Provident Bank 401(k) Plan

Statements of Changes in Net Assets Available for Benefits

Years ended December 31, 2019 and 2018

`

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2019

|

|

2018

|

|

Additions to net assets attributable to:

|

|

|

|

|

Investment income:

|

|

|

|

|

Net appreciation (depreciation) in fair value of investments

|

$

|

16,687,889

|

|

|

$

|

(5,815,342)

|

|

|

Dividend income

|

1,142,447

|

|

|

885,179

|

|

|

Interest income

|

181,479

|

|

|

162,758

|

|

|

Net investment income (loss)

|

18,011,815

|

|

|

(4,767,405)

|

|

|

|

|

|

|

|

|

|

Interest on participant notes receivable

|

144,995

|

|

|

115,272

|

|

|

Contributions:

|

|

|

|

|

Employee contributions

|

5,987,422

|

|

|

5,665,233

|

|

|

Employer contributions

|

964,601

|

|

|

987,625

|

|

|

Rollover contributions

|

675,172

|

|

|

1,260,243

|

|

|

Total contributions

|

7,627,195

|

|

|

7,913,101

|

|

|

Total additions

|

25,784,005

|

|

|

3,260,968

|

|

|

|

|

|

|

|

|

|

Deductions from net assets attributable to:

|

|

|

|

|

|

|

Benefits paid to participants

|

7,122,181

|

|

|

5,059,201

|

|

|

Administrative expenses

|

140,675

|

|

|

138,359

|

|

|

Total deductions

|

7,262,856

|

|

|

5,197,560

|

|

|

Increase (decrease) in net assets available for benefits, before transfers

|

18,521,149

|

|

|

(1,936,592)

|

|

|

|

|

|

|

|

|

|

Transfers to the Plan

|

368,319

|

|

|

255,814

|

|

|

Increase (decrease) in net assets available for benefits, after transfers

|

18,889,468

|

|

|

(1,680,778)

|

|

|

Net assets available for benefits at beginning of year

|

92,597,855

|

|

|

94,278,633

|

|

|

Net assets available for benefits at end of year

|

$

|

111,487,323

|

|

|

$

|

92,597,855

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying notes to financial statements.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROVIDENT BANK 401(k) PLAN

Notes to Financial Statements

December 31, 2019 and 2018

(1)Plan Description

Provident Bank 401(k) Plan (the “Plan”) is a voluntary, participant-directed defined contribution plan sponsored by Provident Bank (the “Bank”) and covers all eligible employees, as defined, of the Bank. The Plan is subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”). The Benefits Committee of Provident Bank is the plan administrator for the Plan and is the responsible fiduciary for managing and investing Plan assets.

The following description of the Plan provides only general information. Eligible employees should refer to the Plan documents for a more complete description of the Plan’s provisions.

a.Eligibility

Employees of the Bank are generally eligible to participate in the Plan on the first day of the month on or after they reach age 21 if they are actively at work on that day. If they are not actively at work on that day, they become eligible on the day they return to active employment.

b.Employee Contributions

Participants may elect to make tax deferred and, beginning August 1, 2018, after-tax ("Roth") contributions up to the maximum amount allowed by the Internal Revenue Service (“IRS”) or the Plan Document. Participants may also rollover account balances of previous employer sponsored qualified retirement plans.

All new employees are automatically enrolled in the Plan 30 days after they first become eligible with an automatic participant contribution percentage of 4% of eligible compensation. In addition, for auto-enrolled participants, the contribution percentage will be automatically increased by 1% on or around each January 1 until it reaches 10%. Enrolled participants may change their contribution rates at any time, including selecting not to contribute to the Plan.

A participant may make “catch-up” contributions if the maximum annual amount of regular contributions is made and the participant is age 50 or older. The maximum allowable catch-up contribution limit for the years ended December 31, 2019 and 2018 is $6,000. Catch-up contributions are not eligible for the employer’s matching contributions. Tax law requires that a participant's catch-up contributions be reclassified as regular contributions if the participant elects catch-up contributions and fails to make the maximum allowable regular 401(k) contribution.

c.Employee Stock Ownership Plan (“ESOP”) Diversification - Transfers to the Plan

Effective January 1, 2012, participants in the ESOP, a separate plan sponsored by the Bank, who have both attained age 55 and completed ten years of participation in the Plan, will have an annual option to diversify their holdings.

