|

Item 1.01

|

Entry into a Material Definitive Agreement

|

Merger Agreement

On March 11, 2020, Provident Financial Services, Inc. (“Provident”) entered into an Agreement and Plan of Merger (the “Merger Agreement”) with SB One Bancorp (“SB One”). The Merger Agreement provides that upon the terms and subject to the conditions set forth therein, SB One will merge with and into Provident, with Provident as the surviving corporation (the “Merger”). At the effective time of the Merger (the “Effective Time”), each outstanding share of SB One common stock, no par value per share (“SB One Common Stock”), will be converted into the right to receive 1.357 shares (the “Exchange Ratio”) of Provident common stock (“Provident Common Stock”), par value $0.01 per share (the “Merger Consideration”).

At the Effective Time, each outstanding option granted by SB One to purchase shares of SB One Common Stock under the SB One stock incentive plans (the “SB One Options”), whether vested or unvested, will be cancelled and converted automatically into the right to receive an amount of cash equal to the product of (i) the excess of (A) the product of (x) the Exchange Ratio and (y) the Provident Closing Price (as defined below), over (B) the exercise price of such SB One Option, and (ii) the number of shares of SB One Common Stock subject to said SB One Option (whether vested or unvested). The Provident Closing Price means the average of the closing sales price of a share of Provident Common Stock, as reported on the New York Stock Exchange (“NYSE”) for the ten consecutive trading days ending on the fifth trading day preceding the closing date.

Furthermore, at the Effective Time, each share of SB One restricted stock, whether vested or unvested, will be cancelled and converted automatically into the right to receive the merger consideration.

Following the Merger, SB One Bank, a New Jersey-chartered commercial bank and a wholly owned subsidiary of SB One, will merge with and into Provident Bank, a New Jersey-chartered savings bank and a wholly owned subsidiary of Provident, with Provident Bank as the surviving bank.

At the Effective Time, Provident will appoint Anthony Labozzetta and two other persons from the SB One Board of Directors to be selected by Provident in consultation with SB One (and who will be subject to Provident’s customary qualification requirements) to the Boards of Directors of Provident and Provident Bank, with one former SB One director being appointed to each of the three terms of directors comprising the Provident and Provident Bank Boards of Directors.

The Merger Agreement contains customary representations and warranties from each of Provident and SB One, and each party has agreed to customary covenants, including, among others, covenants relating to the conduct of SB One’s and Provident’s businesses during the interim period between the execution of the Merger Agreement and the Effective Time and, in the case of SB One, its obligation to call a meeting of its shareholders to adopt the Merger Agreement, its obligation, subject to certain exceptions, to recommend that its stockholders approve the Merger Agreement and the Merger, and its non-solicitation obligations relating to alternative acquisition proposals.

The completion of the Merger is subject to customary conditions, including, among others, (1) the approval of the Merger by the holders of SB One Common Stock, (2) authorization for listing on the NYSE of the shares of Provident Common Stock to be issued in the Merger, (3) the effectiveness of the registration statement on Form S-4 for the Provident Common Stock to be issued in the Merger, (4) the absence of any order, decree or injunction preventing the completion of the Merger and (5) the receipt or waiver of required regulatory approvals. Each party’s obligation to complete the Merger is also subject to certain additional customary conditions, including (i) subject to certain exceptions, the accuracy of the representations and warranties of the other party, (ii) performance in all material respects by the other party of its obligations under the Merger Agreement and (iii) receipt by such party of an opinion from its counsel to the effect that the Merger will qualify as a reorganization within the meaning of Section 368(a) of the Internal Revenue Code of 1986, as amended.

The Merger Agreement provides certain termination rights for both Provident and SB One and further provides that a termination fee of $9.0 million will be payable by SB One to Provident upon termination of the Merger Agreement under certain circumstances.

The Merger Agreement was unanimously approved by the boards of both Provident and SB One.

