoring significant events that

may materially affect the values of the Fund's securities or assets and for determining whether the value of the applicable securities

or assets should be reevaluated in light of such significant events.

When the Fund uses fair valuation

to determine the value of a portfolio security or other asset for purposes of calculating its NAV, such investments will not be

priced on the basis of quotes from the primary market in which they are traded, but rather may be priced by another method that

the Board or persons acting at their direction believe reflects fair value. Fair valuation may require subjective determinations

about the value of a security. While the Fund’s policy is intended to result in a calculation of the Fund’s NAV that

fairly reflects security values as of the time of pricing, the Fund cannot ensure that fair values determined by the Board or

persons acting at their direction would accurately reflect the price that the Fund could obtain for a security if it were to dispose

of that security as of the time of pricing (for instance, in a forced or distressed sale). The prices used by the Fund may differ

from the value that would be realized if the securities were sold.

(b) Fair Value Hierarchy U.S.

GAAP describes fair value as the price that the Fund would receive to sell an asset or pay to transfer a liability in an orderly

transaction between market participants at the measurement date. It establishes a fair value hierarchy that prioritizes inputs

to valuation methods and requires disclosure of the fair value hierarchy, separately for each major category of assets and liabilities,

that segregates fair value measurements into levels (Level 1, 2, or 3). The inputs or methodology used for valuing securities

are not necessarily an indication of the risks associated with investing in those securities. Levels 1, 2, and 3 of the fair value

hierarchy are defined as follows:

• Level 1 — Quoted prices

in active markets or exchanges for identical assets and liabilities.

• Level 2 — Significant

other observable inputs, which may include, but are not limited to, quoted prices for similar assets or liabilities in markets

that are active, quoted prices for identical or similar assets or liabilities in markets that are not active, inputs other than

quoted prices that are observable for the assets or liabilities (such as interest rates, yield curves, volatilities, prepayment

speeds, loss severities, credit risks and default rates) or other market corroborated inputs.

• Level 3 — Significant

unobservable inputs based on the best information available in the circumstances, to the extent observable inputs are not available,

which may include assumptions made by the Board or persons acting at their direction that are used in determining the fair value

of investments.

In accordance

with the requirements of U.S. GAAP, the amounts of transfers into and out of Level 3, if material,

are disclosed in the Notes to Schedule of Investments for the Fund.

For fair valuations using significant

unobservable inputs, U.S. GAAP requires a reconciliation of the beginning to ending balances for reported fair values that presents

changes attributable to realized gain (loss), unrealized appreciation (depreciation), purchases and sales, accrued discounts (premiums),

and transfers into and out of the Level 3 category during the period. The end of period value is used for the transfers between

Levels of the Fund's assets and liabilities. Additionally, U.S. GAAP requires quantitative information regarding the significant

unobservable inputs used in the determination of fair value of assets or liabilities categorized as Level 3 in the fair value

hierarchy. In accordance with the requirements of U.S. GAAP, a fair value hierarchy, and if material, a Level 3 reconciliation

and details of significant unobservable inputs, have been included in the Notes to Schedule of Investments for the Fund.

(c) Valuation Techniques and

the Fair Value Hierarchy

Notes to Financial Statements

(Cont.)

Level 1 and Level 2 trading assets

and trading liabilities, at fair value The valuation methods (or “techniques”) and significant inputs used in

determining the fair values of portfolio securities or other assets and liabilities categorized as Level 1 and Level 2 of the

fair value hierarchy are as follows:

Fixed income securities including

corporate, convertible and municipal bonds and notes, U.S. government agencies, U.S. treasury obligations, sovereign issues, bank

loans, convertible preferred securities and non-U.S. bonds are normally valued on the basis of quotes obtained from brokers and

dealers or Pricing Services that use broker-dealer quotations, reported trades or valuation estimates from their internal pricing

models. The Pricing Services' internal models use inputs that are observable such as issuer details, interest rates, yield curves,

prepayment speeds, credit risks/spreads, default rates and quoted prices for similar assets. Securities that use similar valuation

techniques and inputs as described above are categorized as Level 2 of the fair value hierarchy.

Fixed income securities purchased

on a delayed-delivery basis or as a repurchase commitment in a sale-buyback transaction are marked to market daily until settlement

at the forward settlement date and are categorized as Level 2 of the fair value hierarchy.

Level 3 trading assets and trading

liabilities, at fair value When a fair valuation method is applied by PIMCO that uses significant unobservable inputs, investments

will be priced by a method that the Board or persons acting at their direction believe reflects fair value and are categorized

as Level 3 of the fair value hierarchy.

Short-term debt instruments (such

as commercial paper) having a remaining maturity of 60 days or less may be valued at amortized cost, so long as the amortized

cost value of such short-term debt instruments is approximately the same as the fair value of the instrument as determined without

the use of amortized cost valuation. These securities are categorized as Level 2 or Level 3 of the fair value hierarchy depending

on the source of the base price.

2.

FEDERAL INCOME TAX MATTERS

The Fund intends to qualify as a

regulated investment company under Subchapter M of the Internal Revenue Code (the “Code”) and distribute all of its

taxable income and net realized gains, if applicable, to shareholders. Accordingly, no provision for Federal income taxes has

been made.

The Fund may be subject to local

withholding taxes, including those imposed on realized capital gains. Any applicable foreign capital gains tax is accrued daily

based upon net unrealized gains, and may be payable following the sale of any applicable investments.

In accordance with U.S. GAAP, the

Manager has reviewed the Fund's tax positions for all open tax years. As of September 30, 2019, the Fund has recorded no liability

for net unrecognized tax benefits relating to uncertain income tax positions it has taken or expects to take in future tax returns.

The Fund files U.S. federal, state,

and local tax returns as required. The Fund's tax returns are subject to examination by relevant tax authorities until expiration

of the applicable statute of limitations, which is generally three years after the filing of the tax return but which can be extended

to six years in certain circumstances. Tax returns for open years have incorporated no uncertain tax positions that require a

provision for income taxes.

|

Glossary:

(abbreviations that may be used in the preceding statements)

|

|

|

|

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Counterparty

Abbreviations:

|

|

|

|

|

|

|

|

|

|

FICC

|

|

Fixed Income Clearing Corporation

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Currency

Abbreviations:

|

|

|

|

|

|

|

|

|

|

USD (or $)

|

|

United States Dollar

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Municipal

Bond or Agency Abbreviations:

|

|

|

|

|

|

|

|

|

|

AGC

|

|

Assured Guaranty Corp.

|

|

AGM

|

|

Assured Guaranty Municipal

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Abbreviations:

|

|

|

|

|

|

|

|

|

|

TBA

|

|

To-Be-Announced

|

|

|

|

|

|

|

|

|

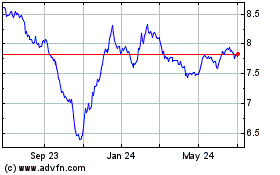

Pimco New York Municipal... (NYSE:PNF)

Historical Stock Chart

From Mar 2024 to Apr 2024

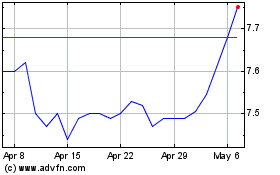

Pimco New York Municipal... (NYSE:PNF)

Historical Stock Chart

From Apr 2023 to Apr 2024