For each of the first five ESOP Plan years in the qualified participant election period of six years, the participant may elect to diversify an amount which does not exceed 25% of the number of shares allocated to their ESOP account since the inception of the ESOP, less all shares with respect to which an election under this provision has already been made. For the last year of the qualified election period, the participant may elect to diversify up to 50 percent of the value of their ESOP account, less all shares with respect to which an election under this provision has already been made. Once diversification is elected, the funds will be transferred from the ESOP to the Plan.

In 2019 and 2018, approximately $368,000 and $256,000 was transferred into the Plan, respectively, in connection with ESOP diversifications.

PROVIDENT BANK 401(k) PLAN

Notes to Financial Statements

December 31, 2019 and 2018

d.Employer Contributions

In 2019 and 2018, employer matching contributions were made by the Bank in an amount equal to 25% of the first 6% of a participant’s eligible contributions. The Bank’s board of directors sets the matching contribution rate at its sole discretion. Employer contributions effective during the Plan year but not paid until after the Plan year ended are accrued and recorded as employer contributions receivable on the statements of net assets available for benefits. As of December 31, 2019 and 2018, the Plan recorded employer contributions receivable of $28,910 and $26,638, respectively.

e.Vesting

Participants are always fully vested in their contributions, employer matching contributions, and income or losses thereon.

f.Notes Receivable from Participants

Upon written application by a participant, the Plan administrator may direct that a loan be made from the participant’s account. The minimum permissible loan is $2,000. The maximum permissible loan available is limited to the lesser of: (i) $50,000 with certain reductions or (ii) 50% of the participant’s account balance. Any loan made must generally be repaid within a period, not to exceed the earlier of termination of employment or five years. The term of the loan may exceed five years for the purchase of a primary residence. Loans bear a rate of interest that remains in effect for the duration of the loan and effective January 1, 2018, this rate was equal to the prime rate (as published in the Wall Street Journal) as of the date of the loan application, plus 1%. As of December 31, 2019 and December 31, 2018, the interest rates ranged from 4.25% to 6.50%.

Principal and interest is paid ratably through bi-weekly payroll deductions or directly by the participant to the Plan custodian.

g.Benefit Payments/Withdrawals

Upon retirement or termination of employment, participants may, under certain conditions, elect to receive vested amounts in: (i) a cash lump sum, or (ii) equal monthly, quarterly, semi-annual or annual installments over a period not to exceed the life expectancy of the participant or the combined life expectancy of the participant and his or her designated beneficiary. During employment, participants may make cash withdrawals of post-tax participant contributions and related vested employer matching contributions and earnings thereon once per year without penalty. Hardship withdrawals of pre-tax participant contributions are also permitted once per year, but may include a penalty.

Participants may elect to have allocated cash dividends declared on the employer common stock and received by the Trustee distributed in cash or elect to reinvest the dividends. For the years ended December 31, 2019 and 2018, cash dividends of $13,238 and $9,371, respectively were paid to Plan participants and are reflected as benefits paid to participants on the statements of changes in net assets available for benefits.

h.Participants’ Accounts

Separate accounts for each participant are maintained and credited with the participant’s contributions, employer matching contributions, and the participant’s proportionate share, as defined, of Plan earnings or losses. The benefit to which a participant is entitled is the benefit that can be provided from his or her account.

PROVIDENT BANK 401(k) PLAN

Notes to Financial Statements

December 31, 2019 and 2018

i.Plan Changes

Effective January 1, 2019, the Financial Hardship Distribution section of the Plan was amended to follow current IRS guidance. Participants no longer need to take a loan(s) before requesting a Hardship Distribution and they can continue to contribute to their 401(k) account. The Plan was also amended so that Plan participants can take a hardship distribution on account of certain disasters declared by the Federal Emergency Management Agency.

j.Funds and Accounts Managed by Principal Trust Company

Under the terms of a trust agreement between the Principal Trust Company (the “Custodian”) and the Bank, the Custodian manages funds on behalf of the Plan. The Custodian held the Plan’s investment assets and executed transactions relating to such assets.