The foregoing description of the Merger Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Merger Agreement, which is attached hereto as Exhibit 2.1 and is incorporated herein by reference. The representations, warranties and covenants of each party set forth in the Merger Agreement have been made only for purposes of, and were and are solely for the benefit of the parties to, the Merger Agreement, may be subject to limitations agreed upon by the contracting parties, including being qualified by confidential disclosures made for the purposes of allocating contractual risk between Provident and SB One instead of establishing these matters as facts, and may be subject to standards of materiality applicable to the contracting parties that differ from those applicable to investors. Accordingly, the representations and warranties may not describe the actual state of affairs at the date they were made or at any other time, and investors should not rely on them as statements of fact. In addition, such representations and warranties (1) will not survive consummation of the Merger, unless otherwise specified therein, and (2) were made only as of the date of the Merger Agreement or such other date as is specified in the Merger Agreement. Moreover, information concerning the subject matter of the representations and warranties may change after the date of the Merger Agreement, which subsequent information may or may not be fully reflected in the parties’ public disclosures. Accordingly, the Merger Agreement is included with this filing only to provide investors with information regarding the terms of the Merger Agreement, and not to provide investors with any other factual information regarding Provident or SB One, their respective affiliates or their respective businesses. The Merger Agreement should not be read alone, but should instead be read in conjunction with the other information regarding Provident, SB One, their respective affiliates or their respective businesses, the Merger Agreement and the Merger that will be contained in, or incorporated by reference into, the Registration Statement on Form S-4 that will include a proxy statement of SB One and a prospectus of Provident, as well as in the Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and other filings that each of Provident and SB One make with the Securities and Exchange Commission (the “SEC”).

Voting Agreement

In connection with the Merger Agreement, in their capacity as shareholders of SB One, each SB One director and certain SB One executive officers entered into a Voting Agreement with Provident (the “Voting Agreements”). The SB One directors and executive officers that are party to the Voting Agreements beneficially own, in the aggregate, approximately 14.93% of the outstanding shares of SB One Common Stock. The Voting Agreements require, among other things, that the SB One shareholder that is party thereto vote his or her shares of SB One Common Stock in favor of the Merger and the other transactions contemplated by the Merger Agreement and against alternative transactions and not to, directly or indirectly, assign, sell, transfer or otherwise dispose of his or her shares of SB One Common Stock, subject to certain exceptions.

The foregoing description of the Voting Agreements does not purport to be complete and is qualified in its entirety by reference to the form of Voting Agreement, which is attached to this Current Report as Exhibit 10.1, and incorporated by reference herein.

|

Item 5.02

|

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers

|

On March 11, 2020, Provident entered into the following agreements with Mr. Labozzetta: (1) an employment agreement (the “Provident Employment Agreement”); (2) a side-letter agreement (the “Provident Side-Letter Agreement”) to which Provident Bank is also a party; and (3) a change in control agreement (the “Provident Change in Control Agreement”). In addition, Provident, Provident Bank, SB One and SB One Bank are parties to a Settlement Agreement that was entered into with Mr. Labozzetta on March 11, 2020. The Provident Employment Agreement, the Provident Side-Letter Agreement, the Provident Change in Control Agreement and the Settlement Agreement (together, the “Provident Agreements”) will become effective and terminate Mr. Labozzetta’s employment agreement with SB One and SB One Bank dated January 20, 2010 (the “SB One Employment Agreement”) immediately upon the consummation of the Merger. Mr. Labozzetta, age 56, has served as the President and Chief Executive Officer of SB One and SB One Bank since August 2010. In the event that the Merger Agreement is terminated for any reason, the Merger does not occur or Mr. Labozzetta fails to become an employee of Provident and Provident Bank as of the consummation of the Merger, the Provident Agreements will automatically terminate and become null and void.

Provident Employment Agreement

The Provident Employment Agreement has an initial term that will continue through December 31, 2021 (the “Initial Term”). Commencing on January 1, 2022 and continuing at each January 1 thereafter, the term will automatically renew for an additional year (each, a “Renewal Term”). During the Initial Term, Mr. Labozzetta will serve as the Chief Operating Officer and President of each of Provident and Provident Bank. Additionally, subject to and conditioned upon the approval of, and appointment by, the Board of Directors of Provident, Mr. Labozzetta will serve as Chief Executive Officer and President of Provident and Provident Bank as of January 1, 2022.

Mr. Labozzetta is entitled to an initial annual base salary of $584,119 and to participate in Provident’s or Provident Bank’s bonus, incentive and benefit plans offered generally to senior officers and key management, and will be provided with an automobile suitable for his position. In addition, Provident and Provident Bank will honor the terms and conditions of Mr. Labozzetta’s Supplemental Executive Retirement Agreement, dated as of July 20, 2011 with SB One.

