Provident Financial Services, Inc. (NYSE:PFS) (the “Company”)

reported net income of $27.1 million, or $0.37 per basic and

diluted share, for the three months ended September 30, 2020,

compared to net income of $31.4 million, or $0.49 per basic and

diluted share, for the three months ended September 30, 2019.

For the nine months ended September 30, 2020, the Company reported

net income of $56.4 million, or $0.84 per basic and diluted share,

compared to net income of $86.7 million, or $1.34 per basic and

diluted share, for the same period last year.

On July 31, 2020, the Company completed its

acquisition of SB One Bancorp ("SB One"), which added $2.19 billion

to total assets, $1.77 billion to loans, and $1.76 billion to

deposits. The results of operations for the three and nine months

ended September 30, 2020 included pre-tax non-recurring charges

related to the acquisition of SB One totaling $2.0 million and $3.1

million, respectively.

The Company’s earnings for the three and nine

months ended September 30, 2020 were also impacted by the January

1, 2020 adoption of a new accounting standard that requires the

current recognition of allowances for losses expected to be

incurred over the life of covered assets (“CECL”). The

acquisition of SB One and changing economic forecasts attributable

to the COVID-19 pandemic and projected economic recovery drove

provisions for credit losses and off-balance sheet credit exposures

totaling $6.7 million and $38.6 million for the three and nine

months ended September 30, 2020, respectively. The Company's

earnings were further impacted by COVID-19 related costs which

totaled $200,000 and $1.2 million for the three and nine months

ended September 30, 2020, respectively.

Christopher Martin, Chairman and Chief Executive

Officer commented: “We look forward to the opportunities that our

merger with SB One Bancorp provides our combined company, and we

welcome our new colleagues who joined us in the transaction.

Our team did a great job getting the acquisition completed on a

timely basis in a challenging operating environment.” Martin

added, “We continue to work with our borrowers who have been

impacted by this stressed economic environment and we are heartened

by the number of customers who have rebounded and resumed making

their full loan payments. In addition, our investments in

enhancing digital delivery channels have provided our customers

with a widely accepted and convenient platform for remote access to

their accounts and other services.”

Declaration of Quarterly

Dividend

The Company’s Board of Directors declared a

quarterly cash dividend of $0.23 per common share payable on

November 27, 2020, to stockholders of record as of the close of

business on November 13, 2020.

Balance Sheet Summary

Total assets at September 30, 2020 were

$12.87 billion, a $3.06 billion increase from December 31,

2019. The increase in total assets was primarily due to $2.19

billion of assets acquired from SB One, which includes $22.4

million of goodwill and $10.0 million of other intangible

assets, as well as an increase of $474.8 million related to

commercial loans made under the Paycheck Protection Program

("PPP").

The Company’s loan portfolio increased $2.42

billion to $9.76 billion at September 30, 2020, from $7.33

billion at December 31, 2019, which included $1.77 billion of

loans acquired from SB One and $474.8 million of commercial PPP

loans. For the nine months ended September 30, 2020, loan

originations, including advances on lines of credit, totaled $2.63

billion, compared with $2.04 billion for the same period in

2019. During the nine months ended September 30, 2020, the

loan portfolio had net increases of $1.17 billion in commercial

mortgage loans, $655.4 million in commercial loans, $319.2 million

in multi-family mortgage loans, $242.0 million in residential

mortgage loans, $32.3 million in construction loans and $15.1

million in consumer loans. Commercial real

estate, commercial and construction loans represented 82.3% of the

loan portfolio at September 30, 2020, compared to 80.0% at

December 31, 2019.

At September 30, 2020, the Company’s

unfunded loan commitments totaled $2.26 billion, including

commitments of $967.3 million in commercial loans, $697.4 million

in construction loans and $307.9 million in commercial mortgage

loans. Unfunded loan commitments at December 31, 2019

and September 30, 2019 were $1.47 billion and $1.65 billion,

respectively.

The loan pipeline, consisting of work-in-process

and loans approved pending closing, totaled $1.37 billion at

September 30, 2020, compared to $905.9 million and $1.09

billion at December 31, 2019 and September 30, 2019,

respectively.

Cash and cash equivalents were $510.1 million at

September 30, 2020, a $323.4 million increase from

December 31, 2019, largely due to increases in cash collateral

pledged to counterparties to secure loan-level swaps and short-term

investments and $78.1 million of cash and cash equivalents acquired

from SB One.

Total investments were $1.62 billion at

September 30, 2020, a $129.2 million increase from

December 31, 2019. This increase was mainly attributable

to investment securities acquired from SB One, partially offset by

repayments of mortgage-backed securities, maturities and calls of

certain municipal and agency bonds.

Banking premises and equipment increased $17.7

million for the nine months ended September 30, 2020, to $72.9

million, primarily due to assets acquired from SB One at a fair

value of $16.6 million.

Total deposits increased $2.46 billion during

the nine months ended September 30, 2020 to $9.56 billion.

The increase in total deposits consisted of $1.76 billion of

deposits acquired from SB One and additional net deposit growth of

$698.9 million. Total core deposits, consisting of savings and

demand deposit accounts, increased $2.05 billion to $8.41 billion

at September 30, 2020, while total time deposits increased

$410.7 million to $1.14 billion at September 30, 2020.

The increase in core deposits was largely attributable to an $821.6

million increase in non-interest bearing demand deposits, which

partially benefited from deposits retained from activity associated

with PPP loans and stimulus funding, a $511.1 million increase in

interest bearing demand deposits, a $386.7 million increase in

money market deposits and a $326.5 million increase in savings

deposits. The increase in time deposits was largely the

result of $577.3 million acquired from SB One, partially offset by

the outflow of time deposits totaling $166.6 million. Core

deposits represented 88.0% of total deposits at September 30,

2020, compared to 89.7% at December 31, 2019.

Borrowed funds increased $287.9 million during

the nine months ended September 30, 2020, to $1.41 billion.

The increase in borrowings for the period was primarily due to

$201.6 million acquired from SB One and asset funding

requirements. Borrowed funds represented 11.0% of total

assets at September 30, 2020, a decrease from 11.5% at

December 31, 2019.

Stockholders’ equity increased $187.7 million

during the nine months ended September 30, 2020, to $1.60 billion,

primarily due to common stock issued for the purchase of SB One,

net income earned for the period and an increase in unrealized

gains on available for sale debt securities, partially offset by

dividends paid to stockholders, the adoption of CECL on January 1,

2020 and the related charge to equity of $8.3 million, net of tax,

to establish initial allowances against credit losses and

off-balance sheet credit exposures, and common stock

repurchases. The Company issued 12,788,370 shares of common

stock from treasury stock in the acquisition of SB One. For

the three months ended September 30, 2020, common stock repurchases

totaled 69,549 shares at an average cost of $13.90, of which 1,045

shares, at an average cost of $12.86, were made in connection with

withholding to cover income taxes on the vesting of stock-based

compensation. For the nine months ended September 30, 2020,

common stock repurchases totaled 455,343 shares at an average cost

of $18.04, of which 49,461 shares, at an average cost of $19.69,

were made in connection with withholding to cover income taxes on

the vesting of stock-based compensation. At

September 30, 2020, approximately 1.1 million shares remained

eligible for repurchase under the current stock repurchase

authorization. Book value per share and tangible book value

per share(1) at September 30, 2020 were $20.41 and $14.45,

respectively, compared with $21.49 and $14.85, respectively, at

December 31, 2019.