(2)Summary of Significant Accounting Policies

a.Basis of Presentation

The accompanying financial statements have been prepared on the accrual basis of accounting in accordance with U.S. generally accepted accounting principles ("U.S. GAAP").

b.Use of Estimates

The preparation of financial statements in accordance with U.S. GAAP requires the Plan administrator to make estimates and assumptions that affect the reported amounts of assets, liabilities, and changes therein, and disclosure of contingent assets and liabilities at the date of the financial statements. Actual results could differ from those estimates.

c.Risks and Uncertainties

The Plan invests in various investment instruments, including mutual funds, pooled separate accounts, collective investment trusts, guaranteed investment contracts, and common stocks. Investment securities in general are exposed to various risks, such as interest rate, credit, and market risk. Due to the level of risk associated with certain investments, it is reasonably possible that changes in the values of investments will occur in the near-term and that such changes could materially affect the amounts reported in the financial statements.

The Plan invests indirectly in securities with contractual cash flows such as asset backed securities, collateralized mortgage obligations and commercial mortgage backed securities, including securities backed by subprime mortgage loans. The value, liquidity and related income of these securities are sensitive to changes in economic conditions, including real estate values, delinquencies or defaults, or both, and may be adversely affected by shifts in the market's perception of the issuers and changes in interest rates.

The Plan's exposure to a concentration of credit risk is limited by the diversification of investments across various participant-directed fund elections. Additionally, the investments within each participant-directed fund election are further diversified into varied financial instruments, with the exception of the common stock fund of the parent company of the Bank.

The Plan provides for investment in the common stock of Provident Financial Services, Inc. (the “Company”), the parent company of the Bank. At December 31, 2019 and 2018, approximately 14% and 16% of the Plan’s net assets were invested in the common stock of the Company, respectively. The underlying values of the Company common stock are entirely dependent upon the financial performance of the Company, and the market’s evaluation of such performance.

PROVIDENT BANK 401(k) PLAN

Notes to Financial Statements

December 31, 2019 and 2018

d.Notes Receivable from Participants

Participant loans are classified as notes receivable from participants, which are segregated from Plan investments and measured at their unpaid principal balance plus any accrued but unpaid interest.

e.Investment Securities

Investment securities, other than fully benefit-responsive investment contracts, are reported at fair value. Fair value is the amount at which an asset may be purchased or sold in an orderly transaction between market participants. Purchases and sales of securities are recorded on the trade date and are stated at fair value.

For fully benefit-responsive investment contracts of a defined contribution plan, contract value is the relevant measurement attributable to that portion of the net assets available for benefits, because contract value is the amount participants would receive if they were to initiate permitted transactions under the terms of the Plan.

f.Income Recognition

Interest income is recorded as earned on the accrual basis. Dividend income is recorded on the ex-dividend date.

g.Benefits Paid to Participants

Benefits are recorded when paid.

h.Impact of Recent Accounting Pronouncements

The Plan assessed recent accounting pronouncements, noting none that would impact the financial statements or notes to the financial statements.

(3)Plan Expenses

Certain costs of administrative services rendered on behalf of the Plan including accounting, tax, legal, audit and other administrative support were borne by the Bank. Effective January 1, 2018, the payment of contract administrator fees changed and each participant account with assets now pays a monthly fee of $7.00 to the Plan to be paid to the Record Keeper, Principal Life Insurance Company ("Principal"). For newly eligible participants, the Bank pays the monthly administrator fee to Principal for their initial year of participation. A portion of investment management fees of certain funds offered by the Plan are paid by Principal in a revenue share arrangement and are reflected in the change in fair value of the Plan holdings. Participants invested in those funds receive a monthly fee adjustment for revenue sharing.

(4)Plan Termination

Although it has not expressed an intent to do so, the Bank has the right to terminate the Plan subject to the provisions of ERISA.

(5)Federal Income Taxes

On November 4, 2016, the Plan received a favorable Determination Letter from the IRS, which stated that the Plan and its underlying trust qualify under the applicable provisions of the Code and therefore are exempt from federal income taxes. The Plan has been amended since the issuance of the IRS determination letter in accordance with the IRS requirements. In the opinion of the Plan administrator,

PROVIDENT BANK 401(k) PLAN

Notes to Financial Statements

December 31, 2019 and 2018

the Plan and its underlying trust have operated within the terms of the Plan document and remain qualified under the applicable provisions of the Code.

U.S. GAAP requires plan management to evaluate tax positions taken by the Plan and recognize a tax liability (or asset) if the Plan has taken an uncertain position that more likely than not would not be sustained upon examination by the IRS. The Plan administrator has analyzed the tax positions taken by the Plan and has concluded that as of December 31, 2019 and 2018, there were no uncertain positions taken or expected to be taken that would require recognition of a liability (or asset) or disclosure in the financial statements. The Plan is subject to routine audits by taxing jurisdictions; however, there are currently no audits for any tax periods in progress.

