Going Beyond the Tampon, Big Brands Try New Ideas

September 17 2019 - 1:30PM

Dow Jones News

By Sharon Terlep

The market for feminine-care products has changed little in the

more than half-century since modern tampons hit stores.

Now, consumers' growing affinity for products that minimize

waste and cut down on chemicals is fueling interest in alternatives

to traditional pads and tampons. Some are products that have

existed for years yet failed to generate mass sales.

Kimberly-Clark Corp., which sells Kotex brand tampons and pads,

hopes to capitalize on the shift. The consumer-products giant is

investing $25 million in startup Thinx LLC, which makes reusable

period underwear.

The pairing aims to get the mostly online brand into mainstream

retailers like Target and Walmart.

Thinx has remained a niche product since it launched in 2015,

with $50 million in sales last year. Feminine-care products are a

$1.6 billion industry in the U.S., according to Nielsen data

provided by Wells Fargo.

Thinx Chief Executive Maria Molland said getting the brand into

big retailers will ensure consumers know it exists -- which has

been a major hurdle, she said. Thinx also makes a line of underwear

for bladder leaks called Speax.

"It takes a while to change behavior," Ms. Molland said, "and

part of how you do that is by letting people know you exist."

Kimberly-Clark's investment will enable Thinx to launch a

lower-cost line of underwear, she said, with prices between $15 and

$19 a pair, compared with current options with prices between $32

and $39.

Thinx, which isn't seeking other investors, hopes to leverage

Kimberly-Clark's relationships with retailers to get on store

shelves. It is already sold in Nordstrom Inc. stores and a handful

of other retailers.

Big consumer-products companies, long able to ignore smaller

rivals, are finding they need to respond as shoppers get more

comfortable with alternative products, said Svetlana Uduslivaia,

head of home and tech research at Euromonitor International.

Tampon sales are falling, she said, as population growth

stagnates and women increasingly seek natural products and

sustainability. Reusable products present a quandary for

consumer-products companies, she said, because they are a one-time

buy rather than a repeat purchase.

Procter & Gamble Co., the industry's biggest player, last

year launched a Tampax brand reusable silicone menstrual cup, which

women insert like a tampon and empty. Edgewell Personal Care Co.'s

o.b tampon brand this year launched an all-cotton line of

tampons.

Mariana Espinal, a Yale University School of Medicine resident

who is conducting a local study of women's menstrual needs, said

lack of awareness, along with unease over learning to use a new

product, are the main reasons women don't consider

alternatives.

"There hasn't been a big break in the media or a culture shift,"

Dr. Espinal said, referring to menstrual cups. "We are still

waiting for publicity or awareness."

Kimberly-Clark came out in 1919 with Kotex, the first disposable

sanitary napkin, at a time when advertisements for the product were

controversial because women's periods were taboo.

A Colorado doctor patented a design for the modern tampon in

1933, which became the Tampax brand and, eventually, Tambrands Inc.

P&G acquired the company in 1997 for $1.85 billion.

Joanne Bailey, director of the nurse-midwifery service at the

University of Michigan's Von Voigtlander Women's Hospital, said she

doubts products such as Thinx and the menstrual cup, of which there

are several brands that range from $6 to $40 on Amazon.com, will go

mainstream.

"Women don't want contact with their menstrual blood," she said.

"Anything that you have to touch the inside of your body in order

to use isn't going to appeal to a larger portion of the

population."

Write to Sharon Terlep at sharon.terlep@wsj.com

(END) Dow Jones Newswires

September 17, 2019 13:15 ET (17:15 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

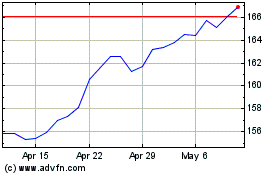

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Mar 2024 to Apr 2024

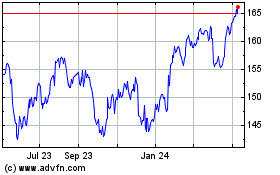

Procter and Gamble (NYSE:PG)

Historical Stock Chart

From Apr 2023 to Apr 2024