Current Report Filing (8-k)

April 13 2020 - 11:56AM

Edgar (US Regulatory)

0000931015

false

0000931015

2020-04-08

2020-04-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date

of earliest event reported): April 9, 2020

POLARIS INC.

(Exact name of Registrant as specified

in its charter)

|

Minnesota

|

|

1-11411

|

|

41-1790959

|

|

(State of Incorporation)

|

|

(Commission File Number)

|

|

(I.R.S. Employer Identification No.)

|

|

2100 Highway 55

|

|

|

|

Medina,

Minnesota

|

|

55340

|

|

(Address of principal

executive offices)

|

|

(Zip Code)

|

(Registrant’s telephone number, including

area code) (763) 542-0500

Polaris Industries Inc.

(Former name)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section

12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol

|

|

Name

of each exchange on which registered

|

|

Common

Stock, $.01 par value per share

|

|

PII

|

|

The New York Stock Exchange

|

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2

of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 1.01 Entry

into a Material Definitive Agreement

Item 2.03 Creation

of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

On April 9, 2020, Polaris

Inc. (“Polaris”) entered into an amendment to its existing credit facility with U.S. Bank National Association, as

administrative agent, and the several lenders party thereto such (the “Amended Credit Facility”) to provide for a

new incremental 364-Day Term Loan Agreement in the amount of $300.0 million (the “Incremental Term Loan Facility”).

The proceeds of the Incremental Term Loan Facility will be to finance general corporate operations.

The new Incremental Term

Loan Facility is unsecured and has a term of 364-days, ending on April 8, 2021 and can be extended for one additional 364-day

period to April 7, 2022 at Polaris’s request and consent of each lender party to a term loan under the Incremental Term

Loan Facility(the “Lenders”).

The applicable margin

for advances under the Incremental Term Loan Facility ranges from 0.50% to 1.25% for base rate advances and from 1.50% to 2.25%

for eurocurrency advances, in each case depending upon Polaris’s leverage ratio. In connection with the Incremental

Term Loan Facility, a floor of 0.75% was added for eurocurrency advances and other indexes and a floor of 1.75% was added for

base rate advances. The Amended Credit Facility continues to be subject to various covenants, including financial covenants requiring

that Polaris’ leverage ratio be less than or equal to 3.5 times Consolidated EBITDA as of the end of each of its fiscal

quarters. The Amended Credit Facility also continues to contain standard covenants with regards to mergers and consolidations,

asset sales, and is subject to acceleration upon various events of default.

A copy of the Amended

Credit Facility is filed as Exhibit 10.01 hereto qualifies the above description and is incorporated by reference herein.

A copy of the press release is furnished

herewith as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements

and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly

authorized.

Date: April 13, 2020

POLARIS INC.

|

/s/

Lucy Clark Dougherty

|

|

|

Lucy Clark Dougherty

|

|

|

Senior Vice President – General Counsel,

Chief Compliance Officer and Secretary

|

|

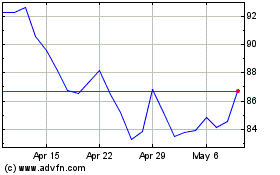

Polaris (NYSE:PII)

Historical Stock Chart

From Mar 2024 to Apr 2024

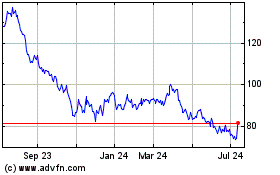

Polaris (NYSE:PII)

Historical Stock Chart

From Apr 2023 to Apr 2024