(6)Investment Securities at Fair Value

Investment Securities recorded at fair value at December 31, 2019 and 2018 consisted of mutual funds, pooled separate accounts, collective investment trusts, and common stock issued by Provident Financial Services, Inc.

U.S. GAAP establishes a fair value hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements). The three levels of fair value hierarchy under U.S. GAAP are as follows:

Level 1: Unadjusted quoted market prices in active markets that are accessible at the measurement date for identical, unrestricted assets or liabilities;

Level 2: Quoted prices in markets that are not active, or inputs that are observable either directly or indirectly, for substantially the full term of the asset or liability; and

Level 3: Prices or valuation techniques that require inputs that are both significant to the fair value measurement and unobservable (i.e., supported by little or no market activity).

A financial instrument’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement.

There have been no changes in valuation methodologies used at December 31, 2019 and 2018 and there were no transfers between levels for the years ended December 31, 2019 and 2018. The valuation methodologies used for assets measured at fair value are as follows:

Pooled separate accounts: Measured using quoted prices in markets that are not active, and valued by the net asset value ("NAV") of the pooled separate accounts, based on the fair value of the underlying holdings.

Collective Investment Trusts: Measured using quoted prices in markets that are not active, and valued by the NAV of the units, based on the fair value of the underlying holdings.

Mutual funds: Mutual Funds are measured based on exchange quoted prices available in active markets.

Provident Financial Services Inc. common stock: Valued at the closing price reported on the active market on which the individual securities are traded (New York Stock Exchange).

The preceding methods described may produce a fair value calculation that may not be indicative of net realizable value or reflective of future fair values. Furthermore, although the Plan believes its valuation methods are appropriate and consistent with other market participants, the use of different methodologies or assumptions to determine the fair value of certain financial instruments could result in a different fair value measurement at the reporting date.

PROVIDENT BANK 401(k) PLAN

Notes to Financial Statements

December 31, 2019 and 2018

The following tables present the Plan’s fair value hierarchy for those investments measured at fair value as of December 31, 2019 and 2018:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair value measurements at December 31, 2019

|

|

|

|

|

|

|

|

|

|

Total

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Pooled separate accounts

|

|

$

|

10,551,478

|

|

|

$

|

—

|

|

|

$

|

10,551,478

|

|

|

$

|

—

|

|

|

Collective Investment Trusts

|

|

$

|

31,394,051

|

|

|

—

|

|

|

31,394,051

|

|

|

—

|

|

|

Mutual funds

|

|

$

|

41,115,033

|

|

|

41,115,033

|

|

|

—

|

|

|

—

|

|

|

Provident Financial Services, Inc. common stock

|

|

$

|

15,280,358

|

|

|

15,280,358

|

|

|

—

|

|

|

—

|

|

|

|

|

$

|

98,340,920

|

|

|

$

|

56,395,391

|

|

|

$

|

41,945,529

|

|

|

$

|

—

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fair value measurements at December 31, 2018

|

|

|

|

|

|

|

|

|

|

Total

|

|

Level 1

|

|

Level 2

|

|

Level 3

|

|

Pooled separate accounts

|

|

$

|

8,326,293

|

|

|

$

|

—

|

|

|

$

|

8,326,293

|

|

|

$

|

—

|

|

|

Collective Investment Trusts

|

|

24,417,385

|

|

|

—

|

|

|

24,417,385

|

|

|

—

|

|

|

Mutual funds

|

|

32,781,660

|

|

|

32,781,660

|

|

|

—

|

|

|

—

|

|

|

Provident Financial Services, Inc. common stock

|

|

14,854,407

|

|

|

14,854,407

|

|

|

—

|

|

|

—

|

|

|

|

|

$

|

80,379,745

|

|

|

$

|

47,636,067

|

|

|

$

|

32,743,678

|

|

|

|

|

The Plan’s investments in mutual funds, collective investment trusts and pooled separate accounts are valued and redeemable daily. There are no restrictions on redemptions except if certain funds are held in participant accounts for less than specified periods, the account may be charged a redemption fee on the amount redeemed.