Results of Operations

Net Interest Income and Net Interest

Margin

For the three months ended September 30, 2020,

net interest income increased $8.5 million to $82.0 million, from

$73.5 million for the same period in 2019. Net interest

income for the nine months ended September 30, 2020 decreased $1.3

million to $223.8 million, from $225.1 million for the same period

in 2019. Both comparative periods were favorably impacted by

the net assets acquired from SB One, partially offset by

period-over-period compression in the net interest margin as the

decrease in the yield on interest-earning assets outpaced the

decline in the Company's cost of interest-bearing

liabilities. This decline was tempered by growth in both

average loans outstanding and lower-costing average

interest-bearing and non-interest bearing core deposits. For

the nine months ended September 30, 2019, the Company recognized

the acceleration of accretion of $2.2 million in interest income

upon the prepayment of loans which had been non-accruing.

The Company’s net interest margin increased four

basis points to 3.01% for the quarter ended September 30,

2020, from 2.97% for the trailing quarter, primarily due to

decreases in funding costs and growth in non-interest bearing

deposits. The weighted average yield on interest-earning

assets decreased three basis points to 3.44% for the quarter ended

September 30, 2020, compared to 3.47% for the quarter ended

June 30, 2020. The weighted average cost of

interest-bearing liabilities for the quarter ended

September 30, 2020 decreased 11 basis points to 0.57%,

compared to 0.68% for the trailing quarter. The average cost

of interest bearing deposits for the quarter ended

September 30, 2020 was 0.44%, compared to 0.54% for the

trailing quarter ended June 30, 2020. Average

non-interest bearing demand deposits totaled $2.21 billion for the

quarter ended September 30, 2020, compared with $1.85 billion

for the trailing quarter ended June 30, 2020. The

average cost of all deposits, including non-interest bearing

deposits, was 33 basis points for the quarter ended

September 30, 2020, compared with 41 basis points for the

trailing quarter. The average cost of borrowed funds for the

quarter ended September 30, 2020 was 1.19%, compared to 1.31%

for the trailing quarter.

The net interest margin decreased 22 basis

points to 3.01% for the quarter ended September 30, 2020,

compared to 3.23% for the quarter ended September 30,

2019. The weighted average yield on interest-earning assets

decreased 65 basis points to 3.44% for the quarter ended

September 30, 2020, compared to 4.09% for the quarter ended

September 30, 2019, while the weighted average cost of

interest bearing liabilities decreased 56 basis points for the

quarter ended September 30, 2020 to 0.57%, compared to the

third quarter of 2019. The average cost of interest bearing

deposits for the quarter ended September 30, 2020 was 0.44%,

compared to 0.87% for the same period last year. Average

non-interest bearing demand deposits totaled $2.21 billion for the

quarter ended September 30, 2020, compared to $1.51 billion

for the quarter ended September 30, 2019. The average

cost of all deposits, including non-interest bearing deposits, was

33 basis points for the quarter ended September 30, 2020,

compared with 68 basis points for the quarter ended

September 30, 2019. The average cost of borrowed funds

for the quarter ended September 30, 2020 was 1.19%, compared

to 2.13% for the same period last year.

For the nine months ended September 30, 2020,

the net interest margin decreased 29 basis points to 3.06%,

compared to 3.35% for the nine months ended September 30,

2019. The weighted average yield on interest earning assets

declined 59 basis points to 3.60% for the nine months ended

September 30, 2020, compared to 4.19% for the nine months ended

September 30, 2019, while the weighted average cost of interest

bearing liabilities decreased 38 basis points to 0.72% for the nine

months ended September 30, 2020, compared to 1.10% for the same

period last year. The average cost of interest bearing

deposits decreased 26 basis points to 0.58% for the nine months

ended September 30, 2020, compared to 0.84% for the same period

last year. Average non-interest bearing demand deposits

totaled $1.85 billion for the nine months ended September 30, 2020,

compared with $1.47 billion for the nine months ended September 30,

2019. The average cost of all deposits, including

non-interest bearing deposits, was 44 basis points for the nine

months ended September 30, 2020, compared with 61 basis points for

the nine months ended September 30, 2019. The average cost of

borrowings for the nine months ended September 30, 2020 was 1.42%,

compared to 2.13% for the same period last year.

Non-Interest Income

Non-interest income totaled $20.6 million for

the quarter ended September 30, 2020, an increase of $2.6

million, compared to the same period in 2019. Insurance

agency income, a new revenue opportunity for the Company resulting

from the SB One acquisition, totaled $1.7 million for the three

months ended September 30, 2020. Other income increased $1.6

million to $4.7 million for the three months ended September 30,

2020, compared to the quarter ended September 30, 2019,

primarily due to a $1.2 million increase in net fees on loan-level

interest rate swap transactions, a $171,000 increase in net gains

on the sale of foreclosed real estate and a $159,000 increase in

net gains on the sale of fixed assets. Wealth management

income increased $763,000 to $6.8 million for the three months

ended September 30, 2020. The increase was largely a function

of market improvements in the value of assets under management and

an increase in managed mutual fund fees. Also, income from

Bank-owned life insurance ("BOLI") increased $372,000 to $1.6

million for the three months ended September 30, 2020, compared to

the same period in 2019, primarily due to an increase in benefit

claims, partially offset by lower equity valuations.

Partially offsetting these increases, fee income decreased $1.9

million to $5.7 million for the three months ended September 30,

2020, compared to the same period in 2019, largely due to a $1.0

million decrease in commercial loan prepayment fees and an $850,000

decrease in deposit related fees. The decrease in fee income

is largely due to the effects of COVID-19 on consumer and business

activities.

For the nine months ended September 30, 2020,

non-interest income totaled $52.0 million, an increase of $5.9

million, compared to the same period in 2019. Other income

increased $4.9 million to $9.7 million for the nine months ended

September 30, 2020, compared to $4.8 million for the same period in

2019, due to a $3.9 million increase in net fees on loan-level

interest rate swap transactions, an $800,000 increase in net gains

on the sale of fixed assets and a $684,000 increase in net gains on

the sale of foreclosed real estate, partially offset by a $300,000

decrease in net gains from the sale of loans. Wealth

management income increased $2.7 million to $19.1 million for the

nine months ended September 30, 2020, compared to the same period

in 2019, primarily due to fees earned on assets under management

acquired in the April 1, 2019 Tirschwell & Loewy ("T&L")

acquisition, partially offset by a decrease in managed mutual fund

fees. Also, insurance agency income totaled $1.7 million

derived from the July 31, 2020 acquisition of SB One.

Partially offsetting these increases, fee income decreased $3.4

million, primarily due to a $2.1 million decrease in deposit

related fees, an $838,000 decrease in commercial loan prepayment

fees and a $100,000 decrease in non-deposit investment fee income,

all largely due to the effects of COVID-19 on consumer and business

activities.

