By Katherine Blunt and Alejandro Lazo

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (November 2, 2019).

California Gov. Gavin Newsom is threatening a state takeover of

PG&E Corp. unless the company exits bankruptcy and dramatically

improves the safety of its electric grid before the next wildfire

season.

The governor on Friday said he has demanded that PG&E

executives, investors and representatives for wildfire victims

appear in Sacramento next week to discuss how to expedite the

company's emergence from chapter 11 by a state-imposed deadline of

June 30. He said the state may intervene if the company's

shareholders and bondholders don't quickly agree on a

reorganization plan.

"PG&E as we know it, may or may not be able to figure this

out, if they cannot we are not going to sit around and be passive,"

Mr. Newsom said. "The state will prepare itself as backup for a

scenario where we do that job for them."

Mr. Newsom said he has assigned his cabinet secretary, Ana

Matosantos, to head a team tasked with preparing a plan should the

state need to intervene. Ann Patterson, Mr. Newsom's lead attorney

on the matter, Alice Reynolds, his lead energy and environmental

policy expert, and Rachel Wagoner, his senior legislative

strategist, will aid in the effort.

All options, including a state takeover, are on the table,

according to Mr. Newsom's advisers. Mr. Newsom didn't specify how

the state would structure a takeover of the company, and what

compensation it would offer investors. He said the team will work

to scope that plan.

"It's not writing a check," he said, referring to the complexity

of such a transaction.

The governor's threat comes after a fraught month for PG&E,

which pre-emptively shut off the power to millions of Californians

in an effort to prevent its equipment from sparking more

destructive wildfires as strong winds swept its service territory.

The shut-offs created widespread turmoil and drew the ire of

customers, businesses and state officials.

"We share the Governor's focus on reducing wildfire risk across

California and understand that PG&E must play a role in these

efforts," the company said Friday. "We welcome the Governor's and

the State's engagement on these vital matters and share the same

goal of fairly resolving the wildfire claims and exiting the

Chapter 11 process as quickly as possible."

PG&E disclosed that one of its transmission lines may have

sparked the Kincade Fire in Sonoma County, despite having turned

off a large section of the power grid there, as well as a series of

smaller fires in the Bay Area.

The disclosures eroded PG&E's stock and bond prices on

concerns that the company could face additional fire-related

liability costs, and threatened to stall negotiations among

investors in bankruptcy court. The company's shareholders and

bondholders have proposed competing plans to pay billions of

dollars in liability costs related to a series of deadly fires in

2017 and 2018.

Mr. Newsom, a Democrat, said he will compel PG&E to make

massive investments in its infrastructure to improve the safety of

the system and reduce the need for pre-emptive power shut-offs.

"This process needs to take shape with a deep sense of urgency,"

Mr. Newsom said. He added that the state cannot wait until June 30

for PG&E to restructure.

Democratic state Sen. Jerry Hill, a longtime critic of PG&E,

said he supported the governor's willingness to take control of the

company if it "cannot or will not transform itself."

"We'll have a future with or without PG&E," he said. "That's

the message they need to hear."

Democratic state Sen. Bill Dodd, who has written two bills in

the past two years aimed at financially supporting the state's

utilities in the face of wildfire liabilities, said he didn't

support a state takeover of PG&E.

"I still remain concerned that, at least at this time, that the

liability could threaten -- if the worst happens -- it could

threaten our state budget," Mr. Dodd said Friday.

Gerald Singleton, a San Diego lawyer who represents 7,000 fire

victims in PG&E's bankruptcy, called the governor's move a

positive step.

His clients want compensation, he said, but "they are also very

concerned about the future and want to make sure that PG&E is

making the necessary changes."

PG&E sought bankruptcy protection in January, citing more

than $30 billion in potential liability costs tied to more than a

dozen wildfires that collectively killed more than 100 people.

California lawmakers outlined a road map for PG&E to make

safety investments earlier this year, as part of legislation that

established a wildfire fund to help all of the state's utilities

cover liability costs. To participate in the fund, which PG&E

investors consider necessary for reorganization, the company must

meet the state's bankruptcy deadline, spend heavily to upgrade its

infrastructure and meet certain safety requirements.

Write to Katherine Blunt at Katherine.Blunt@wsj.com and

Alejandro Lazo at alejandro.lazo@wsj.com

(END) Dow Jones Newswires

November 02, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

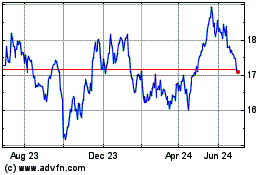

PG&E (NYSE:PCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

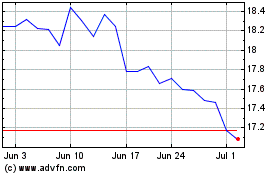

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2023 to Apr 2024