Pinterest, Inc. (NYSE: PINS) today announced financial results

for the quarter ended September 30, 2019.

- Q3 revenue grew 47% year-over-year to $280 million.

- Global Monthly Active Users (MAUs) grew 28% year over year to

322 million.

- GAAP net loss was $125 million. Adjusted EBITDA was $4

million.

"In Q3, we redesigned Pinterest to make the service more

intuitive and improved recommendations quality to help people

discover new ideas they didn’t know about before," said Ben

Silbermann, Pinterest CEO and Co-founder. "We are also expanding

the number of shoppable products on Pinterest, which makes it easy

for our users to go from inspiration to action."

"In the third quarter, revenue grew 47% year over year and MAUs

grew 28% to 322 million. We saw double-digit user growth in nearly

all international countries," said Todd Morgenfeld, Pinterest CFO.

"We are thrilled to serve Pinterest ads in 28 markets currently,

compared to seven at the end of 2018. Pinterest also realized

adjusted EBITDA profitability in Q3."

Q3 2019 Financial Highlights

The following table summarizes our consolidated financial

results (in thousands, except percentages, unaudited):

Three Months Ended September

30,

% Change

2019

2018

Revenue

$

279,703

$

190,197

47

%

Net loss

$

(124,732

)

$

(18,874

)

(561

)%

Non-GAAP net income (loss)*

$

5,960

$

(14,912

)

140

%

Adjusted EBITDA*

$

3,871

$

(13,426

)

129

%

Adjusted EBITDA margin*

1

%

(7

)%

* For more information on these non-GAAP financial measures,

please see "―About non-GAAP financial measures" and the tables

under "―Reconciliation of GAAP to non-GAAP financial results"

included at the end of this release.

Q3 2019 Other Highlights

The following table sets forth our revenue, MAUs and average

revenue per user ("ARPU") based on the geographic location of our

users (in millions, except ARPU and percentages, unaudited):

Three Months Ended September

30,

% Change

2019

2018

Revenue - Global

$

280

$

190

47

%

Revenue - United States

$

251

$

181

39

%

Revenue - International

$

28

$

9

212

%

MAUs - Global

322

251

28

%

MAUs - United States

87

80

8

%

MAUs - International

235

171

38

%

ARPU - Global

$

0.90

$

0.79

14

%

ARPU - United States

$

2.93

$

2.33

26

%

ARPU - International

$

0.13

$

0.06

127

%

Full year 2019 outlook

- Total revenue is expected to be between $1,100 million and

$1,115 million, compared to our prior forecast of $1,095 million

and $1,115 million.

- Adjusted EBITDA is expected to be between $(30) million and

$(10) million, compared to our prior forecast of $(50) million and

$(25) million.*

* With respect to projected 2019 Adjusted EBITDA, we are unable

to prepare a quantitative reconciliation without unreasonable

efforts due to the high variability, complexity and low visibility

with respect to certain items such as taxes and interest income

that we are unable to quantify and that would be required to

reconcile projected Adjusted EBITDA to net loss, the nearest GAAP

equivalent. We expect the variability of these items to have a

potentially unpredictable and potentially significant impact on

future GAAP financial results, and, as such, we also believe that

any reconciliations provided would imply a degree of precision that

would be confusing or misleading to investors. For more information

on this non-GAAP financial measure, please see "―About non-GAAP

financial measures."

Webcast and conference call information

A live audio webcast of our third quarter 2019 earnings release

call will be available at investor.pinterestinc.com. The call

begins today at 2:00 PM (PT) / 5:00 PM (ET). We have also posted to

our investor relations website a letter to shareholders. This press

release, including the reconciliations of certain non-GAAP measures

to their nearest comparable GAAP measures, letter to shareholders

and slide presentation are also available. A recording of the

webcast will be available at investor.pinterestinc.com for 90

days.

We have used, and intend to continue to use, our investor

relations website at investor.pinterestinc.com as a means of

disclosing material nonpublic information and for complying with

our disclosure obligations under Regulation FD.