In the event Mr. Labozzetta terminates his employment for Good Reason or is terminated without Cause (as each such term is defined in the Provident Employment Agreement), he would receive: (1) any standard compensation and benefits that have been earned by Mr. Labozzetta as of his date of termination (the “Standard Termination Benefits”); (2) a cash lump sum payment equal to his base salary and cash bonus due for the longer of: (i) the remaining term of the agreement; or (ii) 12 months following the date of termination (the “Benefits Period”); and (3) continued life, medical, dental and disability coverage during the Benefits Period, provided, however, that Provident or Provident Bank may pay cash in lieu of such coverage if such coverage is not practicable, plus an amount to reflect the income and payroll taxes incurred by him with respect to such payment.

Subject to certain terms and limitations, the Provident Employment Agreement further provides that during its term and for a period of one year thereafter (except following a change in control), Mr. Labozzetta may not compete with, or solicit customers or employees of, Provident or Provident Bank, provided, however, that upon his termination during any Renewal Term, any restrictions limiting Mr. Labozzetta from becoming an employee of or providing services to another institution would be reduced to six months.

Provident Side-Letter Agreement

Pursuant to the Provident Side-Letter Agreement, if Mr. Labozzetta is not appointed President and Chief Executive Officer of Provident and Provident Bank by January 1, 2022 or he has a qualifying termination without Cause or for Good Reason (as set forth in the Provident Employment Agreement) during the Initial Term of the Provident Employment Agreement, his employment with Provident and Provident Bank will cease immediately following the expiration of the Initial Term (in the case of the failure to be appointed President and Chief Executive Officer) or as of the date of termination, and, in lieu of any payments or benefits under the Provident Employment Agreement, Provident or Provident Bank would pay Mr. Labozzetta the following: (1) any Standard Termination Benefits; (2) a cash lump sum payment equal to two times the sum of his base salary and annual cash bonus paid to (or earned by) him with respect to the completed fiscal year prior to the date of termination; and (3) continued life, medical, dental and disability coverage for two years, provided, however, that Provident or Provident Bank may pay cash in lieu of such coverage if such coverage is not practicable, plus an amount to reflect the income and payroll taxes incurred by him with respect to such payment.

Upon such termination, Mr. Labozzetta would be subject to the non-competition and post-termination obligations set forth in the Provident Employment Agreement.

Provident Change in Control Agreement

In the event of a change in control of Provident or Provident Bank, Mr. Labozzetta would not be entitled to any severance benefits under the Provident Employment Agreement or Provident Side-Letter Agreement upon any subsequent termination of employment. Rather, he would be entitled to only the severance benefits provided under the Provident Change in Control Agreement.

The Provident Change in Control Agreement has an initial three-year term which will automatically renew each April 1st starting in 2021 for an additional year such that there will be a three-year term remaining as of each April 1st. In the event Mr. Labozzetta terminates his employment for Good Reason or is terminated without Cause (as each such term is defined in the Provident Change in Control Agreement) during the term subsequent to a change in control, Provident or Provident Bank would pay Mr. Labozzetta: (1) any Standard Termination Benefits; and (2) a cash lump sum payment equal to three times the highest level of aggregate annualized base salary and other cash compensation paid to Mr. Labozzetta during the calendar year the termination occurs, or during either of the immediately preceding two calendar years, whichever is greater. In addition, Provident Bank will provide Mr. Labozzetta with continued group insurance, life, health, accident and disability insurance coverage for three years, provided, however, that Provident or Provident Bank may pay cash in lieu of such coverage if such coverage is not practicable, plus an amount to reflect the income and payroll taxes incurred by him with respect to such payment.

Settlement Agreement

The Settlement Agreement terminates Mr. Labozzetta’s SB One Employment Agreement (including his right thereunder to receive a gross-up payment with respect to any excise tax imposed under Section 4999 of the Internal Revenue Code) in consideration for a lump sum cash payment payable to Mr. Labozzetta at, or within five business days after, the Effective Time (the “Cash Settlement”). The Cash Settlement will equal the cash consideration and the cash equivalent of the continued welfare benefits that Mr. Labozzetta would have received under the SB One Employment Agreement in the event of his qualifying termination event following a change in control, such as the Merger. The Cash Settlement is subject to adjustment to result in no portion of any payment or benefit to be made or provided to Mr. Labozzetta being non-deductible and subject to an excise tax imposed under Sections 280G and 4999 of the Internal Revenue Code, respectively. The estimated Cash Settlement, as adjusted and to be further adjusted as necessary pursuant to the foregoing, is $2,400,004.