(7) Principal Fixed Income Option

The Plan invests in the Principal Fixed Income Guarantee Option (the “Contract”), a benefit-responsive group annuity contract issued by the Principal Life Insurance Company. The Contract is not a portfolio of contracts with yields based on changes in the fair value of underlying assets, but is rather a single group annuity contract with a fixed rate of interest. As a result, the average yield earned by the Plan is the yield earned, or the interest credited, on the group annuity contract. The underlying assets consist primarily of treasuries, commercial real estate mortgages, mortgage-backed securities and short-term cash equivalents.

The interest crediting rate is determined on a semiannual basis and is calculated based upon many factors, including current economic and market conditions, the general interest rate environment, and purchases and redemptions by unit holders. An employer-level surrender of the Plan’s interest in the Principal Fixed Income Guarantee Option or employer-initiated transfer will be subject to either a 12-month irrevocable advance notice or a 5% surrender charge, whichever the employer chooses.

The average market yield earned by the Contract, which is also the actual interest credited to participants in the Contract, for the years ending on December 31, 2019 and 2018 was 1.90% and 1.80%, respectively. There are no reserves against contract value for credit risk of the contract issuer or otherwise.

Although the existence of certain conditions or transactions outside the normal operations of the Contract could limit the Plan's ability to transact at contract value, management has determined that as of December 31, 2019 these conditions or transactions are not considered probable.

PROVIDENT BANK 401(k) PLAN

Notes to Financial Statements

December 31, 2019 and 2018

(8) Related-Party Transactions

Certain Plan investments are investment contracts or shares of fixed income and pooled separate accounts managed or issued by The Principal Financial Group (“Principal”) or its affiliates. Investment fees were paid by the funds to Principal and are reflected in the change in fair value of the funds. Principal is also the trustee and record keeper as defined by the Plan and, therefore, these transactions qualify as party-in-interest transactions. Contract administrator fees that were paid from Plan assets were $140,675 and $138,359, for the years ended December 31, 2019 and 2018, respectively.

The Plan had invested $15,280,358 and $14,854,407, at fair value, in the common stock of Provident Financial Services, Inc. as of December 31, 2019 and 2018, respectively.

(9) Subsequent Events

On March 12, 2020, Provident Financial Services Inc. announced the acquisition of SBOne Bank with an expected closing in the third quarter of 2020.

In December 2019, a coronavirus was reported in China, and in March 2020, the World Health Organization declared Covid-19 a pandemic. On March 12, 2020, the President of the United States declared a national emergency due to the Covid-19 outbreak. This resulted in a slowdown in economic activity that has had an adverse impact on the Bank. It also resulted in the modification of certain Bank business practices, including but not limited to, reductions in employee hours worked and changes in work locations. Given the evolving nature of the Covid-19 pandemic and the responses of the federal and state governments, it is difficult to predict the financial impact on the Plan which will largely depend on future developments. In response to the Covid-19 pandemic, on March 27, 2020, Congress passed the Coronavirus Aid, Relief, and Economic Security Act ("CARES Act"), which included several relief provisions available to tax qualified retirement plans and their participants. The provisions of the CARES Act may be effective and operationalized immediately, prior to amending the Plan document. The Plan has implemented provisions related to terminated vested participants who are required to take minimum distributions.

In connection with the preparation of the financial statements, the Plan administrator has evaluated subsequent events after December 31, 2019 through June 25, 2020, the date the financial statements were issued, and concluded that no additional disclosures were required.

PROVIDENT BANK 401(k) PLAN

Supplemental Schedule H, line 4i – Schedule of Assets (Held at End of Year)

December 31, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Identity of issuer

|

|

|

|

|

|

|

|

|

Description of investment

|

|

|

|

|

|

|

|

|

Shares

|

|

|

|

Fair value

|

|

|

|

*

|

Principal Life Insurance Company

|

|

|

|

|

|

|

|

Pooled Separate Accounts

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Principal Small Cap S&P 600 Index

|

|

|

|

|

|

|

32,511

|

|

|

|

|

$

|

2,306,310

|

|

|

|

|

*

|

Principal Life Insurance Company

|

|

|

|

|

|

|

|

Pooled Separate Accounts

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Principal Mid Cap S&P 400 Index

|

|

|

|

|

|

|

19,429

|

|

|

|

|

1,304,747

|

|

|

|

|

*

|

Principal Life Insurance Company

|

|

|

|

|

|

|

|

Pooled Separate Accounts

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Principal Large Cap S&P 500

|

|

|

|

|

|

|

41,144

|

|

|

|

|

6,940,421

|

|

|

|

|

*

|

Principal Life Insurance Company

|

|

|

|

|

|

|

|

Insurance Company General Account

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Principal Fixed Income Guarantee Option at contract value

