Stocks: PG&E Shares Slide as Judge Allows Rival Bankruptcy Plan -- WSJ

October 11 2019 - 3:02AM

Dow Jones News

By Karen Langley

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (October 11, 2019).

Shares of PG&E Corp. plummeted Thursday after a judge

cleared the way for a rival bankruptcy plan that could nearly wipe

out the troubled utility's shareholders.

The stock dropped 29% to $7.79, its biggest decline since Jan.

14 when it fell 52%. The shares are down 89% from their closing

high of $71.56 in September 2017.

The judge overseeing PG&E's bankruptcy case stripped

management of its exclusive right to file a plan to restructure the

company. The decision opens the door for bondholders -- who are

allied with victims of wildfires that drove PG&E to bankruptcy

-- to put forth a plan that would leave shareholders with a smaller

stake in PG&E than envisioned in the plan previously proposed

by management.

"PG&E's goal of a tough negotiation stance with the [fire

victims] backfired," Praful Mehta, lead analyst for utilities and

renewables at Citigroup, wrote in a note Thursday.

He changed his price target on the stock to $5, reflecting what

he estimates is a 75% chance that the bondholder bankruptcy plan is

selected and existing shares become worthless, versus a 25% chance

that the PG&E plan wins out and shares are worth $20.

"The ruling means more voices and more of a governance debate

upcoming," UBS analysts wrote in a note.

In another bad publicity move, the company cut power Wednesday

to about 700,000 households and businesses in northern and central

California. The blackout is meant to avoid the type of deadly fires

that killed dozens last year and forced the utility into bankruptcy

court.

PG&E filed for chapter 11 in January to manage the potential

legal costs of a series of deadly wildfires caused by its equipment

in 2017 and 2018.

The company declined to comment on its stock price but told The

Wall Street Journal Wednesday that it was disappointed by the

judge's decision to open the door to rival restructuring plans.

PG&E's bonds were also active. Its 6.05% bonds due in 2034

got a particularly large boost, rising to roughly 115 cents on the

dollar from around 109 cents before the judge's decision, according

to MarketAxess. With their relatively high coupon and distant

maturity, the 6.05% bonds have the most to gain from a plan that is

more favorable to bondholders, analysts said.

--Sam Goldfarb contributed to this article.

(END) Dow Jones Newswires

October 11, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

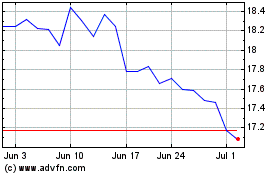

PG&E (NYSE:PCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

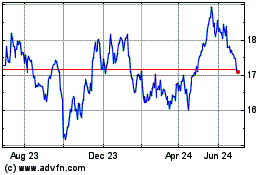

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2023 to Apr 2024