Non-Interest Expense

For the three months ended September 30, 2020,

non-interest expense totaled $59.8 million, an increase of $10.0

million, compared to the three months ended September 30,

2019. Non-interest expense for the three months ended

September 30, 2020, included non-recurring costs related to the

acquisition of SB One and two months of expenses associated with

the operation of the former SB One franchise. Compensation

and benefits expense increased $6.3 million to $35.7 million for

the three months ended September 30, 2020, compared to $29.4

million for the same period in 2019. This increase was

principally due to an increase in salary expense associated with

the addition of former SB One employees, COVID-19 supplemental pay

for branch employees and an increase in severance expense,

partially offset by a decrease in stock-based compensation.

Other operating expenses increased $1.9 million to $9.8 million for

the three months ended September 30, 2020, compared to the same

period in 2019, largely due to increases in legal and consulting

expenses, which included $1.8 million related to the acquisition of

SB One. FDIC insurance increased $1.2 million due to the

addition of SB One, along with increases in both the insurance

assessment rate and total assets subject to assessment. Data

processing expense increased $912,000 to $5.0 million for the three

months ended September 30, 2020, compared with the same period in

2019, primarily due to increases in software subscription service

expense and on-line banking costs. Partially offsetting these

increases, credit loss expense for off-balance sheet credit

exposures under the CECL standard was reduced $575,000 in the

quarter, due to a decrease in loss factors associated with the

current economic forecast, partially offset by an increase in the

pipeline of loans approved awaiting closing, largely due to the

addition of the SB One loan pipeline.

Non-interest expense totaled $169.2 million for

the nine months ended September 30, 2020, an increase of $21.3

million, compared to $147.8 million for the nine months ended

September 30, 2019. Compensation and benefits expense

increased $9.4 million to $96.1 million for the nine months ended

September 30, 2020, compared to $86.7 million for the nine months

ended September 30, 2019, primarily due to an increase in salary

expense associated with the addition of former SB One and T&L

employees, an increase in severance expense and COVID 19

supplemental pay for branch employees, partially offset by the

increased deferral of salary expense related to PPP loan

originations. For the nine months ended September 30, 2020,

credit loss expense for off-balance sheet credit exposures was $5.7

million related to the January 1, 2020 adoption of CECL, and the

subsequent increase in loss factors due to the current economic

forecast, increase in the pipeline of loans approved awaiting

closing and an increase in availability on committed lines of

credit due to below average utilization. Other operating

expenses increased $3.8 million to $26.4 million for the nine

months ended September 30, 2020, compared to the same period in

2019, largely due to an increase in legal and consulting expenses

related to the SB One transaction and a market valuation adjustment

on foreclosed real estate. Data processing expense increased

$2.0 million to $14.4 million for the nine months ended September

30, 2020, compared to $12.4 million for the same period in 2019,

principally due to increases in software subscription service

expense and on-line banking costs. FDIC insurance increased

$786,000 for the nine months ended September 30, 2020, primarily

due to the addition of SB One and increases in both the insurance

assessment rate and total assets subject to assessment.

Partially offsetting these increases, net occupancy expense

decreased $267,000 to $19.4 million for the nine months ended

September 30, 2020, compared to the same period in 2019, due to

reductions in snow removal, depreciation expenses and branch

closures, partially offset by additional occupancy expense related

to SB One.

The Company’s annualized adjusted non-interest

expense as a percentage of average assets(1) was 1.92% for the

quarter ended September 30, 2020, compared to 1.99% for the

same period in 2019, with the 2020 improvement driven by the

significant increase in average assets largely attributable to

assets acquired from SB One and PPP loans. For the nine

months ended September 30, 2020, the Company’s annualized adjusted

non-interest expense as a percentage of average assets(1) was

1.97%, compared to 2.01% for the same period in 2019. The

efficiency ratio (adjusted non-interest expense divided by the sum

of net interest income and non-interest income)(1) was 56.72% and

57.69% for the quarter and nine months ended September 30, 2020,

respectively, compared to 54.31% and 54.52% for the same respective

periods in 2019.

Asset Quality

The Company’s total non-performing loans at

September 30, 2020 were $49.0 million, or 0.50% of total

loans, compared to $35.5 million, or 0.46% of total loans at

June 30, 2020, and $40.2 million, or 0.55% of total loans at

December 31, 2019. The $13.5 million increase in

non-performing loans at September 30, 2020, compared to the

trailing quarter, included $11.5 million of non-performing loans

acquired from SB One and consisted of an $11.5 million increase in

non-performing commercial mortgage loans, a $2.6 million increase

in non-performing residential loans and a $347,000 increase in

non-performing consumer loans, partially offset by a $1.2 million

decrease in non-performing commercial loans. At

September 30, 2020, impaired loans totaled $65.8 million with

related specific reserves of $3.3 million, compared with impaired

loans totaling $63.1 million with related specific reserves of $3.6

million at June 30, 2020. At December 31, 2019,

impaired loans totaled $70.6 million with related specific reserves

of $5.1 million.

Loans that have been or are expected to be

granted COVID-19 related deferrals or modifications have decreased

from a peak level of $1.31 billion, or 16.8% of loans, to $310.8

million, or 3.2% of loans as of October 16, 2020. This $310.8

million of loans includes $47.5 million acquired from SB One and

consists of $27.0 million in a first 90-day deferral period, $84.9

million in a second 90-day deferral period, and $198.9 million that

have completed their initial deferral periods, but are expected to

require ongoing assistance. Included in the $310.8

million of loans, $92.4 million are secured by hotels, $43.7

million are secured by retail properties, $31.4 million are secured

by restaurants, $15.1 million are secured by suburban office space,

and $42.7 million are secured by residential mortgages, with the

balance comprised of diverse commercial loans.

At September 30, 2020, the Company’s

allowance for credit losses related to the loan portfolio was 1.09%

of total loans, compared to 1.11% and 0.76% at June 30, 2020

and December 31, 2019, respectively. The Company

recorded provisions for credit losses of $6.4 million and $32.0

million for the three and nine months ended September 30, 2020,

respectively, compared with provisions of $500,000 and $10.2

million for the three and nine months ended September 30, 2019,

respectively. For the three and nine months ended September

30, 2020, the Company had net recoveries of $59,000 and net

charge-offs of $2.7 million, respectively, compared to net

charge-offs of $6.0 million and $8.4 million, respectively, for the

same periods in 2019. The allowance for loan losses increased

$50.8 million to $106.3 million at September 30, 2020 from

$55.5 million at December 31, 2019. The increase in the

allowance for credit losses was attributable to elevated provisions

for credit losses primarily due to the current weak economic

forecast attributable to the COVID-19 pandemic and the adoption of

CECL, along with $15.5 million and $13.6 million additions to the

allowance for credit losses for loans and purchased credit

deteriorated ("PCD") loans, respectively, related to the

acquisition of the SB One loan portfolio. In addition, a

gross allowance for credit losses of $7.9 million and a related

deferred tax asset were recorded against equity upon the January 1,

2020 adoption of CECL. Future credit loss provisions are

subject to significant uncertainty given the undetermined nature of

prospective changes in economic conditions, as the impact of the

COVID-19 pandemic continues to unfold. The effectiveness of

medical advances, government programs, and the resulting impact on

consumer behavior and employment conditions will have a material

bearing on future credit conditions and reserve requirements.

