PG&E's Bankruptcy Judge Opens the Door to Rival Chapter 11 Exit Plan

October 09 2019 - 6:21PM

Dow Jones News

By Peg Brickley

The judge presiding over PG&E Corp.'s bankruptcy handed

shareholders a loss, opening the door to a competition over the

best path out of bankruptcy that pits the troubled utility against

bondholders led by Elliott Management Corp.

Judge Dennis Montali of the U.S. Bankruptcy Court in San

Francisco cleared the way for a rival chapter 11 plan from Elliott

and other bondholders that are allied with victims of wildfires

that drove PG&E to bankruptcy. His ruling stripped PG&E of

the sole right to propose a chapter 11 plan covering billions of

dollars of damages from blazes linked to PG&E equipment.

The decision means at least two chapter 11 plans will move

forward as PG&E shifts into a crucial phase of its chapter 11

proceeding. The coming months will see either a deal with fire

victims or a series of judicial rulings that will produce an

estimate of how much PG&E will have to set aside to cover those

damages.

The rival plans are about $5 billion to $6 billion apart on

where they think that number will fall. Wall Street banks and hedge

funds from California to Connecticut are placing their bets,

cutting deals to finance PG&E's chapter 11 plan, the

bondholders' rival plan or both.

The bondholders proposed a plan to raise new money and use all

but a sliver of PG&E equity to pay off debts, while the company

favors raising both debt and equity financing to dig itself out of

chapter 11 and prevent shareholders from taking a bigger hit.

Write to Peg Brickley at peg.brickley@wsj.com

(END) Dow Jones Newswires

October 09, 2019 18:06 ET (22:06 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

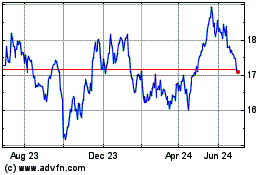

PG&E (NYSE:PCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

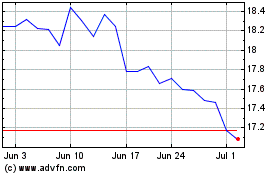

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2023 to Apr 2024