The foregoing descriptions of the Provident Agreements are not complete and are qualified in their entirety by references to the Provident Employment Agreement, Provident Side Letter, Provident Change in Control Agreement and Settlement Agreement, which are filed as Exhibits 10.2, 10.3, 10.4 and 10.5, respectively, and incorporated herein by reference.

Forward-Looking Statements

This Current Report on Form 8-K contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, but are not limited to, statements about (i) the benefits of the Merger, including future financial and operating results, cost savings, enhancements to revenue and accretion to reported earnings that may be realized from the Merger; (ii) Provident’s and SB One’s plans, objectives, expectations and intentions and other statements contained in this Current Report on Form 8-K that are not historical facts; and (iii) other statements identified by words such as “expects” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “targets,” “projects,” or words of similar meaning generally intended to identify forward-looking statements. These forward-looking statements are based upon the current beliefs and expectations of the respective managements of Provident and SB One and are inherently subject to significant business, economic and competitive uncertainties and contingencies, many of which are beyond the control of Provident and SB One. In addition, these forward-looking statements are subject to assumptions with respect to future business strategies and decisions that are subject to change. Actual results may differ materially from the anticipated results discussed in these forward-looking statements because of possible uncertainties.

The following factors, among others, could cause actual results to differ materially from the anticipated results or other expectations expressed in the forward-looking statements: (1) the businesses of Provident and SB One may not be combined successfully, or such combination may take longer, be more difficult, time-consuming or costly to accomplish than expected; (2) the expected growth opportunities or cost savings from the Merger may not be fully realized or may take longer to realize than expected; (3) deposit attrition, operating costs, customer losses and business disruption following the Merger, including adverse effects on relationships with employees and customers, may be greater than expected; (4) the regulatory approvals required for the Merger may not be obtained on the proposed terms or on the anticipated schedule; (5) the shareholders of SB One may fail to approve the Merger; (6) legislative or regulatory changes, including changes in accounting standards, may adversely affect the businesses in which Provident and SB One are engaged; (7) the interest rate environment may further compress margins and adversely affect net interest income; (8) results may be adversely affected by continued diversification of assets and adverse changes to credit quality; (9) competition from other financial services companies in Provident’s and SB One’s markets could adversely affect operations; and (10) an economic slowdown could adversely affect credit quality and loan originations. Additional factors, that could cause actual results to differ materially from those expressed in the forward-looking statements are discussed in SB One’s and Provident’s reports (such as Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K) filed with the SEC and available on the SEC’s Internet site (http://www.sec.gov).

Provident and SB One caution that the foregoing list of factors is not exhaustive. All subsequent written and oral forward-looking statements concerning the proposed transaction or other matters attributable to Provident or SB One or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Provident and SB One do not undertake any obligation to update any forward-looking statement to reflect circumstances or events that occur after the date the forward-looking statements are made.

Important Additional Information and Where to Find It

This Current Report on Form 8-K does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval with respect to the Merger. No offer of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933, as amended, and no offer to sell or solicitation of an offer to buy shall be made in any jurisdiction in which such offer, solicitation or sale would be unlawful.

In connection with the Merger, Provident will file with the SEC a registration statement on Form S-4 (the “Registration Statement”) that will include a proxy statement of SB One and a prospectus of Provident (the “Proxy Statement/Prospectus”), and each of Provident and SB One may file with the SEC other relevant documents concerning the Merger. The definitive Proxy Statement/Prospectus will be mailed to shareholders of SB One. Shareholders and investors are urged to read the Registration Statement and the Proxy Statement/Prospectus regarding the Merger carefully and in their entirety when they become available and any other relevant documents filed with the SEC by Provident and SB One, as well as any amendments or supplements to those documents, because they will contain important information about Provident, SB One and the Merger.