Forward-looking statements

This press release may contain forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Exchange Act of 1934, as amended,

about us and our industry that involve substantial risks and

uncertainties, including, among other things, statements about our

future operational and financial performance. Words such as

"believe," "project," "may," "will," "estimate," "continue,"

"anticipate," "intend," "expect," "plan" and similar expressions

are intended to identify forward-looking statements. These

forward-looking statements are only predictions and may differ

materially from actual results due to a variety of factors

including: our ability to attract and retain users and engagement

levels; our ability to provide useful and relevant content; risks

associated with new products and changes to existing products as

well as other new business initiatives; our ability to maintain and

enhance our brand and reputation; compromises in security; our

financial performance and fluctuations in operating results; our

dependency on internet search engines’ methodologies and policies;

discontinuation, disruptions or outages in authentication by

third-party login providers; changes by third-party login providers

that restrict our access or ability to identify users; competition;

our ability to scale our business and revenue model; our reliance

on advertising revenue and our ability to attract and retain

advertisers and effectively measure advertising campaigns; our

ability to effectively manage growth and expand and monetize our

platform internationally; our lack of operating history and ability

to attain and sustain profitability; decisions that reduce

short-term revenue or profitability or do not produce expected

long-term benefits; risks associated with government actions, laws

and regulations that could restrict access to our products or

impair our business; litigation and government inquiries; privacy,

data and other regulatory concerns; real or perceived inaccuracies

in metrics related to our business; disruption, degradation or

interference with our hosting services and infrastructure; our

ability to attract and retain personnel; and the dual class

structure of our common stock and its effect of concentrating

voting control with stockholders who held our capital stock prior

to the completion of our initial public offering. These and other

potential risks and uncertainties that could cause actual results

to differ from the results predicted are more fully detailed in our

Quarterly Report on Form 10-Q for the quarter ended September 30,

2019, which is available on our investor relations website at

investor.pinterestinc.com and on the SEC website at www.sec.gov.

Additional information will be made available in our quarterly

report on Form 10-Q and other future reports that we may file with

the SEC from time to time, which could cause actual results to vary

from expectations. All information provided in this release and in

the attachments is as of October 31, 2019. Undue reliance should

not be placed on the forward-looking statements in this press

release, which are based on information available to us on the date

hereof. We undertake no duty to update this information unless

required by law.

About non-GAAP financial measures

To supplement our condensed consolidated financial statements,

which are prepared and presented in accordance with generally

accepted accounting principles in the United States ("GAAP"), we

use the following non-GAAP financial measures: Adjusted EBITDA,

Adjusted EBITDA margin, non-GAAP costs and expenses (including

non-GAAP cost of revenue, research and development, sales and

marketing, and general and administrative), non-GAAP loss from

operations, non-GAAP net income (loss) and non-GAAP net income

(loss) per share. The presentation of these financial measures is

not intended to be considered in isolation, as a substitute for or

superior to the financial information prepared and presented in

accordance with GAAP. Investors are cautioned that there are

material limitations associated with the use of non-GAAP financial

measures as an analytical tool. In addition, these measures may be

different from non-GAAP financial measures used by other companies,

limiting their usefulness for comparative purposes. We compensate

for these limitations by providing specific information regarding

GAAP amounts excluded from these non-GAAP financial measures.

We define Adjusted EBITDA as net loss adjusted to exclude

depreciation and amortization expense, share-based compensation

expense, interest income, interest expense and other income

(expense), net and provision for (benefit from) income taxes.

Adjusted EBITDA margin is calculated by dividing Adjusted EBITDA by

revenue. Non-GAAP costs and expenses (including non-GAAP cost of

revenue, research and development, sales and marketing, and general

and administrative) and non-GAAP net income (loss) exclude

amortization of acquired intangible assets and share-based

compensation expense. Non-GAAP loss from operations is calculated

by subtracting non-GAAP costs and expenses from revenue. Non-GAAP

net income (loss) per share is calculated by dividing non-GAAP net

income (loss) by diluted weighted-average shares outstanding. We

use Adjusted EBITDA, Adjusted EBITDA margin, non-GAAP costs and

expenses, non-GAAP loss from operations, non-GAAP net income (loss)

and non-GAAP net income (loss) per share to evaluate our operating

results and for financial and operational decision-making purposes.

