Regional Bank Leaders Brush Off Yield Curve Worries

January 16 2019 - 4:25PM

Dow Jones News

By Allison Prang

Regional bank leaders on Wednesday talked up the strength of the

economy, even though the spread between long-term and short-term

lending has gotten smaller, a move that could lead the market to

worry the economy isn't far off from a recession.

From the end of the third quarter through mid-January, the yield

curve spread -- or the difference between 2-year and 10-year

Treasury yields -- has narrowed, compressing from about 24 basis

points at the end of September to about 18 basis points on Tuesday,

according to Dow Jones Market Data. During that more than

three-month period, the difference between the two yields hit a low

in mid-December at about 11 basis points.

Investors watch the yield curve closely as a gauge of the

profitability of their lending businesses. When the gap narrows, it

can erode the margins from borrowing at low short-term rates and

lending and higher long-term rates. An inversion of the yield curve

-- or when short-term rates are higher than long-term rates -- has

happened before every recession since at least 1975, according to

Dow Jones Market Data.

Even so, some of the country's largest regional banks aren't

that worried, even as financial stocks have taken a hit in recent

months along with the wider stock market.

U.S. Bancorp Chief Financial Officer Terry Dolan said in an

interview Wednesday that people tend to watch the yield curve as

the biggest indicator of when a recession is coming, but cautioned

that an inverted yield curve is one of a number of things that

would have to happen for the economy to turn. Those other factors

-- like less business spending or early consumer credit

delinquencies -- haven't happened.

"We see the yield curve and not really anything else," Mr. Dolan

said.

In PNC Financial Services Group Inc.'s fourth-quarter earnings

call on Wednesday, Chief Executive Bill Demchak noted the yield

curve's movements, but said PNC's corporate customers are "largely

bullish" still and that economic data from the Institute of Supply

Management measuring business activity shows expansion, even while

being off from its highs.

"We don't think we're headed towards a recession," Mr. Demchak

told analysts. "Consumer confidence remains high and it's going to

provide support for consumer spending."

He still cautioned that if the government shutdown continued for

a while or trade issues with China continue, the situation could

change, but added PNC didn't think that would happen.

"Instead, we see an economy growing at over 2.5% and healthy

loan demand as the repricing of the risk in the capital markets

drives business back to the banks," he said.

In reporting their fourth-quarter earnings results Wednesday,

both firms reported increases in their provisions for credit losses

from the comparable quarter a year ago. U.S. Bancorp's rose 9.9% to

$368 million and PNC's rose 18% to $148 million.

Mr. Dolan said the firm feels "really good" about credit

quality. The company's net charge-offs will increase seasonally in

the first part of 2019 but start to fall after that, he said.

Mr. Demchak said that PNC had four commercial loans change to

nonperforming assets during the quarter, but they were "associated

with strange things" and "nothing kind of based on the broader

economy." Chief Financial Officer Robert Reilly also said the

increase in the provision was partly because of loan growth.

"We don't see anything," Mr. Demchak said. "It just can't stay

... that low forever."

Write to Allison Prang at allison.prang@wsj.com

(END) Dow Jones Newswires

January 16, 2019 16:10 ET (21:10 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

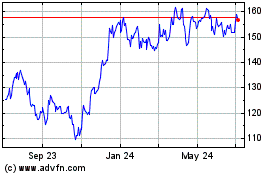

PNC Financial Services (NYSE:PNC)

Historical Stock Chart

From Mar 2024 to Apr 2024

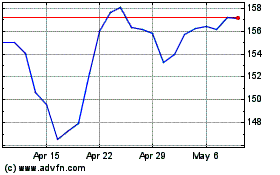

PNC Financial Services (NYSE:PNC)

Historical Stock Chart

From Apr 2023 to Apr 2024