|

|

|

|

|

|

|

744,323

|

|

|

|

|

10,390,331

|

|

|

|

|

|

T. Rowe Price Associates, Inc.

|

|

|

|

|

|

|

|

Common/Collective Trust

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retirement 2005 Trust

|

|

|

|

|

|

|

7,963

|

|

|

|

|

131,153

|

|

|

|

|

|

T. Rowe Price Associates, Inc.

|

|

|

|

|

|

|

|

Common/Collective Trust

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retirement 2010 Fund

|

|

|

|

|

|

|

43,073

|

|

|

|

|

743,871

|

|

|

|

|

|

T. Rowe Price Associates, Inc.

|

|

|

|

|

|

|

|

Common/Collective Trust

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retirement 2015 Trust

|

|

|

|

|

|

|

41,913

|

|

|

|

|

775,396

|

|

|

|

|

|

T. Rowe Price Associates, Inc.

|

|

|

|

|

|

|

|

Common/Collective Trust

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retirement 2020 Trust

|

|

|

|

|

|

|

334,797

|

|

|

|

|

6,635,675

|

|

|

|

|

|

T. Rowe Price Associates, Inc.

|

|

|

|

|

|

|

|

Common/Collective Trust

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retirement 2025 Trust

|

|

|

|

|

|

|

209,119

|

|

|

|

|

4,399,864

|

|

|

|

|

|

T. Rowe Price Associates, Inc.

|

|

|

|

|

|

|

|

Common/Collective Trust

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retirement 2030 Trust

|

|

|

|

|

|

|

304,464

|

|

|

|

|

6,746,929

|

|

|

|

|

|

T. Rowe Price Associates, Inc.

|

|

|

|

|

|

|

|

Common/Collective Trust

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retirement 2035 Trust

|

|

|

|

|

|

|

75,027

|

|

|

|

|

1,725,629

|

|

|

|

|

|

T. Rowe Price Associates, Inc.

|

|

|

|

|

|

|

|

Common/Collective Trust

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retirement 2040 Trust

|

|

|

|

|

|

|

189,627

|

|

|

|

|

4,473,295

|

|

|

|

|

|

T. Rowe Price Associates, Inc.

|

|

|

|

|

|

|

|

Common/Collective Trust

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retirement 2045 Trust

|

|

|

|

|

|

|

81,562

|

|

|

|

|

1,937,104

|

|

|

|

|

|

T. Rowe Price Associates, Inc.

|

|

|

|

|

|

|

|

Common/Collective Trust

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retirement 2050 Trust

|

|

|

|

|

|

|

107,318

|

|

|

|

|

2,547,724

|

|

|

|

|

|

T. Rowe Price Associates, Inc.

|

|

|

|

|

|

|

|

Common/Collective Trust

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retirement 2055 Trust

|

|

|

|

|

|

|

42,603

|

|

|

|

|

1,010,116

|

|

|

|

|

|

T. Rowe Price Associates, Inc.

|

|

|

|

|

|

|

|

Common/Collective Trust

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Retirement 2060 Trust

|

|

|

|

|

|

|

17,516

|

|

|

|

|

267,295

|

|

|

|

|

|

T. Rowe Price Associates, Inc.

|

|

|

|

|

|

|

|

Registered Investment Company

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

T. Rowe Price Mid Cap Value

|

|

|

|

|

|

|

82,869

|

|

|

|

|

2,317,840

|

|

|

|

|

|

JP Morgan Investment Mgmt Inc

|

|

|

|

|

|

|

|

Registered Investment Company

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

JP Morgan US Equity

|

|

|

|

|

|

|

156,973

|

|

|

|

|

2,519,422

|

|

|

|

|

|

Mainstay

|

|

|

|

|

|

|

|

Registered Investment Company

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mainstay Large Cap Growth

|

|

|

|

|

|

|

1,061,883

|

|

|

|

|

10,778,117

|

|

|

|

|

|

Columbia Funds

|

|

|

|

|

|

|

|

Registered Investment Company

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Columbia Dividend Income

|

|

|

|

|

|

|

288,747

|

|

|

|

|

7,059,870

|

|

|

|

|

|

PIMCO

|

|

|

|

|

|

|

|

Registered Investment Company

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PIMCO Total Return

|

|

|

|

|

|

|

375,312

|

|

|

|

|

3,880,729

|

|

|

|

PROVIDENT BANK 401(k) PLAN

Supplemental Schedule H, line 4i – Schedule of Assets (Held at End of Year)

