Philips Taps Into Remote Care Growth With $2.47 Billion BioTelemetry Deal -- Update

December 18 2020 - 4:41AM

Dow Jones News

--Philips seeks to boost telehealth operations to capitalize on

demand for remote care

--Dutch company will start a tender offer to buy BioTelemetry

shares at $72 each

--Philips expects acquisition to boost sales growth and

margin

By Adria Calatayud

Koninklijke Philips NV has agreed to buy U.S. remote

medical-technology company BioTelemetry Inc., in a $2.47 billion

deal that seeks to boost its telehealth operations to tap into

growing demand for remote care on the back of the coronavirus

pandemic.

The Dutch medical-technology company said Friday that Malvern,

Pennsylvania-based BioTelemetry, a provider of remote cardiac

diagnostics and monitoring, fits well in its strategy. Philips said

its strength in patient monitoring in hospitals will be

complemented by BioTelemetry's position outside hospitals.

Philips said telehealth services and remote monitoring are on

the rise around the world, as the pandemic has accelerated adoption

of these options as patients sought to stay away from

hospitals.

"Covid has been an accelerator. The technology was already

there, but doctors and patients liked coming in to hospitals for

their care," Chief Executive Frans van Houten said in a call with

reporters.

BioTelemetry President and CEO Joseph H. Capper said Philips'

portfolio, innovation and global scale will allow it to address the

rising demand for telehealth and remote-monitoring services.

While BioTelemetry focuses on the diagnosis and monitoring of

heart rhythm disorders and predominantly operates in the U.S.,

Philips aims to eventually add other therapeutic areas and take its

services to new markets, it said.

Philips said it will start a tender offer to acquire all of the

issued and outstanding shares of BioTelemetry for $72.00 each, to

be paid in cash upon completion. That price represents a 16.5%

premium to BioTelemetry's closing price on Thursday, Philips

said.

Philips said the deal implies an enterprise value for the target

of $2.8 billion, including BioTelemetry's cash and debt.

The acquisition of BioTelemetry will result in significant

synergies driven by cross-selling opportunities, geographical

expansion, portfolio innovation synergies, and productivity gains,

Philips said.

Since BioTelemetry has higher revenue growth rates and profit

margins than the Dutch company, Philips said the deal will be

accretive for its sales growth and adjusted earnings margin in

2021.

BioTelemetry said its board has approved the transaction and

recommends the offer to its shareholders. The acquisition is

expected to close in the first quarter of 2021, Philips said.

Shares in Philips at 0840 GMT were up EUR0.94, or 2.1%, at

EUR44.97.

Write to Adria Calatayud at adria.calatayud@dowjones.com

(END) Dow Jones Newswires

December 18, 2020 04:26 ET (09:26 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

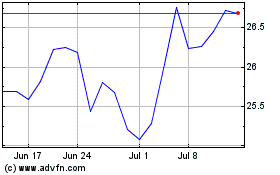

Koninklijke Philips NV (NYSE:PHG)

Historical Stock Chart

From Mar 2024 to Apr 2024

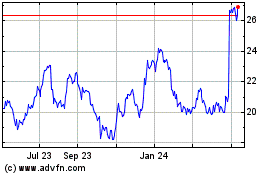

Koninklijke Philips NV (NYSE:PHG)

Historical Stock Chart

From Apr 2023 to Apr 2024