At September 30, 2020 and December 31,

2019, the Company held foreclosed assets of $4.7 million and $2.7

million, respectively. During the nine months ended September

30, 2020, there were three additions to foreclosed assets with a

carrying value of $2.6 million and 11 properties sold with a

carrying value of $2.5 million and valuation charges of

$556,000. Foreclosed assets acquired from SB One totaled $2.4

million. Foreclosed assets at September 30, 2020

consisted of $2.8 million of commercial real estate, $1.5 million

of commercial vehicles and $400,000 of residential real

estate. Total non-performing assets at September 30,

2020 increased $10.8 million to $53.7 million, or 0.42% of total

assets, from $42.9 million, or 0.44% of total assets at

December 31, 2019.

Income Tax Expense

For the three months ended September 30, 2020,

the Company’s income tax expense was $9.3 million with an effective

tax rate of 25.5%, compared with income tax expense of $9.9 million

with an effective tax rate of 24.0% for the three months ended

September 30, 2019. For the nine months ended September 30,

2020, the Company's income tax expense was $18.3 million with an

effective tax rate of 24.5%, compared with $26.4 million with an

effective tax rate of 23.4% for the nine months ended September 30,

2019. The decreases in tax expense for the three and nine

months ended September 30, 2020 compared with the same periods in

2019 were largely the result of decreases in taxable income, while

the increases in the effective tax rates for the three and nine

months ended September 30, 2020 compared with the same periods in

2019 were primarily due to increased projections of taxable income

for the remainder of the year and decreases in the proportion of

income derived from tax exempt sources to total pre-tax income.

About the Company

Provident Financial Services, Inc. is the

holding company for Provident Bank, a community-oriented bank

offering "commitment you can count on" since 1839. Provident

Bank provides a comprehensive array of financial products and

services through its network of branches throughout northern and

central New Jersey, as well as Bucks, Lehigh and Northampton

counties in Pennsylvania and Queens County, New York. The

Bank also provides fiduciary and wealth management services through

its wholly owned subsidiary, Beacon Trust Company and insurance

brokerage services through its wholly owned subsidiary, SB One

Insurance Agency, Inc.

Post Earnings Conference

Call

Representatives of the Company will hold a

conference call for investors on Friday, October 30, 2020 at

10:00 a.m. Eastern Time to discuss the Company’s financial results

for the quarter ended September 30, 2020. The call may

be accessed by dialing 1-888-336-7149 (Domestic), 1-412-902-4175

(International) or 1-855-669-9657 (Canada). Internet access

to the call is also available (listen only) at provident.bank by

going to Investor Relations and clicking on "Webcast."

Forward Looking Statements

Certain statements contained herein are

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934. Such forward-looking statements may be

identified by reference to a future period or periods, or by the

use of forward-looking terminology, such as “may,” “will,”

“believe,” “expect,” “estimate,” "project," "intend," “anticipate,”

“continue,” or similar terms or variations on those terms, or the

negative of those terms. Forward-looking statements are

subject to numerous risks and uncertainties, including, but not

limited to, those set forth in Item 1A of the Company's Annual

Report on Form 10-K, as supplemented by its Quarterly Reports on

Form 10-Q, and those related to the economic environment,

particularly in the market areas in which the Company operates,

competitive products and pricing, fiscal and monetary policies of

the U.S. Government, changes in accounting policies and practices

that may be adopted by the regulatory agencies and the accounting

standards setters, changes in government regulations affecting

financial institutions, including regulatory fees and capital

requirements, changes in prevailing interest rates, acquisitions

and the integration of acquired businesses, credit risk management,

asset-liability management, the financial and securities markets

and the availability of and costs associated with sources of

liquidity.

In addition, the COVID-19 pandemic is having an

adverse impact on the Company, its customers and the communities it

serves. Given its ongoing and dynamic nature, it is difficult to

predict the full impact of the COVID-19 outbreak on the Company's

business, financial condition or results of operations. The

extent of such impact will depend on future developments, which are

highly uncertain, including when the coronavirus can be controlled

and abated, and the extent to which the economy can remain open. As

the result of the COVID-19 pandemic and the related adverse local

and national economic consequences, the Company could be subject to

any of the following risks, any of which could have a material,

adverse effect on our business, financial condition, liquidity, and

results of operations: the demand for our products and services may

decline, making it difficult to grow assets and income; if the

economy is unable to remain substantially open, and high levels of

unemployment continue for an extended period of time, loan

delinquencies, problem assets, and foreclosures may increase,

resulting in increased charges and reduced income; collateral for

loans, especially real estate, may decline in value, which could

cause loan losses to increase; our allowance for loan losses may

increase if borrowers experience financial difficulties, which will

adversely affect our net income; the net worth and liquidity of

loan guarantors may decline, impairing their ability to honor

commitments to us; as the result of the decline in the Federal

Reserve Board’s target federal funds rate to near 0%, the yield on

our assets may decline to a greater extent than the decline in our

cost of interest-bearing liabilities, reducing our net interest

margin and spread and reducing net income; our wealth management

revenues may decline with continuing market turmoil; we may face

the risk of a goodwill write-down due to stock price decline; and

our cyber security risks are increased as the result of an increase

in the number of employees working remotely.

The Company cautions readers not to place undue

reliance on any such forward-looking statements which speak only as

of the date made. The Company advises readers that the

factors listed above could affect the Company's financial

performance and could cause the Company's actual results for future

periods to differ materially from any opinions or statements

expressed with respect to future periods in any current

statements. The Company does not have any obligation to

update any forward-looking statements to reflect events or

circumstances after the date of this statement.

Footnotes

(1) Tangible book value per

share, annualized return on average tangible equity, annualized

adjusted non-interest expense as a percentage of average assets and

the efficiency ratio are non-GAAP financial measures. Please

refer to the Notes following the Consolidated Financial Highlights

which contain the reconciliation of GAAP to non-GAAP financial

measures and the associated calculations.

