Statement of Changes in Beneficial Ownership (4)

August 06 2020 - 7:31PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Levine Jeremy S. |

2. Issuer Name and Ticker or Trading Symbol

PINTEREST, INC.

[

PINS

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director _____ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

C/O PINTEREST, INC., 505 BRANNAN STREET |

3. Date of Earliest Transaction

(MM/DD/YYYY)

8/4/2020 |

|

(Street)

SAN FRANCISCO, CA 94107

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Class A Common Stock | 8/4/2020 | | S | | 240207 | D | $34.4054 (1) | 2155288 (2)(3)(4) | D (5) | |

| Class A Common Stock | 8/4/2020 | | S | | 109793 | D | $34.9366 (6) | 2045495 (3)(4)(7) | D | |

| Class A Common Stock | 8/5/2020 | | S | | 13567 | D | $35.6026 (8) | 2031928 (3)(4)(9) | D | |

| Class A Common Stock | 8/5/2020 | | S | | 11433 | D | $35.9555 (10) | 2020495 (3)(4)(11) | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Explanation of Responses: |

| (1) | The reported price in Column 4 is a weighted average sale price. These shares were sold in multiple transactions at prices ranging from $33.83 to $34.82 per share. The Reporting Person undertakes to provide to the Company, any security holder of the Company or the staff of the Securities and Exchange Commission, upon request, full information regarding the number of shares sold at each separate price within the range set forth in this footnote. |

| (2) | These securities consist of 2,141,848 Class A common stock, par value $0.00001 (Class A Common Stock) and 13,440 Restricted Stock Units (RSUs). Each RSU represents the Reporting Person's right to receive one share of Class A Common Stock, subject to vesting. |

| (3) | Includes 311,107 shares of Class A Common Stock received by the Reporting Person in one or more pro rata distributions-in-kind from Bessemer Venture Partners VII L.P. ("BVP VII"), Bessemer Venture Partners VII Institutional L.P. ("BVP VII Inst") BVP Special Opportunity Fund VII L.P. ("BVP VII SOF"), Deer VII & Co. Ltd. ("Deer VII Ltd."), and Deer VII L.P. ("Deer VII LP" and together with BVP VII, BVP VII Inst, BVP VII SOF, and Deer VII Ltd.", the "BVP VII Funds"), on June 8, 2020, which distributions were made in accordance with the exemption afforded by Rules 16a-13 and 16a-9 of the Securities Exchange Act of 1934, as amended and 1,067,814 previously reported pro rate distributions-in-kind from the BVP VII Funds. |

| (4) | Includes 618,463 shares of Class A Common Stock received by the Reporting Person in one or more pro rata distributions-in-kind from the BVP VII Funds, on August 4, 2020 which distributions were made in accordance with the exemption afforded by Rules 16a-13 and 16a-9 of the Securities Exchange Act of 1934, as amended. |

| (5) | The Reporting Person has agreed to assign to Deer Management Co. LLC the right to any shares issuable pursuant to the RSUs or any proceeds from the sale thereof. |

| (6) | The reported price in Column 4 is a weighted average sale price. These shares were sold in multiple transactions at prices ranging from $34.83 to $35.06 per share. The Reporting Person undertakes to provide to the Company, any security holder of the Company or the staff of the Securities and Exchange Commission, upon request, full information regarding the number of shares sold at each separate price within the range set forth in this footnote. |

| (7) | These securities consist of 2,032,055 Class A Common Stock and 13,440 RSUs. |

| (8) | The reported price in Column 4 is a weighted average sale price. These shares were sold in multiple transactions at prices ranging from $34.82 to $35.81 per share. The Reporting Person undertakes to provide to the Company, any security holder of the Company or the staff of the Securities and Exchange Commission, upon request, full information regarding the number of shares sold at each separate price within the range set forth in this footnote. |

| (9) | These securities consist of 2,018,488 Class A Common Stock and 13,440 RSUs. |

| (10) | The reported price in Column 4 is a weighted average sale price. These shares were sold in multiple transactions at prices ranging from $35.82 to $36.25 per share. The Reporting Person undertakes to provide to the Company, any security holder of the Company or the staff of the Securities and Exchange Commission, upon request, full information regarding the number of shares sold at each separate price within the range set forth in this footnote. |

| (11) | These securities consist of 2,007,055 Class A Common Stock and 13,440 RSUs. |

Remarks:

The Power of Attorney for Mr. Jeremy S. Levine is filed as an exhibit to the Form 3 filed by Mr. Levine with the Securities and Exchange Commission on April 17, 2019, which is hereby incorporated by reference. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Levine Jeremy S.

C/O PINTEREST, INC.

505 BRANNAN STREET

SAN FRANCISCO, CA 94107 | X |

|

|

|

Signatures

|

| Monifa Clayton, Attorney-in-Fact | | 8/6/2020 |

| **Signature of Reporting Person | Date |

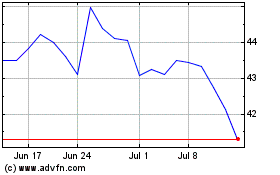

Pinterest (NYSE:PINS)

Historical Stock Chart

From Mar 2024 to Apr 2024

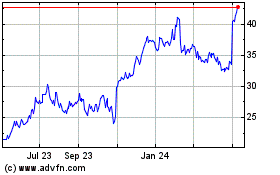

Pinterest (NYSE:PINS)

Historical Stock Chart

From Apr 2023 to Apr 2024