Statement of Changes in Beneficial Ownership (4)

November 01 2022 - 10:30AM

Edgar (US Regulatory)

FORM 4

[X]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

|

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Provident Acquisition Holdings Ltd. |

2. Issuer Name and Ticker or Trading Symbol

Provident Acquisition Corp.

[

PAQCU

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

__X__ Director __X__ 10% Owner

_____ Officer (give title below) _____ Other (specify below)

|

|

(Last)

(First)

(Middle)

UNIT 11C/D, KIMLEY COMMERCIAL BUILDING, 142-146 QUEEN'S ROAD CENTRAL |

3. Date of Earliest Transaction

(MM/DD/YYYY)

10/28/2022 |

|

(Street)

HONG KONG, K3 00000

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

___ Form filed by One Reporting Person

_

X

_ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Class A Ordinary Shares | 10/28/2022 | | C | | 5327500 | A | (1) | 5327500 | I | See Footnotes (7)(8) |

| Class A Ordinary Shares | 10/28/2022 | | D | | 5327500 | D | (2) | 0 (2) | I | See Footnotes (7)(8) |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Class B Ordinary Shares | (1) | 10/28/2022 | | C | | | 5327500 | (1) | (1) | Class A Ordinary Shares | 5327500 | (1) | 0 | I | See Footnotes (7)(8) |

| Private Placement Warrants | (3)(4) | 10/28/2022 | | D | | | 6600000 (5) | (3)(4) | (3)(4) | Class A Ordinary Shares | 6600000 | (6) | 0 (6) | I | See Footnotes (7)(8) |

| Explanation of Responses: |

| (1) | The Class B ordinary shares were converted into Class A ordinary shares on a one-for-one basis upon the consummation of the Issuer's initial business combination on October 28, 2022 (the "Initial Business Combination"). |

| (2) | The reporting person disposed of all Class A ordinary shares upon the consummation of the Issuer's Initial Business Combination, which were automatically exchanged into corresponding Class A ordinary shares of Perfect Corp. |

| (3) | Each Private Placement Warrant is exercisable to purchase one Class A ordinary share of the Issuer at an exercise price of $11.50 per share. As described in the Issuer's Registration Statement on Form S-1/A (File No. 333-251571) filed with the Securities and Exchange Commission on December 31, 2020 (the "Registration Statement"), the Private Placement Warrants are identical to the warrants sold in connection with the Issuer's initial public offering ("IPO"), except that the Private Placement Warrants, so long as they are held by the Provident Acquisition Holdings Ltd. (the "Sponsor") or its permitted transferees, |

| (4) | (i) will not be redeemable by the Issuer, (ii) may not (including the Class A ordinary shares of the Issuer issuable upon exercise of such warrants), subject to certain limited exceptions, be transferred, assigned or sold by until 30 days after the completion of the Issuer's Initial Business Combination, (iii) may be exercised by the holders on a cashless basis and (iv) will be entitled to registration rights. |

| (5) | Due to an administrative error, the Form 4 filed by the reporting person on January 12, 2021 inadvertently excluded 600,000 Private Placement Warrants acquired by the reporting person, when in fact a total of 6,600,000 Private Placement Warrants were acquired. This Form 4 hereby corrects that error. |

| (6) | The reporting person disposed of all Private Placement Warrants upon the consummation of the Issuer's Initial Business Combination, which were automatically exchanged into corresponding warrants exercisable for Class A ordinary shares of Perfect Corp. |

| (7) | Any actions (including voting and dispositive decisions) by the Sponsor with respect to the reported securities are made by the Board of Directors of the Sponsor, which consists of three individuals--Winato Kartono, Michael Aw Soon Beng and Andrew Joseph Hoffmann. Each director has one vote, and the approval of two of the three directors of the Sponsor's Board of Directors is required to approve any action of the Sponsor. Each of Messrs. Kartono, Beng and Hoffmann are also shareholders of the Sponsor and members of the Issuer's Board of Directors. |

| (8) | Under the so-called "rule of three," if voting and dispositive decisions regarding an entity's securities are made by two or more individuals, and a voting and dispositive decision requires the approval of a majority of those individuals, then none of the individuals is deemed a beneficial owner of the entity's securities. Therefore, none of Messrs. Kartono, Beng or Hoffmann exercises voting or dispositive control over any of the securities held by the Sponsor, even those in which he holds any direct or indirect pecuniary interest. Accordingly, none of them are be deemed to have or share beneficial ownership over the reported securities, and the filing of this Form 4 shall not be deemed an admission that any of Messrs. Kartono, Beng or Hoffmann have or share beneficial ownership over the reported securities for purposes of Section 16 of the Securities Exchange Act of 1934, as amended, or otherwise. |

Remarks:

Exhibit 99 - Joint Filer Statement |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Provident Acquisition Holdings Ltd.

UNIT 11C/D, KIMLEY COMMERCIAL BUILDING

142-146 QUEEN'S ROAD CENTRAL

HONG KONG, K3 00000 | X | X |

|

|

Kartono Winato

UNIT 11C/D, KIMLEY COMMERCIAL BUILDING

142-146 QUEEN'S ROAD CENTRAL

HONG KONG, K3 00000 |

| X |

|

|

Beng Michael Aw Soon

UNIT 11C/D, KIMLEY COMMERCIAL BUILDING

42-146 QUEEN'S ROAD CENTRAL

HONG KONG, K3 00000 | X |

|

|

|

Hoffmann Andrew Joseph

UNIT 11C/D, KIMLEY COMMERCIAL BUILDING

42-146 QUEEN'S ROAD CENTRAL

HONG KONG, K3 00000 | X |

|

|

|

Signatures

|

| By: /s/ Provident Acquisition Holdings Ltd., By: /s/ Michael Aw Soon Beng, Authorized Signatory | | 11/1/2022 |

| **Signature of Reporting Person | Date |

| By: /s/ Winato Kartono | | 11/1/2022 |

| **Signature of Reporting Person | Date |

| By: /s/ Michael Aw Soon Beng | | 11/1/2022 |

| **Signature of Reporting Person | Date |

| By: /s/ Andrew Joseph Hoffmann | | 11/1/2022 |

| **Signature of Reporting Person | Date |

| Reminder: Report on a separate line for each class of securities beneficially owned directly or indirectly. |

| * | If the form is filed by more than one reporting person, see Instruction 4(b)(v). |

| ** | Intentional misstatements or omissions of facts constitute Federal Criminal Violations. See 18 U.S.C. 1001 and 15 U.S.C. 78ff(a). |

| Note: | File three copies of this Form, one of which must be manually signed. If space is insufficient, see Instruction 6 for procedure. |

| Persons who respond to the collection of information contained in this form are not required to respond unless the form displays a currently valid OMB control number. |

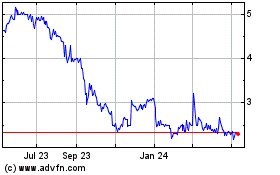

Perfect (NYSE:PERF)

Historical Stock Chart

From Mar 2024 to Apr 2024

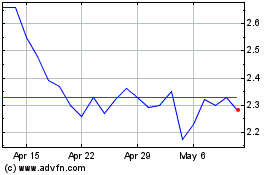

Perfect (NYSE:PERF)

Historical Stock Chart

From Apr 2023 to Apr 2024