| |

|

|

|

|

PROVIDENT FINANCIAL SERVICES, INC. AND

SUBSIDIARY |

|

Consolidated Statements of Financial Condition |

|

September 30, 2020 (Unaudited) and December 31, 2019 |

|

(Dollars in Thousands) |

| |

|

|

|

|

Assets |

September 30, 2020 |

|

December 31, 2019 |

| |

|

|

|

| Cash and due from banks |

$ |

382,014 |

|

|

$ |

131,555 |

|

| Short-term investments |

128,124 |

|

|

55,193 |

|

|

Total cash and cash equivalents |

510,138 |

|

|

186,748 |

|

| |

|

|

|

| Available for sale debt

securities, at fair value |

1,100,391 |

|

|

976,919 |

|

| Held to maturity debt

securities, net (fair value of $467,769 at September 30, 2020

(unaudited) and $467,966 at December 31, 2019) |

446,591 |

|

|

453,629 |

|

| Equity securities, at fair

value |

869 |

|

|

825 |

|

| Federal Home Loan Bank

stock |

69,975 |

|

|

57,298 |

|

| Loans |

9,756,809 |

|

|

7,332,885 |

|

|

Less allowance for credit losses |

106,314 |

|

|

55,525 |

|

|

Net loans |

9,650,495 |

|

|

7,277,360 |

|

| Foreclosed assets, net |

4,720 |

|

|

2,715 |

|

| Banking premises and

equipment, net |

72,909 |

|

|

55,210 |

|

| Accrued interest

receivable |

43,967 |

|

|

29,031 |

|

| Intangible assets |

467,128 |

|

|

437,019 |

|

| Bank-owned life insurance |

234,410 |

|

|

195,533 |

|

| Other assets |

269,729 |

|

|

136,291 |

|

|

Total assets |

$ |

12,871,322 |

|

|

$ |

9,808,578 |

|

| |

|

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

| |

|

|

|

| Deposits: |

|

|

|

|

Demand deposits |

$ |

7,104,322 |

|

|

$ |

5,384,868 |

|

|

Savings deposits |

1,310,231 |

|

|

983,714 |

|

|

Certificates of deposit of $100,000 or more |

627,041 |

|

|

438,551 |

|

|

Other time deposits |

517,647 |

|

|

295,476 |

|

|

Total deposits |

9,559,241 |

|

|

7,102,609 |

|

| Mortgage escrow deposits |

27,510 |

|

|

26,804 |

|

| Borrowed funds |

1,413,029 |

|

|

1,125,146 |

|

| Subordinated debentures |

25,099 |

|

|

— |

|

| Other liabilities |

244,874 |

|

|

140,179 |

|

|

Total liabilities |

11,269,753 |

|

|

8,394,738 |

|

| |

|

|

|

| Stockholders' equity: |

|

|

|

| Preferred stock, $0.01 par

value, 50,000,000 shares authorized, none issued |

— |

|

|

— |

|

| Common stock, $0.01 par value,

200,000,000 shares authorized, 83,209,293 shares issued and

78,481,159 shares outstanding at September 30, 2020 and 65,787,900

outstanding at December 31, 2019 |

832 |

|

|

832 |

|

| Additional paid-in

capital |

960,863 |

|

|

1,007,303 |

|

| Retained earnings |

694,240 |

|

|

695,273 |

|

| Accumulated other

comprehensive income |

13,331 |

|

|

3,821 |

|

| Treasury stock |

(45,118 |

) |

|

(268,504 |

) |

| Unallocated common stock held

by the Employee Stock Ownership Plan |

(22,579 |

) |

|

(24,885 |

) |

| Common Stock acquired by the

Directors' Deferred Fee Plan |

(3,330 |

) |

|

(3,833 |

) |

| Deferred Compensation -

Directors' Deferred Fee Plan |

3,330 |

|

|

3,833 |

|

|

Total stockholders' equity |

1,601,569 |

|

|

1,413,840 |

|

|

Total liabilities and stockholders' equity |

$ |

12,871,322 |

|

|

$ |

9,808,578 |

|

|

PROVIDENT FINANCIAL SERVICES, INC. AND

SUBSIDIARY |

|

Consolidated Statements of Income |

|

Three and Nine Months Ended September 30, 2020 and 2019

(Unaudited) |

|

(Dollars in Thousands, except per share data) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Nine Months Ended |