We believe Adjusted EBITDA, Adjusted EBITDA margin, non-GAAP costs

and expenses, non-GAAP loss from operations, non-GAAP net income

(loss) and non-GAAP net income (loss) per share help identify

underlying trends in our business that could otherwise be masked by

the effect of the income and expenses they exclude. We also believe

Adjusted EBITDA, Adjusted EBITDA margin, non-GAAP costs and

expenses, non-GAAP loss from operations, non-GAAP net income (loss)

and non-GAAP net income (loss) per share provide useful information

about our operating results, enhance the overall understanding of

our past performance and future prospects and allow for greater

transparency with respect to key metrics we use for financial and

operational decision-making. We present Adjusted EBITDA, Adjusted

EBITDA margin, non-GAAP costs and expenses, non-GAAP loss from

operations, non-GAAP net income (loss) and non-GAAP net income

(loss) per share to assist potential investors in seeing our

operating results through the eyes of management and because we

believe these measures provide an additional tool for investors to

use in comparing our operating results over multiple periods with

other companies in our industry. There are a number of limitations

related to the use of Adjusted EBITDA, Adjusted EBITDA margin,

non-GAAP costs and expenses, non-GAAP loss from operations,

non-GAAP net income (loss) and non-GAAP net income (loss) per share

rather than net loss, net margin, total costs and expenses, loss

from operations, net loss and net loss per share, respectively, the

nearest GAAP equivalents. For example, Adjusted EBITDA excludes

certain recurring, non-cash charges such as depreciation of fixed

assets and amortization of acquired intangible assets, although

these assets may have to be replaced in the future, and share-based

compensation expense, which has been, and will continue to be for

the foreseeable future, a significant recurring expense and an

important part of our compensation strategy.

With respect to projected 2019 Adjusted EBITDA, we are unable to

prepare a quantitative reconciliation without unreasonable efforts

due to the high variability, complexity and low visibility with

respect to certain items such as taxes and interest income that we

are unable to quantify and that would be required to reconcile

projected Adjusted EBITDA to net loss, the nearest GAAP equivalent.

We expect the variability of these items to have a potentially

unpredictable and potentially significant impact on future GAAP

financial results, and, as such, we also believe that any

reconciliations provided would imply a degree of precision that

would be confusing or misleading to investors.

For a reconciliation of these non-GAAP financial measures to the

most directly comparable GAAP financial measures, please see the

tables under "―Reconciliation of GAAP to non-GAAP financial

results" included at the end of this release.

Limitation of key metrics and other data

The numbers for our key metrics, which include our MAUs and

ARPU, are calculated using internal company data based on the

activity of user accounts. We define a monthly active user as an

authenticated Pinterest user who visits our website, opens our

mobile application or interacts with Pinterest through one of our

browser or site extensions, such as the Save button, at least once

during the 30-day period ending on the date of measurement. We

present MAUs based on the number of MAUs measured on the last day

of the current period. In this press release, we updated the

definition of MAUs to better align with how we have historically

and currently calculated MAUs and how our users interact with our

platform. This change in definition does not affect the number of

MAUs presented in past disclosures or in this press release. We

measure monetization of our platform through our average revenue

per user metric. We define ARPU as our total revenue in a given

geography during a period divided by the average of the number of

MAUs in that geography during the period. We calculate average MAUs

based on the average between the number of MAUs measured on the

last day of the current period and the last day prior to the

beginning of the current period. We calculate ARPU by geography

based on our estimate of the geography in which revenue-generating

activities occur. We use these metrics to assess the growth and

health of the overall business and believe that MAUs and ARPU best

reflect our ability to attract, retain, engage and monetize our

users, and thereby drive revenue. While these numbers are based on

what we believe to be reasonable estimates of our user base for the

applicable period of measurement, there are inherent challenges in

measuring usage of our products across large online and mobile

populations around the world. In addition, we are continually

seeking to improve our estimates of our user base, and such

estimates may change due to improvements or changes in our

methodology.