Free copies of the Proxy Statement/Prospectus, as well as other filings containing information about Provident and SB One, may be obtained at the SEC’s website, www.sec.gov, when they are filed. You will also be able to obtain these documents, when they are filed, free of charge, by directing a request to Provident Financial Services, Inc., 100 Wood Avenue South, P.O. Box 1001, Iselin, New Jersey 08830, Attention: Corporate Secretary, Telephone: (732) 590-9200 or to SB One Bancorp, 95 State Route 17, Paramus, New Jersey 07652, Attention: Corporate Secretary, Telephone: (844) 256-7328, or by accessing Provident’s website at www.provident.bank under the tab “Investor Relations” and then under the heading “SEC Filings” or by accessing SB One’s website at www.sbone.bank under the tab “Investor Relations” and then under the heading “SEC Filings”. The information on Provident’s and SB One’s websites is not, and shall not be deemed to be, a part of this Current Report on Form 8-K or incorporated into other filings either company makes with the SEC.

Participants in the Solicitation

Provident, SB One and their respective directors, and certain of their executive officers and employees may be deemed to be participants in the solicitation of proxies from the shareholders of SB One in connection with the Merger. Information about Provident’s directors and executive officers is available in its proxy statement for its 2019 annual meeting of stockholders, which was filed with the SEC on March 15, 2019, and information about SB One’s directors and executive officers is available in its proxy statement for its 2019 annual meeting of shareholders, which was filed with the SEC on March 25, 2019. Information regarding all of the persons who may, under the rules of the SEC, be deemed participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the Proxy Statement/Prospectus regarding the Merger and other relevant materials to be filed with the SEC when they become available. Free copies of these documents may be obtained as described in the preceding paragraph.

|

Item 9.01.

|

Financial Statements and Exhibits

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(a)

|

|

|

Financial statements of businesses acquired. None.

|

|

|

|

|

|

|

|

|

(b)

|

|

|

Pro forma financial information. None.

|

|

|

|

|

|

|

|

|

(c)

|

|

|

Shell company transactions: None.

|

|

|

|

|

|

|

|

|

(d)

|

|

|

Exhibits.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2.1

|

|

|

Agreement and Plan of Merger, dated March 11, 2020, by and between Provident Financial Services, Inc. and SB One Bancorp*

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.1

|

|

|

Form of Voting Agreement, dated March 11, 2020, by and between Provident Financial Services, Inc. and certain shareholders of SB One Bancorp

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.2

|

|

|

Employment Agreement, dated March 11, 2020, by and between Provident Financial Services, Inc. and Anthony J. Labozzetta

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.3

|

|

|

Side-Letter Agreement, dated March 11, 2020, by and among Provident Financial Services, Inc., Provident Bank and Anthony J. Labozzetta

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.4

|

|

|

Change in Control Agreement, dated March 11, 2020, by and between Provident Financial Services, Inc. and Anthony J. Labozzetta

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10.5

|

|

|

Settlement Agreement, dated March 11, 2020, by and among SB One Bancorp, SB One Bank, Provident Financial Services, Inc., Provident Bank and Anthony J. Labozzetta

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

104

|

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

|

*

|

Schedules have been omitted pursuant to Item 601(b)(2) of Regulation S-K. A copy of any omitted schedule will be furnished supplementally to the SEC upon request; provided, however, that the parties may request confidential treatment pursuant to Rule 24b-2 of the Securities Exchange Act of 1934, as amended, for any document so furnished.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROVIDENT FINANCIAL SERVICES, INC.

|

|

|

|

|

|

|

|

|

|

DATE: March 12, 2020

|

|

|

|

By:

|

|

/s/ Christopher Martin

|

|

|

|

|

|

|

|

Christopher Martin

|

|

|

|

|

|

|

|

Chairman, President and Chief Executive Officer

|

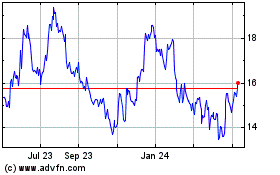

Provident Financial Serv... (NYSE:PFS)

Historical Stock Chart

From Mar 2024 to Apr 2024

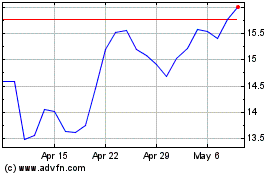

Provident Financial Serv... (NYSE:PFS)

Historical Stock Chart

From Apr 2023 to Apr 2024