Current Report Filing (8-k)

December 19 2019 - 3:34PM

Edgar (US Regulatory)

false0001004980000007548800010049802019-12-192019-12-190001004980pcg:PACIFICGASANDELECTRICCOMPANYMember2019-12-192019-12-190001004980pcg:NYSEMemberpcg:CommonStockNoParValueMember2019-12-192019-12-190001004980pcg:NYSEAmericanLLCMemberpcg:FirstPreferredStockCumulativeParValue25PerShare6NonredeemableMember2019-12-192019-12-190001004980pcg:FirstPreferredStockCumulativeParValue25PerShare5NonredeemableMemberpcg:NYSEAmericanLLCMember2019-12-192019-12-190001004980pcg:FirstPreferredStockCumulativeParValue25PerShare480RedeemableMemberpcg:NYSEAmericanLLCMember2019-12-192019-12-190001004980pcg:NYSEAmericanLLCMemberpcg:FirstPreferredStockCumulativeParValue25PerShare5SeriesARedeemableMember2019-12-192019-12-190001004980pcg:NYSEAmericanLLCMemberpcg:FirstPreferredStockCumulativeParValue25PerShare450RedeemableMember2019-12-192019-12-190001004980pcg:NYSEAmericanLLCMemberpcg:FirstPreferredStockCumulativeParValue25PerShare5RedeemableMember2019-12-192019-12-190001004980pcg:NYSEAmericanLLCMemberpcg:FirstPreferredStockCumulativeParValue25PerShare550NonredeemableMember2019-12-192019-12-190001004980pcg:NYSEAmericanLLCMemberpcg:FirstPreferredStockCumulativeParValue25PerShare436SeriesARedeemableMember2019-12-192019-12-19

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report: December 19, 2019

(Date of earliest event reported)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions (see General Instruction A.2. below):

Securities registered pursuant to Section 12(b) of the Act:

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new

or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 8.01 Other Events.

2020 Cost of Capital Application

As previously disclosed, on November 25, 2019, the assigned administrative law judge of the California Public Utilities Commission (the “CPUC”) issued a

proposed decision (the “PD”) in the 2020 Cost of Capital proceeding of Pacific Gas and Electric Company (the “Utility”), a subsidiary of PG&E Corporation, as revised on December 18, 2019 (the “revised PD”). The revised PD did not propose any

changes to the Utility’s cost of capital or capital structure proposed in the PD.

On December 19, 2019, the CPUC approved the revised PD (the “decision”), maintaining the Utility’s return on common equity for the three-year period

beginning January 1, 2020 at 10.25%, as compared to 12% requested by the Utility. The Utility’s annual cost of capital adjustment mechanism also remains unchanged. The decision maintains the common equity component of the Utility’s capital structure

at 52%, as requested by the Utility, and reduces its preferred stock component from 1% to 0.5%, also as requested by the Utility. The decision also approves the cost of debt requested by the Utility.

For more information about the PD, see PG&E Corporation and the Utility’s joint Current Report on Form 8-K dated November 25, 2019.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrants have duly caused this report to be signed on their behalf by the

undersigned thereunto duly authorized.

|

|

PG&E CORPORATION

|

|

|

|

|

|

|

|

|

By:

|

/s/ LINDA Y.H. CHENG

|

|

|

|

|

Name: Linda Y.H. Cheng

|

|

|

|

|

Title: Vice President, Corporate Governance and

|

|

|

|

|

Corporate Secretary

|

|

|

|

PACIFIC GAS AND ELECTRIC COMPANY

|

|

|

|

|

|

|

|

|

By:

|

/s/ DAVID S. THOMASON

|

|

|

|

|

Name: David S. Thomason

|

|

|

|

|

Title: Vice President, Chief Financial Officer and Controller

|

|

|

|

|

|

|

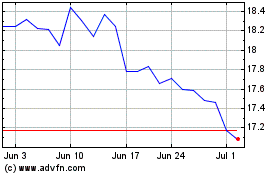

PG&E (NYSE:PCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

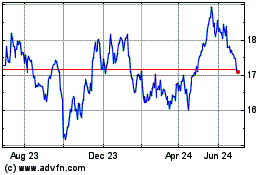

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2023 to Apr 2024