| |

September 30, |

|

September 30, |

| |

2020 |

|

2019 |

|

2020 |

|

2019 |

| Interest income: |

|

|

|

|

|

|

|

|

Real estate secured loans |

$ |

58,897 |

|

|

$ |

56,402 |

|

|

$ |

162,635 |

|

|

$ |

167,051 |

|

|

Commercial loans |

20,622 |

|

|

20,104 |

|

|

58,238 |

|

|

63,788 |

|

|

Consumer loans |

4,305 |

|

|

4,648 |

|

|

12,024 |

|

|

14,216 |

|

|

Available for sale debt securities, equity securities and Federal

Home Loan Bank stock |

6,321 |

|

|

7,918 |

|

|

19,669 |

|

|

24,584 |

|

|

Held to maturity debt securities |

2,836 |

|

|

3,075 |

|

|

8,661 |

|

|

9,408 |

|

|

Deposits, federal funds sold and other short-term investments |

472 |

|

|

879 |

|

|

1,932 |

|

|

2,038 |

|

|

Total interest income |

93,453 |

|

|

93,026 |

|

|

263,159 |

|

|

281,085 |

|

| |

|

|

|

|

|

|

|

| Interest expense: |

|

|

|

|

|

|

|

|

Deposits |

7,400 |

|

|

11,730 |

|

|

26,000 |

|

|

33,940 |

|

|

Borrowed funds |

3,862 |

|

|

7,768 |

|

|

13,120 |

|

|

22,055 |

|

|

Subordinated debt |

206 |

|

|

— |

|

|

206 |

|

|

— |

|

|

Total interest expense |

11,468 |

|

|

19,498 |

|

|

39,326 |

|

|

55,995 |

|

|

Net interest income |

81,985 |

|

|

73,528 |

|

|

223,833 |

|

|

225,090 |

|

| Provision for credit

losses |

6,400 |

|

|

500 |

|

|

32,017 |

|

|

10,200 |

|

|

Net interest income after provision for credit losses |

75,585 |

|

|

73,028 |

|

|

191,816 |

|

|

214,890 |

|

| |

|

|

|

|

|

|

|

| Non-interest income: |

|

|

|

|

|

|

|

|

Fees |

5,736 |

|

|

7,634 |

|

|

17,179 |

|

|

20,617 |

|

|

Wealth management income |

6,847 |

|

|

6,084 |

|

|

19,075 |

|

|

16,406 |

|

|

Insurance agency income |

1,711 |

|

|

— |

|

|

1,711 |

|

|

— |

|

|

Bank-owned life insurance |

1,644 |

|

|

1,272 |

|

|

4,290 |

|

|

4,253 |

|

|

Net gain on securities transactions |

— |

|

|

— |

|

|

55 |

|

|

29 |

|

|

Other income |

4,688 |

|

|

3,057 |

|

|

9,672 |

|

|

4,764 |

|

|

Total non-interest income |

20,626 |

|

|

18,047 |

|

|

51,982 |

|

|

46,069 |

|

| |

|

|

|

|

|

|

|

| Non-interest expense: |

|

|

|

|

|

|

|

|

Compensation and employee benefits |

35,700 |

|

|

29,376 |

|

|

96,095 |

|

|

86,735 |

|

|

Net occupancy expense |

6,993 |

|

|

6,413 |

|

|

19,362 |

|

|

19,629 |

|

|

Data processing expense |

5,026 |

|

|

4,114 |

|

|

14,439 |

|

|

12,447 |

|

|

FDIC Insurance |

1,185 |

|

|

— |

|

|

1,953 |

|

|

1,167 |

|

|

Amortization of intangibles |

918 |

|

|

827 |

|

|

2,373 |

|

|

2,161 |

|

|

Advertising and promotion expense |

773 |

|

|

1,098 |

|

|

2,774 |

|

|

3,059 |

|

|

Credit loss (benefit) expense for off-balance sheet credit

exposures |

(575 |

) |

|

— |

|

|

5,714 |

|

|

— |

|

|

Other operating expenses |

9,763 |

|

|

7,910 |

|

|

26,447 |

|

|

22,650 |

|

|

Total non-interest expense |

59,783 |

|

|

$ |

49,738 |

|

|

169,157 |

|

|

147,848 |

|

|

Income before income tax expense |

36,428 |

|

|

$ |

41,337 |

|

|

74,641 |

|

|

113,111 |

|

| Income tax expense |

9,285 |

|

|

9,938 |

|

|

18,257 |

|

|

26,429 |

|

|

Net income |

$ |

27,143 |

|

|

$ |

31,399 |

|

|

$ |

56,384 |

|

|

$ |

86,682 |

|

| |

|

|

|

|

|

|

|

| Basic earnings per share |

$ |

0.37 |

|

|

$ |

0.49 |

|

|

$ |

0.84 |

|

|

$ |

1.34 |

|

| Average basic shares

outstanding |

72,519,123 |

|

|

64,511,956 |

|

|

67,093,442 |

|

|

64,720,642 |

|

| |

|

|

|

|

|

|

|

| Diluted earnings per

share |

$ |

0.37 |

|

|

$ |

0.49 |

|

|

$ |

0.84 |

|

|

$ |

1.34 |

|

| Average diluted shares

outstanding |

72,604,298 |

|

|

64,632,285 |

|

|

67,173,876 |

|

|

64,852,983 |

|

|

PROVIDENT FINANCIAL SERVICES, INC. AND

SUBSIDIARY |

|

Consolidated Financial Highlights |

|

(Dollars in Thousands, except share data) (Unaudited) |

| |

|

|

|

| |

At or for the |

|

At or for the |

| |

Three months ended September 30, |

|

Nine months ended September 30, |

| |

2020 |

|

2019 |

|

2020 |

|

2019 |

| Statement of

Income |

|

|

|

|

|

|

|

|

Net interest income |

$ |

81,985 |

|

|

|

$ |

73,528 |

|

|

$ |

223,833 |

|

|

|

$ |

225,090 |

|

|

|

Provision for credit losses |

6,400 |

|

|

|

500 |

|

|

32,017 |

|

|

|

10,200 |

|

|

|

Non-interest income |

20,626 |

|

|

|

18,047 |

|

|

51,982 |

|

|

|

46,069 |

|

|

|

Non-interest expense |

59,783 |

|

|

|

49,738 |

|

|

169,157 |

|

|

|

147,848 |

|

|

|

Income before income tax expense |

36,428 |

|

|

|

41,337 |

|

|

74,641 |

|

|

|

113,111 |

|

|

|

Net income |

27,143 |

|

|

|

31,399 |

|

|

56,384 |

|

|

|

86,682 |

|

|

|

Diluted earnings per share |

$ |

0.37 |

|

|

|

$ |

0.49 |

|

|

$ |

0.84 |

|

|

|

$ |

1.34 |

|

|

|

Interest rate spread |

2.87 |

|

% |

|

2.96 |

% |

|

2.88 |

|

% |

|

3.09 |

|

% |

|

Net interest margin |

3.01 |

|

% |

|

3.23 |

% |

|

3.06 |

|

% |

|

3.35 |

|

% |

| |

|

|

|

|

|

|

|

|

Profitability |

|

|

|

|

|

|

|

|

Annualized return on average assets |

0.90 |

|

% |

|

1.26 |

% |

|

0.70 |

|

% |

|

1.18 |

|

% |

|

Annualized return on average equity |

7.04 |

|

% |

|

8.90 |

% |

|

5.18 |

|

% |

|

8.34 |

|

% |

|