PINTEREST, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(in thousands, except par

value)

(unaudited)

September 30,

December 31,

2019

2018

ASSETS

Current assets:

Cash and cash equivalents

$

1,033,871

$

122,509

Marketable securities

691,894

505,304

Accounts receivable, net of allowances of

$2,408 and $3,097 as of September 30, 2019 and December 31, 2018,

respectively

210,339

221,932

Prepaid expenses and other current

assets

46,424

39,607

Total current assets

1,982,528

889,352

Property and equipment, net

89,758

81,512

Operating lease right-of-use assets

164,922

145,203

Goodwill and intangible assets, net

14,959

14,071

Restricted cash

24,822

11,724

Other assets

3,483

10,869

Total assets

$

2,280,472

$

1,152,731

LIABILITIES, REDEEMABLE CONVERTIBLE

PREFERRED STOCK AND STOCKHOLDERS’ EQUITY (DEFICIT)

Current liabilities:

Accounts payable

$

31,509

$

22,169

Accrued expenses and other current

liabilities

112,685

86,258

Total current liabilities

144,194

108,427

Operating lease liabilities

161,164

151,395

Other liabilities

18,713

22,073

Total liabilities

324,071

281,895

Commitments and contingencies

Redeemable convertible preferred stock,

$0.00001 par value; no shares authorized, issued or outstanding as

of September 30, 2019; 928,676 shares authorized, 308,373 shares

issued and outstanding as of December 31, 2018

—

1,465,399

Stockholders’ equity (deficit):

Common stock, $0.00001 par value, no

shares authorized, issued or outstanding as of September 30, 2019;

1,932,500 shares authorized, 127,298 shares issued and outstanding

as of December 31, 2018

—

1

Class A common stock, $0.00001 par value,

6,666,667 shares authorized, 214,082 shares issued and outstanding

as of September 30, 2019; Class B common stock, $0.00001 par value,

1,333,333 shares authorized, 333,483 shares issued and outstanding

as of September 30, 2019; no shares authorized, issued or

outstanding as of December 31, 2018 for either class

5

—

Additional paid-in capital

4,127,028

252,212

Accumulated other comprehensive income

(loss)

376

(1,421

)

Accumulated deficit

(2,171,008

)

(845,355

)

Total stockholders’ equity (deficit)

1,956,401

(594,563

)

Total liabilities, redeemable convertible

preferred stock, and stockholders’ equity (deficit)

$

2,280,472

$

1,152,731

PINTEREST, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(in thousands, except per share

amounts)

(unaudited)

Three Months Ended September

30,

2019

2018

Revenue

$

279,703

$

190,197

Costs and expenses:

Cost of revenue

83,520

63,649

Research and development

167,703

63,541

Sales and marketing

110,740

66,722

General and administrative

51,450

18,716

Total costs and expenses

413,413

212,628

Loss from operations

(133,710

)

(22,431

)

Other income (expense), net:

Interest income

9,837

3,547

Interest expense and other income

(expense), net

(1,056

)

82

Loss before provision for income taxes

(124,929

)

(18,802

)

Provision for (benefit from) income

taxes

(197

)

72

Net loss

$

(124,732

)

$

(18,874

)

Net loss per share attributable to common

stockholders, basic and diluted

$

(0.23

)

$

(0.15

)

Weighted-average shares used in computing

net loss per share attributable to common stockholders, basic and

diluted

546,126

127,218

PINTEREST, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(in thousands)

(unaudited)

Nine Months Ended September

30,

2019

2018

Operating activities

Net loss

$

(1,325,653

)

$

(109,990

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization

19,496

15,415

Share-based compensation

1,265,581

12,681

Other

(3,296

)

796

Changes in assets and liabilities:

Accounts receivable

12,331

(1,978

)

Prepaid expenses and other assets

(1,502

)

15,443

Operating lease right-of-use assets

21,746

13,549

Accounts payable

8,897

5,725

Accrued expenses and other liabilities

13,133

19,369

Operating lease liabilities

(19,634

)

(12,556

)

Net cash used in operating activities

(8,901

)

(41,546

)

Investing activities

Purchases of property and equipment and

intangible assets

(20,433

)

(17,636

)

Purchases of marketable securities

(527,899

)

(427,305

)