December 31, 2019

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

American Funds Service Company

|

|

|

|

|

|

|

|

Registered Investment Company

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

American Funds Europacific Growth

|

|

|

|

|

|

|

91,013

|

|

|

|

|

5,052,159

|

|

|

|

|

|

Vanguard Group

|

|

|

|

|

|

|

|

Registered Investment Company

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vanguard Total Bond Market Index

|

|

|

|

|

|

|

128,365

|

|

|

|

|

1,418,430

|

|

|

|

|

|

Vanguard Group

|

|

|

|

|

|

|

|

Registered Investment Company

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vanguard Total International Stock Index

|

|

|

|

|

|

|

34,057

|

|

|

|

|

1,017,283

|

|

|

|

|

|

Wells Fargo

|

|

|

|

|

|

|

|

Registered Investment Company

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Wells Fargo Spl Small Cap Value I Fund

|

|

|

|

|

|

|

39,370

|

|

|

|

|

1,422,030

|

|

|

|

|

|

Carillon Tower Advisors

|

|

|

|

|

|

|

|

Registered Investment Company

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Carillon Eagle Small Cap Growth R5 Fund

|

|

|

|

|

|

|

8,363

|

|

|

|

|

446,922

|

|

|

|

|

|

MFS Investment Management

|

|

|

|

|

|

|

|

Registered Investment Company

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

MFS Mid-Cap Growth R6 Fund

|

|

|

|

|

|

|

230,595

|

|

|

|

|

5,202,231

|

|

|

|

|

*

|

Provident Financial Services, Inc.

|

|

|

|

|

|

|

|

Common Stock

|

|

|

|

|

|

|

|

|

619,893

|

|

|

|

|

15,280,358

|

|

|

|

|

*

|

Notes receivable from participants (a)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2,727,162

|

|

|

|

|

|

Total

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$

|

111,458,413

|

|

|

|

|

*

|

A party-in-interest as defined by ERISA.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

As of December 31, 2019, the interest rate ranged from 4.25% to 6.50% with maturity dates through September 10, 2049.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

See accompanying Report of Independent Registered Public Accounting Firm.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the trustees (or other persons who administer the employee benefit plan) have duly caused this annual report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROVIDENT BANK 401(K) PLAN

|

|

|

|

|

|

|

|

|

|

|

by: /s/ Andrea Lustig

|

|

|

|

|

|

|

|

|

|

Andrea Lustig

|

|

|

|

|

Plan Administrator

|

|

|

|

|

Senior Vice President

|

|

|

|

|

Provident Bank

|

|

|

|

|

|

|

Date: June 25, 2020

EXHIBIT INDEX

Exhibit Description of the Exhibit

23.1 Consent of Independent Registered Public Accounting Firm

EXHIBIT 23.1

Consent of Independent Registered Public Accounting Firm

The Audit Committee of Provident Financial Services, Inc.

Provident Bank 401(k) Plan:

We consent to the incorporation by reference in the registration statement (No. 333-103041) on Form S-8 of Provident Financial Services, Inc. of our report dated June 25, 2020, with respect to the statements of net assets available for benefits of the Provident Bank 401(k) Plan as of December 31, 2019 and 2018, the related statements of changes in net assets available for benefits for the years then ended, and the related notes (collectively, the financial statements), and the supplemental Schedule H, Line 4i – Schedule of Assets (Held at End of Year) as of December 31, 2019, which report appears in the December 31, 2019 annual report on Form 11-K of the Provident Bank 401(k) Plan.

New York, New York

June 25, 2020

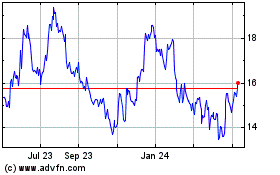

Provident Financial Serv... (NYSE:PFS)

Historical Stock Chart

From Mar 2024 to Apr 2024

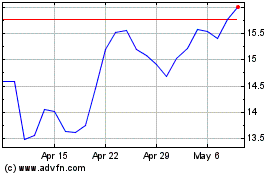

Provident Financial Serv... (NYSE:PFS)

Historical Stock Chart

From Apr 2023 to Apr 2024