Annualized return on average tangible equity (2) |

10.05 |

|

% |

|

12.97 |

% |

|

7.45 |

|

% |

|

12.11 |

|

% |

|

Annualized non-interest expense to average assets (3) |

1.92 |

|

% |

|

1.99 |

% |

|

1.97 |

|

% |

|

2.01 |

|

% |

|

Efficiency ratio (4) |

56.72 |

|

% |

|

54.31 |

% |

|

57.69 |

|

% |

|

54.52 |

|

% |

| |

|

|

|

|

|

|

|

| Asset

Quality |

|

|

|

|

|

|

|

|

Non-accrual loans |

|

|

|

|

$ |

48,953 |

|

|

|

$ |

39,981 |

|

|

|

90+ and still accruing |

|

|

|

|

— |

|

|

|

— |

|

|

|

Non-performing loans |

|

|

|

|

48,953 |

|

|

|

39,981 |

|

|

|

Foreclosed assets |

|

|

|

|

4,720 |

|

|

|

1,534 |

|

|

|

Non-performing assets |

|

|

|

|

53,673 |

|

|

|

41,515 |

|

|

|

Non-performing loans to total loans |

|

|

|

|

0.50 |

|

% |

|

0.55 |

|

% |

|

Non-performing assets to total assets |

|

|

|

|

0.42 |

|

% |

|

0.42 |

|

% |

|

Allowance for loan losses |

|

|

|

|

$ |

106,314 |

|

|

|

$ |

57,344 |

|

|

|

Allowance for loan losses to total non-performing loans |

|

|

|

|

217.18 |

|

% |

|

143.43 |

|

% |

|

Allowance for loan losses to total loans |

|

|

|

|

1.09 |

|

% |

|

0.79 |

|

% |

|

Net loan (recoveries) charge-offs |

$ |

(59 |

) |

|

|

5,966 |

|

|

$ |

2,727 |

|

|

|

8,418 |

|

|

|

Annualized net loan (recoveries) charge offs to average total

loans |

— |

|

% |

|

0.33 |

% |

|

0.05 |

|

% |

|

0.16 |

|

% |

| |

|

|

|

|

|

|

|

| Average Balance Sheet

Data |

|

|

|

|

|

|

|

|

Assets |

$ |

12,063,681 |

|

|

|

$ |

9,899,693 |

|

|

$ |

10,811,585 |

|

|

|

$ |

9,811,371 |

|

|

|

Loans, net |

8,931,927 |

|

|

|

7,199,945 |

|

|

7,929,687 |

|

|

|

7,169,099 |

|

|

|

Earning assets |

10,749,395 |

|

|

|

8,955,859 |

|

|

9,672,290 |

|

|

|

8,889,786 |

|

|

|

Core deposits |

7,988,166 |

|

|

|

6,067,107 |

|

|

7,103,221 |

|

|

|

6,095,784 |

|

|

|

Borrowings |

1,292,646 |

|

|

|

1,445,112 |

|

|

1,233,580 |

|

|

|

1,386,349 |

|

|

|

Interest-bearing liabilities |

8,046,751 |

|

|

|

6,825,203 |

|

|

7,269,066 |

|

|

|

6,812,752 |

|

|

|

Stockholders' equity |

1,533,771 |

|

|

|

1,399,583 |

|

|

1,455,235 |

|

|

|

1,388,838 |

|

|

|

Average yield on interest-earning assets |

3.44 |

|

% |

|

4.09 |

% |

|

3.60 |

|

% |

|

4.19 |

|

% |

|

Average cost of interest-bearing liabilities |

0.57 |

|

% |

|

1.13 |

% |

|

0.72 |

|

% |

|

1.10 |

|

% |

| |

|

|

|

|

|

|

|

| Loan

Data |

|

|

|

|

|

|

|

|

Mortgage loans: |

|

|

|

|

|

|

|

|

Residential |

|

|

|

|

$ |

1,320,222 |

|

|

|

$ |

1,072,701 |

|

|

|

Commercial |

|

|

|

|

3,750,639 |

|

|

|

2,437,210 |

|

|

|

Multi-family |

|

|

|

|

1,544,924 |

|

|

|

1,298,754 |

|

|

|

Construction |

|

|

|

|

462,161 |

|

|

|

399,501 |

|

|

|

Total mortgage loans |

|

|

|

|

7,077,947 |

|

|

|

5,208,166 |

|

|

|

Commercial loans |

|

|

|

|

2,290,196 |

|

|

|

1,659,965 |

|

|

|

Consumer loans |

|

|

|

|

406,451 |

|

|

|

403,576 |

|

|

|

Total gross loans |

|

|

|

|

9,774,593 |

|

|

|

7,271,707 |

|

|

|

Premium on purchased loans |

|

|

|

|

1,514 |

|

|

|

2,716 |

|

|

|

Unearned discounts |

|

|

|

|

(26 |

) |

|

|

(26 |

) |

|

|

Net deferred |

|

|

|

|

(19,272 |

) |

|

|

(7,403 |

) |

|

|

Total loans |

|

|

|

|

$ |

9,756,809 |

|

|

|

$ |

7,266,994 |

|

|

Notes and Reconciliation of GAAP and Non-GAAP Financial

Measures

(Dollars in Thousands, except share data)

The Company has presented the following non-GAAP

(U.S. Generally Accepted Accounting Principles) financial measures

because it believes that these measures provide useful and

comparative information to assess trends in the Company’s results

of operations and financial condition. Presentation of these

non-GAAP financial measures is consistent with how the Company

evaluates its performance internally and these non-GAAP financial

measures are frequently used by securities analysts, investors and

other interested parties in the evaluation of companies in the

Company’s industry. Investors should recognize that the

Company’s presentation of these non-GAAP financial measures might

not be comparable to similarly-titled measures of other

companies. These non-GAAP financial measures should not be

considered a substitute for GAAP basis measures and the Company

strongly encourages a review of its condensed consolidated

financial statements in their entirety.

| (1) Book and Tangible

Book Value per Share |

|

|

|

|

|

|

|

|

| |

|

|

At September 30, |

|

At December 31, |

|

| |

|

|

2020 |

|

2019 |

|

2019 |

|

|

Total stockholders' equity |

|

|

$ |

1,601,569 |

|

|

$ |

1,397,833 |

|

|

$ |

1,413,840 |

|

|

|

Less: total intangible assets |

|

|

467,128 |

|

|

437,585 |

|

|

437,019 |

|

|

|

Total tangible stockholders' equity |

|

|

$ |

1,134,441 |

|

|

$ |

960,248 |

|

|

$ |

976,821 |

|

|

| |

|

|

|

|

|

|

|

|

|

Shares outstanding |

|

|

78,481,159 |

|

|

65,760,468 |

|

|

65,787,900 |

|

|

| |

|

|

|

|

|

|

|

|

|

Book value per share (total stockholders' equity/shares

outstanding) |

|

|

$ |

20.41 |

|

|

$ |

21.26 |

|

|

$ |

21.49 |

|

|

|

Tangible book value per share (total tangible stockholders'

