Current Report Filing (8-k)

October 29 2019 - 10:30AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 29, 2019

PARKER-HANNIFIN CORPORATION

(Exact name of registrant as spec

ified in its charter)

|

Ohio

|

|

1-4982

|

|

34-0451060

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

|

6035 Parkland Boulevard, Cleveland, Ohio

|

44124-4141

|

|

(Address of Principal

Executive Offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (216) 896-3000

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of Each Class

|

|

Trading

Symbol

|

|

Name of Each Exchange

on which Registered

|

|

Common Shares, $.50 par value

|

|

PH

|

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of

this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section

13(a) of the Exchange Act. ☐

Item 2.01. Completion of Acquisition or Disposition of Assets.

On October 29, 2019, Parker-Hannifin Corporation (“Parker”) completed its previously announced acquisition of LORD Corporation (“LORD”) pursuant to the terms of the Agreement and Plan of Merger, dated April 26, 2019 (the

“Merger Agreement”), by and among Parker, Erie Merger Sub, Inc., a wholly-owned subsidiary of Parker, LORD and Shareholder Representative Services LLC, as the shareholders’ representative (the “Acquisition”).

Pursuant to the Merger Agreement, Parker paid a purchase price of $3.675 billion in cash, on a cash-free, debt-free basis, subject to customary post-closing adjustments.

A copy of the Merger Agreement was filed as Exhibit 2.1 to the Current Report on Form 8-K filed by Parker with the Securities and Exchange Commission (the “SEC”) on April 29, 2019, and is incorporated herein by reference.

The foregoing description of the Merger Agreement does not purport to be complete and is qualified in its entirety by reference to the Merger Agreement.

Item 2.03. Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Obligation of a Registrant.

As previously disclosed, on May 22, 2019, Parker entered into a Credit Agreement (the “Credit Agreement”) among Parker, the lenders party thereto and KeyBank National Association, as administrative agent. The Credit

Agreement provides for a senior unsecured delayed-draw term loan facility in an aggregate principal amount of $800 million (the “Term Loan Facility”). In connection with the consummation of the Acquisition, on October 29, 2019, Parker borrowed $800

million in the aggregate under the Term Loan Facility to pay a portion of the purchase price and other fees and expenses related thereto.

Item 7.01. Regulation FD Disclosure.

On October 29, 2019, Parker issued a press release announcing the completion of the Acquisition. A copy of the press release is attached as Exhibit 99.1 and is incorporated herein by reference.

This information shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be

incorporated by reference into a filing under the Securities Act of 1933 or the Exchange Act, except as shall be set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(a) Financial statements of business acquired.

Parker will provide the financial statements required to be filed by Item 9.01(a) of Form 8-K by amendment to this Current Report on Form 8-K no later than the 71st day after the required filing date for this Current Report

on Form 8-K.

(b) Pro forma financial information.

Parker will provide the pro forma financial statements required to be filed by Item 9.01(b) of Form 8-K by amendment to this Current Report on Form 8-K no later than the 71st day after the required filing date for this

Current Report on Form 8-K.

(d) Exhibits.

|

Exhibit Number

|

|

Description

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*

|

Certain schedules have been omitted and Parker agrees to furnish supplementally to the SEC a copy of any omitted exhibits and schedules upon request.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

PARKER-HANNIFIN CORPORATION

|

|

|

|

|

|

|

|

|

|

|

|

|

October 29, 2019

|

By:

|

/s/ Joseph R. Leonti

|

|

|

|

|

Name:

|

Joseph R. Leonti

|

|

|

|

|

Title:

|

Vice President, General Counsel and Secretary

|

|

|

|

|

|

|

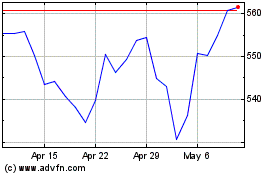

Parker Hannifin (NYSE:PH)

Historical Stock Chart

From Mar 2024 to Apr 2024

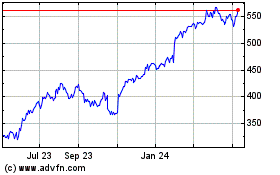

Parker Hannifin (NYSE:PH)

Historical Stock Chart

From Apr 2023 to Apr 2024