Sales of marketable securities

93,389

91,738

Maturities of marketable securities

252,164

422,317

Net cash provided by (used in) investing

activities

(202,779

)

69,114

Financing activities

Proceeds from initial public offering, net

of underwriters' discounts and commissions

1,573,200

—

Proceeds from exercise of stock options,

net

744

548

Shares repurchased for tax withholdings on

release of restricted stock units

(424,965

)

—

Payment of deferred offering costs and

other financing activities

(11,305

)

—

Net cash provided by financing

activities

1,137,674

548

Effect of exchange rate changes on cash,

cash equivalents, and restricted cash

(182

)

(43

)

Net increase in cash, cash equivalents,

and restricted cash

925,812

28,073

Cash, cash equivalents, and restricted

cash, beginning of period

135,290

83,969

Cash, cash equivalents, and restricted

cash, end of period

$

1,061,102

$

112,042

Supplemental cash flow

information

Accrued property and equipment

$

7,174

$

1,048

Operating lease right-of-use assets

obtained in exchange for operating lease liabilities

$

41,399

$

5,817

Reconciliation of cash, cash

equivalents and restricted cash to condensed consolidated balance

sheets

Cash and cash equivalents

$

1,033,871

$

100,063

Restricted cash included in prepaid

expenses and other current assets

2,409

1,057

Restricted cash

24,822

10,922

Total cash, cash equivalents, and

restricted cash

$

1,061,102

$

112,042

Reconciliation of GAAP to

non-GAAP financial results

(in thousands, except per share

amounts)

(unaudited)

Three Months Ended September

30,

2019

2018

Share-based compensation by

function:

Cost of revenue

$

1,568

$

16

Research and development

83,539

3,380

Sales and marketing

21,243

188

General and administrative

23,938

304

Total share-based compensation

$

130,288

$

3,888

Amortization of acquired intangible

assets by function:

Cost of revenue

$

94

$

—

General and administrative

310

74

Total amortization of acquired intangible

assets

$

404

$

74

Reconciliation of total costs and

expenses to non-GAAP costs and expenses:

Total costs and expenses

$

413,413

$

212,628

Share-based compensation

(130,288

)

(3,888

)

Amortization of acquired intangible

assets

(404

)

(74

)

Non-GAAP costs and expenses

$

282,721

$

208,666

Reconciliation of net loss to non-GAAP

net income (loss):

Net loss

$

(124,732

)

$

(18,874

)

Share-based compensation

130,288

3,888

Amortization of acquired intangible

assets

404

74

Non-GAAP net income (loss)

$

5,960

$

(14,912

)

Weighted-average shares outstanding for

net loss per share, basic and diluted

546,126

127,218

Weighted-average dilutive

securities(1)

104,594

—

Diluted weighted-average shares

outstanding for Non-GAAP net income (loss) per share

650,720

127,218

Net loss per share

$

(0.23

)

$

(0.15

)

Non-GAAP net income (loss) per share

$

0.01

$

(0.12

)

____________

(1) Gives effect to potential common stock

instruments such as stock options and unvested restricted stock

units

Reconciliation of net loss to Adjusted

EBITDA

Net loss

$

(124,732

)

$

(18,874

)

Depreciation and amortization

7,293

5,117

Share-based compensation

130,288

3,888

Interest income

(9,837

)

(3,547

)

Interest expense and other (income)

expense, net

1,056

(82

)

Provision for (benefit from) income

taxes

(197

)

72

Adjusted EBITDA

$

3,871

$

(13,426

)

View source

version on businesswire.com: https://www.businesswire.com/news/home/20191031005872/en/

Investor relations: Jane Penner ir@pinterest.com Media: Mike Mayzel

press@pinterest.com

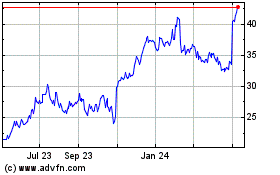

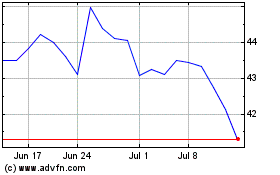

Pinterest (NYSE:PINS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pinterest (NYSE:PINS)

Historical Stock Chart

From Apr 2023 to Apr 2024