equity/shares outstanding) |

|

|

$ |

14.45 |

|

|

$ |

14.60 |

|

|

$ |

14.85 |

|

|

| |

|

|

|

|

|

|

|

|

| (2) Annualized Return

on Average Tangible Equity |

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Nine Months Ended |

|

| |

September 30, |

|

September 30, |

|

| |

2020 |

|

2019 |

|

2020 |

|

2019 |

|

|

Total average stockholders' equity |

$ |

1,533,771 |

|

|

|

$ |

1,399,583 |

|

|

$ |

1,455,235 |

|

|

$ |

1,388,838 |

|

|

|

Less: total average intangible assets |

459,002 |

|

|

|

438,906 |

|

|

443,975 |

|

|

431,802 |

|

|

|

Total average tangible stockholders' equity |

$ |

1,074,769 |

|

|

|

$ |

960,677 |

|

|

$ |

1,011,260 |

|

|

$ |

957,036 |

|

|

| |

|

|

|

|

|

|

|

|

|

Net income |

$ |

27,143 |

|

|

|

$ |

31,399 |

|

|

$ |

56,384 |

|

|

$ |

86,682 |

|

|

| |

|

|

|

|

|

|

|

|

|

Annualized return on average tangible equity (net income/total

average stockholders' equity) |

10.05 |

|

% |

|

12.97 |

% |

|

7.45 |

% |

|

12.11 |

% |

|

| |

|

|

|

|

|

|

|

|

| (3) Annualized

Adjusted Non-Interest Expense to Average Assets |

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Nine Months Ended |

|

| |

September 30, |

|

September 30, |

|

| |

2020 |

|

2019 |

|

2020 |

|

2019 |

|

|

Reported non-interest expense |

$ |

59,783 |

|

|

|

$ |

49,738 |

|

|

$ |

169,157 |

|

|

$ |

147,848 |

|

|

|

Adjustments to non-interest expense: |

|

|

|

|

|

|

|

|

|

Credit loss expense for off-balance sheet credit exposures |

(575 |

) |

|

|

— |

|

|

5,714 |

|

|

— |

|

|

|

Merger-related transaction costs and COVID-19 expenses |

2,157 |

|

|

|

— |

|

|

4,318 |

|

|

— |

|

|

|

Adjusted non-interest expense |

$ |

58,201 |

|

|

|

$ |

49,738 |

|

|

$ |

159,125 |

|

|

$ |

147,848 |

|

|

|

Annualized adjusted non-interest expense |

$ |

231,539 |

|

|

|

$ |

197,330 |

|

|

$ |

212,554 |

|

|

$ |

197,672 |

|

|

| |

|

|

|

|

|

|

|

|

|

Average assets |

$ |

12,063,681 |

|

|

|

$ |

9,899,693 |

|

|

$ |

10,811,585 |

|

|

9,811,371 |

|

|

| |

|

|

|

|

|

|

|

|

|

Annualized adjusted non-interest expense/average assets |

1.92 |

|

% |

|

1.99 |

% |

|

1.97 |

% |

|

2.01 |

% |

|

| |

|

|

|

|

|

|

|

|

| (4) Efficiency Ratio

Calculation |

|

|

|

|

|

|

|

|

| |

Three Months Ended |

|

Nine Months Ended |

|

| |

September 30, |

|

September 30, |

|

| |

2020 |

|

2019 |

|

2020 |

|

2019 |

|

|

Net interest income |

$ |

81,985 |

|

|

|

$ |

73,528 |

|

|

$ |

223,833 |

|

|

$ |

225,090 |

|

|

|

Non-interest income |

20,626 |

|

|

|

18,047 |

|

|

51,982 |

|

|

46,069 |

|

|

|

Total income |

$ |

102,611 |

|

|

|

$ |

91,575 |

|

|

$ |

275,815 |

|

|

$ |

271,159 |

|

|

| |

|

|

|

|

|

|

|

|

|

Adjusted non-interest expense |

$ |

58,201 |

|

|

|

$ |

49,738 |

|

|

$ |

159,125 |

|

|

$ |

147,848 |

|

|

| |

|

|

|

|

|

|

|

|

|

Efficiency ratio (adjusted non-interest expense/income) |

56.72 |

|

% |

|

54.31 |

% |

|

57.69 |

% |

|

54.52 |

% |

|

|

PROVIDENT FINANCIAL SERVICES, INC. AND

SUBSIDIARY |

|

Net Interest Margin Analysis |

|

Quarterly Average Balances |

|

(Dollars in Thousands) (Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

September 30, 2020 |

|

June 30, 2020 |

| |

Average |

|

|

|

Average |

|

Average |

|

|

|

Average |

| |

Balance |

|

Interest |

|

Yield/Cost |

|

Balance |

|

Interest |

|

Yield/Cost |

|

Interest-Earning Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits |

$ |

80,120 |

|

|

$ |

50 |

|

|

0.25 |

% |

|

$ |

157,980 |

|

|

$ |

98 |

|

|

0.25 |

% |

|

|

Federal funds sold and other short-term investments |

134,319 |

|

|

421 |

|

|

1.25 |

% |

|

134,362 |

|

|

487 |

|

|

1.46 |

% |

|

|

Available for sale debt securities |

1,091,524 |

|

|

5,299 |

|

|

1.94 |

% |

|

970,639 |

|

|

5,417 |

|

|

2.23 |

% |

|

|

Held to maturity debt securities, net (1) |

444,240 |

|

|

2,836 |

|

|

2.55 |

% |

|

444,317 |

|

|

2,885 |

|

|

2.60 |

% |

|

|

Equity securities, at fair value |

845 |

|

|

— |

|

|

— |

% |

|

746 |

|

|

— |

|

|

— |

% |

|

|

Federal Home Loan Bank stock |

66,420 |

|

|

1,023 |

|

|

6.16 |

% |

|

61,461 |

|

|

862 |

|

|

5.61 |

% |

|

|

Net loans: (2) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total mortgage loans |

6,392,105 |

|

|

58,897 |

|

|

3.64 |

% |

|

5,261,323 |

|

|

49,297 |

|

|

3.72 |

% |

|

|

Total commercial loans |

2,150,787 |

|

|

20,622 |

|

|

3.78 |

% |

|

1,960,322 |

|

|

18,944 |

|

|

3.85 |

% |

|

|

Total consumer loans |

389,035 |

|

|

4,305 |

|

|

4.40 |

% |

|

366,370 |

|

|

3,547 |

|

|

3.89 |

% |

|

|

Total net loans |

8,931,927 |

|

|

83,824 |

|

|

3.71 |

% |

|

7,588,015 |

|

|

71,788 |

|

|

3.76 |

% |

|

|

Total interest-earning assets |

$ |

10,749,395 |

|

|

$ |

93,453 |

|

|

3.44 |

% |

|

$ |

9,357,520 |

|

|

$ |

81,537 |

|

|

3.47 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-Interest Earning Assets: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and due from banks |

301,500 |

|

|

|

|

|

|

|

|

|

164,086 |

|

|

|

|

|

|

|

|

|

|

Other assets |

1,012,786 |

|

|

|

|

|

|

|

|

|

912,252 |

|

|

|

|

|

|

|

|

|

|

Total assets |

$ |

12,063,681 |

|

|

|

|

|

|

|

|

|

$ |

10,433,858 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest-Bearing Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Demand deposits |

$ |

4,557,172 |

|

|

$ |

5,065 |

|

|

0.44 |

% |

|

$ |

4,047,493 |

|

|

5,156 |

|

|

0.51 |

% |

|

|

Savings deposits |

1,223,004 |

|

|

439 |

|

|

0.14 |

% |

|

1,026,325 |

|

|

391 |

|

|

0.15 |

% |

|

|

Time deposits |

957,512 |

|

|

1,896 |

|

|

0.79 |

% |

|

605,764 |

|

|

2,095 |

|

|

1.39 |

% |

|

|

Total Deposits |

6,737,688 |

|

|

7,400 |

|

|

0.44 |

% |

|

5,679,582 |

|

|

7,642 |

|

|

0.54 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Borrowed funds |

1,292,646 |

|

|

3,862 |

|

|

1.19 |

% |

|

1,249,741 |

|

|

4,069 |

|

|

1.31 |

% |

|

|

Subordinated debentures |

16,417 |

|

|

206 |

|

|

4.99 |

% |

|

— |

|

|

— |

|

|

— |

% |

|

|

Total interest-bearing liabilities |

8,046,751 |

|

|

11,468 |

|

|

0.57 |

% |

|

6,929,323 |

|

|

11,711 |

|

|

0.68 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-Interest Bearing Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-interest bearing deposits |

2,207,990 |

|

|

|

|

|

|

|

|

|

1,847,087 |

|

|

|

|

|

|

|

|

|

|

Other non-interest bearing liabilities |

275,169 |

|

|

|

|

|

|

|

|

|

248,124 |

|

|

|

|

|

|

|

|

|

|

Total non-interest bearing liabilities |

2,483,159 |

|

|

|

|

|

|

|

|

|

2,095,211 |

|

|

|

|

|

|

|

|

|

|

Total liabilities |

10,529,910 |

|

|

|

|

|

|

|

|

|

9,024,534 |

|

|

|

|

|

|

|

|

|

|

Stockholders' equity |

1,533,771 |

|

|

|

|

|

|

|

|

|

1,409,324 |

|

|

|

|

|

|

|

|

|

|

Total liabilities and stockholders' equity |

$ |

12,063,681 |

|

|

|

|

|

|

|

|

|

$ |

10,433,858 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest

income |

|

|

|

|

$ |

81,985 |

|

|

|

|

|

|

|

|

|

$ |

69,826 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest rate

spread |

|

|

|

|

|

|

|

|

2.87 |

% |

|

|

|

|

|

|

|

|

|

2.79 |

% |

|

| Net

interest-earning assets |

$ |

2,702,644 |

|

|

|

|

|

|

|

|

|

$ |

2,428,197 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest

margin (3) |

|

|

|

|

|

|

|

|

3.01 |

% |

|

|

|

|

|

|

|

|

|

2.97 |

% |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Ratio of

interest-earning assets to total interest-bearing liabilities |

1.34x |

|

|

|

|

|

|

|

|

|

1.35x |

|

|

|

|

|

|

|

|

|

| (1)

Average outstanding balance amounts shown are amortized cost, net

of allowance for credit losses. |

|

| (2)

Average outstanding balances are net of the allowance for loan

losses, deferred loan fees and expenses, loan premiums and

discounts and include non-accrual loans. |

|

| (3)

Annualized net interest income divided by average interest-earning

assets. |

|

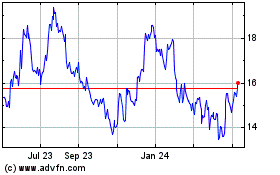

| The following

table summarizes the quarterly net interest margin for the previous

five quarters. |

|

|

| |

|

|

|

|

|

|

|

|

|

| |

9/30/20 |

|

6/31/20 |

|

3/31/20 |

|

12/31/19 |

|

9/30/19 |

| |

3rd Qtr. |

|

2nd Qtr. |