Amundi Pioneer Declares Monthly Distributions for Pioneer Closed-End Funds

June 04 2019 - 4:05PM

Business Wire

Amundi Pioneer Asset Management today announced the declaration

of dividends for five Pioneer closed-end funds for June.

Ex Date: June 17, 2019 Record Date: June 18, 2019

Payable: June 28, 2019

Ticker

Taxable

Funds

DistributionPer

Share

Change FromPrevious

Month

HNW Pioneer Diversified High Income Trust $0.0950 - PHD Pioneer

Floating Rate Trust $0.0625* $0.0025 PHT Pioneer High Income Trust

$0.0675 -

Ticker

Tax-Exempt

Funds

DistributionPer

Share

Change FromPrevious

Month

MAV Pioneer Municipal High Income Advantage Trust $0.0375**

-$0.0050 MHI Pioneer Municipal High Income Trust $0.0525 -

*PHD’s June per share distribution of $0.0625 represents a 4.2%

increase from the $0.0600 per share distribution paid in May. The

increase was due primarily to widening spreads in the floating rate

bond market, which allowed the Fund to replace maturing and

callable securities with new securities with higher yields,

increasing the Fund’s income. This change better aligns the Fund’s

distribution rates with its current and projected level of earnings

and reserves.

**MAV’s June per share distribution of $0.0375 represents a

11.8% decrease from the $0.0425 per share distribution paid in May.

The decrease was due primarily to reduced yields in the high yield

municipal bond market. The Fund’s maturing and callable securities

were often replaced with new securities with lower yields, reducing

the Fund’s income. This change better aligns the Fund’s

distribution rate with its current and projected level of earnings

and reserves.

MarketPrice

Market PriceDistribution Rate

NAV

NAVDistribution

Rate

Pioneer Diversified High Income Trust $14.14 8.06% $15.99 7.13%

Pioneer Floating Rate Trust $10.37 7.23% $12.02 6.24% Pioneer High

Income Trust $8.88 9.12% $9.81 8.26% Pioneer Municipal High Income

Advantage Trust $10.87 4.14% $11.82 3.81% Pioneer Municipal High

Income Trust $12.11 5.20% $12.85 4.90%

The closing market price and NAV are based on data as of June 3,

2019. The Market Price Distribution Rate is calculated by dividing

the latest declared monthly distribution per share (annualized) by

the market price. The NAV Distribution Rate is calculated by

dividing the latest declared monthly distribution per share

(annualized) by the NAV per share.

All funds are closed-end investment companies. PHD, PHT, MHI and

MAV trade on the New York Stock Exchange (NYSE). HNW trades on the

NYSEAMER.

Amundi Pioneer Asset Management, Inc. is each fund’s investment

adviser. On July 3, 2017, the name of the adviser was changed from

Pioneer Investment Management, Inc., coinciding with its

acquisition by Amundi. As a result of the transaction, Amundi

Pioneer Asset Management, Inc. became an indirect wholly owned

subsidiary of Amundi. Amundi, one of the world’s largest asset

managers, is headquartered in Paris, France.

Keep in mind, distribution rates are not guaranteed. A fund’s

distribution rate may be affected by numerous factors, including

changes in actual or projected investment income, the level of

undistributed net investment income, if any, and other factors.

Shareholders should not draw any conclusions about a fund’s

investment performance based on a fund’s current distributions.

Closed-end funds, unlike open-end funds, are not continuously

offered. Once issued, common shares of closed-end funds are bought

and sold in the open market through a stock exchange and frequently

trade at prices lower than their net asset value. Net Asset Value

(NAV) is total assets less total liabilities divided by the number

of common shares outstanding. For performance data on Amundi

Pioneer's closed-end funds, please call 800-225-6292 or visit our

closed-end pricing page.

About Amundi Pioneer Asset ManagementAmundi Pioneer is

the U.S. business of Amundi, Europe’s largest asset manager by

assets under management and ranked among the ten largest

globally[1]. Amundi Pioneer was formed in July 2017 when Amundi

acquired Pioneer Investments, and established Amundi Pioneer Asset

Management USA, Inc., based in Boston and Durham, NC. Boston is one

of Amundi’s six main global investment hubs and offers a broad

range of fixed-income, equity, and multi-asset investment solutions

in close partnership with wealth management firms, distribution

platforms, and institutional investors across the Americas, Europe,

and Asia-Pacific. Our long history of proprietary research, robust

risk management, disciplined investment processes, and strong

client relationships have made Amundi Pioneer an investment advisor

of choice among leading institutional and individual investors

worldwide. Amundi Pioneer had approximately $84.7 billion in assets

under management as of March 31, 2019.

[1] Source IPE “Top 400 asset managers” published in June 2018

and based on AUM as of end December 2017.

Visit amundipioneer.com for more information.

Follow us on www.linkedin.com/company/amundi-pioneer and

https://twitter.com/amundipioneer.

Amundi Pioneer Distributor, Inc., Member SIPC© 2019 Amundi

Pioneer Asset Management

View source

version on businesswire.com: https://www.businesswire.com/news/home/20190604005983/en/

Shareholder Inquiries: Please contact your financial advisor or

visit amundipioneer.com.

Broker/Advisor Inquiries Please Contact: 800-622-9876

Media Inquiries Please Contact: Geoff Smith, 617-422-4758

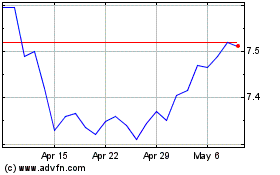

Pioneer High Income (NYSE:PHT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pioneer High Income (NYSE:PHT)

Historical Stock Chart

From Apr 2023 to Apr 2024