Utility agrees to pay $11 billion to firms; no deal yet with

victims

By Peg Brickley and Russell Gold

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (September 14, 2019).

PG&E said it has reached an $11 billion settlement with

insurance companies over wildfire claims, a significant step toward

emerging from bankruptcy.

The deal covers insurance carriers and hedge funds that were

seeking compensation from PG&E for payouts insurers made to

homeowners and businesses in connection with fires sparked by the

utility's equipment.

It leaves wildfire victims as the only major group of claimants

that has not reached a settlement with the San Francisco utility,

which is pushing to emerge from bankruptcy next year.

The settlement is the second major agreement PG&E has

reached with claimants. In June, PG&E agreed to pay $1 billion

to local governments and state agencies to settle claims from fires

in 2017 and 2018, obtaining their support for the company's

bankruptcy plan.

Representatives for wildfire victims criticized the settlement

Friday, saying the company appeared to be trying to isolate those

who lost homes and lives to the fires.

"PG&E is taking money out of the pockets of people whose

homes and businesses it burned down and handing the money to

insurance companies to buy their cooperation," said Cecily Dumas,

one of the lead lawyers representing fire victims in the

bankruptcy. "This settlement violates the rights of the victims

under California law to be compensated first. The settlement shows

that PG&E puts victims' needs last."

The settlement was negotiated with carriers that hold roughly

85% of so-called insurance subrogation claims against the company,

which allow insurance companies to pursue those deemed responsible

for damage.

A PG&E spokeswoman said she expected the deal would cover

all insurance claims. PG&E added that it was continuing to work

to resolve claims with individual plaintiffs.

PG&E has been negotiating for some time with insurance

companies that own claims for fire damage payments, including

affiliates of Farmers Insurance Exchange and Hartford Accident

& Indemnity Co., as well as Baupost Group LLC, a hedge fund

that bought more than $2.5 billion worth of insurance claims.

"We hope that this compromise will pave the way for a plan of

reorganization that allows PG&E to fairly compensate all

victims," a spokesman for the insurance group said in a

statement.

PG&E, which provides gas and electric service to 16 million

people, f iled for bankruptcy protection earlier this year, citing

$30 billion in liabilities from a series of deadly and destructive

wildfires sparked by its equipment.

Since then, it has begun inspecting and repairing thousands of

miles of its wires to reduce the risk of sparking future wildfires

-- and it has been engaged in complex negotiations with California

lawmakers, claimants, bondholders and shareholders to restore the

century-old company to firm financial footing.

PG&E faces a June 30, 2020, deadline to exit bankruptcy if

it wants to participate in a fund being set up by California to

help utilities pay for wildfire-related damages, which are growing

as the state deals with the impacts of drought and climate

change.

For the past several months, the company has been battling

insurers and wildfire victims over how much it should set aside to

cover existing fire-related damages. The settlement with insurers

will ultimately include a support agreement that requires the

insurers to favor PG&E's plan to exit from bankruptcy,

according to a person familiar with the matter.

Final papers have yet to be prepared on the insurance

settlement.

California fire investigators have found that PG&E equipment

sparked numerous fires in the state in 2017 and 2018, including

last November's Camp Fire, which killed 86 people and destroyed the

town of Paradise. But state investigators concluded that the

company didn't cause the most destructive 2017 fire, known as the

Tubbs Fire.

Lawyers representing fire victims strongly dispute that

conclusion, and PG&E's culpability in the Tubbs Fire is now set

for a state trial, creating significant uncertainty about the total

liability the company faces.

The settlement with insurers, which involves both PG&E Corp.

and its Pacific Gas and Electric Co. utility, is subject to the

approval of the bankruptcy court overseeing PG&E's Chapter 11

plan.

On Monday PG&E unveiled an $18 billion plan to resolve all

wildfire-related claims and exit bankruptcy next year as it seeks

to prevent creditors from taking over the embattled company.

That plan disappointed representatives for fire victims, who

have said in court filings that they are owed $54 billion, and the

ultimate figure PG&E has to pay may wind up being substantially

higher.

With the tentative settlements to insurance companies and local

governments, PG&E has already struck deals for a combined $12

billion to settle claims, excluding fire victims.

The company said it still planned to raise $14 billion in new

equity to pay claims, according to papers filed with the U.S.

Bankruptcy Court in San Francisco. PG&E said it has received

commitments of $1.5 billion and will seek remaining equity

financing commitments over the next several weeks.

--Dave Sebastian contributed to this article.

Corrections & Amplifications PG&E said it has reached an

agreement with 85% of insurance subrogation claim holders to settle

all such claims related to the 2017 Northern California wildfires

and 2018 Camp Fire. An earlier version of this article incorrectly

said the company agreed to resolve the majority of claims. (Sept.

13, 2019)

Write to Peg Brickley at peg.brickley@wsj.com and Russell Gold

at russell.gold@wsj.com

(END) Dow Jones Newswires

September 14, 2019 02:47 ET (06:47 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

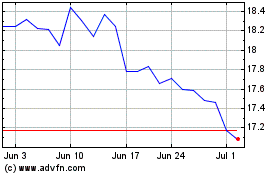

PG&E (NYSE:PCG)

Historical Stock Chart

From Mar 2024 to Apr 2024

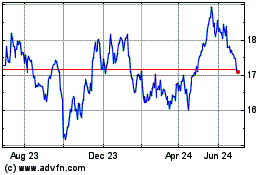

PG&E (NYSE:PCG)

Historical Stock Chart

From Apr 2023 to Apr 2024